Well, it happened. Just as we predicted during our presentation at last year’s PARCEL Forum, a major carrier has finally imposed a Peak Season Surcharge (PSS) for 2017. UPS’s announcement comes as a surprise to many shippers, but to industry analysts, carriers finding new ways to make things a little more expensive and a little more complex surprises no one.

By now, you’ve probably read a dozen or so other articles about this announcement, so we’ll break this down quickly for you and provide some observations.

What the heck just happened?

Peak Season Surcharges imposed on:

(1) Residential Shipments (including to businesses operating out of homes)

· Next Day Air services: $0.81/package (December 17-December 23)

· 2nd Day Air/3-Day Select: $0.97/package (December 17-December 23)

· UPS Ground: $0.27/package (Nov 19-Dec. 2 AND Dec. 17-Dec. 23)

(2) Large Packages (All Service Levels to all Domestic Destinations, i.e. Commercial + Residential)

· Peak Surcharge of $24.00 (November 19 – December 23)

· This is in addition to the Large Package surcharge of $67.50.

· Total surcharges related to Large Package = $91.50 (Nov. 19-Dec. 23)

(3) Over Maximum Limits Packages (All Service Levels to all Domestic Destinations, i.e. Commercial + Residential)

· Peak Surcharge of $249.00 (November 19 – December 23)

· This is in addition to the Over Maximum Limits surcharge of $110.00.

· Total surcharges related to Over Maximum Limits = $359.00 (Nov. 19-Dec. 23)

(4) Imports

· Not yet defined: There will be peak surcharges assessed depending on lanes but those charges and lanes will be available on ups.com “on or before Sept 1.” We all need to keep watch. (Nov. 19-Dec. 23)

Observations

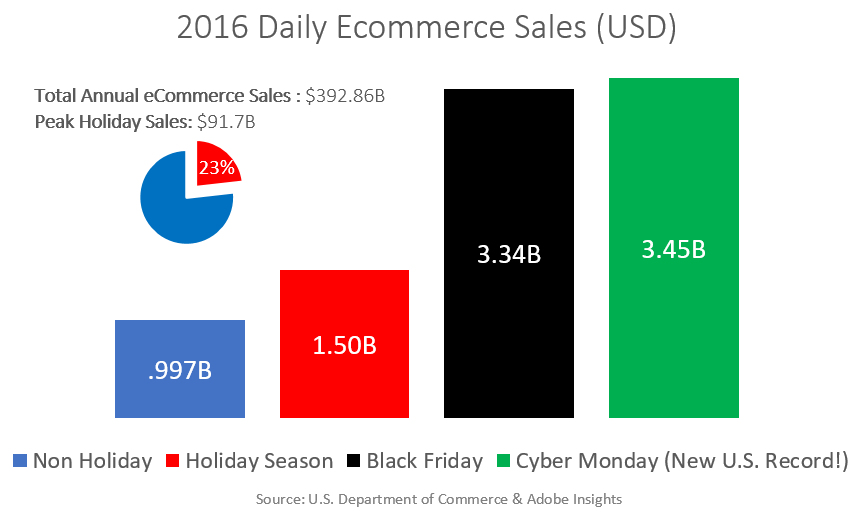

· UPS is taking action based on what they see in clients’ shipping data and their respective cost models. The dramatic rise in e-commerce sales is creating a surge in residential shipments—especially during holidays—causing many operational headaches that ultimately increases costs for UPS. Here are some interesting statistics to note:

· As the graph represents, peak season shipments define any retailer’s success for the year. UPS’s imposition of the PSS will put a definite margin compression on the e-retail sector. From the language of the UPS press release, the PSS is targeted specifically to B2C shippers and daily rates, and it does not apply to commercial deliveries (with the exception of large and over-max packages) or any package shipped under the retail rate structure. Thus, Grandma sweater-shipping is shielded from the PSS.

· UPS redefining home businesses as “residences” for purposes of the PSS. Traditionally, home businesses have been given “commercial” designation by meeting certain parameters. How will UPS identify businesses operating out of a home for PSS purposes? The most likely way is upon delivery. Drivers will make a notation in their DIAD boards (electronic clipboard used when making deliveries) similar to how they notate “residential” to assess residential surcharges. It’s important to note the inconsistency that is likely to occur (similar to residential surcharges) as hundreds of different drivers are making their own subjective judgment regarding “home businesses.” To illustrate a point, I know an auto mechanic who runs his shop from a separate structure on his large property, where his residence sits a good hundred yards away. Business out of home? Most cases will be cut and dry, but not all. It will be interesting to see how objective these decisions can be in the grayer areas.

· Are the peak surcharges on large and over-max packages a direct shot at Amazon? Amazon is a very sophisticated rate shopper. As a result, UPS and FedEx receive a lot of Amazon’s larger, more atypical shipments. It follows that, as peak shipping volumes surge, UPS incurs a higher density of these atypical packages. Thus, the PSS on large and over-max packages is likely an attempt for UPS to address this shift during the holiday given Amazon’s rate shopping propensities.

· Will the PSS be subjected to the fuel surcharge? In the UPS press release, there is nothing saying that the PSS is subject to fuel surcharges; however, fuel surcharges are typically assessed on fees that are considered “transportation-related.” For this reason, we believe the PSS will indeed be subject to fuel surcharges.

· Surprised that they left a gap on Ground services between Dec. 2 and Dec 17? No. UPS is simply pinpointing the times that cause them the most holiday grief. Black Friday, Cyber Monday and “procrastination week” leading up to Christmas.

What Are the Likely Outcomes for Shippers?

Most shippers will either eat this surcharge or pass it on to their customers via price increases. Others might attack the PSS head on. Looking at history in the duopoly environment, we’ll all keep an eye on FedEx’s next move. If FedEx does not match, shippers will retain some leverage against UPS in mitigating the increase. But if FedEx does match, shippers must discover different tactics to mitigate the impact, provided that they are able to emotionally detach themselves from the PSS. By analyzing their data and monetizing the PSS impact, shippers will look for other areas in their agreements to compress their expenses. I’ll beat the dead horse and urge all of you to become data junkies, if you are not already.

Of course there’s another dynamic to consider. What will the USPS do? During the peak season, Priority Mail could become a much more compelling service offering, provided that the USPS doesn’t change something. Is the PSS a final straw for some shippers when you factor in UPS’s/FedEx’s residential surcharges, delivery-area surcharges and DIM adjustments? While Priority Mail can certainly be a less expensive option for residential deliveries, how will customer experience be impacted by a switch? During a season where consumer expectations are lower —with regard to on-time deliveries — does opting for a less-expensive Priority Mail service really make a difference on customer experience? The Postal Service is not known for reliability during peak Holiday season, but then again, in recent years neither are FedEx and UPS. The main difference is that a Priority Mail package delivered 1-2 days late still — in most cases — beats or equals the time-in-transit of on-time FedEx/UPS Ground services. Just something to consider.

Regardless of what we think about the peak season surcharge, we must remember that UPS is simply acting on the data. For shippers to remain competitive, it’s only wise for them to do the same. Remember that audit tools are particularly insufficient and ineffective during the holiday season. If there is not a robust BI platform built into your provider’s audit portal, you could be at a tremendous disadvantage this holiday season. But as is the case in most instances, proactivity wins the day.

So, how are you collecting, analyzing and acting on your shipping data?

Glenn Gooding is President of iDrive Logistics and the industry thought leader in carrier cost model methodologies and data analysis. He spent more than two decades at UPS, where he engineered the cost and pricing models for the world’s largest enterprise shippers. Glenn now leverages his expertise to help shippers better understand their shipping data in pursuit of shipping optimization and cost reduction. Glenn can be reached at glenn@idrivelogistics.com or 678.567.6847.