Despite the pre-eminence of UPS, FedEx, and USPS, regional carriers can play a substantial role in maximizing the efficiency of a small-parcel supply chain. Sourcing relationships with these carriers can provide time-in-transit advantages as well as reduced costs; however, these benefits can be mitigated if one isn’t mindful of national carrier terms and individual package and distribution characteristics, among other factors.

As with most decisions regarding small-parcel supply chain, it is critically important to understand package and distribution characteristics. Without a thorough understanding, one risks ineffective transportation procurement at best, and disastrous financial consequences at worst.

Once a decision-maker acquires a thorough understanding of characteristics, the next step is to craft a contract with the national carriers that allows for multi-sourcing. Poorly executed carrier negotiations can result in restrictive terms and conditions, which can inhibit the ability to effectively multi-source. “Regional carrier solutions always require a multi-sourcing strategy,” shares Glenn Gooding, President of iDrive Logistics. “The desired multi-sourced network must be planned first in order to design the national solution and associated contract structure to allow the flexibility of utilizing regional carriers.”

Another item to check off in a multi-source decision surrounds technology. Shippers must have the savvy to effectively divide shipments by carrier based on geography and environment. Regional carrier transit times are often highly advantageous within their geography, with exceptionally competitive pricing. Utilizing a shipping software can meet much of this need, assuming the software’s rules are properly aligned with speed, cost, and delivery experience objectives.

A fourth consideration surrounds customer proximity and induction point. If the main distribution point is outside a regional carrier’s coverage area, the shipper must have a significant market within the coverage area to effectively utilize a multi-carrier strategy. One must be mindful of induction point; for example, a shipper using OnTrac will maximize time-in-transit benefits by dropping packages at the Reno hub rather than hubs in Salt Lake City or Los Angeles.

Once a shipper has walked through this methodology and confirms fitment of regional carriers with their overarching strategy, the myriad advantages of regional carriers come into focus.

The Perks

One of these advantages is improved time in transit. Regional carriers often utilize fewer hubs within their geography, smoothing out kinks that exist in national parcel carrier networks. Let’s take a package traveling from San Francisco to Los Angeles as an example. While the national carriers offer two-day transit windows for ground, regional carriers offer overnight service. This arrangement provides enormous cost savings over national express services for time-sensitive items and, at a minimum, improved fulfillment speed over national ground services

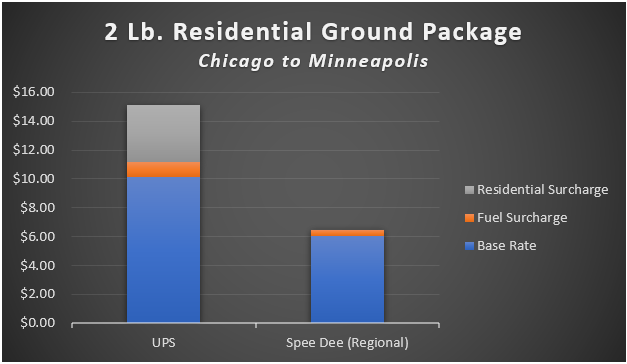

The pricing advantages of regionals are numerous and can be extremely impactful. As accessorial fees become increasingly complex and exorbitant among national carriers, shippers can find refuge in regional carriers. Residential and DAS surcharges are typically reduced or nonexistent among regional carriers, resulting in massive cost savings for B2C operations. “Assuming a proper national contract is in place, regional carriers can offer excellent shelter against accessorial surcharge application,” notes Shaun Rothwell, CEO of iDrive Logistics. “As surcharge revenues and application complexity continue to mount for customers of the national carriers, regional carriers can represent significant appeal.”

As evidenced above, there lies an immense gulf in total package cost between UPS and a Midwest regional carrier. Looking forward, this difference is likely to grow because of the vast assortment of surcharges applied by national carriers and broadening application of fuel surcharge. In the latest UPS GRI, fuel surcharge was expanded to include Add’l Handling, Over Max, Signature Required, and Adult Signature Required surcharges. If history is any guide, this broadening trend is likely to continue until most if not all surcharges are assessed with fuel.

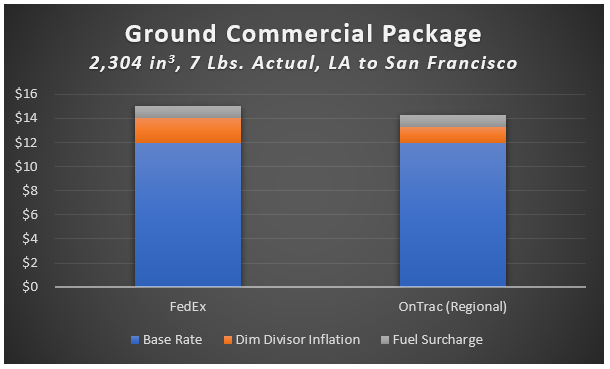

Another advantage extended by certain regional carriers is found in a higher dimensional divisor. OnTrac offers a 166 dimensional divisor, compared to the 139 offered by the national carriers.

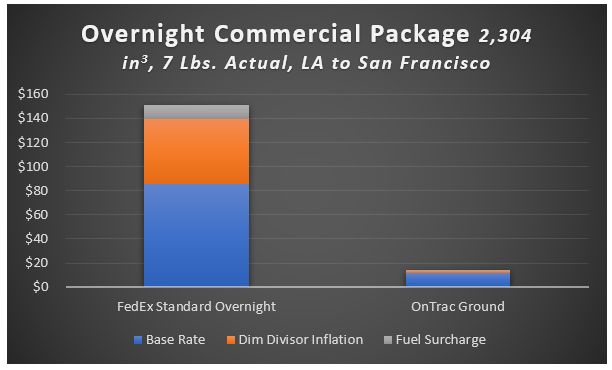

The above table illustrates the advantage of the 166 dimensional divisor. Rather than a bill weight of 17 pounds with FedEx, OnTrac’s higher dimensional divisor applies a bill weight of 14 lbs. This results in a five percent reduction in total cost. It is also helpful to consider the cost difference between an overnight national service and the regional ground service, as this is an overnight service for the regional.

The cost disparity in this scenario is enormous — even if the shipper enjoyed a 70% discount on FedEx Standard Overnight, costs could be reduced substantially by going with the regional.

In an increasingly murky small-parcel landscape, regional carriers can represent a worthwhile bulwark against national carrier pricing and service pressures. Similar to most small-parcel supply chain decisions, characteristics knowledge is power – by putting that knowledge to use, adding a regional carrier to your roster can be an excellent choice.

Jake Wertner is Vice President of Client Services for iDrive Logistics, providing pricing and strategic advisory services in support of the world’s most efficient small-parcel supply chains. He can be reached at jake@idrivelogistics.com or 385.336.6405.

![GettyImages-911045162-[Converted]](https://cms-static.wehaacdn.com/parcelindustry-com/images/GettyImages-911045162--Converted-.2298.widea.0.jpg)