With the onset of COVID, both UPS and FedEx suspended service guarantees that had been in place for years. These guarantees provided shippers a measure of compensation for the many potential issues caused by late deliveries. Freed from long-standing service guarantees, the carriers had no accountability for service failures and coincidentally made record profits during COVID. Now that the pandemic-induced spike in shipping volumes has passed, both carriers have excess network capacity but continue to withhold guarantees on all but the most premium services.

When Carol Tomé, UPS CEO, was pressed in a recent Q&A with Thomas Black (published by Bloomberg) on why guarantees were still suspended, she said, “When you deliver at 98% effectiveness, service guarantees aren’t necessary.” Tomé’s dismissive attitude toward something so valuable to shippers has trickled down to many front-line salespeople who express no need to compete on price when they claim their service is so much better. For several months now, when reviewing our clients’ contract proposal decks from UPS, they invariably include slides slamming FedEx and claiming vastly superior on-time delivery performance. They even propose a dubious calculation of how much money will be saved by paying more with UPS. But does this even matter?

To be fair, FedEx had some well-publicized on-time delivery performance issues, but to overlook the years when UPS had similar challenges is disingenuous at best. Over the years, this cycle of better on-time performance has always been in flux. These cycles of performing better or worse will repeat as long as the two companies compete. For their part, shippers want the fastest possible service for the lowest possible price. Unfortunately, the on-time delivery performance metric, which is largely spin and hyperbole, fails to provide shippers with real time-in-transit insight, especially when carriers deliver it without context.

The on-time percentage metric is vague for multiple reasons.

First, the carriers decide what makes a late shipment eligible for inclusion in the calculation. Once deemed ineligible for any reason, the late shipment is not counted at all. This is somewhat akin to getting to the Super Bowl to play Belichick’s Patriots and finding out he is also the referee.

EXAMPLE: ABC Company ships 100 Ground Residential packages, 87 of which arrive on or before the estimated delivery date. That leaves 13 shipments that did not arrive on time. The carrier then decides that really only 89 shipments count, 87 of which were on-time. Then they tell ABC Company they delivered 98% of their packages on time. In reality, 13% of ABC Company’s Ground residential customers did not receive their shipment on time, leading to multiple inquiry calls and angry customers.

Second, on-time delivery performance does not account for the severity of lateness. One day late counts the same as eight days late, and anecdotally, we have observed many shipments linger for days in a carrier’s delivery center after missing the original estimated date.

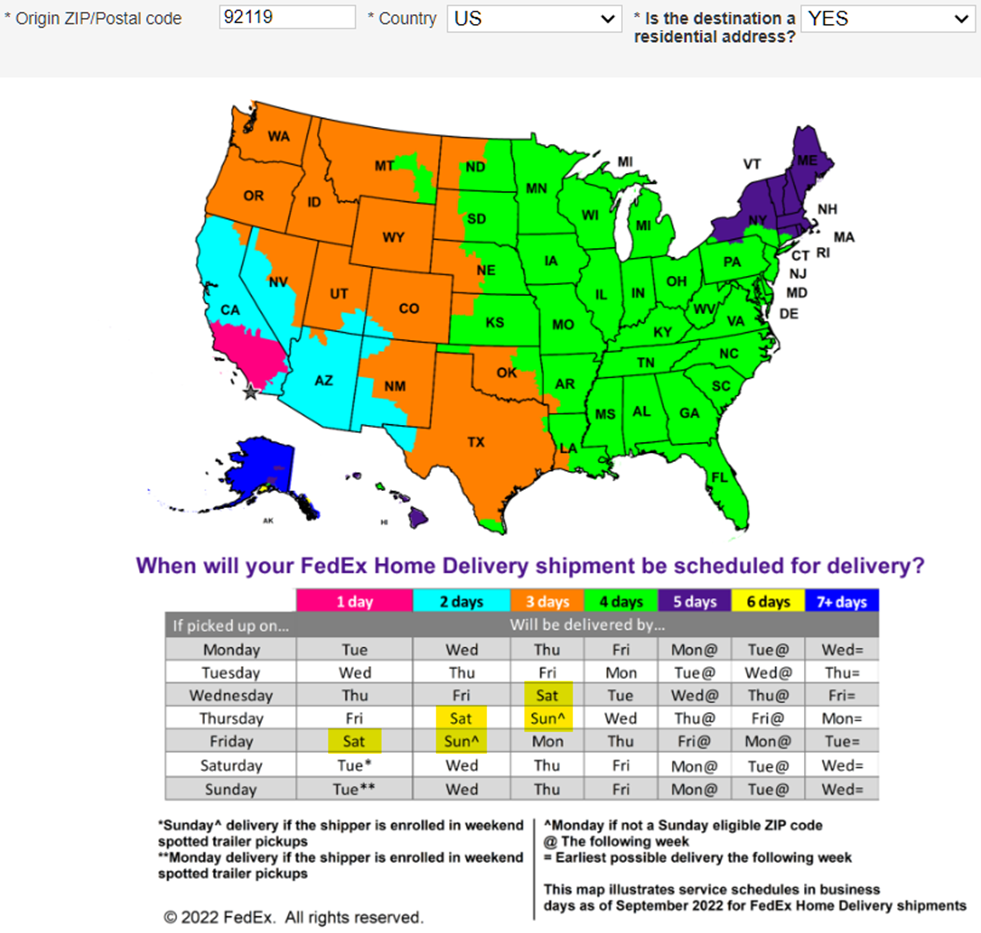

Third, the definition of “days” is inconsistent. UPS’s transit times, published in “business days,” do not usually include weekends. However, FedEx Ground Home Delivery, with its superior Saturday delivery coverage and actual Sunday delivery to most of the country, commits to a particular day that usually includes weekends.

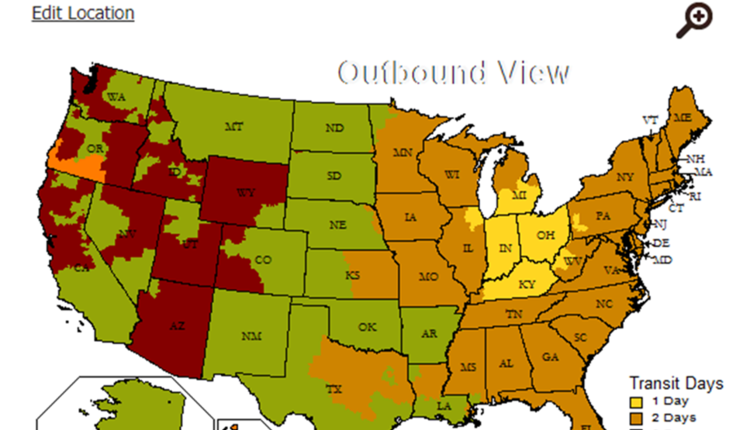

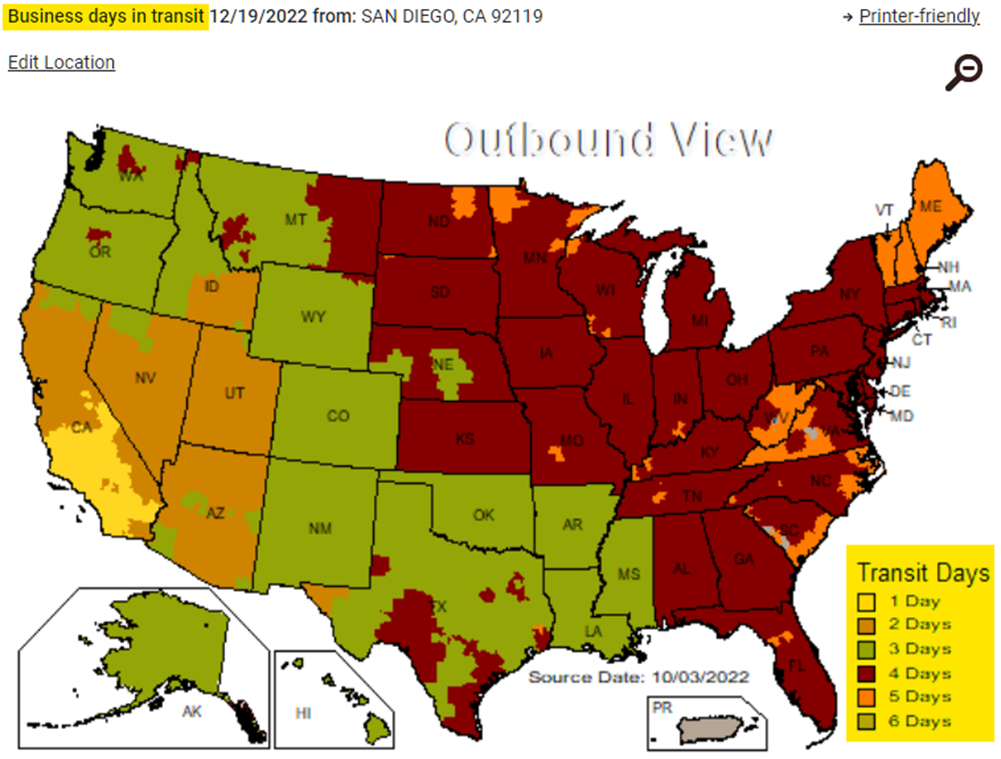

FedEx is considering changing these weekend commitments, but for now, this disparity creates many cases in which FedEx could deliver faster than UPS while still being considered late by published standards. To illustrate this point, consider the following two maps, the first published by UPS for Ground Residential, and the second by FedEx for Ground Home Delivery. Both are from the same origin ZIP Code. Notice the difference in the published time-in-transit commitments.

UPS From San Diego Shipping on a Monday:

FedEx From San Diego Shipping on a Monday:

The day of the week a package is shipped is very important when determining the delivery commitment and which carrier will ultimately deliver faster. Consider a FedEx shipment sent from San Diego to Arizona on a Thursday. The two-day transit commitment is due on Saturday. The two-day commitment from UPS is vague, and generally not due until Monday.

Currently, you will not find a published UPS Ground transit map with the level of specificity that FedEx provides. This means FedEx could be late by missing the estimated Saturday delivery date, deliver a day later on Sunday, and still reach the recipient a day faster than if it had been sent with UPS. (Whether or not FedEx would report this as a late delivery is another question.)

These weekend deliveries result in decreased calendar-days in transit, a difference that clearly shows up in our data. Using a full data set of FedEx Home Delivery shipments versus UPS Ground Residential shipments from our database from October and November 2022, I compared the actual calendar days in transit based on the difference between the carrier-provided ship date and delivery date. Looking at average calendar days in transit is a much clearer metric than a carrier-controlled on-time delivery percentage.

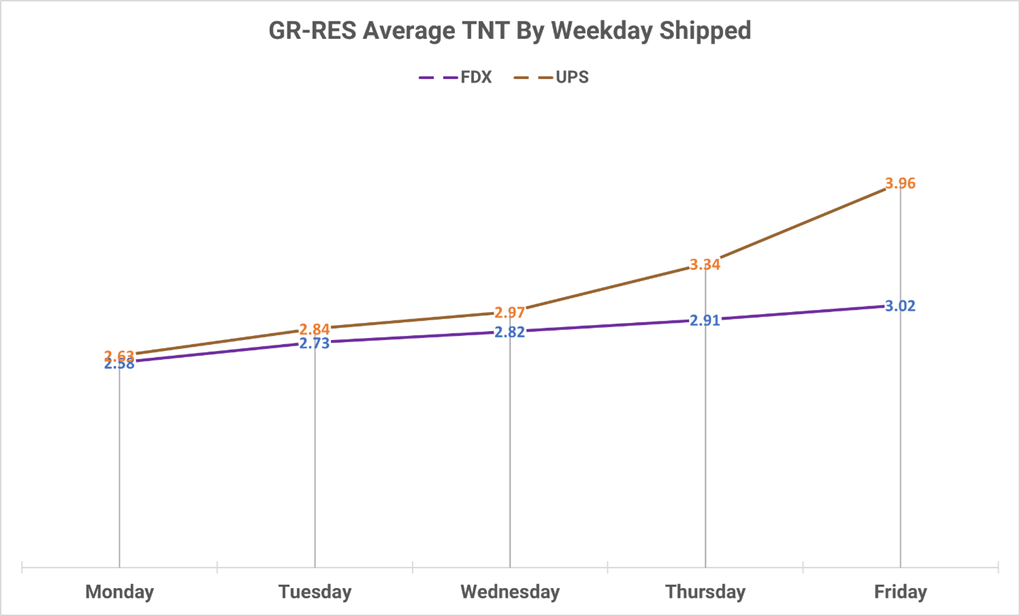

The chart below shows that average calendar days in transit are generally close when shipped on a Monday, Tuesday, or Wednesday. The impact of UPS not committing to weekend deliveries jumps out for packages shipped on Thursday or Friday, with the average difference widening dramatically as the week progresses. Again, this data is agnostic to estimated delivery dates and measures only how quickly the average package was delivered. UPS’s broad claims of superiority fall flat when faced with data. Based on over 2.7 million shipments, FedEx clearly delivered their average Ground Home Delivery package faster than UPS delivered its average Ground Residential package.

GROUND RESIDENTIAL AVERAGE CALENDAR DAY TIME-IN-TRANSIT BY WEEKDAY SHIPPED: (UPS picks up some packages on Saturday for Monday delivery, but the volume is minuscule by comparison to the weekdays)

To be clear, this is a recent, single-service sample of all shipments sent by our clients during the 2022 peak season, at the time of writing. I encourage the carriers to release all the data showing their actual calendar days in transit. Be transparent and show how long it actually took you to deliver! Your current and prospective clients deserve to know what they’re really getting for their money. No cherry picking what counts as late and what doesn’t.

I also encourage FedEx, which had well-publicized “late” issues during COVID, to not take away an actual advantage you currently have with weekend delivery commitments. Based on the quote below fromRaj Subramaniam, FedEx President & CEO, during FedEx’s Q2 2023 (12/20/2022) earnings call, FedEx may actually start marketing this current advantage, and it would be foolish to remove it.

“Our team is performing exceptionally well this peak season with ground time-in-transit in the U.S. at just two days. FedEx Ground is delivering holiday shipments faster to more locations than our nearest competitor [UPS].” – Raj Subramaniam, FedEx President & CEO

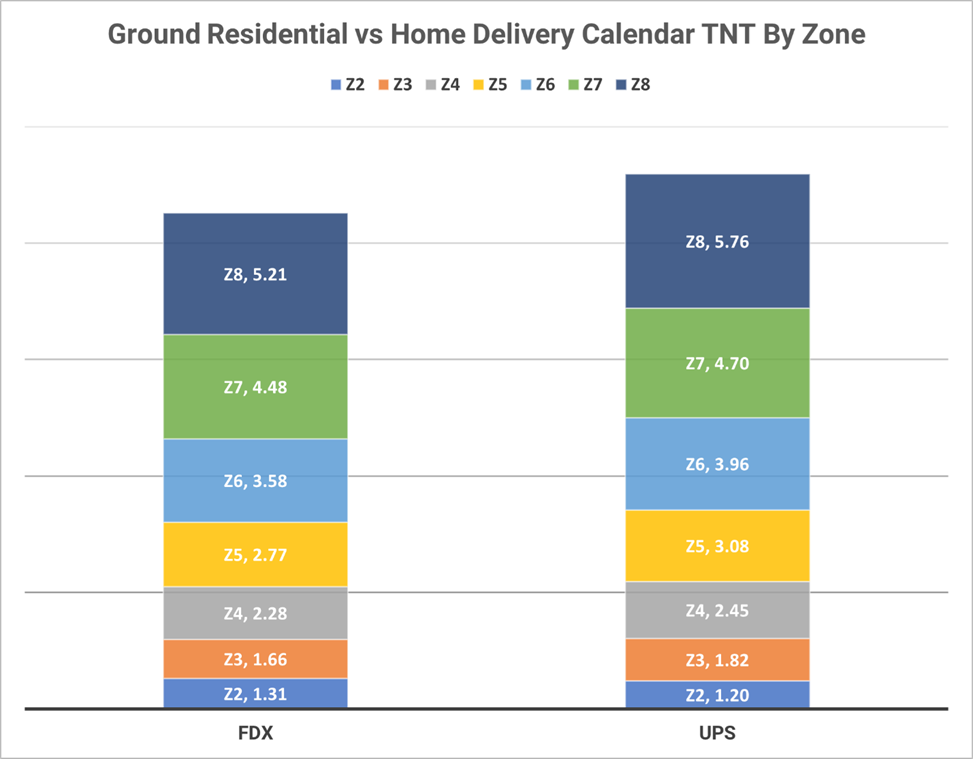

As much as possible, shippers should use actual performance data to set delivery expectations with their buyers. The chart below uses the same data set as above and shows the average transit time by zone in calendar days. Looking only at Zone 2, which has a nearly universal one-day transit commitment, UPS is averaging 1.20 days. One way to interpret this is that on average, 20% of the time, UPS is not delivering in one day to the closest consignees.

But with UPS publishing no actual data, potential shippers can only guess at UPS’s performance until after they’ve signed a contract. One thing’s for sure: 98% effective it ain’t.

Karl Wheeler is a Senior Professional Services Consultant at Shipware, LLC., a shipping consultancy. His first interaction with Shipware was as a client and his perspective was a welcome addition. He has over a decade of hands-on experience in e-commerce logistics and shipper operations, combined with impressive data mining and visualization skills. This combination of backgrounds provides a unique perspective among Shipware’s Professional Services team. Karl also has an extensive background in carrier contract negotiations, service level optimization, inventory location optimization, and data-based cost reduction strategies.

This article originally appeared in the January/February, 2023 issue of PARCEL.