In 2023, shippers are acutely aware of the annual rate increases by the prominent carriers. Additionally, the escalating labor negotiations between UPS and the Teamsters have also caught their attention. However, in February and March, there were two industry developments that received less publicity but deserve some focus as they could have significant implications for the broader parcel market. These announcements are likely to intensify the competition in the already dynamic parcel market.

1. USPS Announces New Ground Advantage Service

To date, USPS has not marketed a product offering that has been truly able to compete with services like UPS Ground or FedEx Home Delivery. The disconnect has always been USPS First Class is typically competitive in price and transit standards but has only been available for packages under one pound. USPS Priority Mail has been competitive with transit standards and is available for packages above one pound, but generally comes in at a higher price point after factoring in UPS and FedEx discounts.

Announced in February, USPS has developed a service offering called Ground Advantage, which may prove competitive against other Ground services in the market. Per the release, this new service will replace the First-Class package service, is available for packages up to 70 pounds, will have two-to-five-day service standards, and includes $100 of insurance.

Many of the announced details of the Ground Advantage service seem to mirror ground offerings from other carriers. As of the writing of this article, USPS has not released the published rates for the new service, but the expectation is that they will be lower than Priority Mail and could compete with the ground rates some shippers have with other carriers.

2. OnTrac Looking for Additional Volume, Moody’s Downgrades Debt Rating

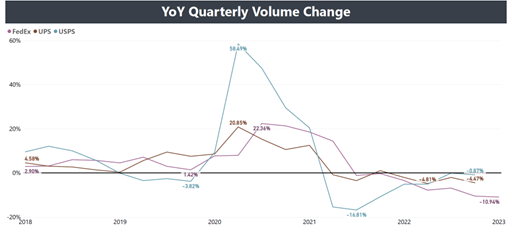

LaserShip made waves in October 2021 when it was announced that it would acquire OnTrac for $1.3 billion – later rebranding under the OnTrac name. The timing of this announcement seemed ideal. National carriers were dictating pricing due to the limited capacity, and shippers were looking for any option to mitigate the cost increases being forced on them. Since that announcement, however, parcel volumes have softened, and national carriers are looking to gain back volume that left their networks. While OnTrac does not have publicly available financials, we can look at the financial reports of the national carriers to see where parcel volumes have trended in Figure 1.

OnTrac’s expanded capacity from the acquisition, along with the declining parcel volume, likely played a role in a report from Moody’s Investor Service. In early March, Moody’s downgraded OnTrac’s debt rating, citing “very high financial leverage, weak liquidity and moderate scale in the competitive e-commerce residential delivery market.”

Figure 1: UPS, FedEx, and USPS Year-Over-Year Volume Change Via Quarterly Financial Reports

The volume of shipments has changed post-pandemic and carriers have seen capacity decline. The era of stimulus money is behind us and now carriers are looking to right-size their businesses.

What do these two announcements mean for shippers?

On the USPS side, it’s been long overdue for USPS to have a service that can directly compete with UPS Ground and FedEx Home Delivery. While the pricing and execution of Ground Advantage remain to be seen, initial signs point towards it being a potentially viable alternative that shippers could take advantage of in future parcel bids.

With OnTrac, a downgraded debt rating is a bit of a mixed bag for shippers. On one hand, it signals that there could be more risk with OnTrac than previously thought. On the other hand, it could potentially mean that OnTrac will be looking to gain more market share to fill its expanded capacity from the 2021 acquisition. OnTrac’s March rebrand and subsequent marketing strategy seem to point to an initial push to gain the additional volume that they need. Shippers can leverage this by evaluating opportunities that would give OnTrac some much-needed volume in exchange for aggressive pricing.

It's crucial to have the right carrier negotiation professionals to assist you, especially with the continuous evolution of the broader shipping industry at a rapid pace. Although the attention has been mainly focused on UPS and FedEx in 2022-2023, it's worth noting that updates from USPS, OnTrac, and other carriers are continually transforming the competitive landscape, challenging the status quo. Therefore, shippers must be equipped with an acute awareness of all the changes in the parcel market, as well as the right negotiation skills to create a carrier mix that allows their businesses to deliver efficiently and profitably in the foreseeable future.

Keegan Leisz is Project Manager, Transportation Consulting, Körber Supply Chain.

This article originally appeared in the May/June, 2023 issue of PARCEL.