This article originally appeared in the May/June, 2018 issue of PARCEL.

When you think about what type of packaging is needed to protect items during shipment, it’s a good bet that you factor in cost and, potentially, labor productivity. Without question, these are important considerations. But have you factored in how your choice of packaging impacts consumer perception of your company and customer lifetime value? You may be surprised by the answer.

In the first-ever study of its kind, Pregis partnered with the University of Wisconsin to understand the link between consumers’ unboxing experience and the perception of product value. The objective was to understand how different protective packaging mediums influenced pricing perception and emotions experienced when unboxing.

So, why is this important? As retail continues to shift from physical stores to digital, the unboxing experience in consumers’ homes is replacing the store experience. Over the years, the retail store experience has become a science that includes branding, placement, merchandising, personalized service, music, and even scent. But many retailers have failed to replicate that euphoric in-store experience with home delivery – which puts customer lifetime value at risk. The study results demonstrate how parcel packaging choices are major influencers in delivering a customer experience that elevates the value of the product and brand.

Study Methodology

The study was conducted at the University of Wisconsin in consultation with Page Moreau, a professor of marketing. There were 60 participants, split into two cells of 30 each. The study participants ranged in age from mid-20s to late 30s — a desirable demographic for online retailers.

Each participant was instructed to unbox the same product. We selected a bamboo bowl because its pricing can vary considerably. The bowl used in the study had a retail price of $25, but a simple online search shows results ranging from $15 to $200. The participants were unaware of the actual bowl cost. You’ll see why, shortly.

It’s important to note that the participants focused on the product itself at this stage; it was imperative to not precondition them to factor in the packaging components this early in the study.

Here’s where things get interesting. While both groups of 30 unboxed the same product, each group had different packaging. Participants only saw their own packaging and were not aware of a different option. One package is best described as “economy” – a plain brown box with white polystyrene foam for inside protection and clear carton sealing tape. The other packaging would be considered “premium,” with a white box; clear, inflated, hybrid cushioning featuring a square pattern to protect the contents; soft white foam wrapped around the bowl with a “thank you” sticker; and white carton sealing tape on the exterior.

After the unboxing experience, participants were asked to complete a survey that focused on the following areas: price expectations, likelihood to gift, unboxing emotions, and packaging description.

After completing the exercise, the data revealed some very compelling truths. Let’s look at each survey section separately.

Price Expectations

The statistics powerfully reflect the difference between receiving the same bowl in premium vs. economy packaging. The premium group was willing to pay $27.77 for the bowl, but they expected the retail price to be even higher at an average of $49.07. The willingness to pay reflected by the economy packaging participants was only $21.30, a 30% lower price point! The expected retail price of $33.83 that they identified was 45% lower than the premium group’s expectations. As consumers generally are more accurate at predicting behavior of others than themselves, we phrased the price expectation question both ways.

Further, in answering the question of, “How likely would you be to gift this bowl to a friend?”, the premium group recorded 4.2 on a seven-point scale, while the economy group response came in at 3.6.

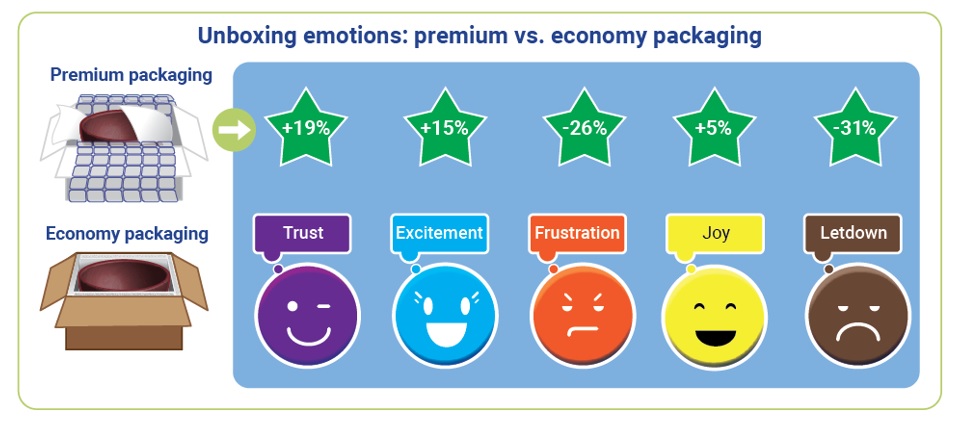

Emotions

As consumers, we intuitively know that emotions are connected with a buying experience. But for the most part, companies rarely factor them into protective packaging decisions. The emotional responses make it crystal clear why we need to pay more attention.

We asked, “Think back to when you first unboxed the product and describe your feelings on the following scale.” Again, we used a seven-point scale, with one indicating “not at all” for that particular emotion and seven indicating “very much.” Let’s look at each emotion individually.

Trust. The premium package ranked 4.4 for trust, with the economy package logging 3.7. Participants in the premium packaging group gave “their” package a 19% higher score.

Excitement. The premium folks averaged 4.8 points for excitement, compared to 4.1 for the economy group. The premium packaging recipients were 15% more excited to receive their package.

Frustration. There was a 25% higher indication of frustration from the economy group (2.4 points) vs. the premium group (1.8 points).

Joy. The point scale results were closer for this attribute, with the premium packaging respondents logging five percent more joy.

Letdown. There was a significant 31% higher letdown emotion identified by the economy group over the premium group.

The key takeaway from this section is that parcel packaging choices significantly impact consumers’ unboxing emotions.

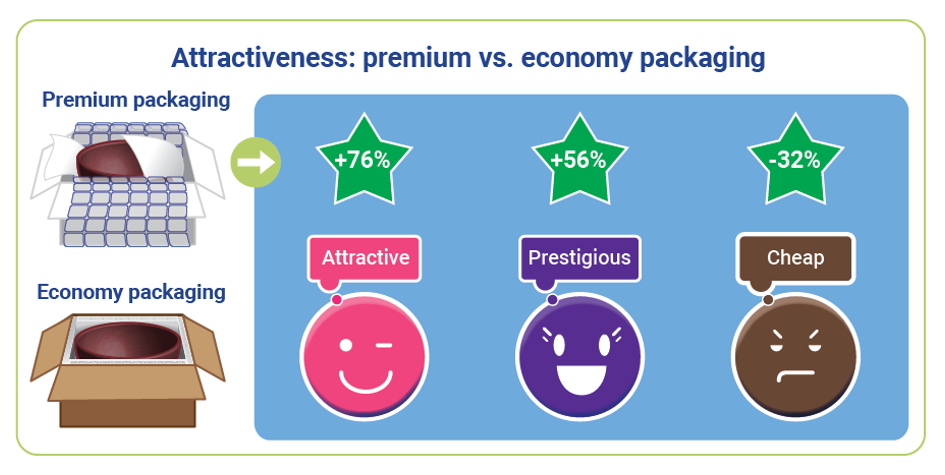

Packaging Description

What kind of vibe does the package give? Is it attractive and prestigious, or does it just look cheap? Here is what the study uncovered.

Attractive. Premium packaging blew the economy type right out of the water, scoring 76% higher on the attractive scale.

Prestigious. Premium also scored an impressed 56% higher than economy on the “prestigious” attribute.

Cheap. Predictably, the economy package was perceived cheaper by 32%.

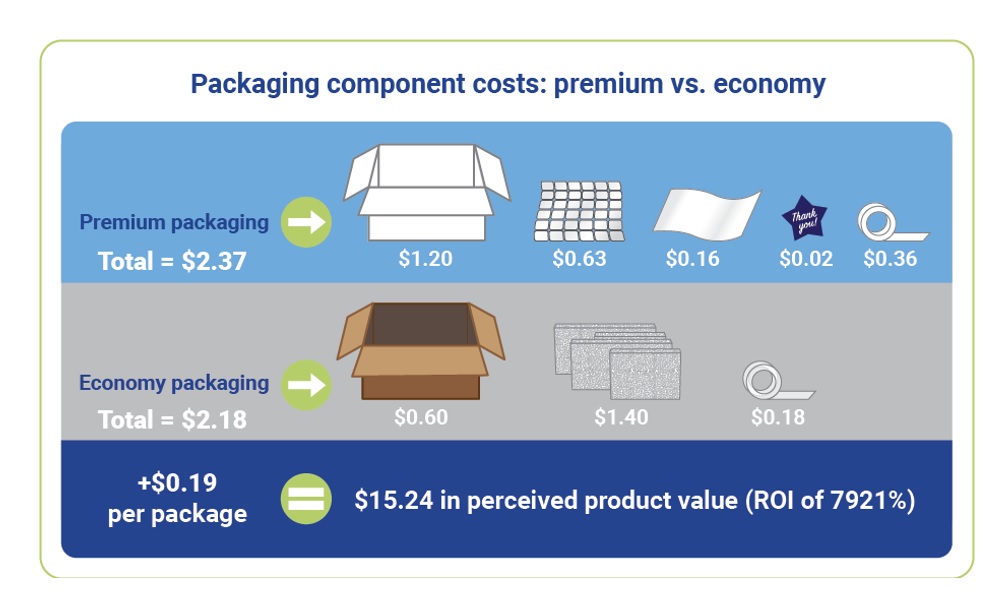

Economics

What’s the cost to upgrade to premium packaging from economy? The increase in expenses must be economically feasible to implement. Here is an itemized list for each packaging component used for both the premium and economy packages. As you can see, the upgrade costs are minimal.

Parcel Packaging: the New Merchandiser

Only 19 cents, or 8.7%, is the difference in cost between the premium and economy components used to conduct this study. However, as noted in the other data points above (emotional response, value perception, willingness to pay, and so on), the additional 19 cents per package has a dramatic impact on what the consumer thinks of your products and brand.

Moreau points out, “There is strong evidence that the unboxing experience impacts customers’ emotions and their perceptions of product value. When a retailer gets the unboxing experience right, they demonstrate that the product is valuable and worth protecting. Consumers recognize that signal, and it influences their perception of quality. As e-commerce continues to be the growth engine for retail, retailers and brands must understand their new showplace is the parcel packaging.”

We previously mentioned the science involved in the consumer experience at physical retail stores. It’s time to start constructing a similar experience in consumers’ homes.

Ryan Germann is eCommerce Segment Manager at Pregis, a leading provider of innovative protective packaging materials, equipment systems, and surface protection. The company provides solutions for a wide variety of consumer and industrial market segments including food, beverage, healthcare, medical devices, agricultural, e-commerce, retail, automotive, furniture, electronics, construction, and military/aerospace. For more information, visit www.pregis.com. To download the complete study, please visit www.pregis.com/knowledge-hub/.

Click here to return to the Packaging Solutions topic page.