Effective December 27, 2020, UPS Ground, Air, and International services will increase by an announced average of 4.9% -- matching both the UPS 2019-2020 increase and the FedEx 2021 GRI announced last month. While this is the average price hike, shippers will be affected differently based on their shipping profile.

The GRI was published shortly following the UPS Q3 earnings call. Before diving into the GRI, it is worth understanding the message new-CEO Carol Tomé continues to reinforce about UPS priorities. It can be encapsulated in two quotes from the call (emphasis mine):

“The final piece of our strategy comes down to being better not bigger. Now that doesn't mean UPS is not going to grow because we are. It means that we will lean into growth from the right opportunities like SMBs, international, global freight forwarding, and other high-yielding sectors, and we will grow from our revenue quality initiatives. We are on a journey to optimize the volume that flows through our network.”

The second quote comes in the answer to an investor question about de-marketing large volume shippers that don’t meet margin goals:

“When you have tight capacity, it also means that prices tighten. And as prices tighten there is a shift in certain customers who are more price-sensitive than others. We're okay with that if we're losing non-nutritive sales. We're okay with that. It's not about volume share growth. It's about value share growth. So that's how we'd like you to think about us at least in the short-term value share growth.”

This context aligns to what UPS is communicating in its latest pricing adjustments. Here are the high-level impacts:

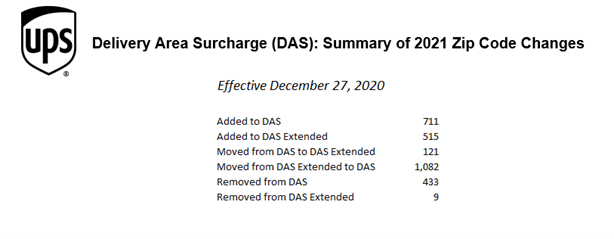

4. Delivery Area Surcharge ZIP Code Changes. More ZIP Codes than ever will be eligible for DAS surcharges:

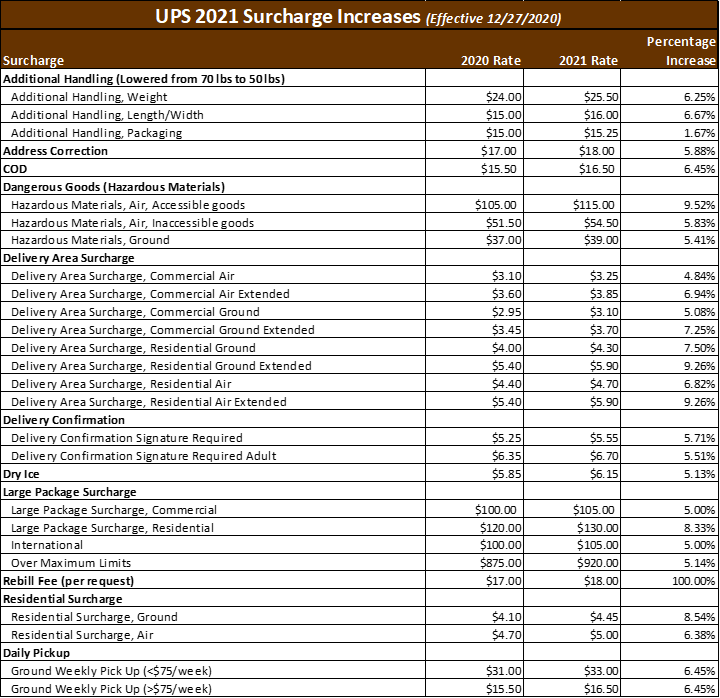

a. Effective January 10, 2021, an Additional Handling charge will be applied to any package with its length plus girth combined exceeding 105 inches.

Details on zone-based pricing for these surcharges have not yet been published.

6. Nearly all surcharges are increasing by more than 4.9%

|

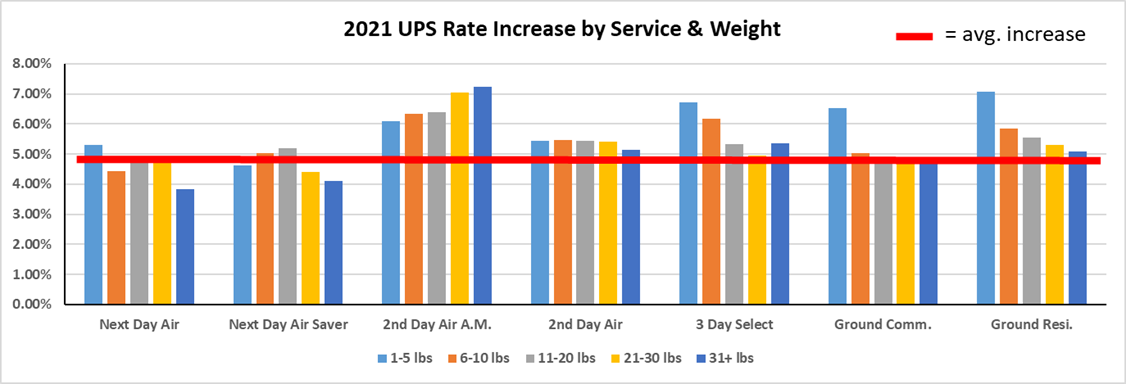

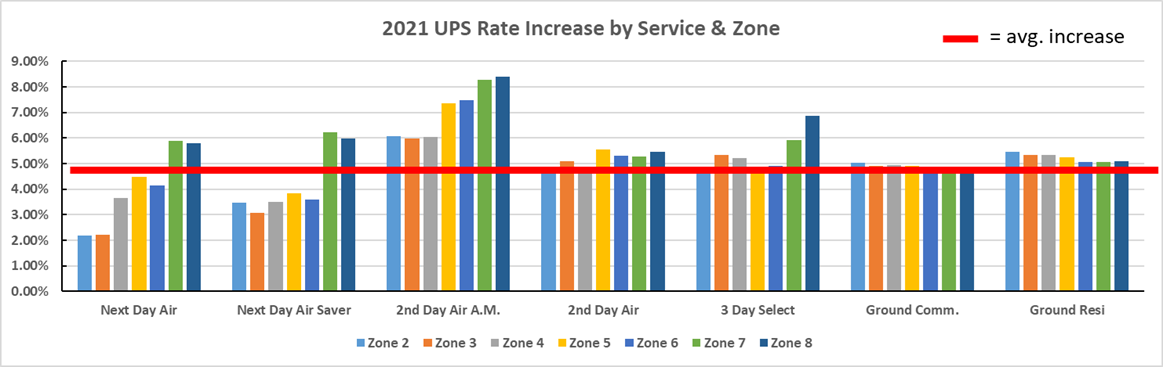

How will this affect individual shippers? The general rate increase will affect some shippers more than others, but everyone can count on some degree of higher costs. This year’s announcement particularly targets low weight Ground packages and high zone Air packages. Shippers with packages that qualify for Large Package and Additional Handling surcharges will continue to get “special treatment” for sending these packages via the UPS parcel network.

Matt Weickert is Senior Consultant for Shipware, a shipping consulting firm that specializes in cost reduction and recovery services. Prior to his work at Shipware, Matt advised the world’s largest shippers like Walmart, Office Depot, Costco, and Apple in strategic logistics analyses and contract negotiations. He earned a B.S. in Industrial Engineering from Mississippi State University and runs a lot.