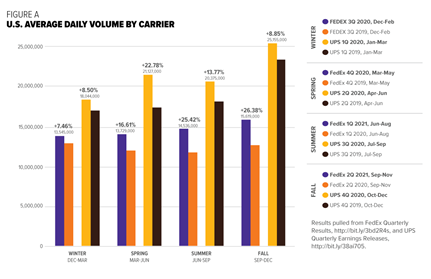

The past year has certainly tested supply chains and brought them to their breaking point. With a 44% YOY increase in e-commerce spend in 2020 , carriers and shippers alike had to shift resources to account for the ever-growing B2C segments of their business. US average daily volumes for FedEx Express/Ground and UPS saw an average 8% and 13% YOY increase respectively, but also jumped more than 22% in at least one quarter for each carrier during their fiscal 2020 year. So, it makes sense that both FedEx and UPS began revaluating their bottom line in Q2 2020, utilizing language that indicated they would have to increase revenues to keep up with the investments they had to make in their supply chains to withstand the large demand growth. Each carrier instituted peak residential surcharges that heavily impacted large retailers. They also created different ways of measuring volume baselines, assessing fees, and put new restrictions on what they would pick up. The dust is now settling after a tough peak season, and many shippers are wondering how they can better prepare for unforeseen fees and thresholds again. There’s no doubt that many will turn to carrier relationships this spring to try and lay out more favorable pricing and language into their contracts, but many also do not know where to start.

Peak Activity Is a Great Starting Place

Updating contracts for 2021 and beyond seems like a daunting task, especially since the year proved that all the best planning can go out the window in a split second. However, there are strategic contract components you can focus on to help lower your cost per package and increase the ability to budget for the years to come. Start by addressing peak in the contract: define what peak season dates are, how fees will be assessed, and potential discounts that could be included. Putting predictability back in budgeting has never been more important. Remember that many shippers did not know how carriers were going to assess billing for peak residential surcharges in 2020. This year, request reporting for your peak shipment volume and charges to ensure you can strategically manage your volume to target costlier peak fees.

Pay Close Attention to the Day-to-Day Terms

Both carriers have also been chasing more favorable payment terms, and FedEx has recently stated it will begin to assess late fees for unpaid billing (something it did not do before 2020). Pay attention to the payment terms laid out in the contract and consider if these terms make sense with how your company currently pays its carriers. Another thing to investigate in your current and prospective contracts is your incentive or earned discounts. Because of a large increase in parcel volume, many shippers could be near the end of their incentive tiers or do not have as favorable incentives for the change in volume or services from 2020. When looking to 2021 and beyond, if you believe your volume will stay on an upward trajectory, it would be best to reevaluate your incentive tiers to reap the cost-saving benefits of increasing volumes. If you changed to different services, or the characteristics of your shipments have changed a lot in the past year, it may also be valuable to revisit all discounts to your services, so that you are getting the best discounts on the most frequently used services and in the areas on the rate card (zone/weight) where most of your packages live. Minimum reductions (or minimum charges, as they are sometimes called) can be, depending on your package profile, some of the most important parts of a service pricing agreement. You can receive 90% off a service pricing, but if your minimum charge does not change or is too high and most of your packages are low weight and zone, you will not see many benefits in pricing because you will most likely be billed the minimum charge. Getting the minimum to a price you are comfortable with is very important.

Keep Your Eye on the Future Market

The GRI has always been an important part of a contract. The major shippers increased their rates by an average of 4.9%; however, we estimate a 7.24% and 7.65% increase for FedEx and UPS’s most common surcharges, respectively. Asking for and receiving a GRI that is less than the published amount is something that major shippers should strive for, and having a rate cap put in place on common accessorials like residential surcharges and DAS would be best-in-class.

Target Bigger Cost Items

There are other parts of the contract to focus on, regardless of the current climate. If you have packages with dimensions that are less dense than the list DIM divisor (139 for UPS and FedEx), where the actual weight is less than DIM weight, then a custom DIM divisor or threshold may be a good item to consider. Residential Fees and Delivery Area Surcharge fees are also some of the hardest hitting surcharges to the bottom line, so getting any discounts on these accessorials would be the best surcharges to focus on first, especially if you are a heavy residential shipper.

If you have certain surcharges that are assessed because of your packaging profile, like Additional Handling, consider custom thresholds. Additional Handling, Oversize/Large Package, and Overmax are three surcharges that have increased penalties during peak season, so addressing the packages that are causing these surcharges, getting custom thresholds, or switching Overmax shipments to a bulkier, article-centric mode like LTL or a courier could bring some savings throughout the year – especially during peak.

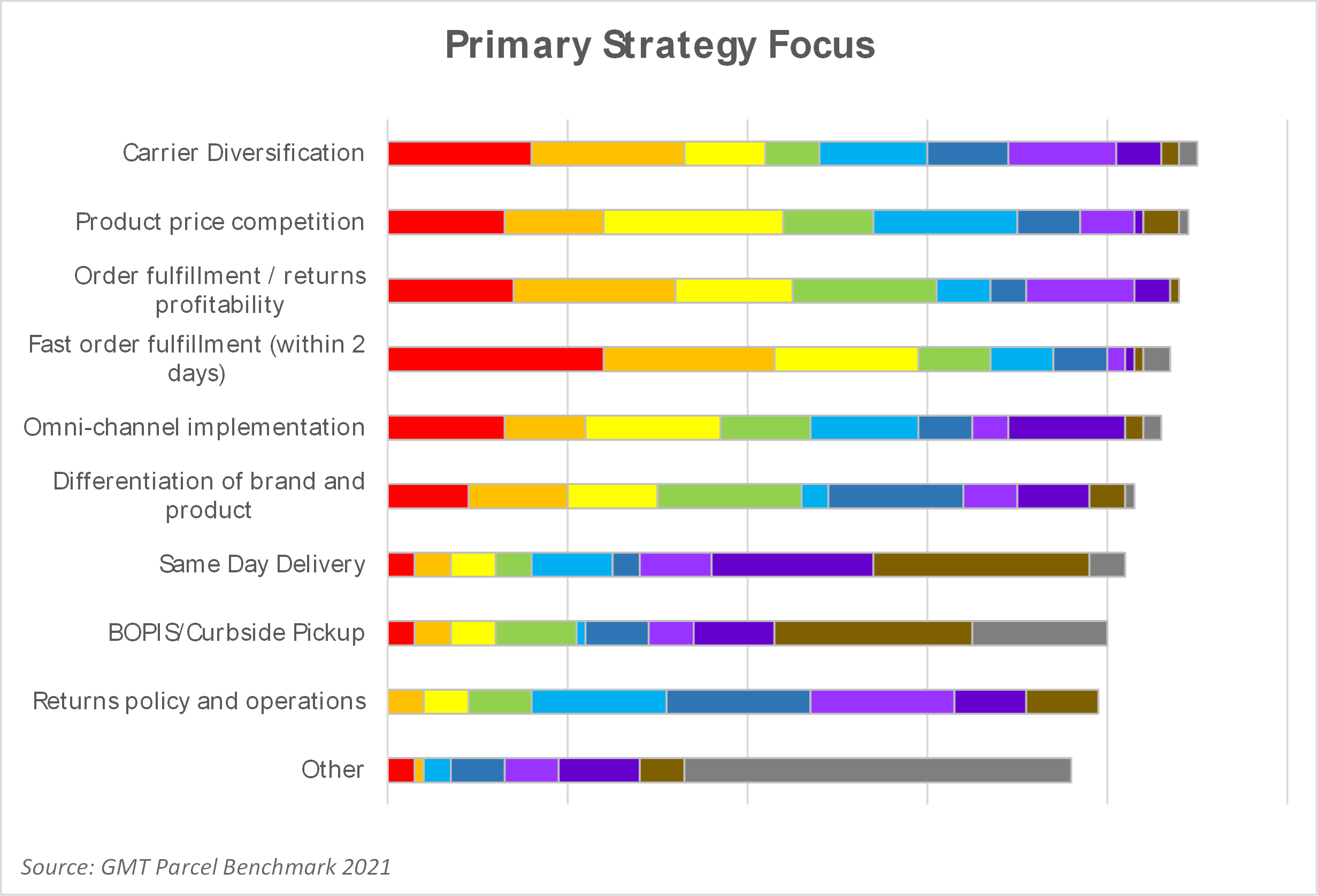

Prepare for Plan B

Inevitably, few contracts are perfect. As market conditions change, you may find your contract a benefit or a curse. Utilizing your shipper profile and customer data can go a long way in optimizing your contract terms; however, we saw many shippers benefit from utilizing a “Plan B” approach via carrier diversification in 2020. According to the 2021 GMT Parcel Benchmark Survey, most shippers prioritized Carrier Diversification as their top focus (Colors represent prioritization, red = top ranked, gray = lowest ranked), especially because carrier volume constraints created major issues for single-source shippers. If one carrier could not take their volume, they had no other option to get their orders off the DC floor. Shippers were also uniquely vulnerable to changing and rising accessorial and surcharge fees. This makes carrier diversification an important strategic conversation going forward, as it presents an opportunity for shippers to select the best rates and services to them at any given time. Shippers who have a regional fulfillment model already will benefit the most using regional shippers, as well as shippers that have the software capabilities to manage multiple carriers. Regional carriers often have cheaper rates and surcharges than the larger carriers. Diversifying your carrier base is something that shippers should do during non-peak periods, because carriers need to estimate their volumes as well, and many were so busy during peak that they put new customer implementations on hold until after peak. Whether shippers want to rebid their current contracts or implement new carriers, one thing is for certain: parcel shipping is an ever-evolving market, and to receive the best cost savings, the best strategy is to be proactive instead of reactive.

Brenden Russell is a Solutions Engineer II at Green Mountain Technology, a Parcel Spend Management solution provider, where he creates reports to help analyze and optimize customer parcel carrier networks. Brenden majored in Supply Chain Management with a minor in Information Systems Management from Auburn University. Visit www.GreenMountainTechnology.com for more information.

This article originally appeared in the May/June, 2021 issue of PARCEL.