Editor's Note: In our printed November/December issue, we incorrectly had UPS listed as USPS in Table 1. We apologize for our error and would like to clarify that Figure 1 was indeed supposed to say UPS.

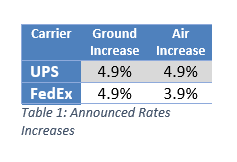

On September 20, FedEx announced its 2017 general rate increase (GRI). UPS announced its 2017 GRI earlier on September 1. This year’s GRI actually shows the carriers going in different directions with their pricing: FedEx is reducing its US Domestic Express and Ground DIM divisor from 166 to 139, while UPS is holding (for now) at 166 for these services. FedEx announced a 4.9% average increase for Ground and a 3.9% increase for US Domestic Express, Export, and Import services. UPS announced an average increase of 4.9% for Ground and 4.9% for US Domestic Air services. The FedEx GRI will take effect on January 2, 2017, while the UPS GRI will take effect one week earlier on December 26, 2016.

The Rates

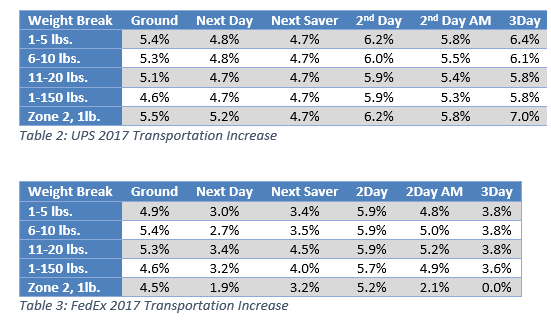

Since these GRIs are described by the carriers as an average net, the actual impact to certain service level rates can vary greatly.

Both UPS and FedEx announced a 4.9% average increase for their Ground service; however, the 2017 Ground rates will be different between the two carriers, which is a first in many years. The US domestic air increase for FedEx (3.9%) is one percent less than the UPS Air increase (4.9%). While the average increase for FedEx is lower, it is very important to consider how these averages are calculated and which services will take the greatest increase.

The UPS increase is broken out by service level and weight breaks in Table 2 to give a better idea where the largest increases will take place. On average, Next Day Air and Next Day Air Saver will take less than the announced increases at 4.7%, while the Ground rates are slightly higher than 4.9%. Meanwhile, 2-Day and 3-Day rates will increase over six percent. Most shippers will utilize the less expensive Air services, thereby causing a greater impact than anticipated by the GRI announcement. It is also noteworthy that the 3-Day Zone 2, one-pound rate, upon which the minimum charge is based, went up seven percent. As always, minimums have a disproportionate impact on total cost relative to list rates for most shippers.

Table 3 shows how FedEx will follow UPS in the pattern of increases, but not in the amounts. Next Day Air will take the lowest average increase at 3.2%. The largest increase will take place on 2Day Air, with an overall 5.7% increase. However, the 3Day Air averages are misleading, and the minimum increase of 0% is a good indicator of why. Zones 2, 3, and 4 will increase 0% because shippers are aware that Ground service can typically get packages to those zones in two to three days, which means less demand for 3-Day service to those zones. Zones 5 and 6 will increase 7.2%, from one to 50 pounds, and zones 7 and 8 will go up 6.2% for the same weight range. This demonstrates how a 3.9% average increase can result in a much higher realized increase.

Additional Charges

Both carriers will be implementing changes to their accessorials, surcharges, and rating logic. FedEx will be changing its Express and Ground DIM divisor from 166 to 139 for all domestic shipments. It is apparent this will equate to a cost increase for shippers without a negotiated DIM divisor.

UPS, on the other hand, will make changes to how and when its Additional Handling Surcharge will be applied. On December 26, 2016, this surcharge will be charged to Air and International packages with the longest side greater than 48 inches (currently 60 inches). UPS will also start applying the Additional Handling Surcharge to SurePost packages on January 8, 2017.

FedEx will be adjusting its Fuel Surcharge percentage on a weekly basis instead of the normal monthly adjustment. This change will be effective on February 6, 2017. The effect of this change is a mixed bag. While it adds sensitivity to fuel price changes, it is typical for fuel prices to decrease slowly but rise quickly. Given this pattern, the weekly fuel surcharge adjustment will be a cost increase over the long run for shippers.

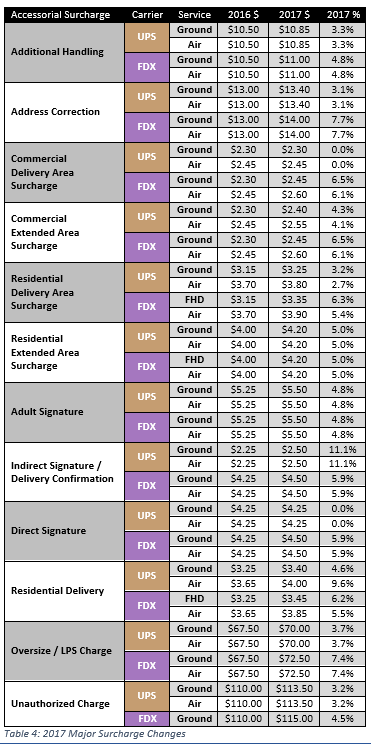

Other accessorials/surcharges increased along with the rates. The surcharges do not really have an average increase, but the individual increases vary from zero to 11%. Table 4 outlines the primary accessorial increases and compares the FedEx increases versus UPS.

Simplifying the Complex Increases

FedEx and UPS, while different in some ways, followed pretty much identical rules and policies, and in 2016 they had identical rates for most services. 2017 is unique in the way that the two carriers are diverging, not only in transportation rates, but also the DIM factor and fuel surcharge calculation. Analyzing the impact of the carrier GRIs prior to the implementation of the changes is highly recommended, as the realized impact will almost certainly be greater than the announced increases. Moreover, renegotiating contracts just got more complex as the 2017 changes will have major consequences on the total spend. A thorough analysis is a must to measure the true impact of the GRI.

Sam Simpson is a Senior Transportation Analyst at enVista. Sam’s diverse background includes expertise in negotiation, analytics, contracts, and vendor management. His main focus during his career has been generating savings through detailed analytics and process improvements. Sam’s experience as an analyst and negotiator gives him a unique perspective on opportunities to generate savings and improve processes.