This article originally appeared in the November/December, 2017 issue of PARCEL.

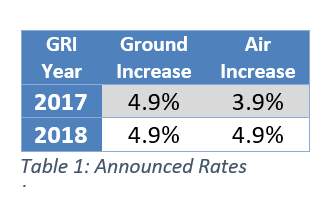

On September 18, FedEx announced its 2018 general rate increase (GRI). FedEx’s 2018 GRI is keeping the US Domestic Express and Ground increase to 4.9% (as compared to 2017 GRI Express at 3.9%). The FedEx GRI will take effect on January 1, 2018, but FedEx also added another significant rating change that will occur 21 days later. On January 22, 2018 FedEx will start dimensional weighting for SmartPost and will start charging third-party billing fees for all service levels.

The Rates

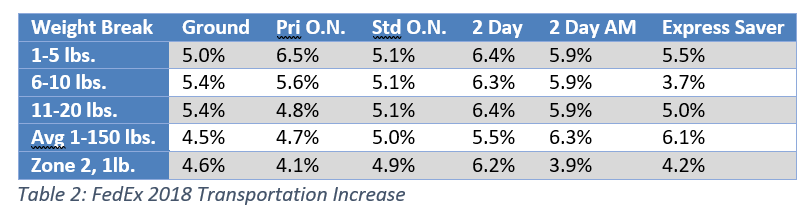

Since these GRIs are described by the carriers as an average net, the actual impact to certain service level rates can vary greatly.

FedEx announced a 4.9% average increase for its Express and Ground services. While the average increase for FedEx is 4.9%, it is very important to consider how these averages are calculated and which services will take the greatest increase. Express Saver is an excellent example of this average and the variances that can take place. Express Saver zones 6 thru 8 took a 7.4%, while the lower zones took an average of 3.9% increase.

The FedEx increase is broken out by service level and weight breaks in Table 2 to give a better idea where the largest increases will take place. On average, Ground and Priority Overnight will take slightly less than the announced increases at 4.5% and 4.7% respectively, while 2 Day AM and Express Saver are taking the greatest increases at 6.3% and 6.1% overall.

Additional Charges

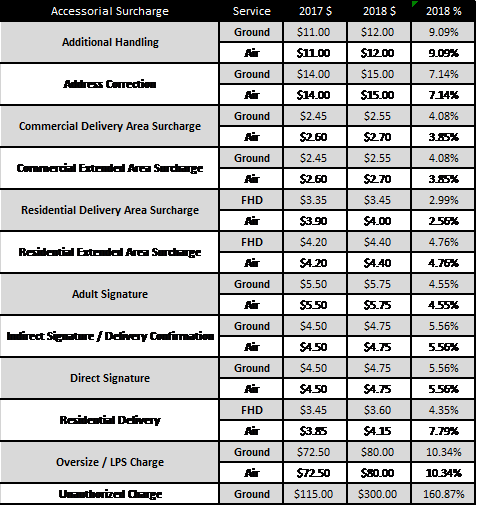

FedEx will be implementing changes to its accessorial surcharges, adding a third-party billing surcharge, and starting Dimensional Weighting for SmartPost. These changes will mean a greater cost for shippers and a need for deeper analysis, depending on which services and surcharges a shipper uses the most.

The majority of the surcharge increases will go into effect on January 1, 2018, whereas the Third-Party Billing Surcharge and the SmartPost Dimensional Weighting will start on January 22, 2018. The major surcharge changes for Ground and Express are listed in Table 3. Most of the increases are between 2.6% and 10.3%. The major callout here is the 160% increase for the Unauthorized/LPS Surcharge, which will be $300 in 2018. FedEx does not have an interest in shipping overly large packages, and the 160% is there to deter shippers of large packages from exceeding the overmax threshold.

The 2.5% Third-Party Billing Surcharge for all service levels will be an increase that will impact all shippers using third- party services. Since this 2.5% is applied to total charges, this will make the cost of the GRI much more than the average 4.9% as well as add to the surcharge increases. Total charges are defined as “transportation charges, surcharges, and additional fees but do not include duties, taxes, and ancillary clearance service fees” by FedEx.

While the FedEx 4.9% GRI was somewhat expected, the Third-Party Billing Surcharge and the SmartPost Dimensional Weighting add considerable costs and complexity to understanding the complete impact. Analyzing the impact of the FedEx GRI prior to the implementation of the changes is highly recommended, as the realized impact will almost certainly be greater than the announced increases. Moreover, renegotiating contracts just got more complex as the FedEx 2018 changes will have major consequences on the total spend of shippers. A thorough analysis is a must to measure the true impact of the GRI and how shippers can minimize the impact to their bottom lines.

Sam Simpson is a Senior Transportation Analyst at enVista. Sam’s diverse background includes expertise in negotiation, analytics, contracts, and vendor management. His experience covers parcel, truckload, LTL, and mail. Sam’s primary focus during his career has been generating savings through detailed analytics and process improvements. Sam’s experience as an analyst and negotiator gives him a unique perspective on opportunities to generate savings and improve processes.