In the frothy battle for online customer loyalty, shipping choices and amounts charged for those choices is a highly influential front. Retailers have been grappling with this changing landscape for years as online disruption continues. Green Mountain Technology has combined the specific experience of its retail clients along with a multitude of other companies across industries in our annual Benchmark Report to understand strategies for differentiation in this dynamic space.

For the second year in a row, the majority of respondents to the report (70% of which had annual revenues equal to or greater than $1.5 billion) cite customer experience as a top priority. This specialty retailer is no exception. A senior logistics manager at the company states, “Differentiation is a struggle… [we] have to distinguish based on service.”

Keep Up with The Status Quo

Differentiation is important, but companies need to make sure they stand out for the right reasons. Customers have come to expect certain shipping options, and at least one of those options needs to be “fast.” Our Benchmark Report showed that 91% of retailers gave a three- to five-day commitment time on orders. The portion of respondents that offered an express option jumped from 61% to 91% when compared to last year, and the portion of shippers who offered same-day delivery more than tripled from 11% to 38%. The specialty retailer we spoke with executes on this by offering three shipping services domestically: Standard (four business days), Express (three business days), and Expedited (two business days).

Figure 1. Source: GMT 2018 Brand Shipping Policies and Research Study

Retailers have been savvy to this by offering quicker shipping for free to members. Free shipping is another bar that has been set in the eyes of most consumers. GMT’s 2018 Brand Shipping Policies and Research Study showed that 90% of retailers offer free shipping, and the Benchmark Report shows that this is based on a minimum order value most of the time. One retailer we work with offers free standard shipping to non-loyalty members who have an order value of $25 or more.

It is important to remember that the status quo is always changing and that a differentiating factor of today becomes the baseline expectation of tomorrow (see my 2017 article section referencing the Kano model). Shippers should constantly keep a finger on the pulse of the customer to find new tactics to distinguish their services, even if it is in subtle ways.

Omnichannel Enables Better Execution and Differentiation

Legacy retailers with a large footprint know that they have to leverage their most expensive and valuable resource to stand out: their stores. “Brick and mortar presence provides an opportunity to interact with your customers the way online and mobile shopping does not,” describes the senior logistics manager. “Value is driven by people in the stores and on the phone.”

Omnichannel strategies are also being leveraged in order to fulfill in a more timely and convenient manner for customers. One example of how this retailer executes on this is with a buy online, pick up in-store option. According to the 2018 UPS Pulse of the Online Shopper Study, this is a wise move as interest has grown with shoppers. Not only has this method been used by 50% of shoppers in the past year, 44% have made additional purchases when picking up in-store. The specialty retailer also harnesses their locations to accomplish ship-from-store, which allows same-day and one-day delivery to certain markets.

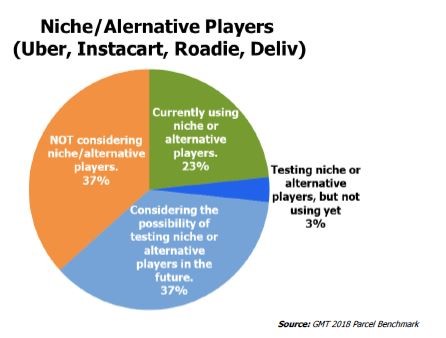

Niche/alternative players may be providing the next iteration of differentiation to shippers. While enticing, the logistics manager we spoke with is still waiting to see which players emerge with a bona fide reputation and proof of a sustainable model. He states, “There is no value to a partner who will not be around in the one-, three-, and five-year marks.” This is in line with our Benchmark findings, which revealed that less than ¼ of shippers are currently using niche players like Uber, Instacart, Roadie, or Deliv.

The Takeaways

Stay up-to-date on what customers are experiencing and expecting in their online journeys. In order to differentiate properly, certain baseline expectations must be met, like offering fast shipping service with some kind of free option. Utilize loyalty programs and omnichannel strategies to provide faster shipping options using ship-from-store or more diverse fulfillment like buy online, pick up in-store. Be open-minded in shipping strategies and experiment with new methods like niche players to see if there might be opportunities to differentiate in ways that larger competitors have yet to embrace.

Attend our Session at PARCEL Forum 2018

To learn more about this topic, join Matt Weickert (GMT), Aaron Guild (GMT), and Jamie Campbell (Barnes & Noble) for their PARCEL Forum session entitled, “CASE STUDY: Strategies for Keeping Pace with Leading Alternatives for Consumer Shipping Options & Fees.” Join us from 11:00-11:50 a.m. on September 25th.

Matt Weickert is a Strategic Solutions Engineer at Green Mountain Technology, a Parcel Spend Management service provider for shippers with over 10 million parcels per year. In this role, he partners with customers to provide our strategic Parcel Spend Management solutions – Network Optimization, Spend Analytics, and Contract Management. Matt has a Bachelor of Science Degree in Industrial Engineering from Mississippi State University and has a passion for distilling vast amounts of data into intelligible, actionable insights by which optimal decision-making can be achieved.