UPS has finally announced its SurePost rates for 2021. Just like the previously announced increases to UPS’s other services, these rates will go into effect on December 27. You can find the new rates here: https://www.ups.com/us/en/surepost-rates.page

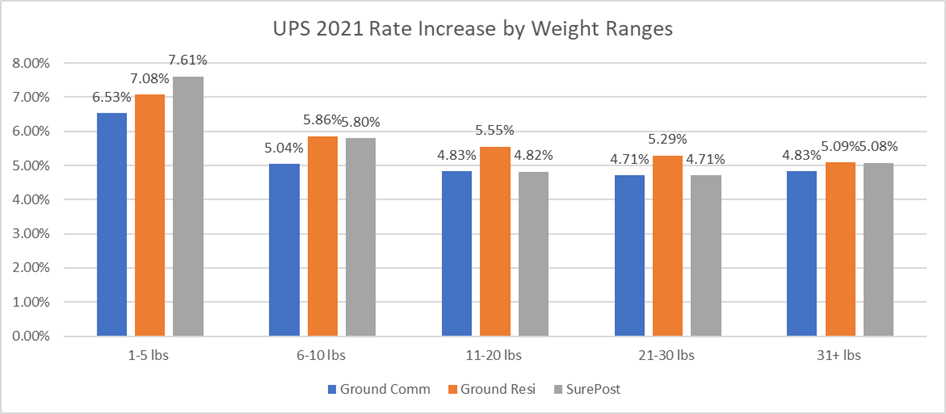

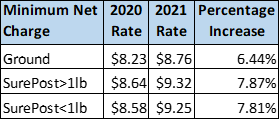

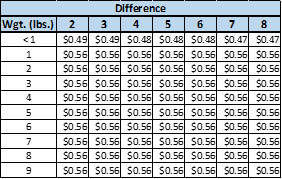

Let’s look at how the rates compare with the 2020 rates in place prior to the $0.24 increase on October 18. The overall increase is 5.22% for 2021. As you see in Figure 1, like with commercial ground, the lightweight packages are taking a much higher increase than average. SurePost ounce rates are going up by 7.2%, another significant jump. The SurePost minimum (zone 2, 1 lb rate) is increasing by almost 8% (Figure 2).

Figure 1: UPS YOY Average Increases by weight range

UPS is taking significant increases in the same segment of its business that has grown tremendously in 2020. With more packages being delivered to residences, and the average residential package weighing less than commercial, shippers are going to see an increase significantly higher than the announced 4.9%.

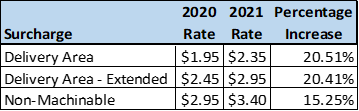

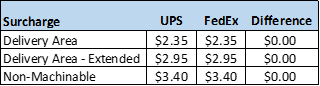

Furthermore, that 4.9% does not include surcharges. SurePost surcharges will have double-digit increases in 2021 (Figure 3).

Figure 3: UPS SurePost YOY surcharge increases

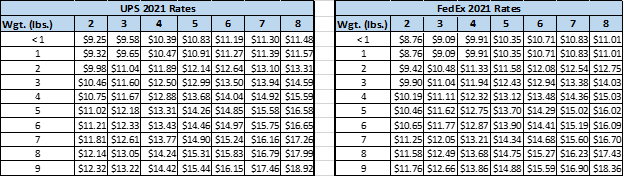

Figure 4: UPS SurePost vs FedEx SmartPost 2021 rate comparison

The key surcharges for both carriers are identical in 2021 (Figure 5).

Figure 5: UPS SurePost vs FedEx SmartPost 2021 surcharge comparison

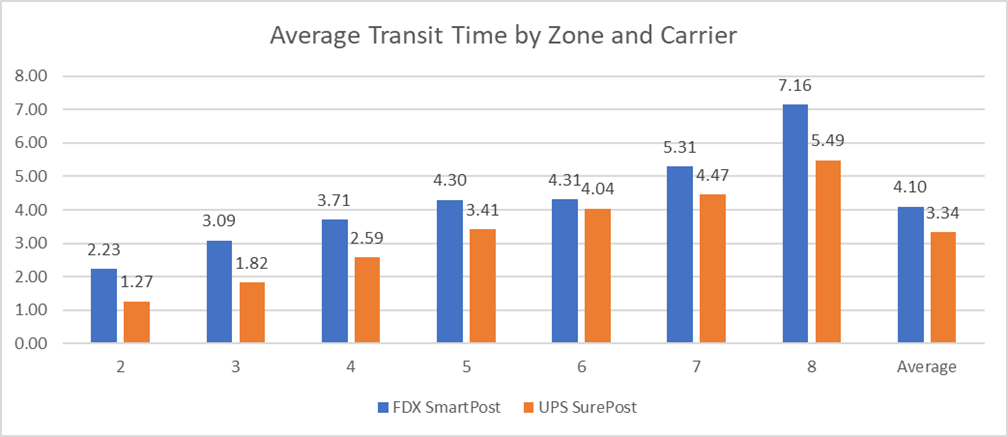

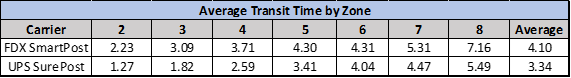

A common question is, “how does SurePost compare to SmartPost as far as transit times?”

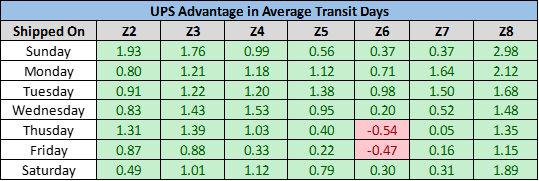

Karl Wheeler, also a Senior Consultant at Shipware, ran a transit time analysis for 2 million total UPS SurePost and FedEx SmartPost shipments in October and November of 2020. As you see in Figure 6, SurePost is arriving faster in just about every combination of ship day and zone. UPS’s design of its SurePost network and ability to deliver more package themselves instead of handing off to USPS is giving them an advantage. FedEx has made changes to its network in 2020 but has some catching up to do.

Figure 6: Green Shaded represents UPS is better by the average transit days difference shown. Red shaded represents UPS is worse by the average tranit days difference shown. Transit time was calculated by subtracting the difference from the delivery date to the ship date as reported by the carriers.

Although transit time is a lower priority on these services, it is useful to see how carriers are performing. Customers will want their product as fast as possible even if they aren’t paying for shipping. Right now, UPS has the advantage there.

Overall, the UPS SurePost rates for 2021 continue the trend of reality being different from the press release. Shippers must analyze these rate increases to understand the true impact to them. With the surcharges included the average increase will be significantly higher than the carrier “press releases.”

Keith Myers is a Senior Consultant, Professional Services for Shipware, a consulting and technology firm that specializes in reducing shipping costs for businesses that ship at high volumes.

Prior to joining Shipware, Keith was a Senior Pricing Advisor at FedEx where he gained direct carrier pricing experience. In his seven years at FedEx, he created and analyzed parcel and LTL pricing for accounts as large as $100 million dollars. He also has worked in logistics analysis at Haemonetics and Bose Corporation giving him almost 20 years of experience in the logistics and transportation industry.

Keith has an MBA with certificate in Supply Chain Management from Northeastern University and a BS in Discrete Mathematics from Georgia Tech.