The anticipated announcements came between August 7 and August 18, when UPS, FedEx and the USPS all revealed their holiday peak surcharge plans. For any optimists expecting a break, I’m sorry to be the bearer of bad news. The existing COVID surcharges remain in place right up until these holiday surcharges take effect. Let’s review each carrier’s charges.

UPS Peak Surcharges

Similar to last year, Peak Surcharges are applied to packages that require additional handling in the UPS network. However, what’s new this year are Peak Surcharges for UPS SurePost and all Residential packages. Both have volume thresholds to meet before being applied.

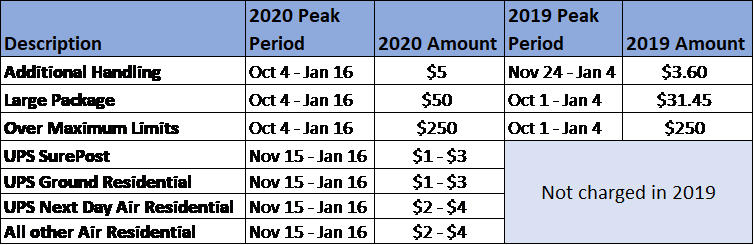

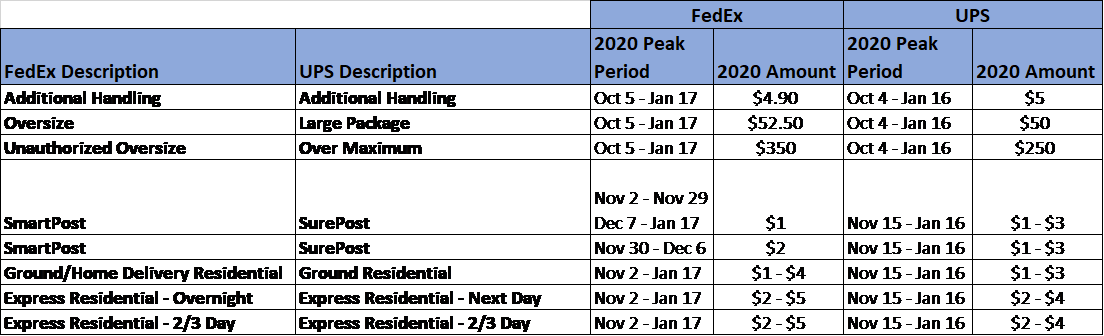

Figure 1 compares the Peak Surcharges between last year and this year. Note that the surcharges run until January 16, 2021, about 2 weeks longer than last year. Also, the Additional Handling Surcharge starts 7 weeks earlier this year. Remember, these are all per package fees, not per shipment fees.

Figure 1

Each surcharge is triggered by volume thresholds. Additional Handling Service, Large Package Surcharge and Over Maximum will apply to customers who ship more than 1,000 total packages in any week during the Peak Period or customers who ship more than 10 packages combined that are either Large Packages, require Additional Handling or are Over Maximum Limits. Once that threshold is reached, the surcharge applies for the duration of the Peak Period. And remember, Additional Handling Service now applies to shipments that weigh greater than 50 lbs instead of 70 lbs as in the past. Both UPS and FedEx reduced that limit this year.

In addition, the Additional Handling charge is almost 40% higher than last year. Large Package Surcharges increased almost 60%! Depending on your perspective, UPS is either encouraging shippers to not send large items because of the extra costs associated with moving them through their network, or it is taking advantage of the duopoly in the parcel space to collect extra revenue and enhance their bottom line.

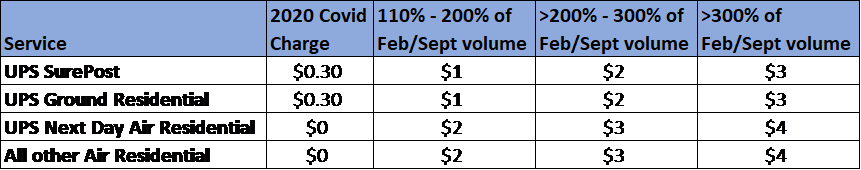

The service-level residential charges are designed to penalize high-volume shippers. To be “eligible” for the charges, shippers must ship at least 25,000 packages per week total in SurePost and Air/Ground Residential during the peak period. If they meet that requirement, then the charge is based on the increase in volume compared to the average weekly volume for each service level for February. For shippers whose average weekly volume in September is less than 80% of February’s average, then UPS will use the September volume as the comparison point. Just like the handling fees, if you meet the threshold once, then the fees apply for the duration of the peak period.

For shippers already paying the COVID charge on residential packages, that fee will more than triple starting in November. Figure 2 shows the per package surcharge based on the volume increase.

Figure 2

These increased fees are consistent with UPS CEO Carol Tomé’s message on UPS’s earnings call that the delivery giant plans to be more aggressive with raising prices on large retailers.

FedEx Peak Surcharges

FedEx is following UPS’s lead in adding peak surcharges to residential and SmartPost shipments this year. Fees for additional handling, oversize, and unauthorized oversize make their expected return.

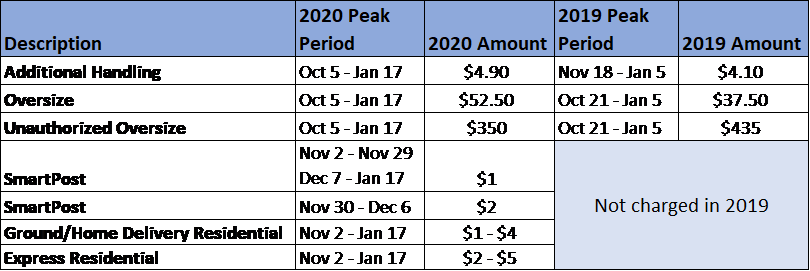

Figure 3 compares the Peak Surcharges between last year and this year. The surcharges run until January 17, 2021, about 2 weeks longer than last year. Also, the Additional Handling Surcharge starts 6 weeks earlier this year. Remember, these are all per package fees, not per shipment fees.

Figure 3

Notice that the Additional Handling charge is almost 20% higher than last year’s. Large Package Surcharges increased 40%. There are no thresholds for the Additional Handling, Oversize and Unauthorized charges. Similarly, the SmartPost charge applies to all packages. The only volume triggers are for the residential fees.

Just like UPS, the residential charges penalize high-volume shippers. FedEx will add the Peak Surcharge for shippers who ship more than 35,000 packages per week (residential and commercial) for the period of October 5 – October 18. FedEx will divide that average by the average weekly volume in from February 3 – March 1 to find a peaking factor that will determine the peak charge.

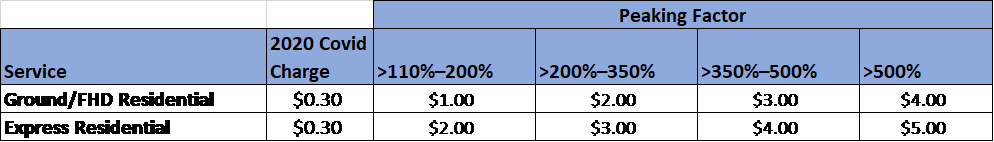

FedEx will run a second peak calculation for Nov 16 – Nov 29. For customers that exceed 35,000 packages in that time, the peaking factor will be calculated using the same February 3 – March 1 volume as above. The surcharge will then apply from December 14 – January 17. Figure 4 shows the peaking factors. The charge for shippers that qualify will more than triple the current Covid residential charge.

Figure 4

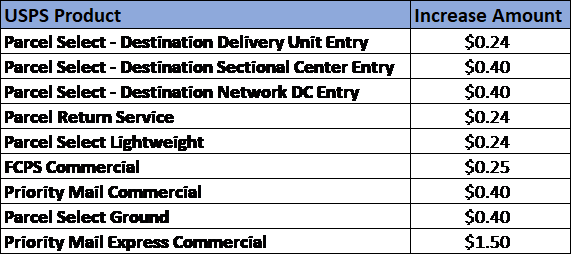

USPS Peak Surcharges

Citing increased expenses and heightened demand, the United States Postal Service filed for a temporary price change running from October 18 until December 27. This increase applies only to commercial rates so individuals shipping holiday presents to their family and friends will not pay it. The increases apply to all commercial domestic competitive parcels – Priority Mail Express, Priority Mail, First-Class Package Service, Parcel Select and Parcel Return Service. Figure 5 shows the new fees.

Figure 5

There are no volume thresholds for these increases – just a flat amount added to every rate for every package. There are a few exceptions in Parcel Select Ground where the listed increase would exceed the Retail Ground rate. Those are 20 lbs zones 8/9 will have a $0.06 increase and 19 lbs zones 8/9 along with Oversized will have no increase.

For easier reference, Figure 6 shows the peak surcharges for UPS and FedEx. The fees around additional handling and oversize are similar. The main difference is in SurePost and SmartPost. FedEx’s fee applies to all SmartPost packages regardless of volume and doubles to $2.00 for the first week in December. UPS’s fee has a volume threshold before it will apply. FedEx’s fee on residential has peaking factors at 350% and 500% while UPS stops at 300%.

Figure 6

Also notice that the residential peak period for FedEx is 11 weeks while UPS is 9 weeks. For the AHS/Large Package charges, both carriers have those in place for 15 weeks.

Let’s take two hypothetical shippers and compare the impact of these surcharges.

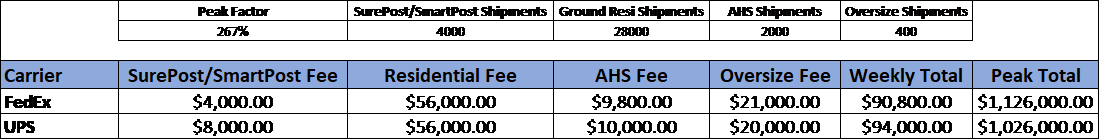

Scenario 1: High-volume Shipper

· 15,000 packages per week on average

· 40,000 packages per week during peak

· 10% SurePost/SmartPost, 70% Ground Residential

· 5% of packages require Additional Handling

· 1% are Oversize.

Figure 7 shows the impact of the Peak Surcharges for FedEx and UPS for Shipper 1.

You can see in these examples that large shippers could be facing an additional million dollars in unbudgeted freight expense in Q4.

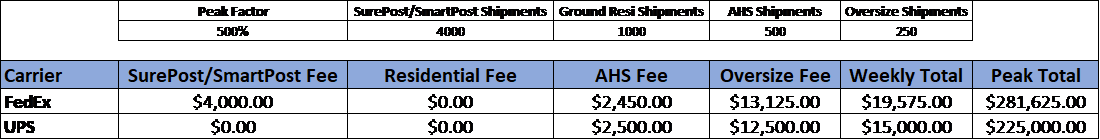

Scenario 2: Small/Medium-Sized Shipper

· 1,000 packages per week on average

· 5,000 packages per week during peak

· 80% SurePost/SmartPost, 20% Ground Residential

· 10% of packages require Additional Handling

· 5% are Oversize.

Figure 8 shows the impact of the Peak Surcharges for FedEx and UPS for Shipper 2.

Shipper 2 does not meet the threshold for the residential fees but FedEx’s SmartPost fee applies. As Figure 8 shows, this shipper would pay almost $60,000 more in peak season fees with FedEx than with UPS because of SmartPost.

In general, small/medium shippers that use SmartPost will be more severely impacted than other shippers in peak. FedEx is applying a $1 fee ($2 for one week) to every SmartPost shipment for 11 weeks. Also remember that FedEx’s residential and SmartPost fees start two weeks earlier than UPS.

Now that the carriers have published these charges, shippers can plot their strategies to mitigate them. Large shippers must determine if they will be impacted by the residential fees and plan accordingly. If your carrier can’t or won’t reduce the peak charges, then other contract concessions must be negotiated to offset the increases via improved discounts, rebates or other surcharge reductions. Other options include moving volume to other providers such as the USPS or regional carriers that have lesser surcharges.

For planning purposes, expect the Covid surcharges from UPS and FedEx to return after peak ends. It is also unknown when the Guaranteed Service Refund and Money Back Guarantee will be reinstated by UPS and FedEx. It looks unlikely for 2020 but perhaps come January 2021, shippers will be able to get refunds on late deliveries again.

|

|