As almost every shipper knows by now, UPS recently announced it will also be changing its dimensional pricing rules in a not unexpected move closely following a similar change from FedEx. Effective January 8, the dimensional divisor will be reduced from 166 to 139 for all packages over one cubic foot, or 1728 cubic inches. Packages below this threshold will continue to be subject to the current dimensional weight factor of 166.

As a quicker refresher, the parcel carriers multiply a package’s length, width, and height, then divide by a dimensional divisor and round up. Carriers like FedEx and UPS then charge the higher of the actual weight or the dimensional weight. The higher the dimensional divisor, the less of an impact it will have on pricing. The lower the divisor, the greater the impact.

This change will certainly increase the actual price hike felt by customers with less dense, large packages. In this article, we will exemplify potential price increases by using various sample box configurations and shipping scenarios.

Dimensional Weight Factor, the Stealth Price Increase

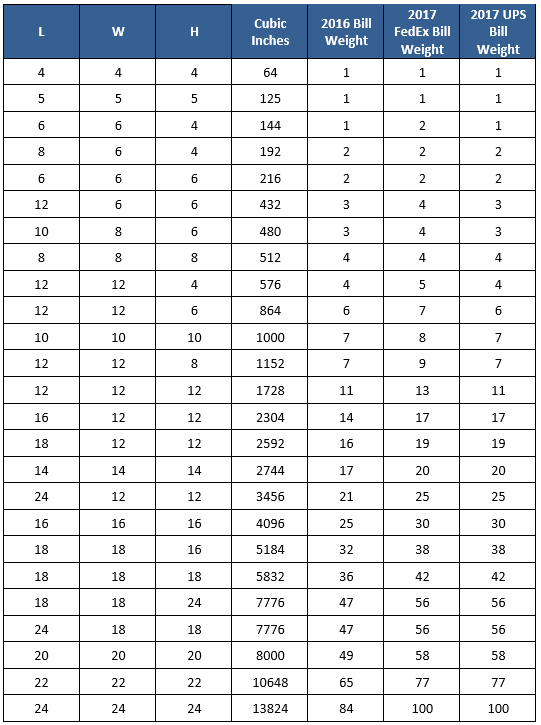

The table below illustrates significant increases in billable weights for UPS packages over one cubic foot, and for all FedEx packages. Note that customers with custom dimensional weight factors in their contract will not immediately be impacted by the change.

Fig 1. Top 25 Box Sizes and minimum billable weights by dim divisor.

We’ll now consider a few examples.

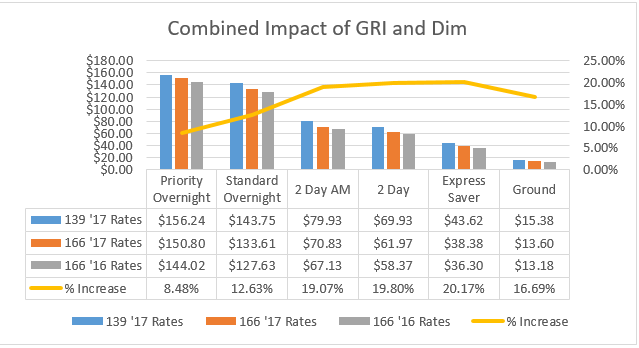

Consider a UPS Zone 5 shipment that weighs 15lb and measures 18x12x12, or 2592 cubic inches. Beginning January 2nd, this box will be billed at 19lb, an increase of 3lb over the 16lb bill weight based on 2016 rules. At list prices, the net increase on this package ranges from 8.48% to 20.17%, which of course much higher than announced “average” rate increases.

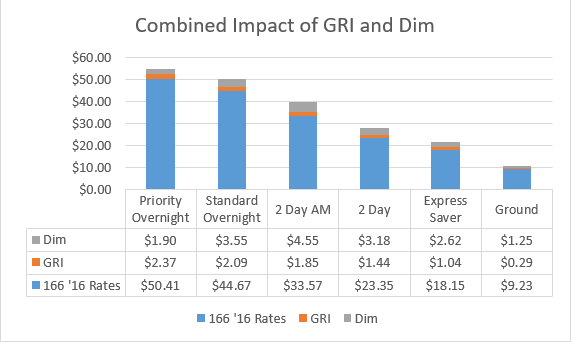

Fig 2. Combined Impact of GRI and Dimensional Changes at List Rates. FedEx, Zone 5 18x12x12.

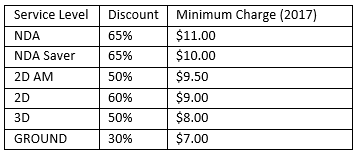

Let’s consider the same package, with hypothetical discounts for a mid-sized shipper.

Fig 3. Sample discounts for a mid-sized shipper.

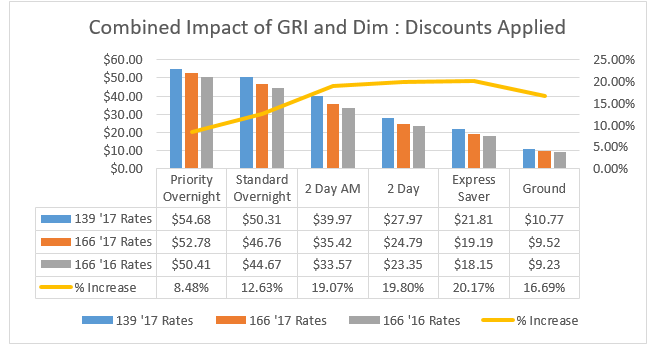

Fig 4. Combined Impact of GRI and Dimensional Changes With Discounts. FedEx, Zone 5, 18x12x12.

Applying discounts has reduced the dollar amount, while the percentage price increase remains the same.

The chart below illustrates how prices change for this shipment beginning with the 2016 rate with a 166 dim factor, adding the GRI – the 2017 rate for same weight, and then adding the cost of the Dim weight – or the difference between 19 and 16lb for 2017.

Fig 5. Contribution of Dimensional Weight and GRI to Total Price Increase. UPS, Zone 5, 18x12x12.

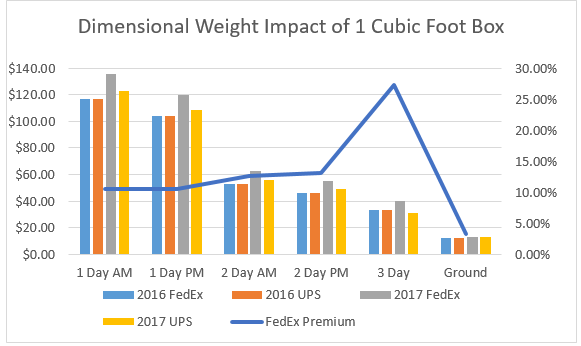

With smaller box sizes, UPS offers lower pricing than FedEx in 2017. Consider a Zone 5 box measuring 12x12x12. With FedEx, this box will be charged a minimum of 13lb compared to 11lb for UPS, as UPS shipments under 1 cubic foot are not subject to dimensional pricing in 2017.

Fig 6. Comparative price increase from 2016 to 2017 FedEx vs UPS. 12x12x12 Zone 5 shipment with actual weight 10lb.

The FedEx price increases are more notable due to the higher required bill weight for boxes under one cubic foot (1728 cubic inches).

Closing Thoughts

Going into 2017, managing transportation spend is becoming even more complicated. Here are just a few of the changes:

· FedEx and UPS 2017 published rates no longer at parity

o Different dimensional pricing rules for FedEx and UPS: Dimensional weight divisor reduced from 166 to 139 for all FedEx shipments; UPS reduced dimensional divisor to 139, but only on shipments larger than 1 cubic foot

· Fuel surcharges do not match

· Fuel surcharges will be subject to weekly adjustment (both carriers)

· AHS size threshold reduced from 60” to 48” for all shipments (both carriers)

· Surcharge increases: AHS, Address Correction, Dangerous Goods, Delivery Area Surcharges, COD, Signature Options, Oversize Package, Residential Delivery and many more (both carriers)

· Surcharges no longer match

· AHS and new dimensional rules to apply to UPS SurePost

With all these changes, it is harder than ever for shippers to easily compare services and pricing between FedEx and UPS. As all shipments will not be impacted in the same way, it’s important for shippers to understand the differences between UPS and FedEx and thoroughly model the impact of all carrier pricing changes to their unique distribution.