Companies’ supply chains have become more global than ever. Why, then, do so many shippers treat their international parcel contracts as an afterthought?

This is an important topic because there’s a good chance that international small parcel shipping makes up a larger percentage of total logistics costs than most companies realize — a full 18% to 20% of volume based on data from our customer base. This lack of focus may be due to the professionals with responsibility for parcel agreements tending to have less experience with international shipping. The problem is often that FedEx and UPS agreements are managed by domestic-focused logistics managers, but this structure could be holding many companies back from big savings opportunities within their international shipping operation.

Smart, proactive small parcel shippers are finding there are significant savings to be found within their service agreements by gaining a better understanding of their international shipping needs and taking a smarter approach. There are always details that can be negotiated and opportunities found that can provide real, impactful savings.

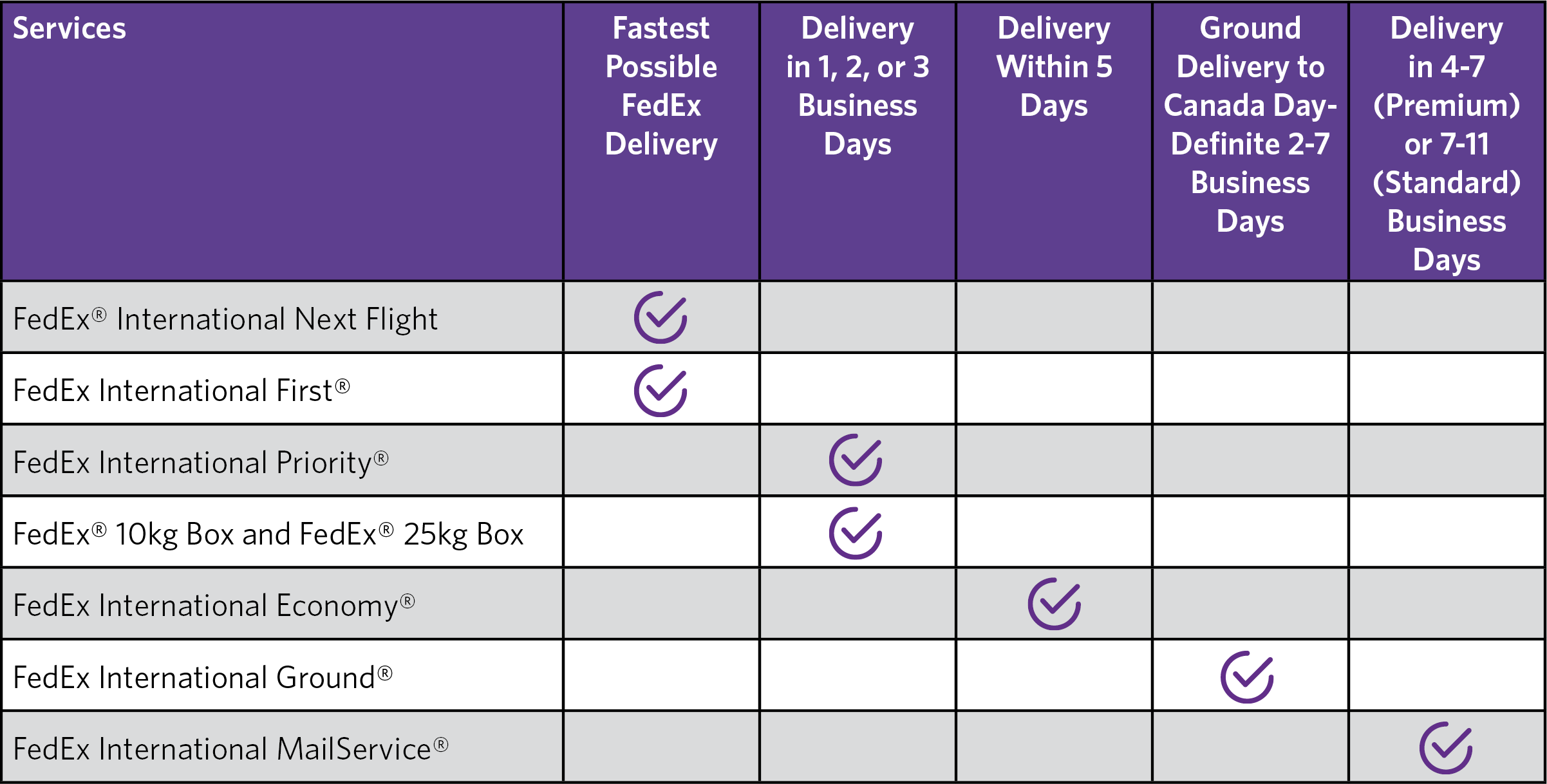

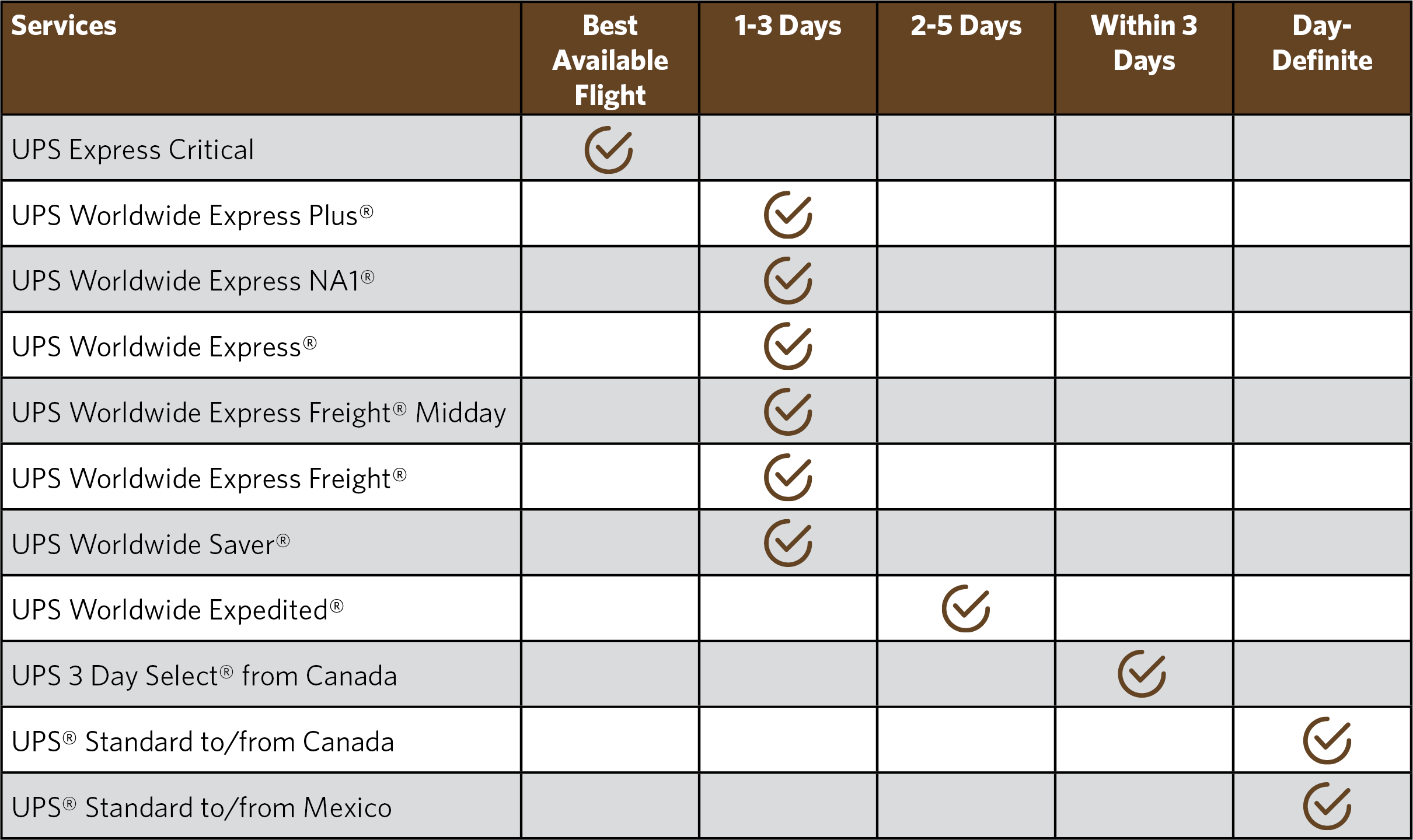

First, a Quick Primer on the Available Services

Although international shipping clearly has many complexities (from paperwork to customs requirements to transit times) that are different than domestic shipping, in general, many of the same delivery service options are available — from time-definite and overnight express deliveries to slower select and economy-type services.

Agreement Structure

When it comes to rates and service agreements, it’s important for shippers to not just know the services and zones each carrier serves, but to understand them.

Perhaps another reason international shipping costs are overlooked is that UPS and FedEx automatically include international rates in their standard small package agreements. Many shippers likely feel confident that since their domestic Ground and other Express rates are well-negotiated, their international rates will be as well, even if they were not as closely reviewed.

The structure of the rates is something domestic shippers will be familiar with, as they are based on zones and service levels at the country level (as opposed to a ZIP Code range).

But there are some notable differences in how the two carriers present international rates in their agreements. For example, FedEx Express International is included in the Express section, with International Ground in the Ground section. UPS customers should know that UPS International discounts and minimums are often split and detailed in different sections of the agreement. Also of note is that both FedEx and UPS discount by lane, which makes it important for large shippers to know their own shipping patterns in detail when approaching a negotiation with either carrier.

Rate Advantages

In terms of list rates, FedEx and UPS both offer shippers advantages depending on the lane and whether the shipments are import or export. For example, UPS offers lower list rates for SE Asia for both imports and exports, while FedEx has lower rates in the majority of other export lanes from the US.

Shippers should also note that UPS and FedEx have limitations on the size and weight of packages, just as with domestic services. This means shippers should consider the use of international freight carriers for larger shipments, depending on the details of their own agreements.

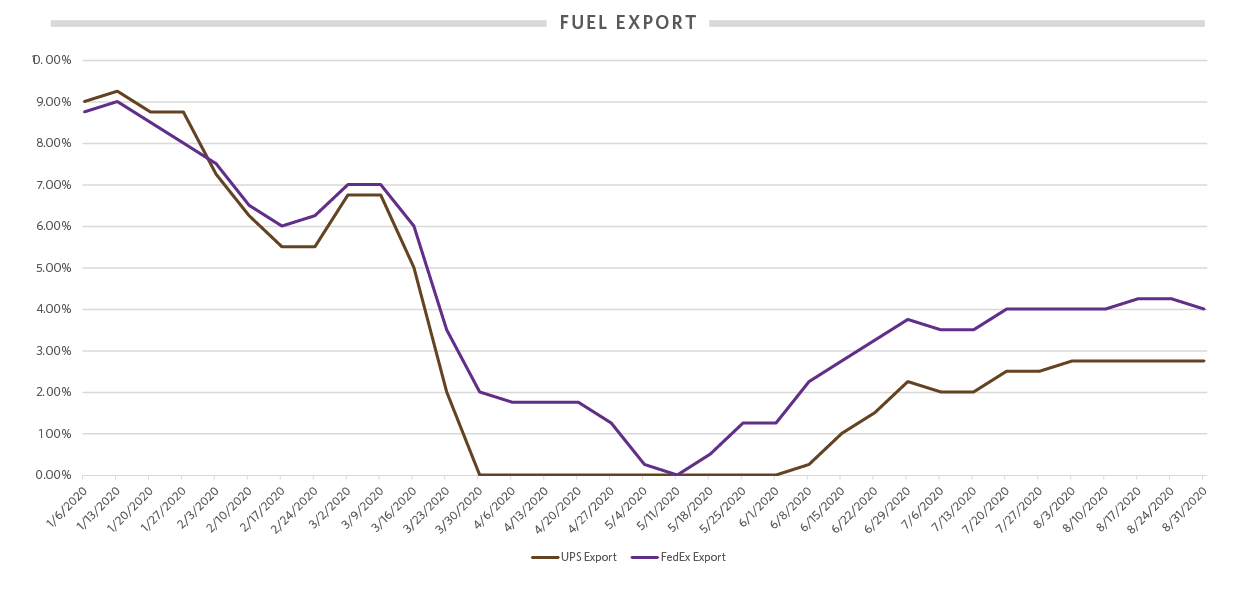

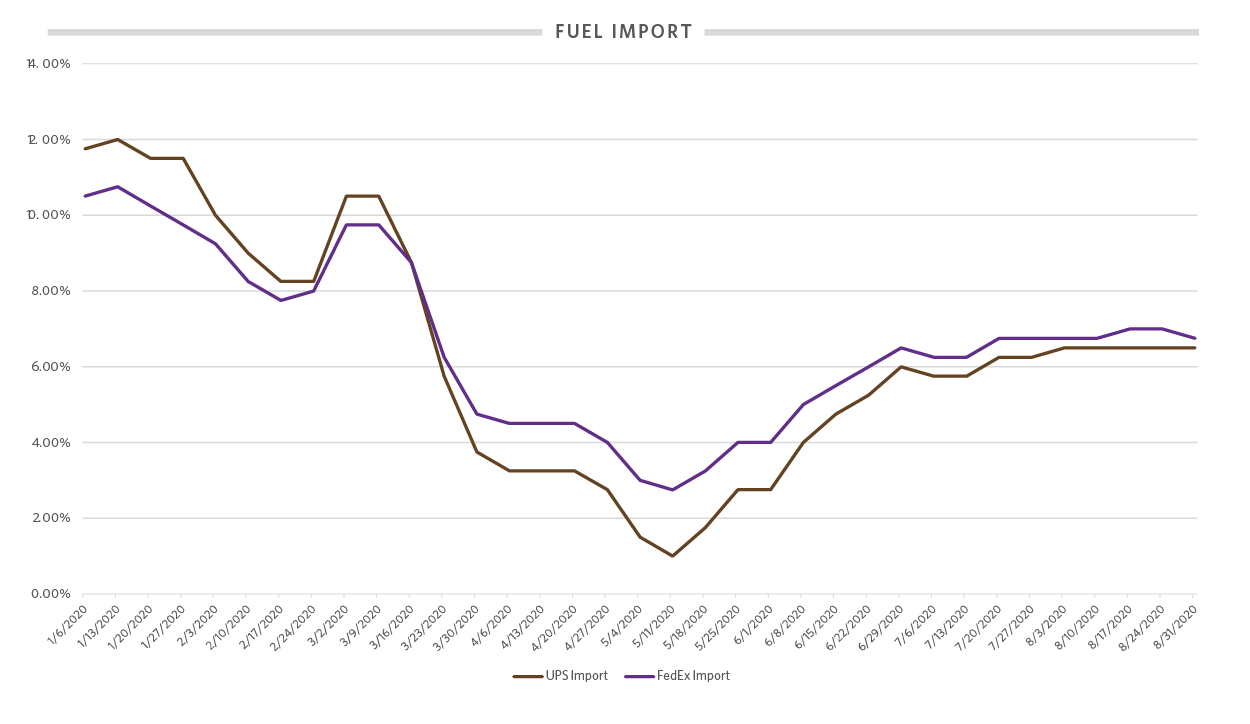

Fuel Surcharges

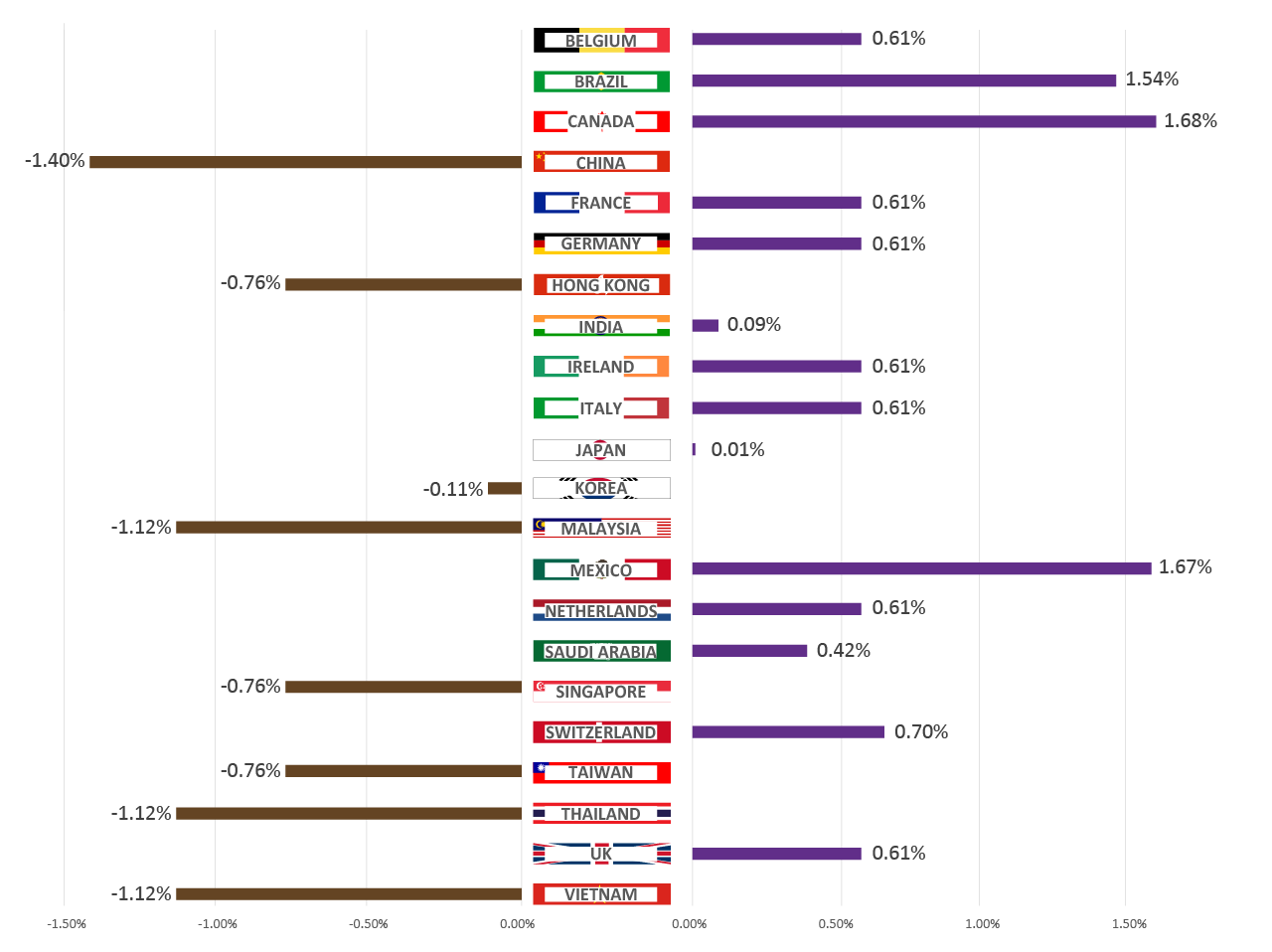

An area of divergence for the carriers that has become more pronounced in 2020 is fuel surcharges. As the following charts illustrate, volatility in the price of fuel has led to the carriers charging (in some cases) vastly different surcharges from week to week. An interesting note is that if the carriers had not changed their fuel surcharge tables mid-year, the surcharge would now be 0%.

Peak Season Surcharges

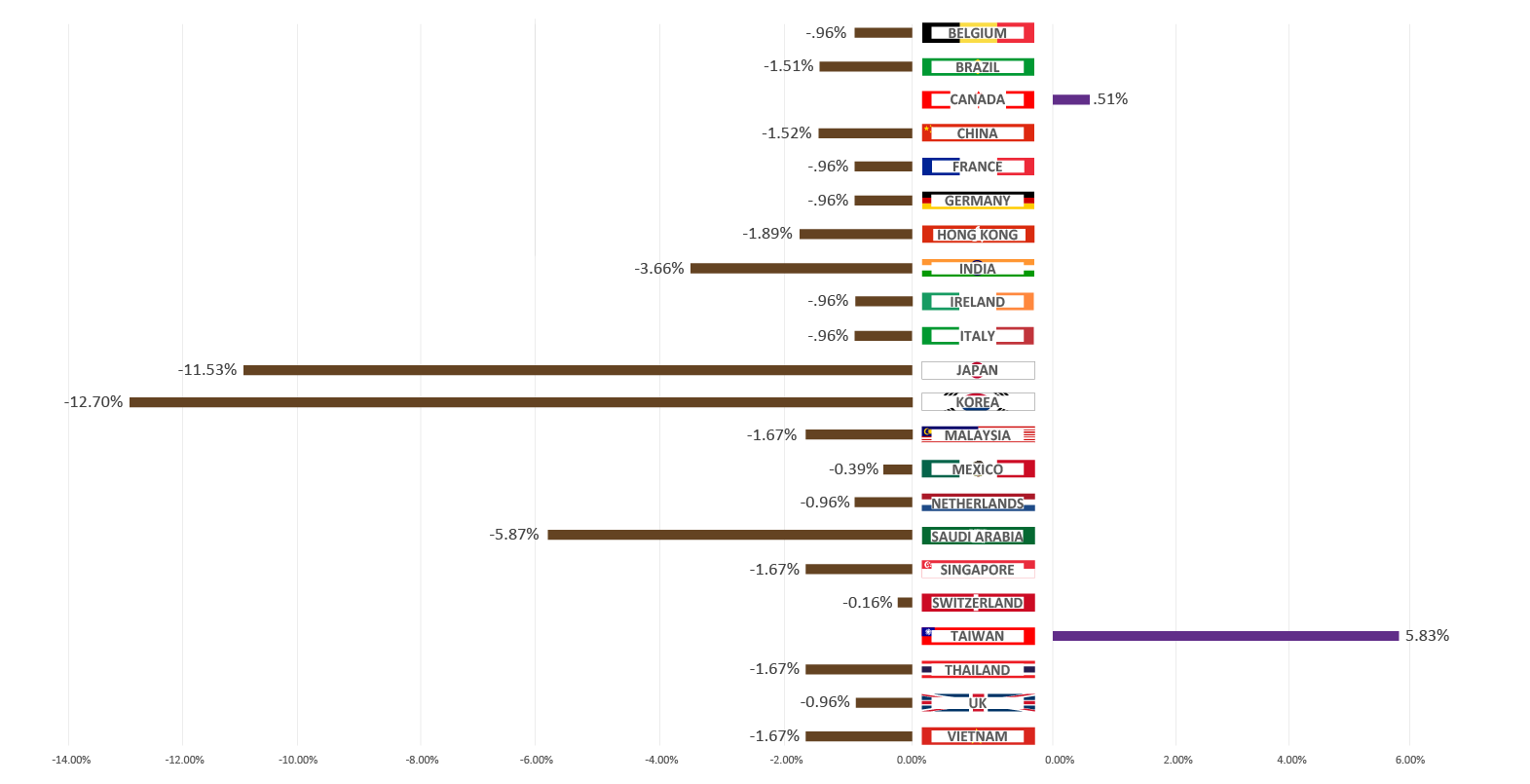

Another new consideration for international shippers in 2020 has been the application of many COVID-related Peak Season Surcharges (PSS). Both carriers were quick to implement these types of additional fees at the outset of the pandemic and, in many cases, they have increased over the course of the year.

The main surcharges are focused on Asia (mostly SE) and include China, Hong Kong, Taiwan, Vietnam, Malaysia, Thailand, Indonesia, Singapore, Philippines, Australia, New Zealand, Japan, and Korea. Other fees are applicable to the rest of the APAC region.

At this point, both carriers have set no end date for the surcharges, leaving them in effect “until further notice.” Thus, all shippers need to understand what their main shipping lanes are and plan based on the assumption the fees will continue through 2020, at minimum.

Other Considerations

There are many other details that go into international shipping that companies need to consider when it comes to managing their logistics costs and transit times.

For example, aspects like Single Point of Clearance (SPOC) and its impact on customs entry and delivery timing into the EU present opportunities. Shippers with a large European footprint should consider SPOC services, which offer the ability to clear a group of shipments as one and then have them delivered individually once within the EU.

Also, while most shippers understand that duties and taxes aren’t negotiable, costs such as the Advancement Fee or certain Forwarding Surcharges often can be. Similar to domestic agreements, standard surcharges such as Residential Delivery, Additional Handling, DAS, and large package can be as well. Both carriers offer extensive guides to help shippers prepare international shipments, including customs clearances, and it’s highly recommended to take advantage of these resources.

Lastly, as NAFTA became the USMCA earlier this year, it changed much of how importers need to manage the process of moving goods between the US and Canada/Mexico. Again, the impact is company-specific, so the onus is on the individual company to understand what USMCA means to the shipping costs and service times.

Despite the added complexity of international shipping, it is not that different from domestic when it comes to understanding costs and services. This means that shippers need to put the same energy and strategy into their rate negotiations for international as for domestic. Even though the process of shipping internationally seems more complicated and cumbersome, shippers have plenty of opportunities to find savings in their agreements and improve their execution.

Brian Byrd is VP of Operations at Transportation Impact. He joined Transportation Impact in 2012, starting as a Business Analyst in the Operations Department and subsequently advancing through leadership roles, in Parcel Audit and Parcel Negotiation services. After five years as Director of Operations, in 2019 Byrd became Vice President of Operations. He excels in the areas of supply-chain optimization and strategy to deliver cost reduction.