When meeting with Shippers, we are often asked why Carriers offer such a vast variance in pricing options... typical response - “because they can”. As we explore this question further, there is validity to why Shippers qualify for diverse pricing. We’ll examine some of the key factors that contribute to Carrier (UPS, FedEx, DHL Express, USPS, and Regional Carriers) costs, which ultimately impact the pricing that can be offered.

Volume is the core driver that carriers typically consider. It’s the foundation that a pricing program is usually built on. Since a mix of fixed and variable costs apply, the greater the volume (assuming similar shipping attributes, such as consistent commodities, packaging / sizes, without adding pickup locations), the greater the opportunity for additional incentives, since the cost per piece is reduced.

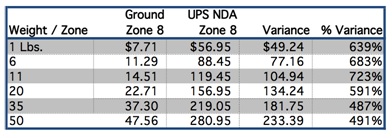

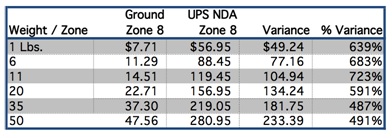

Service Mix (the % of spend by Ground, Domestic Air (1, 2, 3 day), International, etc.) and Dimensional Weight are very important factors. Although costs related to moving shipments by air (plane) rather than ground (truck or rail) are significantly higher, so is the revenue that’s associated with it (note that many air shipments never get more than 6 feet off the ground). As the graph below suggests, the base tariff for a Next Day Air (based on UPS Daily Rates) shipment with UPS is typically 500% to 700% higher than a Ground shipment. With common pricing practices being applied (discounts), the cost typically remains at 200% to 300% higher. Without the protection of the 3 cubic foot rule, the “dimensional weight” for air shipments typically leads to much higher billable weights, as well. Evaluating packaging and dunnage is an important step towards evaluating how it ultimately affects the carrier and how they are pricing your shipments.

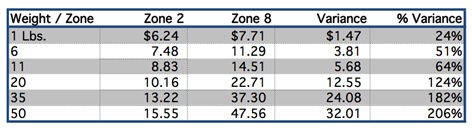

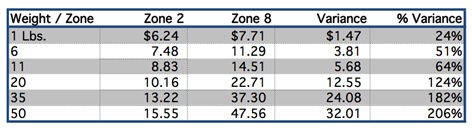

Weight and Zone Distribution Average weight is not always a good indicator, since a 2 oz. letter and a 40 lb. box averages 20 lbs. The same goes for zone distribution. Although a zone 2 and a zone 8 shipment equates to an average zone 5, this is not an accurate indicator of costs. Example: Zone 8 shipments have a base tariff that is 200% more than Zone 2 shipments at heavier weights, but less than 25% more at lighter weights (depicted in the graph below). It is evident that the carrier costs don’t always align with their pricing.

Line-haul costs are certainly important, but so are administrative costs, as well as operational costs that include pickup, sort, delivery, and more. Understanding this as you evaluate your shipment profile is critical in order to have meaningful pricing discussions with your Carrier(s).

Shipping Origin Point(s): Considering that the pickup requires travel to and from, as well as a stop to pick up shipments, as the number of locations grows, the cost associated with pickup costs also increases. For remote origin points, the pickup costs can be substantial. If there is growth, some or all of this can be offset. Since UPS operates a single network while FedEx operates multiple networks based on mode (in addition to independent contractors), each Carrier incurs different costs, as well.

Commodities: In some cases, the commodity is the single most important factor to consider. The value or nature of a product may require something as extreme as security guards to accompany the UPS or FedEx truck directly from a pickup location to the station. In other cases, the commodity may be vulnerable to damages, which drives claims ratios. Then there are the more common implications of dimensional weight versus the actual weight of the commodity that’s being shipped (popcorn or lamp shades versus bowling balls). In all cases, the commodity or commodities must be considered.

Residential % and Remote deliveries are important factors, as well. Many shippers believe that these have a negative impact on the profile. With a standard residential surcharge of $2.90 and Delivery Area Surcharges (DAS) for Ground Residential Extended of $3.62, Ground Residential DAS of $3.35 and Ground Commercial of $2.07, this isn’t accurate. At the standard price-points, the cost is more than offset by the additional revenue that’s generated.

Technology Credits, Supplies paid by Carrier, Cobranded Packaging, etc. will increase Carrier costs, but will often create an environment where future negotiations becomes challenging. The more integrated one becomes with the Carrier, the less flexibility there is going forth. Be careful about saving a little today and leaving yourself vulnerable to the general rate increase or changes in your shipment profile.

The following are some additional factors that impact carrier costs. Packages that require special packaging, additional handling, oversize, declared value, special pickups (Sat / banded / etc.), hazmat, seasonality, signatures upon delivery, and more. The Carriers typically error on the side of caution and apply accessorial charges that more than offset these additional costs. The key is to recognize how carrier costs align with the fees that are being charged and then negotiate accordingly.

Thomas Andersen is Partner / Vice President of Supply Chain Service for LJM Consultants (www.myLJM.com), an Inc. 5000 company. To speak with him, please call (631) 844-9500 or emailtandersen@myLJM.com.

Volume is the core driver that carriers typically consider. It’s the foundation that a pricing program is usually built on. Since a mix of fixed and variable costs apply, the greater the volume (assuming similar shipping attributes, such as consistent commodities, packaging / sizes, without adding pickup locations), the greater the opportunity for additional incentives, since the cost per piece is reduced.

Service Mix (the % of spend by Ground, Domestic Air (1, 2, 3 day), International, etc.) and Dimensional Weight are very important factors. Although costs related to moving shipments by air (plane) rather than ground (truck or rail) are significantly higher, so is the revenue that’s associated with it (note that many air shipments never get more than 6 feet off the ground). As the graph below suggests, the base tariff for a Next Day Air (based on UPS Daily Rates) shipment with UPS is typically 500% to 700% higher than a Ground shipment. With common pricing practices being applied (discounts), the cost typically remains at 200% to 300% higher. Without the protection of the 3 cubic foot rule, the “dimensional weight” for air shipments typically leads to much higher billable weights, as well. Evaluating packaging and dunnage is an important step towards evaluating how it ultimately affects the carrier and how they are pricing your shipments.

Weight and Zone Distribution Average weight is not always a good indicator, since a 2 oz. letter and a 40 lb. box averages 20 lbs. The same goes for zone distribution. Although a zone 2 and a zone 8 shipment equates to an average zone 5, this is not an accurate indicator of costs. Example: Zone 8 shipments have a base tariff that is 200% more than Zone 2 shipments at heavier weights, but less than 25% more at lighter weights (depicted in the graph below). It is evident that the carrier costs don’t always align with their pricing.

Line-haul costs are certainly important, but so are administrative costs, as well as operational costs that include pickup, sort, delivery, and more. Understanding this as you evaluate your shipment profile is critical in order to have meaningful pricing discussions with your Carrier(s).

Shipping Origin Point(s): Considering that the pickup requires travel to and from, as well as a stop to pick up shipments, as the number of locations grows, the cost associated with pickup costs also increases. For remote origin points, the pickup costs can be substantial. If there is growth, some or all of this can be offset. Since UPS operates a single network while FedEx operates multiple networks based on mode (in addition to independent contractors), each Carrier incurs different costs, as well.

Commodities: In some cases, the commodity is the single most important factor to consider. The value or nature of a product may require something as extreme as security guards to accompany the UPS or FedEx truck directly from a pickup location to the station. In other cases, the commodity may be vulnerable to damages, which drives claims ratios. Then there are the more common implications of dimensional weight versus the actual weight of the commodity that’s being shipped (popcorn or lamp shades versus bowling balls). In all cases, the commodity or commodities must be considered.

Residential % and Remote deliveries are important factors, as well. Many shippers believe that these have a negative impact on the profile. With a standard residential surcharge of $2.90 and Delivery Area Surcharges (DAS) for Ground Residential Extended of $3.62, Ground Residential DAS of $3.35 and Ground Commercial of $2.07, this isn’t accurate. At the standard price-points, the cost is more than offset by the additional revenue that’s generated.

Technology Credits, Supplies paid by Carrier, Cobranded Packaging, etc. will increase Carrier costs, but will often create an environment where future negotiations becomes challenging. The more integrated one becomes with the Carrier, the less flexibility there is going forth. Be careful about saving a little today and leaving yourself vulnerable to the general rate increase or changes in your shipment profile.

The following are some additional factors that impact carrier costs. Packages that require special packaging, additional handling, oversize, declared value, special pickups (Sat / banded / etc.), hazmat, seasonality, signatures upon delivery, and more. The Carriers typically error on the side of caution and apply accessorial charges that more than offset these additional costs. The key is to recognize how carrier costs align with the fees that are being charged and then negotiate accordingly.

Thomas Andersen is Partner / Vice President of Supply Chain Service for LJM Consultants (www.myLJM.com), an Inc. 5000 company. To speak with him, please call (631) 844-9500 or emailtandersen@myLJM.com.