This article originally appeared in the September/October issue of PARCEL.

As shippers and logistics professionals, we accept the rationale behind surcharges. After all, from a shipping company’s perspective, surcharges only make sense — some packages cost more to deliver than others, and basing the charges solely on package weight and distance traveled is not an accurate representation of the cost to serve. Surcharges address this concern.

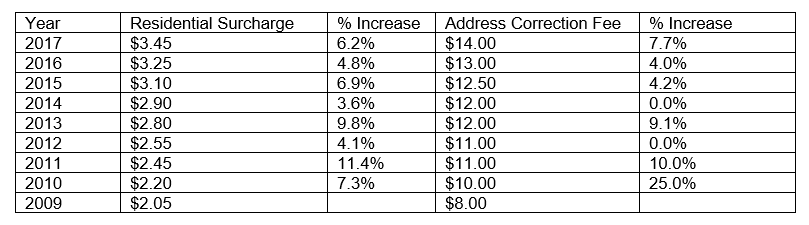

What’s harder to accept, however, is the unpredictability of the annual increases or the creation of entirely new surcharges. For example, since 2009, FedEx’s Home Delivery Residential Surcharge has increased from $2.05 to $3.45, or a whopping 68%. The average annual increase over that period was 6.75% but has been as little as 3.6% and as high as 11.4%. Over that same time period, Address Correction surcharge increased 75%, with annual increases ranging from zero to 25%. If we narrow the timeline of the increases to the last few years, we can see that the variability, for common surcharges at least, has decreased. Take the Residential Surcharge and Address Correction charges once again — from 2014 to 2017, the total increase for Residential was 19%, with the annual increases ranging between 4.8% to 6.9%, while we saw an increase of 16.7% total for Address Corrections with annual increases between four percent and 7.7%. These are more in line with the annual service level increases and reflect a degree of predictability.

Based on the above and looking into 2018’s crystal ball, it’s likely that we’ll see the Residential Surcharge increase to $3.65 (5.8% increase) and the Address Correction fee increase to $15.00 (7.1%). This similar exercise can be repeated for many of the most common surcharges.

But what to do about the not-so-common surcharges or those that previously didn’t yet exist (UPS Third-Party Billing Service fee, anyone?)

Last year, we predicted that the domestic divisor of 166 would align with the 139 international divisor. Why? Divisors, aside from some notion of “industry standard,” are somewhat arbitrary. The existence of multiple divisors adds complexity to the rate calculation for both the shipper as well as the carrier. The 139 divisor was more advantageous to the carriers, so that’s the one that was selected (no mystery there). Even more topical is the recent UPS Peak Season Surcharge announcement. This was less surprising than expected as there have been rumors of these already being applied on a select basis. For those of us in the industry, these changes weren’t a shock. Although the timing couldn’t be predicted, their implementation was foreseeable as they fit into the previously stated “rationale.” Capacity is scarce and additional hiring is necessary during the holidays, which drives up costs for the carriers. The surcharges better allocate the cost to serve specifically to these packages. Varying divisors are not rational, so migrating to a single one is intuitive. For now, UPS still applies a 166 divisor to ground packages under one cubic foot. It doesn’t take a rocket scientist to predict that the 139 divisor will apply to these soon enough. Understanding the factors that drive a carrier’s delivery costs will help in predicting changes to existing accessorial surcharges or the creation of new ones.

Let’s take a look at a couple of areas. Last-mile delivery of a shipment is the most expensive component for the carriers. Many of the existing surcharges were specifically created to address this point (e.g. Residential Surcharge, Delivery Area Surcharge, and Remote Surcharge). It’s safe to assume that future accessorials will be created to further offset the cost. Another significant carrier cost component is internal handling and sort operations. Future hub automation will be enhanced to reduce or eliminate package handling by a human being altogether. Packages that are less conveyable due to size, weight, or shape cost more to process as they require increased human handling. The adjustment to the definitions of Additional Handling last year is an apt example of this. We will continue to see modified or new surcharges that reflect this differentiation in conveyable versus non-conveyable parcels. This may materialize as a further reduction to the dimensional divisors or the creation of a completely new service (FedEx Furniture Direct, maybe?).

Accessorial charges in the parcel world were designed to minimize the subsidizing of more costly deliveries by their more profitable counterparts. The carriers’ unbundling of these charges created an à la carte pricing structure that more closely aligns the shipper’s costs to the carriers’ cost to serve. Future changes or additions to the list of surcharges will be a reflection of this reality.

Bryan Van Suchtelen is Corporate Director, Parcel Negotiations for Lojistic. He has over 28 years in the parcel industry, including 26 years at UPS. James Matthews is also Corporate Director, Parcel Negotiations for Lojistic, bringing almost 30 years of experience to this role. Join Bryan and James at 9 am on September 20 for their PARCEL Forum session titled, How to Predict & Analyze the Impact of Carrier Accessorial Increases.