When businesses like yours review their parcel shipping expenditures for this calendar year, fewer than one-third of you who ship $100,000 or more with UPS and FedEx annually can expect to beat the 4.9% average rate increases those carriers announced for 2018.

In fact, the average effective rate increase projected for 2018 is 6.2%, with just 32% of businesses expected to see increases below the 4.9% benchmark.

These findings, from VeriShip’s 2018 Parcel Rate Effective Impact Analysis Benchmark Study, are the result of simulations informed by the real shipping profiles of more than 3,000 businesses and their more than $1.5 billion and 120 million packages shipped domestically with UPS and FedEx in 2017. So what do the results show? Spoiler alert: 4.9% doesn’t tell the whole story.

Comparing the Carriers

Both UPS and FedEx have been consistent in recent years in reporting that annual average increases — commonly referred to as General Rate Increases (GRI) — are 4.9% when accounting for the revised rates across all service types and accessorial categories. That consistency belies the fact that, for individual businesses, the variance in rates is much wider.

For 2018, at least, it seems FedEx is offering the slightly better deal in the aggregate, based on our analysis. Although FedEx’s effective GRI is 6.22% for the companies analyzed — ahead of UPS’ 6.26% but still far exceeding 4.9% — nearly half of FedEx customers (48%) are seeing rate increases of less than 4.9%, compared to fewer than one in five with UPS (19.7%).

Unfortunately, the implication in the math is clear for FedEx shippers: while some FedEx customers have great rates and still more are sneaking by just under that 4.9 bar, a sizable proportion are facing increases much higher, even into the double digits year-over-year.

I hope you know which side of the line you’re on.

A Surcharge Story

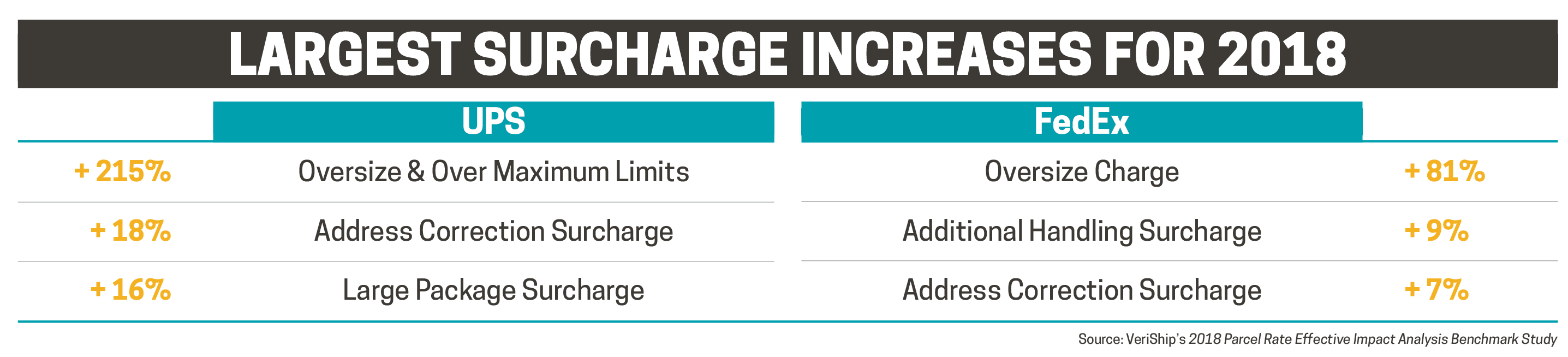

As we’ve seen in recent years, adding new surcharges and accessorials (hello, peak season) — or revising and expanding existing ones (I’m looking at you, DIM) — are revenue generators for carriers whose effect on a shipper’s parcel costs isn’t obvious until invoices arrive.

For 2018, both UPS and FedEx have added the greatest premiums onto the fees that hurt their density and efficiency metrics: heavy or large packages and address corrections, according to our analysis.

Ground Shippers Beware

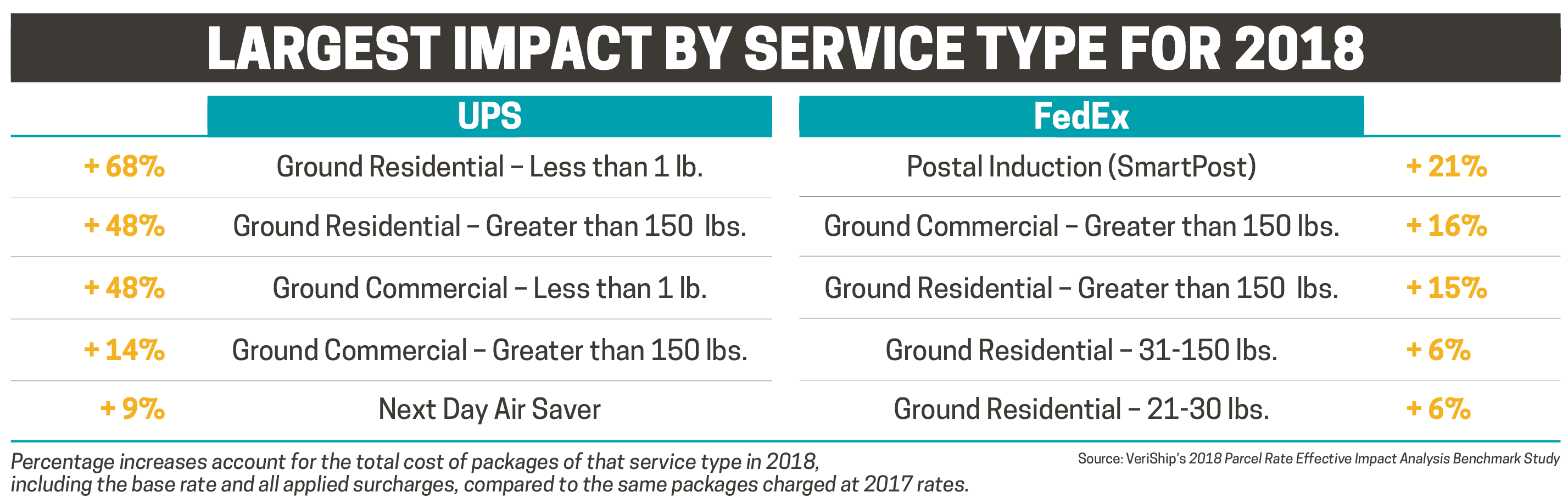

The large increases aren’t limited to add-on fees, either. Some per package service type rates will have outsized impacts on businesses, particularly those who rely on Ground services or FedEx SmartPost.

What It Means

As always, there are lessons in the data and, thankfully, 2018 is less than a quarter old. Now’s a good time to review recent carrier invoices and monitor your shipping going forward. Use the data presented here to gauge where you might stand. Accordingly, don’t hesitate to engage your carrier rep and work toward understanding and mitigating any unexpected impacts, and if you need a partner in this process, now is the time to start looking.

Stephen Rolf is a Senior Solutions Engineer at Sifted, the leader in parcel intelligence. For more information or to request a complimentary impact analysis, visit www.sifted.com/request-a-demo. Contact Stephen at stephen.rolf@veriship.com.