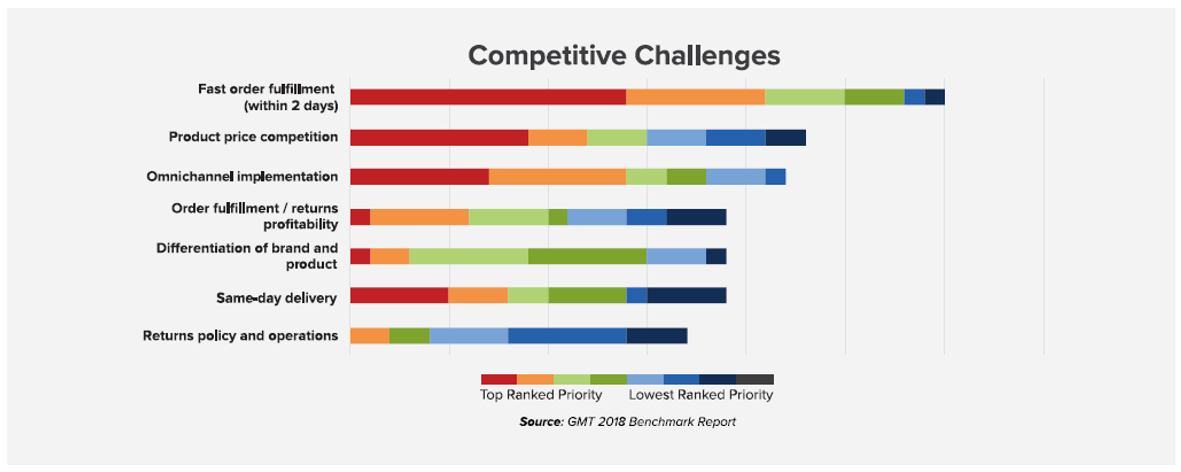

In a hyper-competitive, evolving digital supply chain, brands are required to deliver a positive experience. The faster the shipping, the better — and free shipping is essential. According to the GMT 2018 Benchmark Report, retailers see fast order fulfillment (two days or fewer) as the toughest challenge to stay competitive and have marked it as a primary strategic focus. The quick fix for fast order fulfillment is using an express service, but in a world where shippers are constantly battling rising costs, that is not a sustainable option. Placing distribution centers (DCs) in the correct location can provide a long-term, sustainable option to reduce fulfillment time. Are your current DCs placed in the most optimal locations? Here are four steps in evaluating the location of distribution centers.

Analyze the Customer Base: Are You Close to the Customer?

A company’s customer satisfaction is the reason to maintain a quick fulfillment time, so it should be the first focus in determining where DCs are located. In order to fulfill orders quickly without greatly increasing the cost of shipping, DCs should be placed to reach a high percentage of customers within one to two days using ground services. Otherwise, using next-day and second-day services need to be used to fulfill orders. It may be that those services have to be used to fill in the gaps of the former scenario, but it would be a much lower percentage of packages. Knowing what areas of the country your customers live in can eliminate a majority of locations that a DC should not be.

Stay Close to the Carriers: Are DC locations Near Carrier Hubs?

In reducing the time it takes a customer to receive an order, any reduction helps. So, while keeping close to customers is important, DCs also need to be close to carrier hubs as well. A large distance between a DC and a hub can significantly lengthen the time it takes for the customer to get an order. Failing to place a DC close to the carrier hub could cost the extra time gained from being near the customer. In addition, being close to the hubs of major carriers allows for later pick-up times. This gives the customer the ability to order later in the day and still get the same service. The best option is to find a middle ground where the DC is near both the customer and the carrier.

Play to Your Order Fulfillment Strategy: Direct to Customers or Leverage Stores?

Most fulfillment strategies can be summarized to two options: shipping directly to the customer out of the DC or using stores to fulfill orders. If you ship direct to your customers, then the placement of DCs is pretty straightforward – just place DCs close to customers and carriers. If the latter option is used and ship-from-store or buy online/pick-up in store is the strategy, then setting up DCs closer to the stores rather than the customers will serve the purpose better. Knowing the best locations to place DCs is important, but knowing how many DCs can be managed is a limiting factor on where they can go.

Know Your Limits: How Much Can Be Invested in Infrastructure?

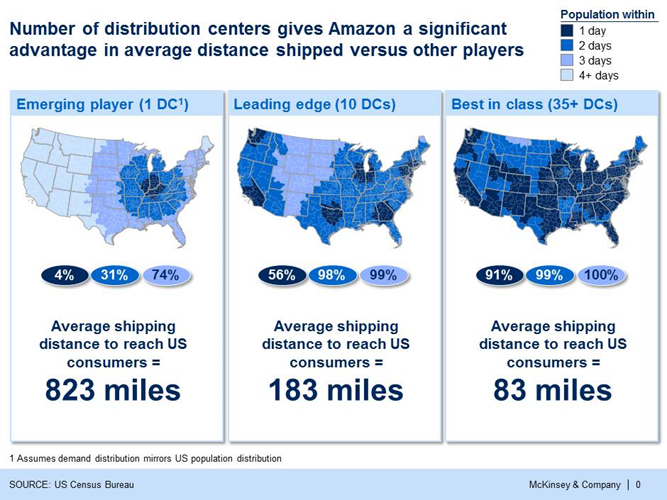

The number of DCs in a network determines how many consumers the network can reach in two days. According to the US Census Bureau, one DC reaches approximately 31% of consumers in two days using a ground service, while 10 DCs reach 98% in two days. Amazon has well over 35 DCs in their network and can reach 99% of consumers in two days. But, placing a DC in every state is not feasible for most companies; so, knowing the limits of the network, specifically monetary limits, is important. Performing an analysis on the cost impact of adding another DC to the network versus upgrading shipments from ground to an express service is beneficial to this process.

Being close to customers is the key to faster fulfillment and maintaining a less expensive network. Understanding the limits of your network and pushing the optimization process will ultimately uncover the best possible locations for distribution centers.

Nathan Martin is a Strategic Solutions Engineer at Green Mountain Technology, a Parcel Spend Management service provider for shippers with over 10 million parcels per year. In this role, Nathan partners with customers to provide strategic Parcel Spend Management solutions – Network Optimization, Spend Analytics, and Contract Management. Nathan has a Bachelor of Science Degree in Industrial Engineering from Mississippi State University.