As e-commerce sales continue to grow, so does consumer demand for same-day delivery. E-commerce distribution operations increasingly need fulfillment footholds in crowded urban areas and near high-spend consumers – but access comes at a price. The need to balance cost with access to urban populations is complicated further by rising rents and the need to curtail the number of delivery trucks on city streets. As a result, inspired property owners, e-commerce distributors and city leaders are inventing new approaches to delivery, according to a new report from JLL.

Among the US markets JLL broadly defines as optimal urban infill destinations, last-mile availability is 180 basis points lower than the market in general, and rental rates have been rising consistently since early 2017.

“Urban infill warehouse and distribution facilities are already extremely scarce, and conversions or redevelopment to other uses have eroded available stock. Given that e-commerce sales are expected to double over the next decade, demand will only grow stronger,” said Aaron Ahlburn, Managing Director, Industrial Research, JLL. “Last mile distribution within dense US cities requires the right location, the right space and the right price – and that calls for creativity in our industry.”

New Approaches to Last-Mile Delivery

- As the e-commerce industry continues to reshape the conventional logistics landscape, JLL’s new report identifies ways last mile distribution demand is transforming urban real estate.

- eBike, anyone?UPS’ eBike electric bike program, activated in Portland, Oregon, and Pittsburgh both reduces harmful emissions and expedites deliveries through narrow city streets with limited parking.

- The sharing economy comes to e-commerce distribution. Startups Flexe and Warehouse Exchange are applying sharing-economy concepts to e-commerce. Flexe connects companies that need warehousing space and services to companies that can provide them using software and a network of warehouses. Like Airbnb, Warehouse Exchange enables warehouse users and providers to connect online.

- Getting smarter with Smart City Logistics. Several major U.S. cities have launched Smart City Logistics innovations and protocols, following the lead of Europe and Asia. For instance, Seattle is partnering with logistics companies in the Urban Freight Lab to address the impact of frequent deliveries on everyday life.

- Up, up and away – in multistory warehouses. Just as urban grocers went to multistory stores, urban warehouses are going multistory, too. In markets with high land values, such as New York City, Seattle and the San Francisco Bay Area, multistory distribution centers are coming to life.

Successful Last-Mile Real Estate Is “and,” not “or”

While many tenants are still moving into traditionally exurban “greenfield” warehouses, some are also establishing fulfillment centers near office buildings, shopping centers and residential areas, or in less functional – but well-located – urban warehouses for the last mile.

Owners and investors are finding opportunities to repurpose overlooked or under-utilized urban infill industrial facilities – and sometimes other types of real estate – in key locations for last mile deliveries. In downtown Chicago, for example, JLL is helping the leaseholders of the Millennium Park parking garages in the city’s center to convert under-utilized space into a last mile urban fulfillment center. The first project of its kind in the United States, the new space will provide 15-minute access to nearly 230,000 city residents and is designed for use by multiple e-commerce companies.

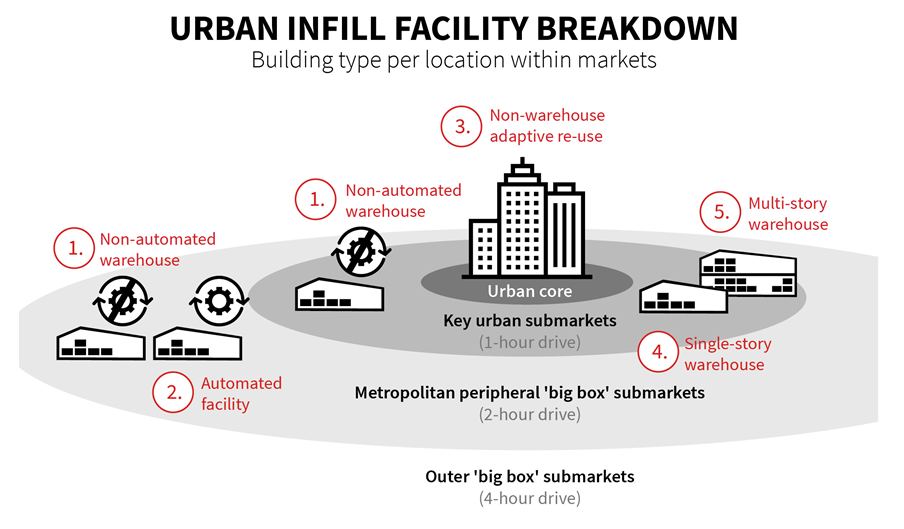

From the urban core to a metropolitan area’s periphery, location can determine the type of building that may match a particular last mile requirement. JLL’s research reveals the preferred building type by market location:

"A national network of regional distribution centers is important, but it’s just the beginning. The sophisticated routing of e-commerce orders through a complex series of supply chain stops is driving demand for nearly all building types and qualities of industrial real estate,” said Gillam Campbell, Research Manager, Industrial, JLL. “With smart demographic analysis, e-commerce companies can identify urban infill locations that will serve their last mile deliveries – and it may look different in different cities.”

JLL’s Urban Infill: the route to delivery solutions report details the evolution of urban infill warehouse and distribution inventory across the United States.

JLL is a leading professional services firm that specializes in real estate and investment management. Our vision is to reimagine the world of real estate, creating rewarding opportunities and amazing spaces where people can achieve their ambitions. In doing so, we will build a better tomorrow for our clients, our people and our communities. JLL is a Fortune 500 company with operations in over 80 countries and a global workforce of 88,000 as of September 30, 2018. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Click here to return to the supply chain topic page.