Editor's Note: The last table of this article was updated on 3/22 with some corrected information to the Additional Handling, Packaging line.

The 2019 FedEx and UPS rate increases have taken effect, and while anyone who has been in the industry for a while knows that rate increases happen on a regular basis, you still might be wondering what the current increases mean for your specific bottom line. Here is a side-by-side comparison to help you determine the true impact.

“Average” Doesn’t Necessarily Show the Whole Picture

While both carriers implemented parcel and air freight average rate increases of 4.9% this year, it’s worth noting that, historically, there has been very little correlation between their announced average increases and actual increases by service level, zone, and weight. In practice, the annual GRIs’ impact to parcel budgets will deviate significantly from announced averages, and to what extent depends on each shipper’s unique profile. In general, smaller shippers take the full brunt of the increase while larger shippers, having the power to negotiate terms that mitigate the general rate increase year over year, take a smaller hit.

Comparisons between FedEx and UPS pricing have become more difficult in recent years, with rates, minimums, fuel tables, and surcharges no longer matching. Reviewing this year’s increases by service and weight reveals that 31+ pound Express services, with approximate increases of six to eight percent, are FedEx customers’ most impacted service, while UPS customers incurred their largest increase between 7.5% and eight percent on 31+ pound, two-day rates. UPS SurePost rates took the largest increase of all services between both carriers, well above and beyond their 4.9% announced averages, by rising as much as 9.3%!

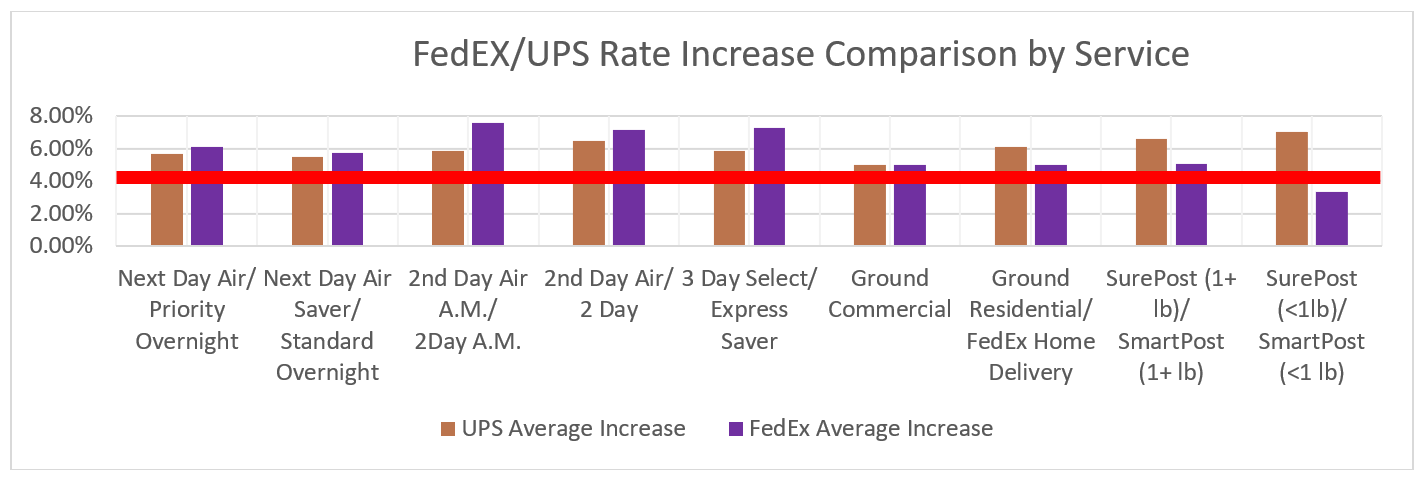

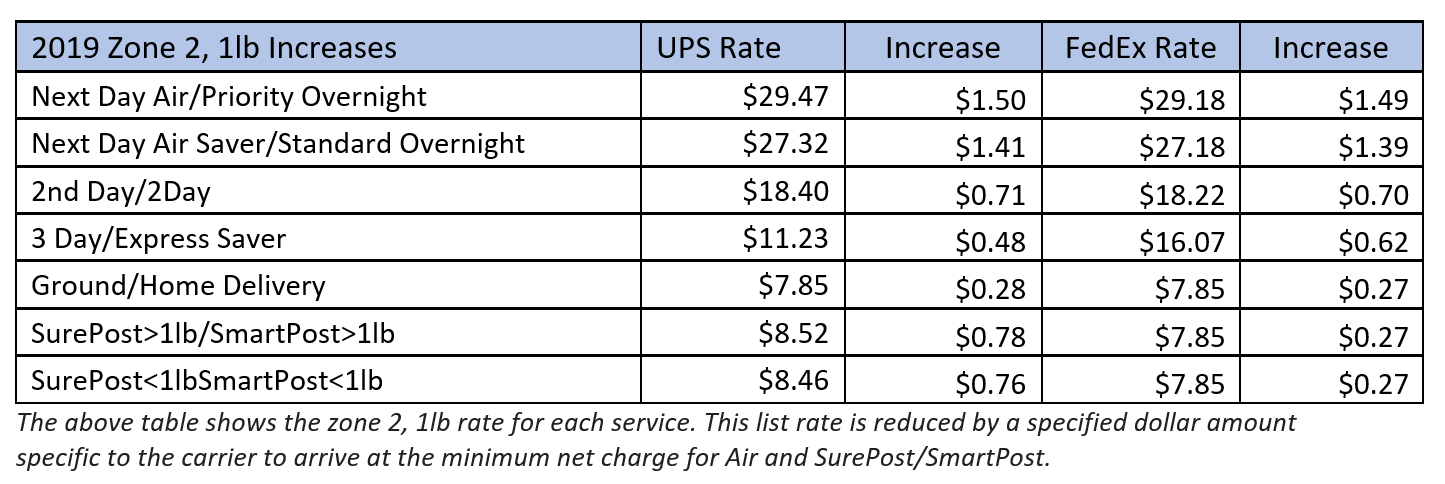

Below is a comparison of the carriers’ 2019 rate increases by service. The largest disparities between FedEx and UPS are seen in UPS SurePost/FedEx SmartPost < 1lb (with SurePost increasing 52% higher than its FedEx counterpart), and UPS’s 2nd Day Air A.M. and FedEx’s 2Day A.M., with FedEx’s two-day service increasing 22% higher than UPS’s.

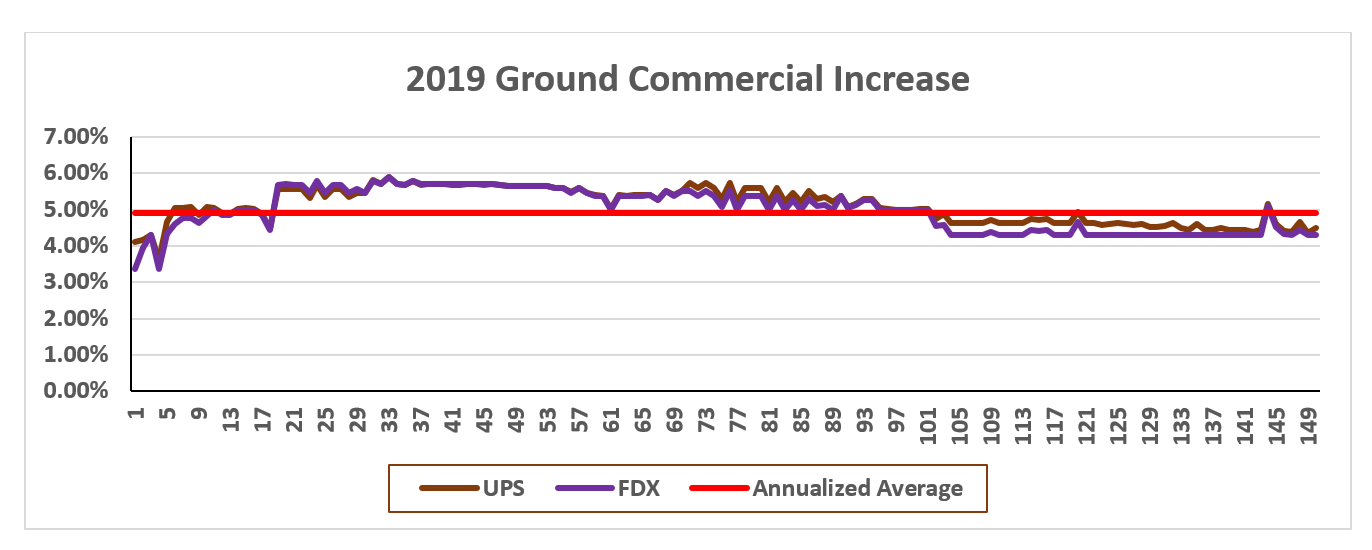

Businesses that mainly ship ground commercial packages will see less volatility in their shipping spends this year with both UPS’s and FedEx’s increases across all weights landing very close to 4.9%.

A shipper’s true increase really depends on what type of package they’re shipping. Commercial Ground rate increases are comparatively close between both carriers across all weight breaks. It’s important to be aware that increases vary not only by service, but also weight and zone.

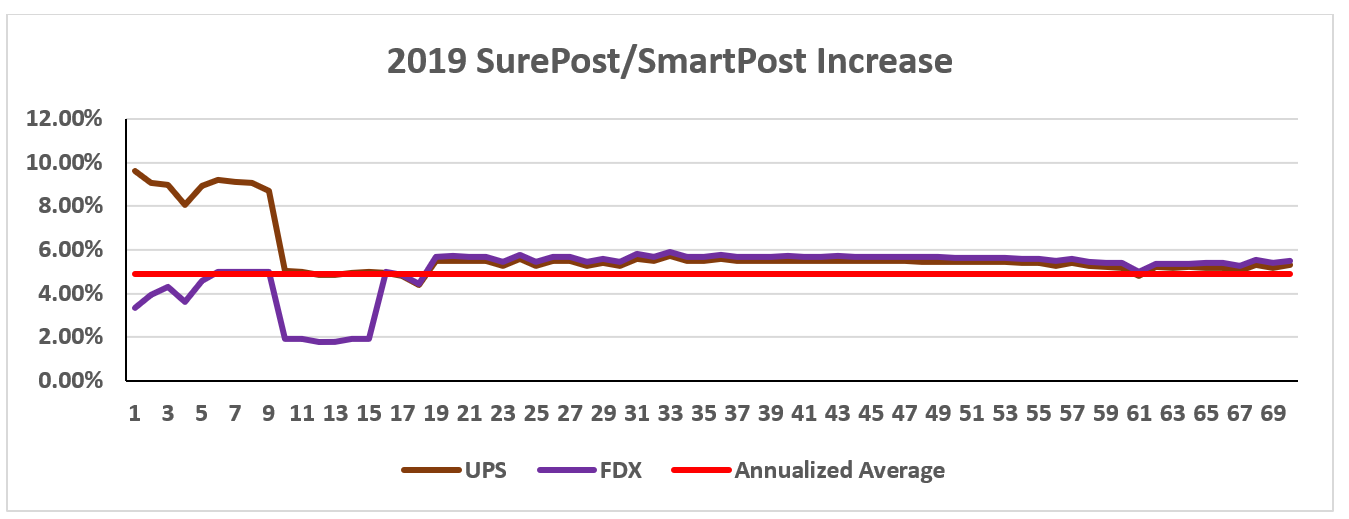

For example, take a look at one-pound SurePost packages. UPS customers are seeing a rate increase of 6.25% more than FedEx SmartPost. Here is a closer look at impact by weight for SurePost/SmartPost > 1lb:

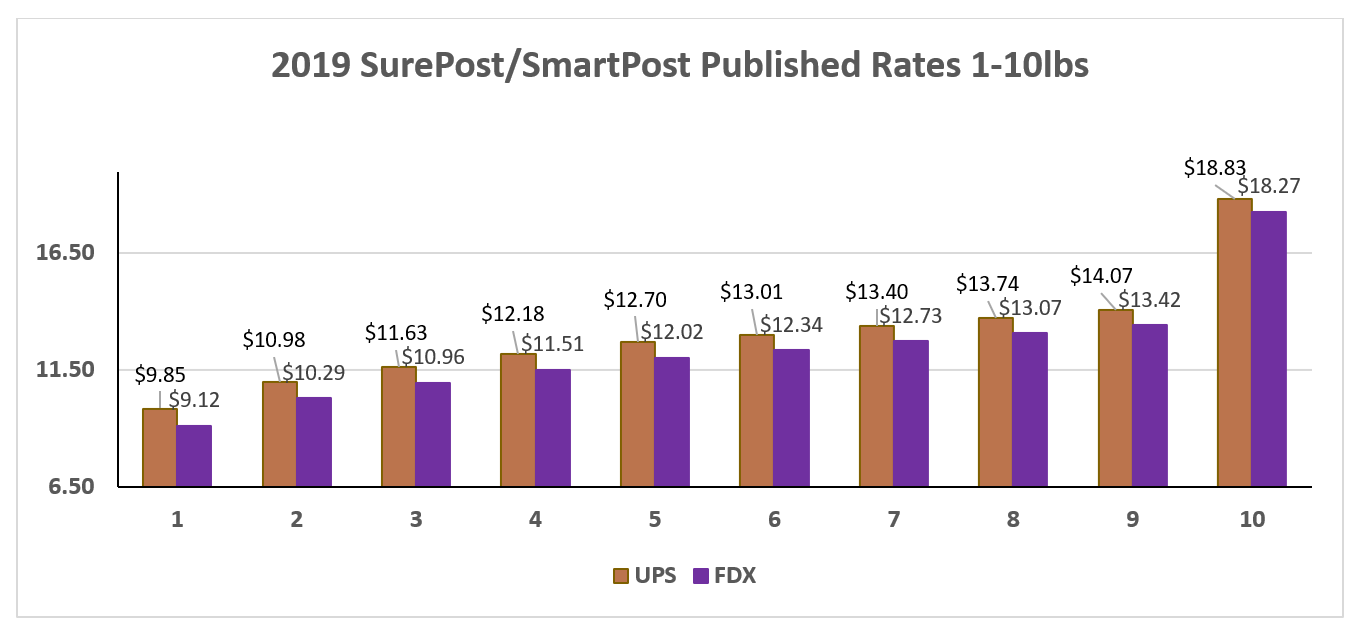

What does this all mean? What is the impact to SmartPost/SurePost shippers? A true rate comparison reveals that, while their rates are close, FedEx shippers are paying slightly less for one- to 10-pound SmartPost packages than those that ship with UPS SurePost. Although UPS increased rates by a much higher percentage, on average, rates are within six percent of each other under 10 pounds.

Not only do shippers need to take published rate increases into consideration, but they must also be cognizant of minimum charges, which increased in 2019 as well. Ground (commercial/residential) services match this year, with UPS increasing their minimum by $.28 and FedEx by $.27 to reach a mutual $7.85. There is a greater disparity between SurePost and SmartPost increases; where UPS raised the > 1lb rate to $8.52 and < 1lb rate to $8.46, FedEx raised <>1lb rates to $7.85.

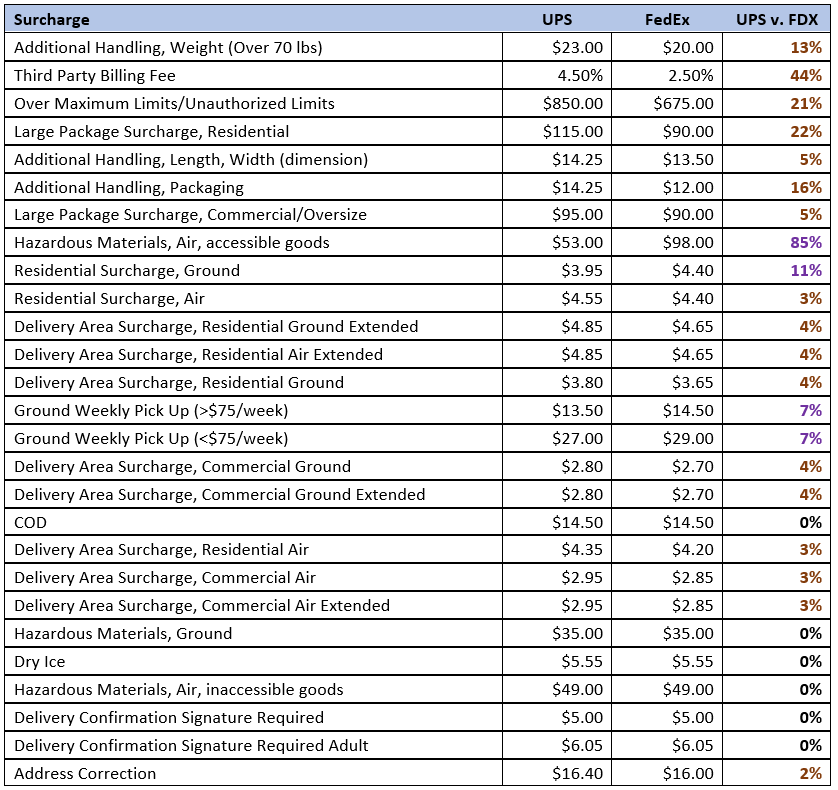

This year, we see many of the same surcharges increasing as in recent years. FedEx doubled the Print Return Label Fee and UPS increased the Third-Party Billing Fee by 80%! Take a closer look at Additional Handling, Large Package Surcharge, and Over Maximum Limits. Both carriers increased these accessorials during the 2018 General Rate Increase, again between June and September, and all three once again in 2019. Additional Handling Weight has increased over 91% in 12 months!

The table below highlights the 2019 changes to some of the more common surcharges. This year, as in years past, there are quite a few surcharges increasing, with great variability in increase percentages. As has been the recent trend, the largest increases continue to be reserved for those surcharges related to greater package size, weight and dimensions.

Depending on which carrier you partner with, the 2019 rate increases could have a drastic impact to your bottom line. FedEx’s Air Accessible Goods fee almost doubles UPS’s, but UPS’s Third-Party Billing Fee is 44% more expensive than FedEx’s. Per the above table, UPS shippers have the advantage of lower accessorials in many cases. The UPS v. FDX columns calculates just how much more expensive one carrier is over the other.

The information presented illustrates the many facets of the 2019 general rate increase and UPS’s and FedEx’s continual efforts to align operating costs with pricing. However, that alignment has created pricing complexity. It’s very difficult to negotiate with the carriers when you can’t decipher rate guides, agreements, and increases – which now occur multiple times throughout the year! Shipping has become more expensive for shippers as the carriers focus on maintaining high margins while capturing added costs to serve. With rates, minimums, and surcharges that no longer match between the two major parcel integrators, it is essential that shippers remain informed to maintain control of their transportation spend. It’s all a matter of truly knowing your shipping profile and being able to navigate the intricacies of carrier pricing.

Rebecca Lannon is the Client Solutions Manager at Shipware, a San Diego-based parcel consulting, technology and spend management firm. An expert in qualitative pricing analysis, carrier contracts and revenue strategies, Rebecca leverages over 11 years of direct carrier pricing experience to help high volume parcel shippers reduce costs up to 30%. For more information, please contact Rebecca at rlannon@shipware.com.