The small parcel shipping industry has had a front-row seat to the impact of COVID-19 since the beginning. Still today, both shippers and carriers are working to adapt their businesses to a very dynamic and unsettled operating environment.

The pandemic has also affected consumers’ buying habits and accelerated a challenging trend that was already in place, which is the surging growth of e-commerce and residential deliveries. Altogether, small parcel carriers are now required to do more and be better, with unprecedented pressures on their internal delivery networks. The repercussions for the industry, and for the shippers who rely on small parcel delivery to serve their customers, have taken shape in many ways.

Ups and Downs for Shipping Costs

One of the first changes felt by shippers as a consequence of COVID-19 took place in March when FedEx and UPS announced the suspension of money-back service guarantees. With little notice, shippers lost their entitlement to a refund when a package is not delivered by the guaranteed delivery time as they’d been entitled to in the past. It’s expected this will be a temporary suspension, but there is no indication when it may end. Then, in June, both FedEx and UPS begin implementing domestic Peak Season Surcharges (PSS). Announcing a PSS is a common tactic the carriers use to offset the increased costs of managing large spikes in package volume, but it’s usually saved for the “peak” shipping season around the holidays.

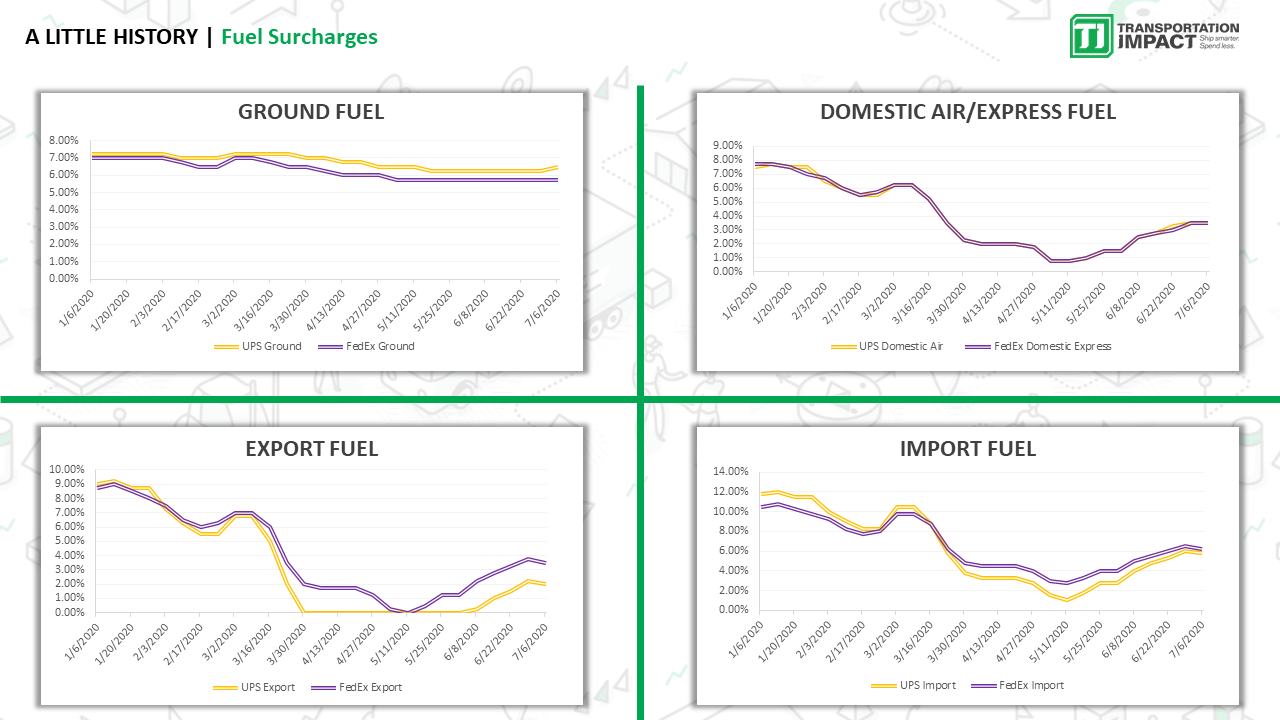

One impact of COVID-19 that has worked to the benefit of shippers, however, is lower fuel prices. This means shippers are paying much lower fuel surcharges with both carriers.

Business Is Changing

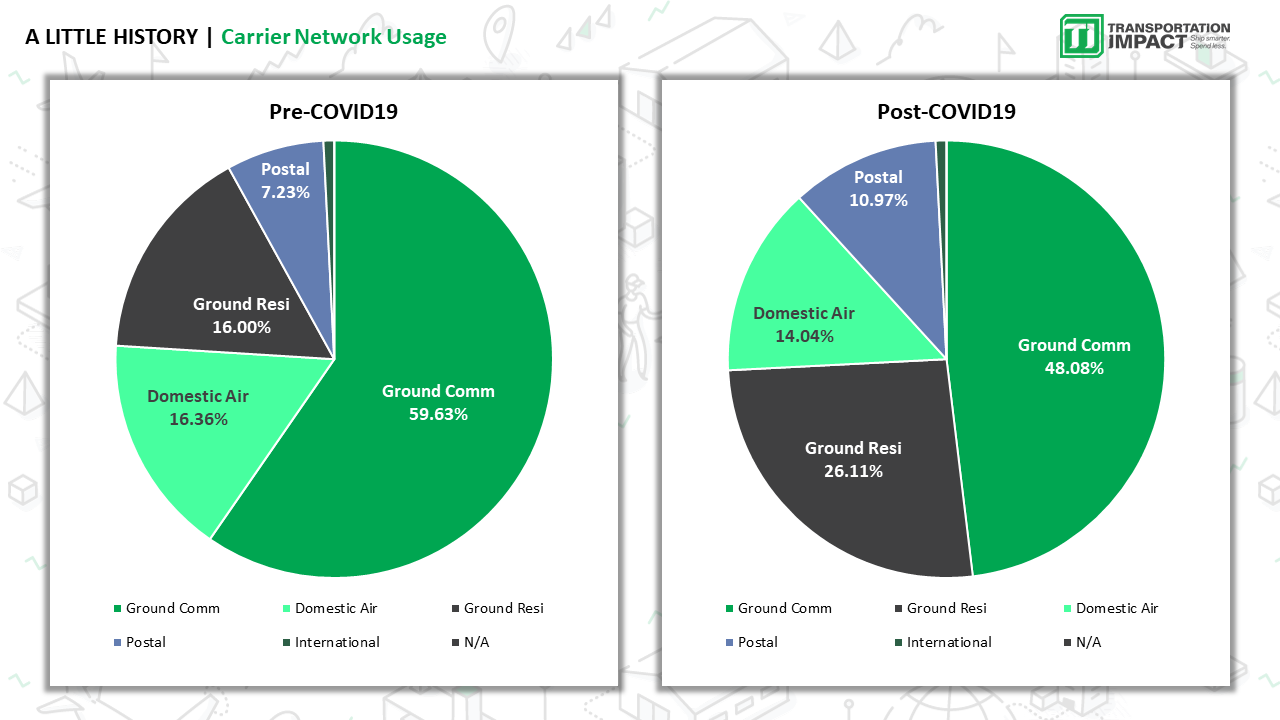

From the carriers’ perspectives, a rapid shift in retail spending manifested itself as a significant change in the types of deliveries moving through their networks. Pre-COVID, a typical breakdown of parcel volume was about 60% Commercial Ground deliveries and only 22% Residential, based on Transportation Impact’s customer data. This is important because, from a cost-to-serve perspective, Commercial and Residential deliveries are very different for the carriers. But during COVID, the ratio has flipped, with Commercial Ground dropping to 40% of volume, and total Residential deliveries now accounting for 46% of delivery volume.

Another related change has been in the use of express services, like Overnight Air. Shippers are moving away from premium service usage and choosing less costly (and slower) options. Pre-COVID, premium services were used for about 17% of packages, but it’s dropped to as low as 11%. A big part of the reason for the decrease is the suspension of money-back service guarantees.

In general, FedEx and UPS strongly prefer delivering to businesses (i.e., Commercial) because their networks are designed to deliver a large number of packages to a small number of addresses in as few stops as possible. Commercial deliveries also tend to be smaller and more consistent sizes, which works well with the automation both carriers have in place that speeds up package sortation and handling. In the current delivery mix, however, carriers are now faced with delivering lighter-weight packages, making more stops, and driving more miles for less total delivery revenue. Clearly, the Peak Season Surcharges are being used by the carriers to recover the additional operating costs of the “new normal.”

Moving Forward

It’s hard to fault companies for not foreseeing the full severity of the effect COVID-19 would have on all of us from both personal and professional standpoints. Clearly, the carriers are still figuring things out themselves, which means all small parcel shippers need to keep monitoring the situation closely. Shippers can also expect that future surcharges and fees announced by the carriers will continue to be focused on Residential packages and the types of deliveries that work against their own operating efficiency. These could include their postal-hybrid products like SurePost and SmartPost, DAS (Delivery Area Surcharge), and large/oversized packages. All small parcel shippers need to make sure they understand how everything the carriers do, from surcharges to service announcements, will affect their costs and delivery performance. The carriers never make it easy to do so, which means it’s incumbent upon shippers to remain aware of what the carriers are up to and diligent in protecting their business’s bottom line.