Two years ago, FedEx, UPS, DHL, and the other parcel carriers delivered 70% of their shipments to businesses mostly in major cities. In the last two years, this delivery ratio has flipped. But why the dramatic change? There is a long list of factors that could potentially contribute to this shift, including COVID, crime, and other issues often found in cities, which are causing many businesses, restaurants, and entertainment venues to close or relocate to more rural areas. Today, the carriers are seeing a 70% rural residential delivery ratio to a 30% business-to-business ratio, a change that may not reverse itself. These changes have prompted the carriers to rethink their shipping strategies and cost models.

The explosion of e-commerce and residential deliveries over the past several years has made it necessary for the parcel carriers to identify ways to lower their cost while making profits along the way. A couple of their more expensive surcharges: Delivery Area Surcharge (DAS) and Extended Area Surcharge (EAS) are on the rise again. Both are designed to charge more for packages destined for the less populated ZIP Coded across the country.

Since COVID, the US population has been increasingly shifting from high density areas like metropolitan intra-city deliveries to more rural areas or DAS and EAS ZIP Codes. As more people and businesses are working from home, more shipping is being done in the rural areas. People are moving to the “burbs” or working remotely since they are no longer necessarily required to reside in or near the more highly populated and denser metropolitan areas like they have in the past. As more businesses ship deliveries to less populated areas, they will be incurring a DAS/EAS charges at a much higher level. The carriers are increasing these already high-priced DAS charges to more rural and urban ZIP Codes.

Rearranging ZIP Codes and adding new DAS fees to increase margins is nothing new to UPS or FedEx. Over the years, there has been an ongoing effort designed to align lower density/more costly deliveries with higher surcharges. These changes are usually associated with Rural Residential and Rural Extended Area Residential ZIP Code deliveries.

Overall, we conclude that the carriers’ “jockeying” of DAS/EAS service area ZIP Codes are only part of the equation. While UPS has just implemented the Delivery Area Surcharge-Remote, FedEx has yet to respond in kind. Suffice to say, both carriers view DAS in a similar fashion with respect to their ZIP Code alignment and a new profit center.

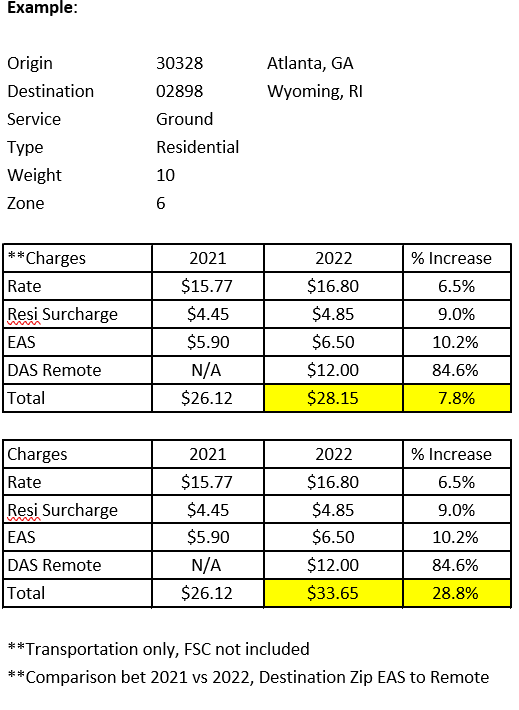

If we add the 2022 GRI of 5.9% and apply either DAS/EAS or even the “new” DAS Remote charge, shippers can expect double digit increases. Keep in mind that in January of this year, UPS just implemented a new DAS Remote Surcharge of $12.00 per package. Application of this new charge will depend on your destination delivery ZIP Code. Consider a UPS 10lb, Ground Residential package travelling from Atlanta, GA to Wyoming, RI. In 2021, the rate would be $26.12. In 2022, that same package would be $33.65 — a whopping 28.8% double digit increase.

The carriers would argue that even though remote areas are getting more deliveries, it doesn’t improve operational efficiency. We disagree; as the population continues to shift, higher rural delivery density will follow.

Mike Erickson is Founder CEO at AFMS Carrier Pricing Experts and Logistics Consulting, North America & Europe. Visit www.afms.com for more information.