Back in 2021, FedEx initiated a key change to its market strategy by rebranding FedEx SmartPost as FedEx Ground Economy. Effectively, this decision resulted in a complete network redesign – removing USPS (mostly) from the FedEx network – and aimed to improve efficiencies in transit time and cost. Now, nearly two years later, the market is beginning to yield the results of that action. As far as results, they are mixed.

Key Performance Indicators Tell an Interesting Tale

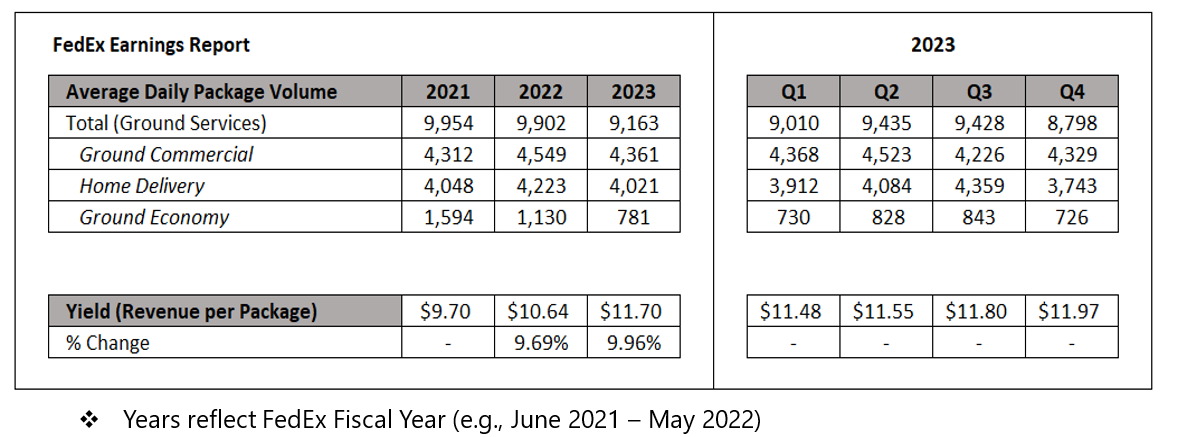

Over the past two years, FedEx has demonstrated remarkable discipline in increasing its revenue yields on a year-over-year basis. Consider Ground services – Ground Commercial, Home Delivery, and Ground Economy. FedEx achieved a 9.7% growth in revenue yields on these services in 2022, followed by an additional 10% increase in 2023. Implementing an annual rate increase doesn’t hurt this metric, but overall, the upward trend suggests that FedEx is continuing to adapt its pricing strategies and optimizing revenue streams.

Concurrently, during the same 2021-2023 period, the average daily volume (ADV) of FedEx Ground Economy shipments has declined dramatically by 51%. By comparison, Ground Commercial and Home Delivery volumes remained remarkably flat during the same window of time. These services experienced only a 0.3% drop in ADV.

|

Reading between the two metrics – Revenue Yield and ADV – FedEx appears to be reevaluating its focus on low-margin, lightweight packages in a concerted effort to improve revenue yields.

Anecdotally, recent negotiations highlight the declining competitiveness of FedEx Ground Economy against traditional alternatives such as UPS SurePost, UPS Mail Innovations, and DHL SmartMail. In fact, the additional ‘Returns and Delivery surcharge’ that FedEx attaches to Ground Economy is an outlying (unique) surcharge related to this service. As a result, it is rare that, as consultants, my team sees significant savings opportunities for FedEx Ground Economy relative to comparable services. And the list of comparable services is growing. FedEx contraction in this space has increased opportunities (and market share) amongst other last-mile carriers interested in lightweight volumes. It is increasingly common for e-commerce shippers to request evaluations of secondary or tertiary carriers to specifically handle package volumes under five pounds.

Considerations for Shippers

Volume decline does not mean FedEx is out of the lightweight parcel game. Not yet. Instead, FedEx appears to be narrowing its definition of ideal shipping volumes and becoming more selective towards customers that receive deeper discounts for FedEx Ground Economy. In many respects, the company appears to be deploying a similar “Better, not Bigger” strategy utilized its rival UPS, albeit, with a twist. For FedEx, the strategy appears to be rather, “Better, not Smaller (Packages).”

Level the Playing Field. As more parameters are added to the definition of ideal shipping volumes, negotiations are changing as well. Shippers that utilize lightweight service offerings should no longer look at UPS and FedEx as a congruent comparison. Both carriers appear to be diverging to some extent in pricing for this particular service area. Instead, shippers ought to consider viewing contract negotiations as UPS vs. FedEx plus one. Adding an additional carrier to handle lightweight volume (e.g., 0-3 lbs.) can take pressure off of FedEx to offer discounts on volume unappealing to its operation. Moreover, adding carriers bolsters future leverage in contract negations and allows diversification outside of a single-source solution offered via UPS.

Leverage Benchmarking. Regardless of carrier utilization, it is always advisable to know how a program measures against broader market trends and conditions. For this reason, benchmarking plays a fundamental role in educating transportation professionals on the relative strengths or weaknesses embedded in their program. As FedEx continues to pursue revenue quality instead of lightweight volume, I would also encourage shippers that heavily utilize FedEx Ground Economy to conduct research on their program. It could very well be the case that a savings opportunity exists in the market with an alternative service provider.

FedEx's strategic rebranding and network redesign have yielded a mixed bag of results, with revenue growth on one hand and a decline in average daily volume on the other. As FedEx focuses on revenue quality and reevaluates its lightweight parcel strategy, shippers must adapt their approach by considering additional carriers, leveraging benchmarking, and exploring alternatives to optimize their shipping programs.

Jack McCrum is a Project Manager at Körber Supply Chain. He and his team specialize in contract negotiation and strategic consulting within the transportation industry. For any inquiries, feel free to reach out directly at john.mccrum@koerber-supplychain.com.