This article appeared in the Fall 2018 International Issue.

The world is truly getting smaller, and more and more merchants from around the globe are entering the global e-commerce arena as technology has enabled merchants to expand their reach beyond their own borders. However, the process of shipping across borders is not as simple as a domestic distribution model. The one major difference is that these parcels need to pass through the local country’s Customs channels. This is where the real challenge begins for novice shippers — and even some very experienced merchants. There are over 220 countries in the world and, yes, there are over 220 rules and regulations around the world. Let’s take a look at some of the areas that impact a global parcel shipment.

Global Delivery Challenges

The global consumer is looking for fast and cheap delivery, which is not a simple task in any case, but especially not when you’re talking about global shipments. In many instances, there are long distances between the merchant and the consumer, multiple time zones, different languages, and various delivery expectations. The global e-commerce world never stops: On one side of the globe, you have someone ordering something, and on the other side, you have a merchant fulfilling the order. Global e-commerce is now a 24 hours a day, seven days a week, 365 days a year business. In addition to these challenges, each global e-commerce parcel needs to pass through Customs in either a private express mode or a postal solution (which deals with 220 country rules and regulations).

Local Customs Authority

What is the purpose of Customs in each country? Their primary responsibility is to govern what is allowed into the country and to manage the duty and tax process. They are primarily looking for contrabands, illegal products, banned items, and smuggling. Many global merchants view them as an obstruction to smooth e-commerce. However, they are just doing what their country has asked them to do, which is to protect their country. It is imperative for global merchants to understand each country’s rules and regulations and to abide by them. If done correctly, global e-commerce can pass through Customs very efficiently.

Customs Concerns

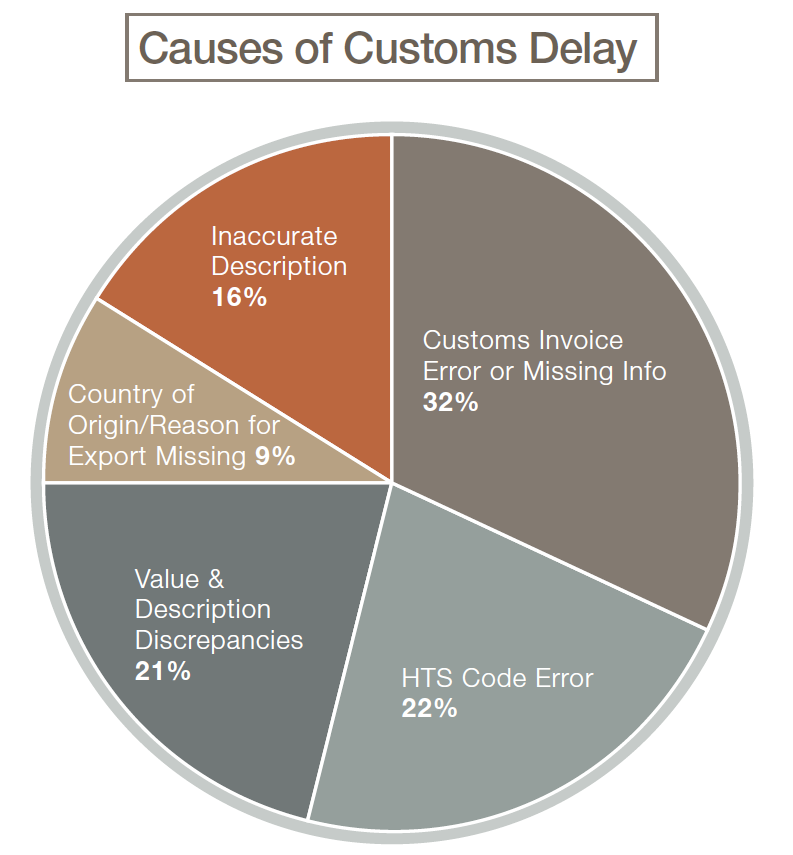

One of the best ways to expedite the customer’s clearance process is to prepare the shipment in accordance with each country’s rules and regulations. It starts with having accurate documentation (shipping label, commercial invoice, and any other required documents). About 75% of the time, delays in Customs are caused by the following: commercial invoice error, missing information, Harmonized Tariff Schedule (HTS) code error, value discrepancies, and description errors. These are all items that can be controlled by the shipper (see chart below).

It is critical to have a detailed description of a product and the correct HTS code. As an example, a pair of brown shoes can be classified very differently than brown leather shoes in Customs, and may be subject to higher taxes based on the description. The HTS code system is a global system that is used by most countries in defining a product. It is best to give the HTS code that best describes your product versus a Customs official doing it on your behalf. They will declare it based on the information that has been provided to them, which may make your product less competitive because of higher duties and taxes. You also need to be aware of any products that are restricted or banned by that country (for example, radar detectors are restricted in the United Arab Emirates).

Express Carriers vs. Postal Solution

As many of you know, most postal authorities around the world do not have the resources to fully inspect all items entering their country. This has created a gap in the Customs clearance process where many e-commerce shipments do not get the same scrutiny as the express operators. This has been a nice benefit for many global e-commerce merchants, but this is changing as we speak. There is a global initiative by most postal authorities to obtain the shipper and consignee information in an electronic format on all postal shipments. This will have two significant enhancements for countries: better control of what is entering their country via postal solution and the ability to collect duties and taxes from the recipient or the shipper (via Deliver Duty Paid (DDP) process).

Optimized Global Solution

As the postal authorities move forward with their global initiative, it is best to prepare for this process now. Here are some ways to be a progressive leader in the global e-commerce world:

· Provide accurate information about your product (detailed description, correct value, correct HTS code)

· Optimize the de minimis value guidelines by country

· Shift to a DDP model and collect duties/taxes up front with a duty/tax calculator in your shopping cart

· Understand the value, commodity, and quantity guidelines by country and develop a shipping strategy that utilizes multiple carriers/partners

Customs officials around the world are prepared for this explosion in global e-commerce. It is up to the merchants to make their jobs easier by providing accurate and complete information, which will provide a quicker Customs clearance. At the end of the day, it is all about a positive customer experience, since that is what will keep consumers coming back, time and time again.

Michael J. Ryan is the Executive Vice President at Preferred Parcel Solutions and has over 25 years of experience in the parcel industry. He can be reached at 708.224.1498 or michael.ryan@preferredship.com.

Click here to return to the Global Logistics and Delivery topic page.