“Insanity: Doing the same thing over and over again and expecting different results.” Albert Einstein

While Einstein was not describing shippers’ approach to parcel carrier sourcing, it can be an accurate description of the strategy commonly referred to as carrier diversification.

All too often, shippers look for opportunities to add a new carrier to fit into their existing program by “peeling off” a small portion of volume, but this approach is flawed and doesn’t always achieve the desired results. Don’t believe me? Let’s find out why this is the case and what shippers can do to change it.

First, let’s define this concept a bit. Executed well, carrier diversification can provide several benefits such as increased capacity, operational flexibility, improved speed to customer, and reduced expense. But does arbitrarily adding carriers for the sake of having more options achieve these benefits? Usually not, and the solution to this issue begins with shippers’ ability and willingness to think differently when assessing their parcel program.

Common Carrier Diversification Mistakes

Even the most experienced sourcing and transportation professionals are susceptible to making mistakes when evaluating their parcel programs. Below are a few common pitfalls, which can impede carrier base optimization efforts.

1. Focusing on current constraints. “I can’t move volume from my primary carrier, or I will lose my discounts.” Sound familiar? This is the first point of focus for many shippers when assessing their parcel program, which can often end the process before it begins. For those who press on, this constraint often dictates the process as shippers seek solutions that fit into their current program.

This issue is not limited to carrier volume and revenue requirements, as shippers often focus on reasons why they can/should not add carriers, such as technology constraints or implementation risk.

While these constraints cannot be ignored, they are often introduced into the process too early, and focusing attention here first is a very effective way to derail carrier diversification plans.

2. Jumping to solutions. Einstein once shared this view on problem-solving: “If I were given one hour to save the planet, I would spend 59 minutes defining the problem and one minute resolving it.” While assessing a parcel program isn’t exactly like saving the planet, I think Einstein was on to something here.

Instead of utilizing a basic problem-solving process, shippers sometimes jump to quick fix and/or one-dimensional solutions, such as shifting volume to a low-cost service to reduce expense or adding a carrier to increase capacity. By not establishing well-defined program objectives, this can result in addressing one issue or need, only to create unintended problems elsewhere.

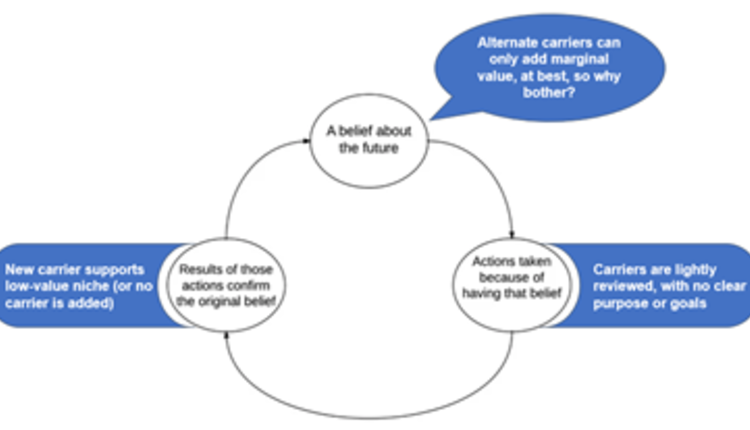

3. Self-fulfilling prophecies and a fear of change. Who knew there was so much psychology involved with parcel carrier sourcing? The impact of how shippers think about these decisions cannot be overstated, so let’s review a couple of examples.

The Self-fulfilling Parcel Prophecy

This may appear a bit dramatic, but it does happen, and it not only impedes the ability to source carriers and services that align to specific program needs, but it results in wasted time spent achieving a sub-optimal result.

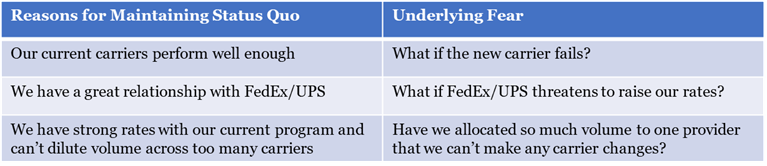

Fear of Change

There are many “reasons” given for not changing or adding carriers, which may be derived from a fear of change. Do any of the below statements sound familiar?

Conscious or not, these thoughts frequently prevent carrier diversification success.

A Different Approach to Carrier Diversification

An effective way to avoid these mistakes is to apply a basic problem-solving framework, with a few mental tips and tricks to keep your focus on one objective: sourcing the services and delivery capabilities that align to your specific parcel program goals.

Notice the objective did not include specific carriers nor current carrier contract requirements. This is a key component of the mindset required to “think outside the box” (or polybag) when evaluating your parcel program.

With this in mind, let’s review the basic thought process. Please note, while the following content is focused on a different approach to carrier diversification, the examples are oversimplified and are included to illustrate the thought process only.

Define program objectives, completely unconstrained

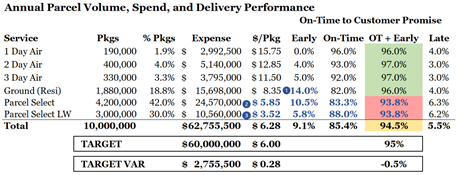

We begin with focusing on the most important expense and service components of the program, ignoring for the moment, all carrier-related details. One way to do this is to define objectives for key metrics, such as total parcel expense, cost per package, cost per unit, customer promise on-time performance, etc., but remove the carrier and service names from the baseline data view.

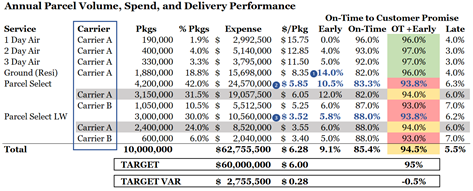

Table 1

Table 1 doesn’t really tell us much, but that’s kind of the point. We begin with a view aggregated by service type only, with no carrier specific information. At a high level, we have determined expense reduction ($2.75M, $0.28 per package) and delivery performance targets (improvement of OT + Early to Customer Promise from 94.5% to 95%) and areas of opportunity, listed below.

-14% of Ground Residential volume delivered early, presenting a possible opportunity to convert to Parcel Select

-Parcel Select OT +Early (93.8%) is below target, but also had 10.5% of packages deliver early. This presents a unique challenge, especially with Parcel Select representing the highest expense.

-Parcel Select Lightweight (LW) OT +Early (93.8%) is also below target

Introduce segmentation by carrier…generically

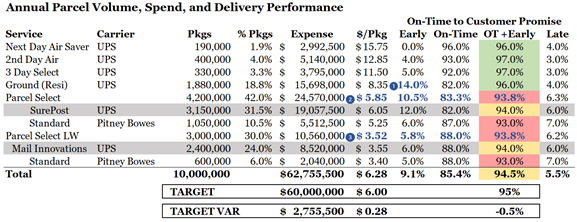

Table 2

Table 2 shows a gradual progression with two additions: listing a carrier for each service (generically displayed as Carriers A and B) and a breakdown by carrier for multi-carrier services (e.g., Parcel Select).

I know what you’re thinking. If you manage this expense, you know the carrier and service names, so why not list them? Remember, we are trying to avoid placing constraints on the process until it is necessary. If we focus on carrier specific details now, it will be tempting to jump to solutions which fit into the current program’s (a.k.a Carrier A’s) requirements.

Let’s take a look at what we can glean from this view.

-Ground Residential is sourced with one provider, Carrier A, so in addition to the Parcel Select conversion option, we may need to explore an alternative Ground service to address the $8.35 cost per package.

-Parcel Select is split between two carriers, with Carrier A supporting 75% of the volume at a noticeably higher cost per package ($6.05) than carrier B ($5.25). While the OT +Early is similar between the carriers (94% Carrier A, 93% Carrier B), 12% of Carrier A packages delivered early, presenting an opportunity to re-allocate volume to a Parcel Select service similar to Carrier B.

-Parcel Select LW remains a challenge, as both Carrier A and B provide similar cost per package ($3.55 Carrier A, $3.40 Carrier B) and OT +Early performance (94% Carrier A, 93% Carrier B). More information is needed, but we may need to consider expedited options to address the lagging delivery performance.

Adding carrier and service details, maintaining focus on identified opportunities

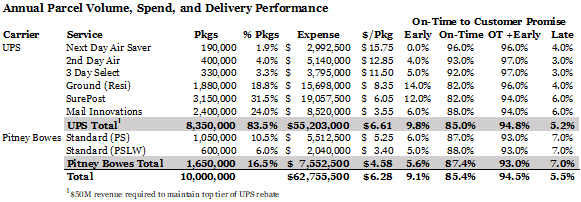

Table 3

Carrier A is UPS (no surprise there), and carrier B is Pitney Bowes. It is obvious that UPS accounts for the majority of volume and spend, but instead of focusing on how to fit other carriers into the program without compromising a UPS rebate (say with a $50M top tier revenue threshold, and current spend of $55.2M), we will complete our thoughts on outlining potential solutions which align to broader program targets.

-Ground Residential options become a bit clearer, as FedEx Home Delivery is an alternative to UPS Ground, either as a standalone option or as part of a larger shift from UPS to FedEx. Re-allocating a portion of Ground volume to one of the many Parcel Select options (existing SurePost or Pitney Bowes Standard, as well as DHL eCommerce Expedited or Expedited Max) remains an opportunity as well.

-Re-allocating Parcel Select volume to a more optimal mix of less premium (DHL eCommerce Expedited Max, UPS SurePost) and more standard (Pitney Bowes Standard, DHL eCommerce Expedited) services may provide an opportunity to maintain or improve delivery performance and reduce expense.

-Although there are few options, Parcel Select LW delivery performance could be improved by re-allocating volume to DHL Expedited Max or perhaps USPS First Class Package (via Negotiated Service Agreement, assuming 1M+ packages are awarded) if the expense increase is acceptable.

We have now outlined three clear areas of opportunity and identified potential solutions to explore when seeking to diversify our carrier base through a parcel RFP.

Stopping the Carrier Diversification Insanity

Now consider if we had started with a view like the one in Table 4, summarized by carrier, with no defined targets.

Table 4

It would have been easy to focus solely on the UPS rebate tier, perhaps by shifting a small portion of volume between Parcel Select services or converting some UPS Ground volume to SurePost. But instead, we were able to avoid this mistake, face our fear of change, and break the cycle of the parcel self-fulfilling prophecy.

Adding the right carriers and services to your parcel program is a challenging process, often complicated by biased thinking and burdensome carrier contract requirements. But it does not have to be this way, if you are willing to start with a clean slate, keep an open mind, and stop the insanity of parcel carrier diversification.

Nate Skiver is the founder of Level Playing Field Spend Management, a parcel consulting company which provides value for its clients through creating parcel shipping programs which reduce expense, while delivering a positive customer experience. Prior to founding Level Playing Field, he spent more than 15 years focused on building, executing, and managing parcel transportation programs for leading global apparel companies. He can be reached at nate@lpfspendmanagement.com.

This article originally appeared in the March/April, 2021 issue of PARCEL.