We asked the questions, you provided responses. Exclusively for the PARCEL Forum, Shipware conducted a live parcel pricing and benchmarking survey, entitled Live & Interactive Parcel Pricing & Procurement Benchmarking, at the 2022 PARCEL Forum. Dozens of shippers responded in real time to survey questions about their parcel usage, carrier preferences, cost reduction strategies, and other valuable benchmarking data. Survey respondents collectively commanded approximately $3.5 billion in annual parcel spend.

This article will highlight demographics and selected responses to more than 79 survey questions to help you gain insight as to how shippers are thinking about general parcel procurement, strategies to mitigate rising costs, receptivity to US Postal Service parcel products as a complement to the services of the private national carriers, concerns about the potential for a UPS strike, and much more.

Due to the length of the survey, we will unveil results in two parts with Part One (this article) covering survey demographics, shipper sentiments around pricing, and procurement practices. Part Two will be published in the May/June issue and will reveal the actual pricing/discount benchmarks, as well as address several miscellaneous categories (Amazon, potential for UPS strike, service performance, etc.).

It’s important to note that parcel pricing agreements were not shared due to confidentiality, but rather, participating shippers responded anonymously to survey questions based on ranges. Technology-enabled and totally blinded to avoid confidentiality concerns, the survey was designed to help shippers to better understand how their pricing stacks up with other shippers. Moreover, all survey responses were cross-tabulated by industry, company revenues, primary carrier, and annual parcel volume/spend for more meaningful like-volume correlations.

Why is benchmarking parcel pricing data so critical? Well, the most common challenge we hear from volume parcel shippers is that they don’t know how good – or bad – are the incentives, terms, and structure of their carrier pricing agreements. While no shipper would ever negotiate a contract and knowingly leave money on the table, the reality is that some shippers have clearly done a better job than others when it comes to negotiating the most favorable rates and terms.

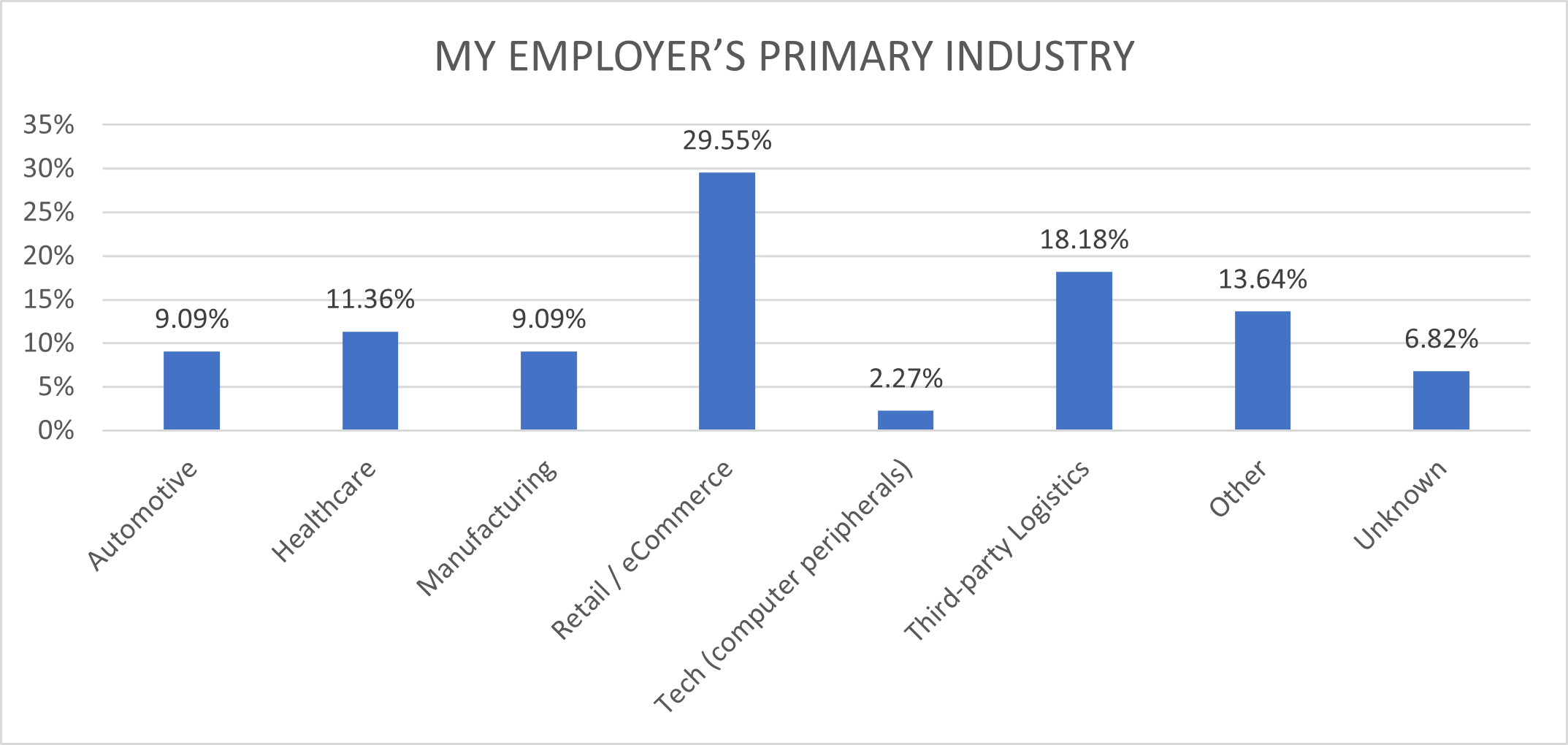

SURVEY DEMOGRAPHICS

Industry

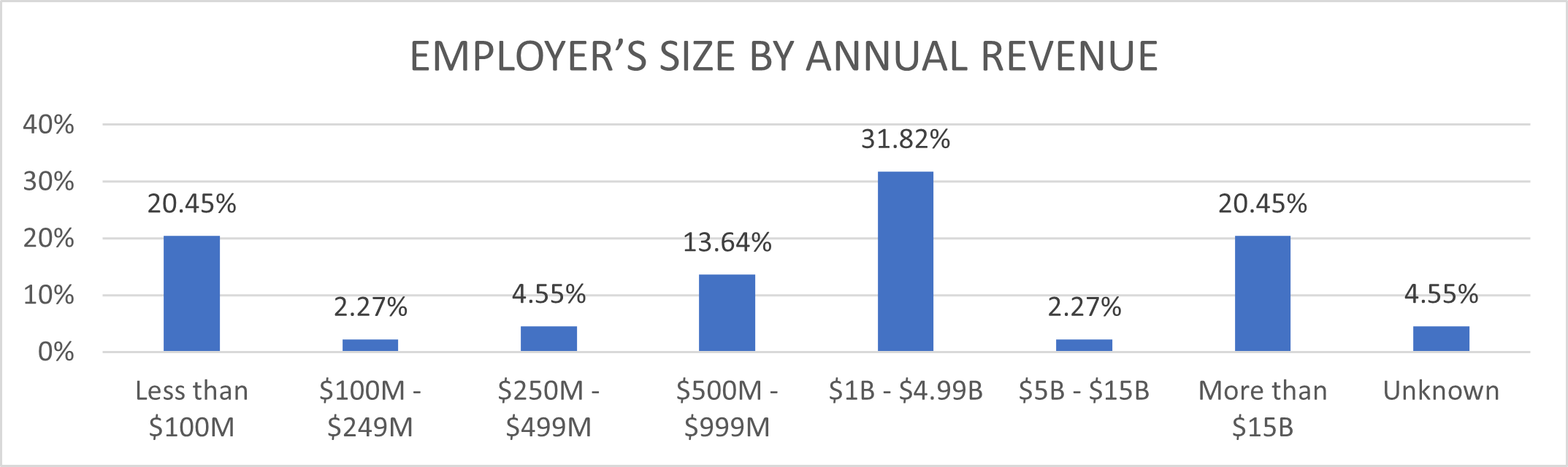

Annual Revenues

Small and large companies alike were represented with annual sales revenues ranging from under $100M to those businesses that generate revenues greater than $15B.

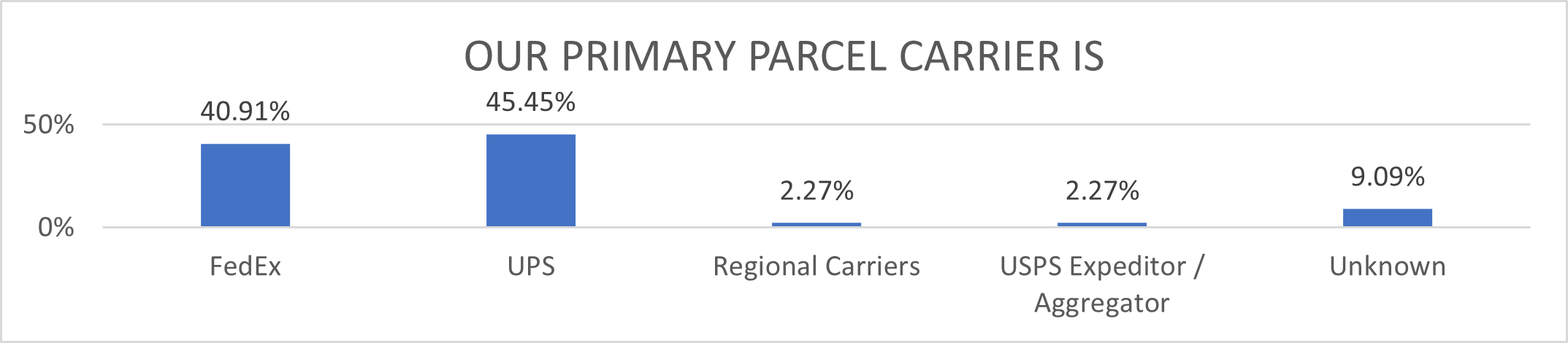

Primary Carrier

Predictably, 86.4% of all survey participants named UPS or FedEx as the “primary” carriers (as defined as more than half of overall volume). Other carriers included USPS and regional carriers although adoption of carriers outside of FedEx and UPS was not common.

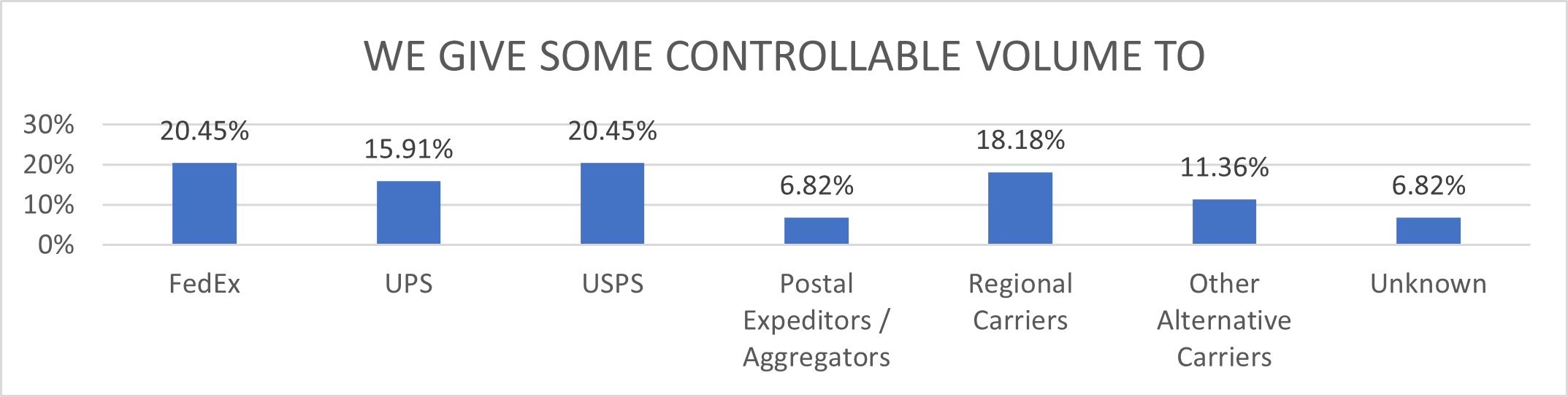

Controllable Volume

While UPS and FedEx enjoy the status as “primary” carrier, shippers continue to diversify carrier mix to include postal aggregators, regionals, postal, and other alternative carriers.

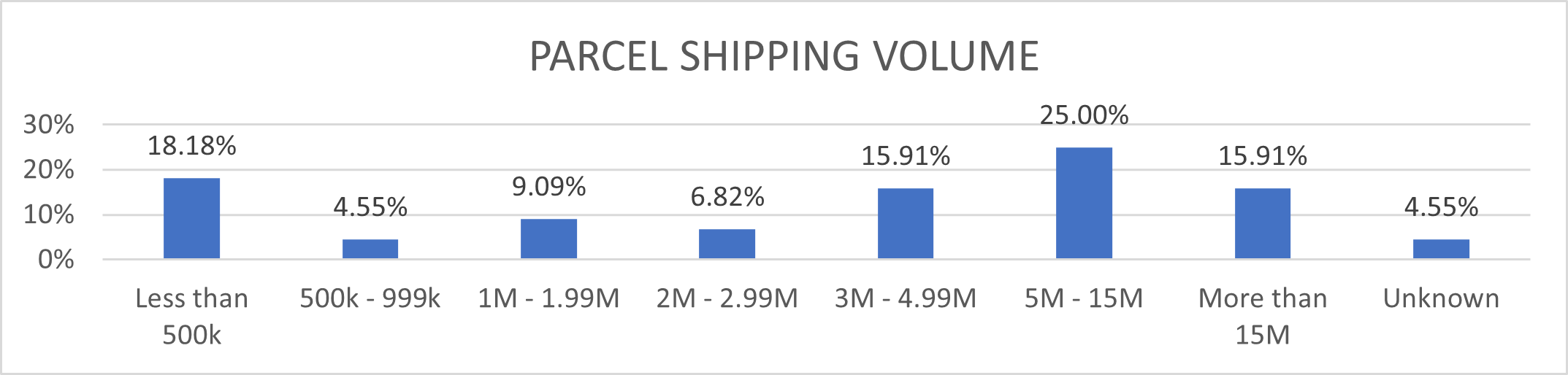

Parcel Volume

Annual parcel volume revealed a balanced mix of small, medium, large, and mega shippers, although as expected for the PARCEL Forum audience, half the survey participants shipped high volumes of more than 15 million parcels annually.

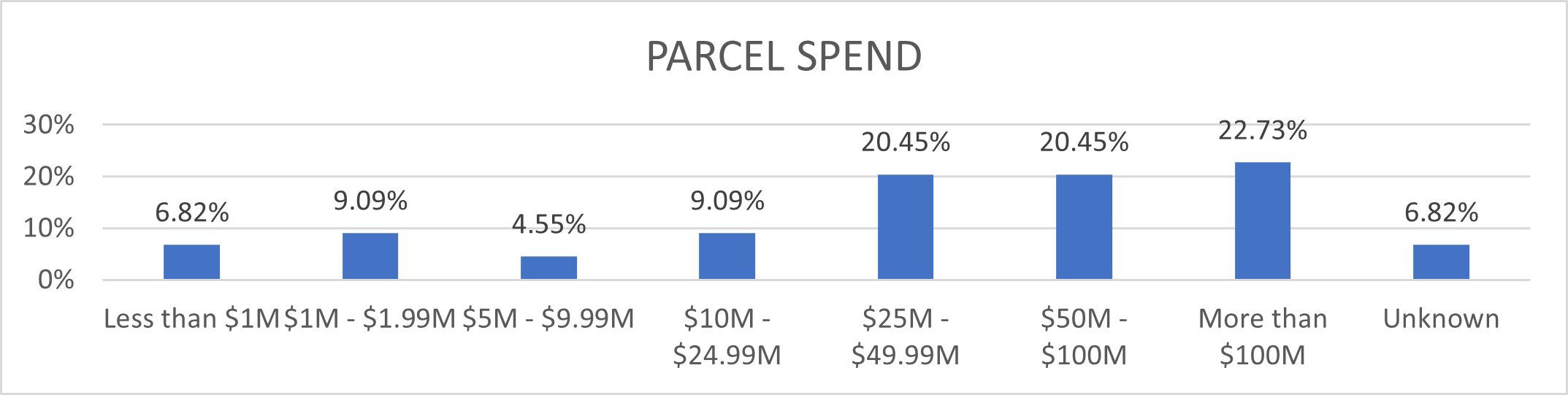

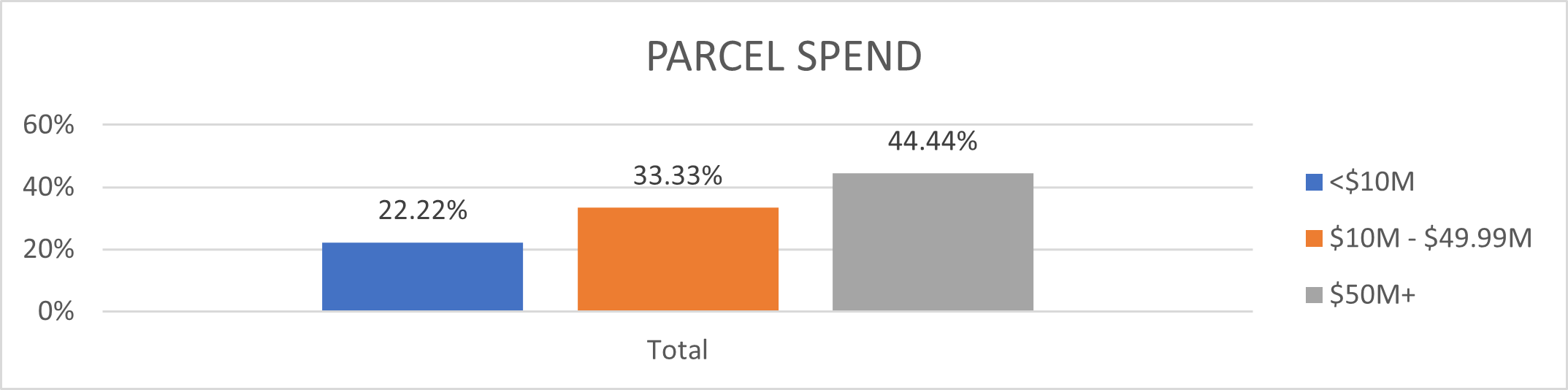

Parcel Spend

Annual parcel expenditures likewise revealed a balanced mix of shippers of all sizes. Collectively, we estimated survey participants command annual parcel spend of $3.5 billion.

As you will see below and throughout this article, for simplicity, we have grouped responses to many survey questions into three revenue categories: Under $10M in annual net charges, $10 to $50 million, and over $50 million. As the chart below shows, survey respondents were mostly larger shippers (44.4%), followed by medium-sized spend (33.3%), and the smallest representation at 22.2% were businesses that spend under $10M net per annum.

GENERAL PARCEL PROCUREMENT

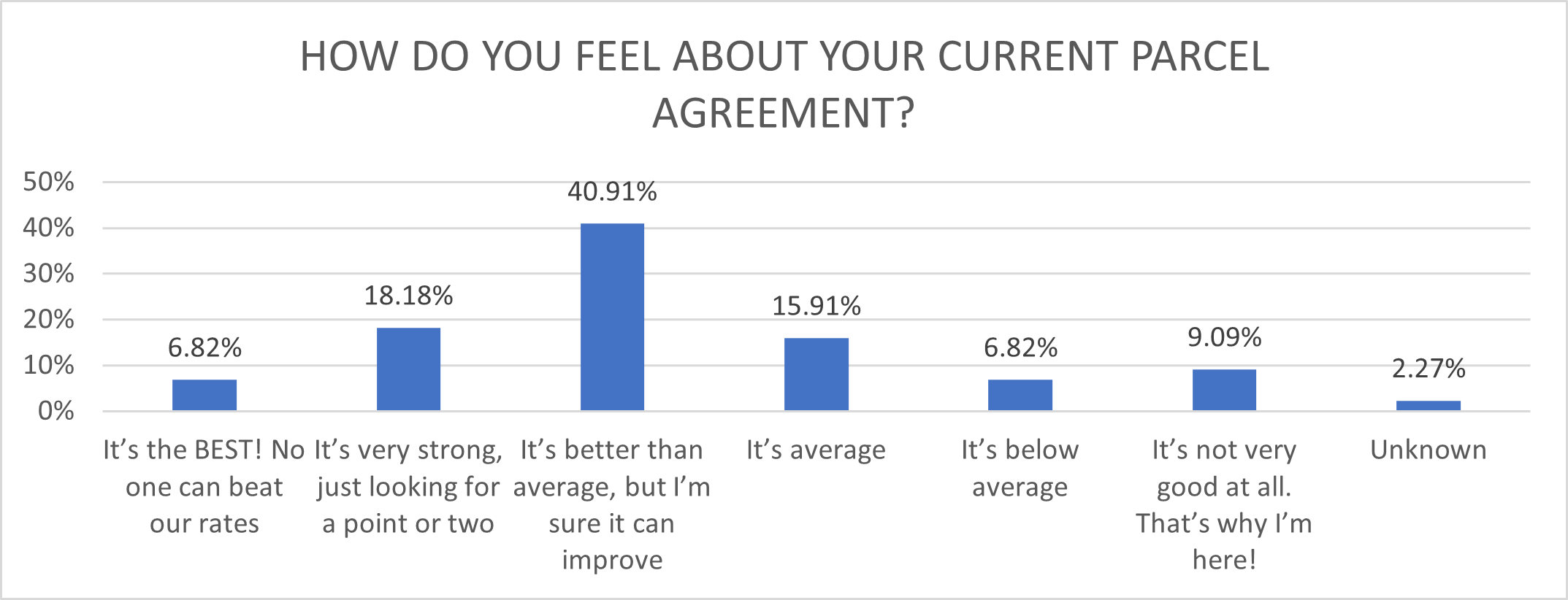

How do you feel about your current parcel agreement?

While nearly 41% of survey respondents feel their discounts are better than average, they conceded that rates and contracts were improvable. In fact, three-quarters of shippers feel their parcel pricing agreements could be improved, with only 6.8% believing they had best-in-class pricing.

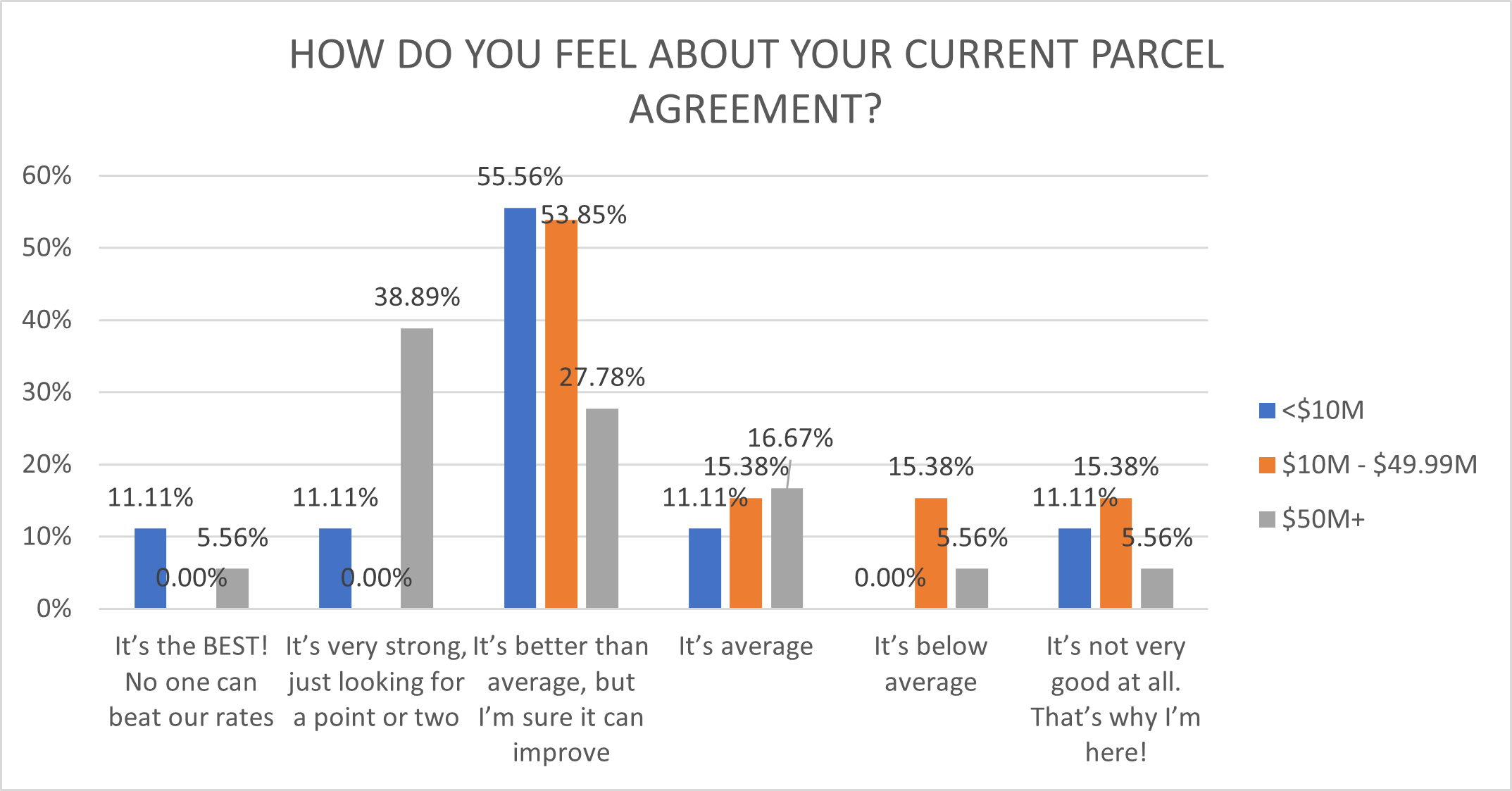

Although all three groups by spend share the sentiment that their parcel discounts are better than average but improvable, there were interesting distinctions amongst the groups, with nearly half of medium spend shippers feeling less confident about their pricing than the other two groups. Surprisingly, nearly a quarter of smaller shippers expressed very strong confidence in their pricing.

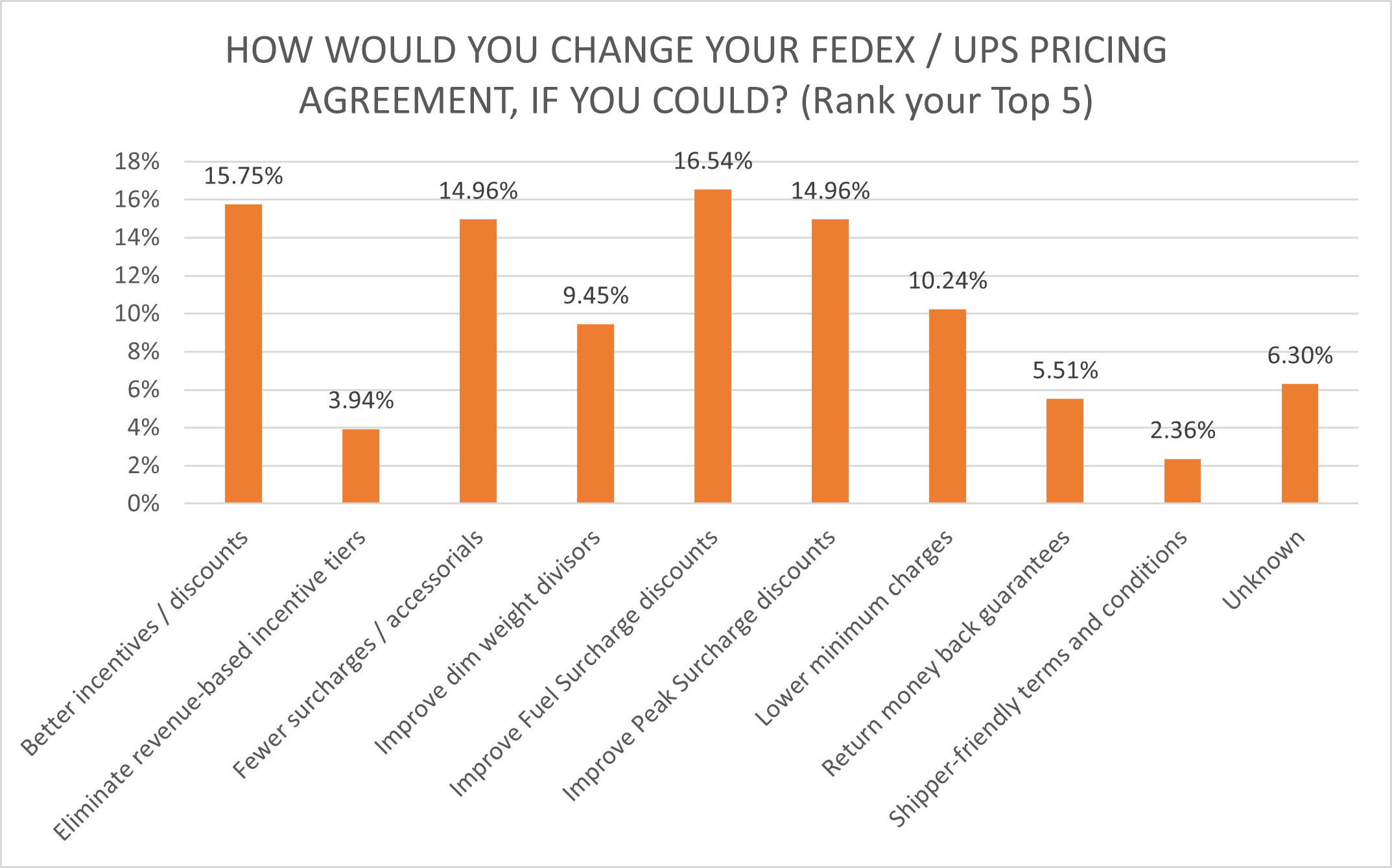

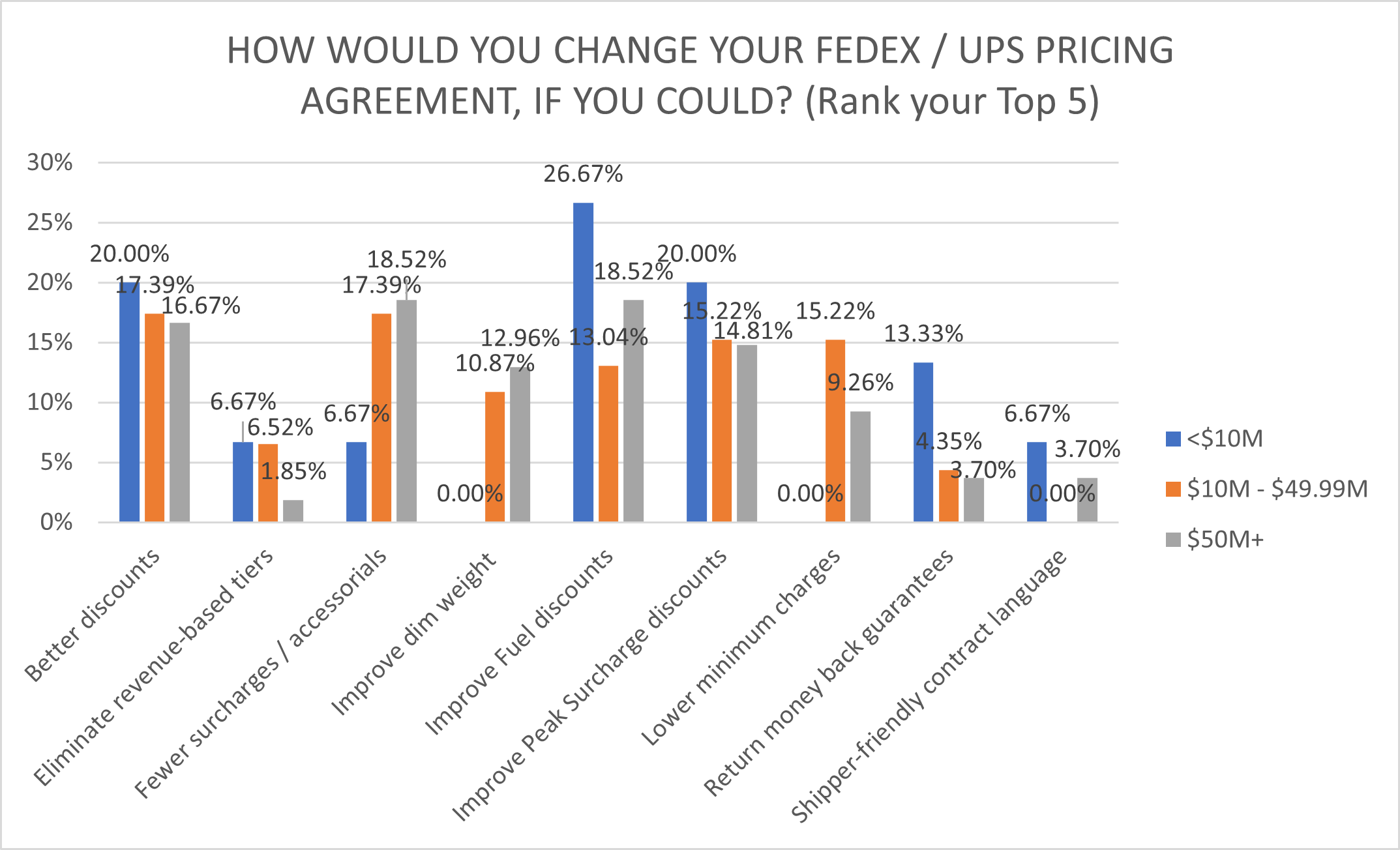

How would you change your FedEx/UPS pricing agreement if you could? (Top 5 rank)

In addition to the desire to improve discounts (15.75%), shippers appear to be plagued by carrier-imposed surcharges: 16.54% would most like to improve fuel surcharge discounts, 14.96% would improve peak surcharges, another 14.96% would like to reduce the impact of other accessorials, and 10.24% would lower minimum charges.

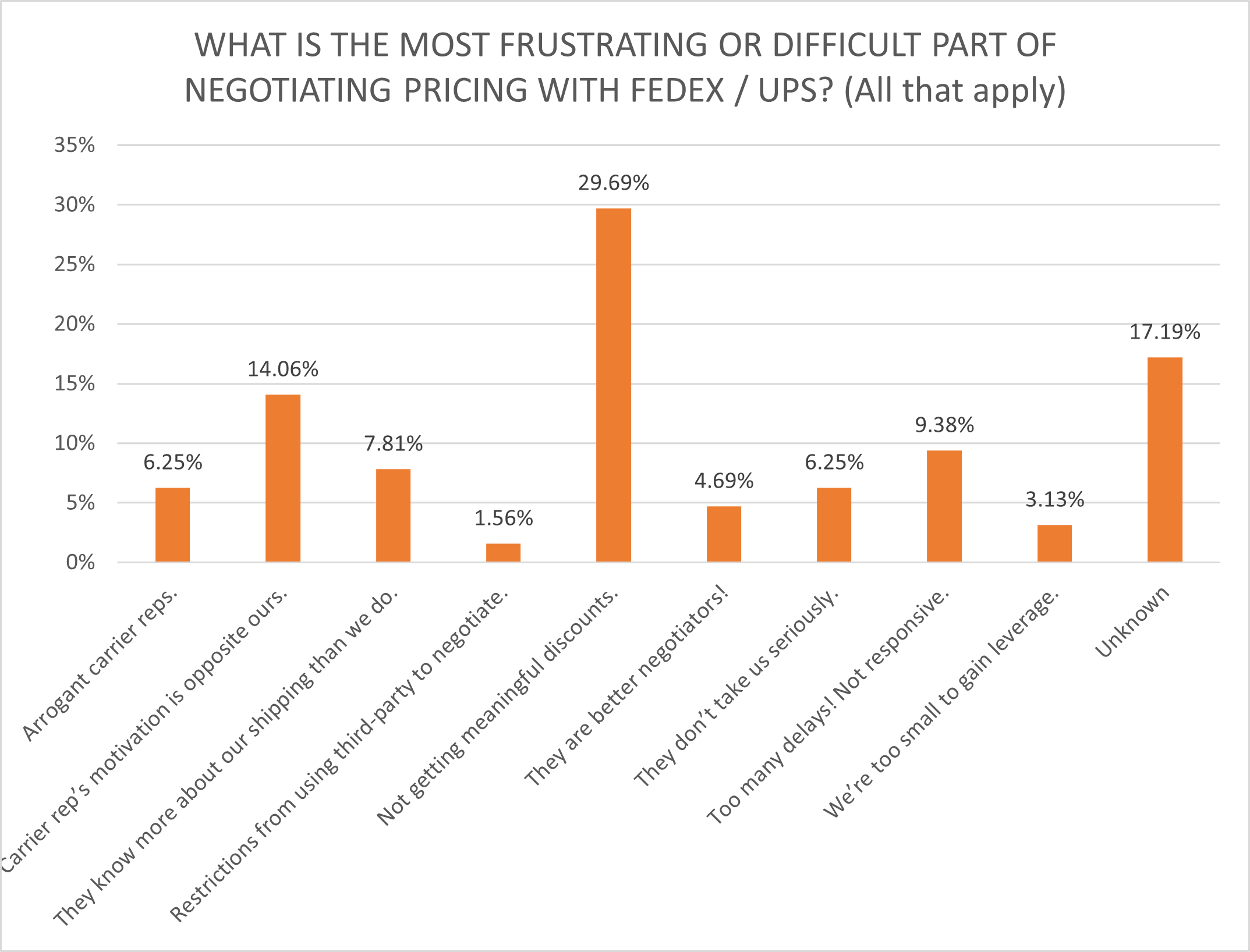

When we asked what is the most frustrating aspect of facing FedEx and UPS at the negotiating table, the number one response (29.69% of respondents) is not getting meaningful discounts despite their best negotiation efforts. Shippers acknowledge that their carrier rep’s motivation to drive revenue and margins is opposite the shippers’ desire to reduce costs (14.06%), leading to pricing delays (9.38%), and not being taken seriously (6.25%).

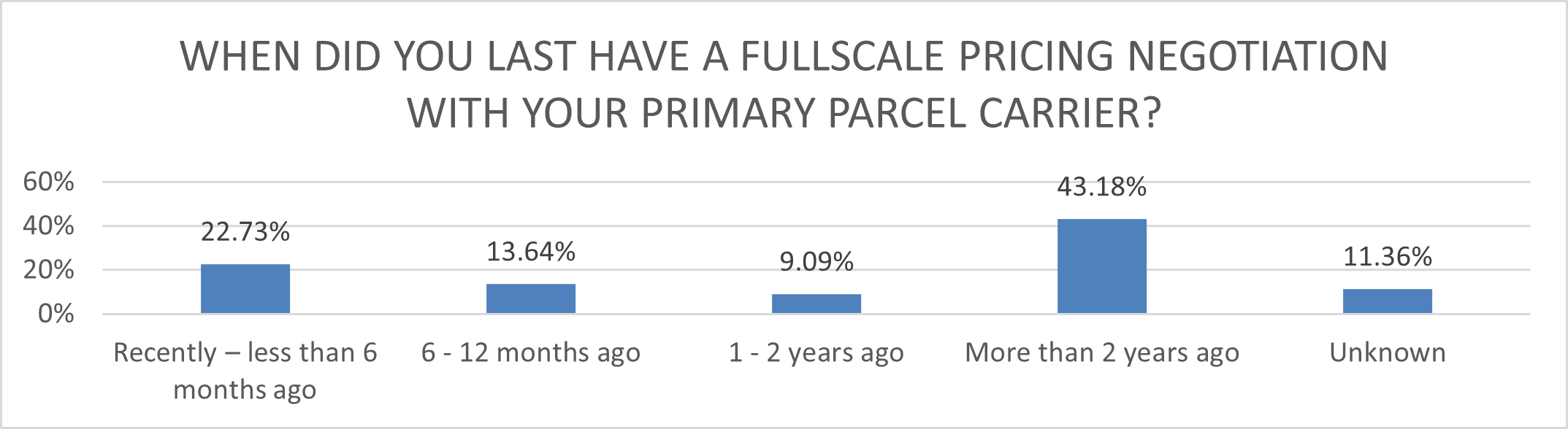

When did you last have a full-scale pricing negotiation with your primary parcel carrier?

While our general observation is that shippers that negotiate pricing most frequently tend to have the strongest pricing, we recognize that the pandemic-inspired volume surge over the past couple of years may have limited pricing discussions. After all, it’s difficult to ask for deeper discounts when the demand exceeds the supply. More than half of survey respondents hadn’t managed a full-scale pricing negotiation for parcel services in more than a year, with 43.18% foregoing the exercise for two years or more.

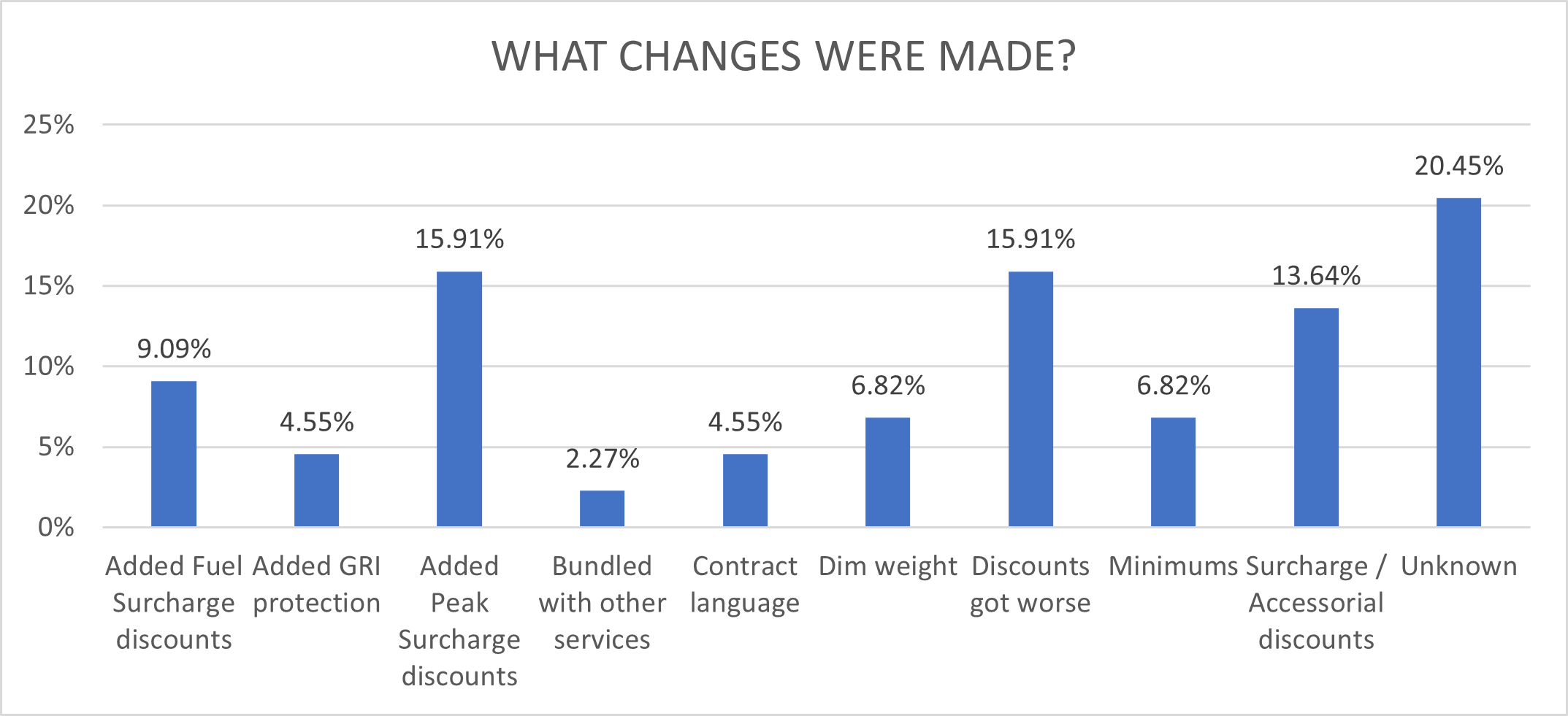

What changes were made?

Given the demand for parcel services throughout the pandemic, shippers need to be careful in how they approach the carriers for pricing. While some achieved savings by adding discounts or improving terms, 15.91% reported discounts got worse!

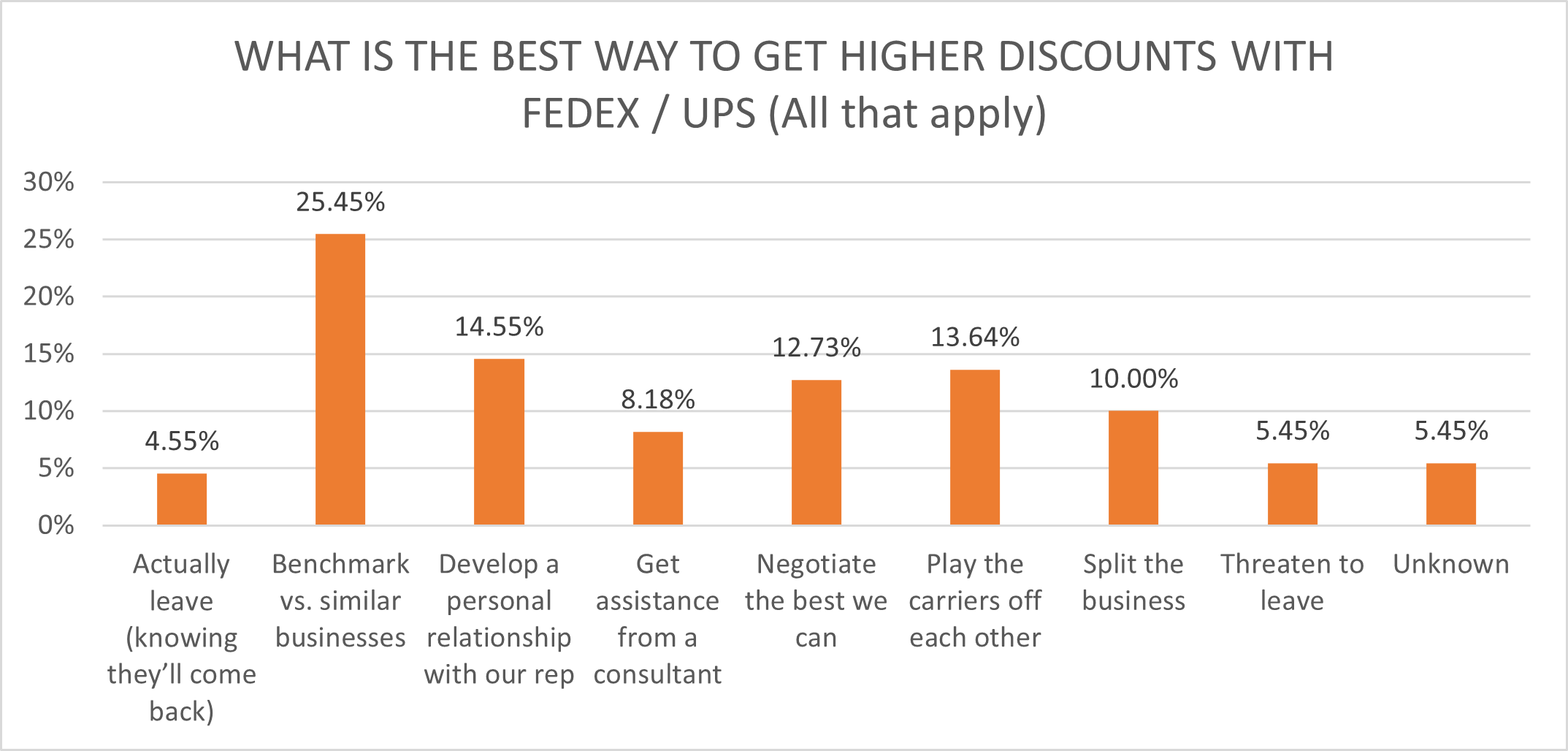

What is the best way to get higher discounts with FedEx/UPS?

Shippers are recognizing the importance of benchmarking as a way to improve discounts (25.45%), developing a personal relationship with carrier reps (14.55%), and playing the carriers off against each other (13.64%).

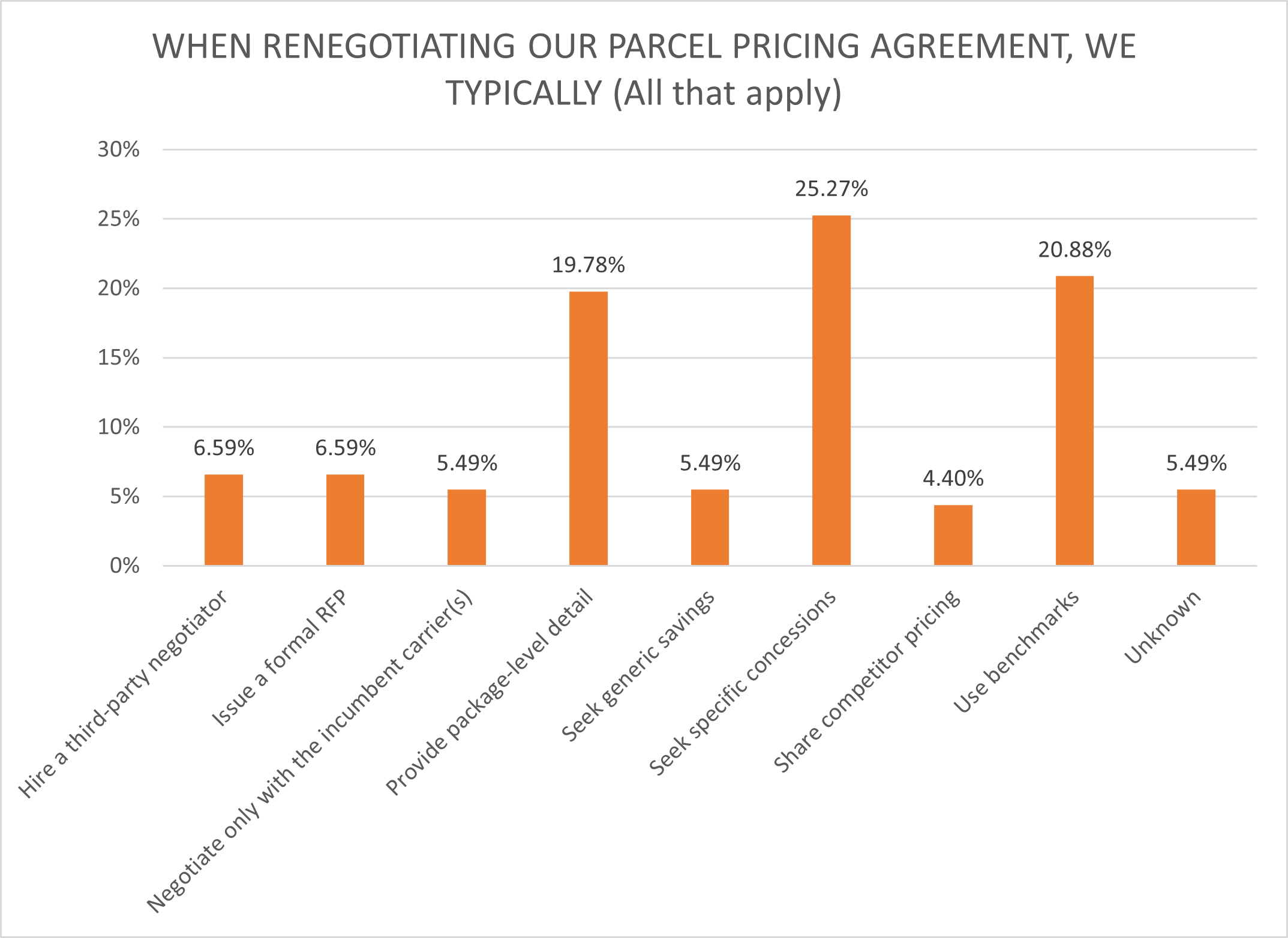

When negotiating our parcel pricing agreement, we typically…?

The most common approaching to negotiating parcel contracts was to ask for very specific concessions, like a discount to the residential surcharge or fuel surcharge (25.27%), followed by the use of benchmarks (20.88%), and providing package-level detail to non-incumbent carriers (19.78%).

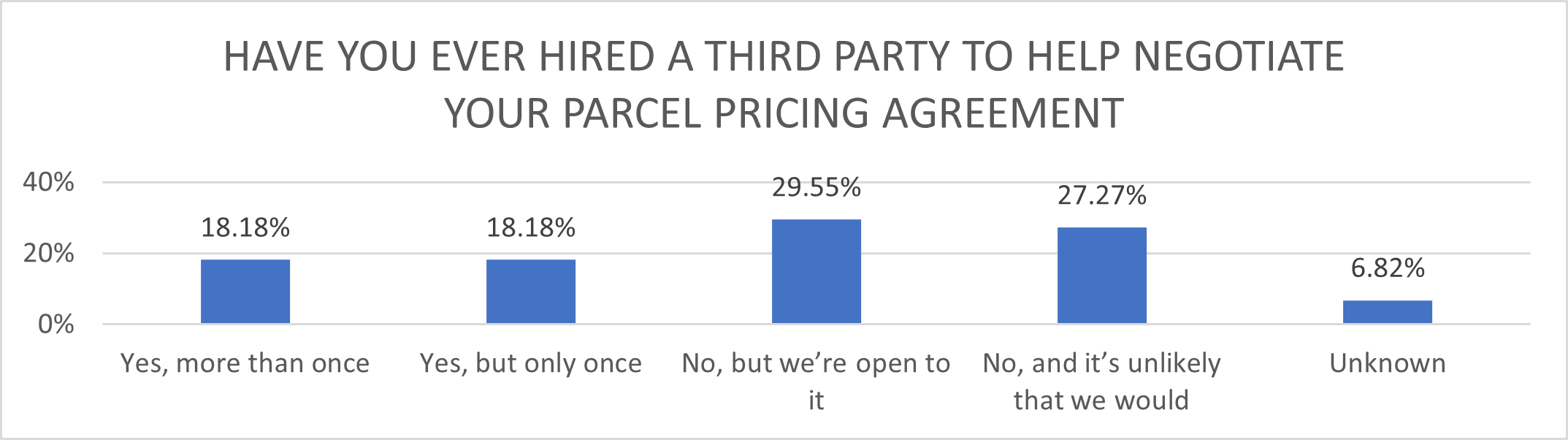

Have you ever hired a third party to help negotiate your parcel pricing agreement?

It’s well-documented that FedEx and UPS don’t prefer their customers to solicit the help of third-party consultants that specialize in parcel procurement, but more than one-third had done so (36.36%). Another 29.55% hadn’t but were open to hiring a parcel pricing expert, and only 27.27% responded it’s unlikely they ever would.

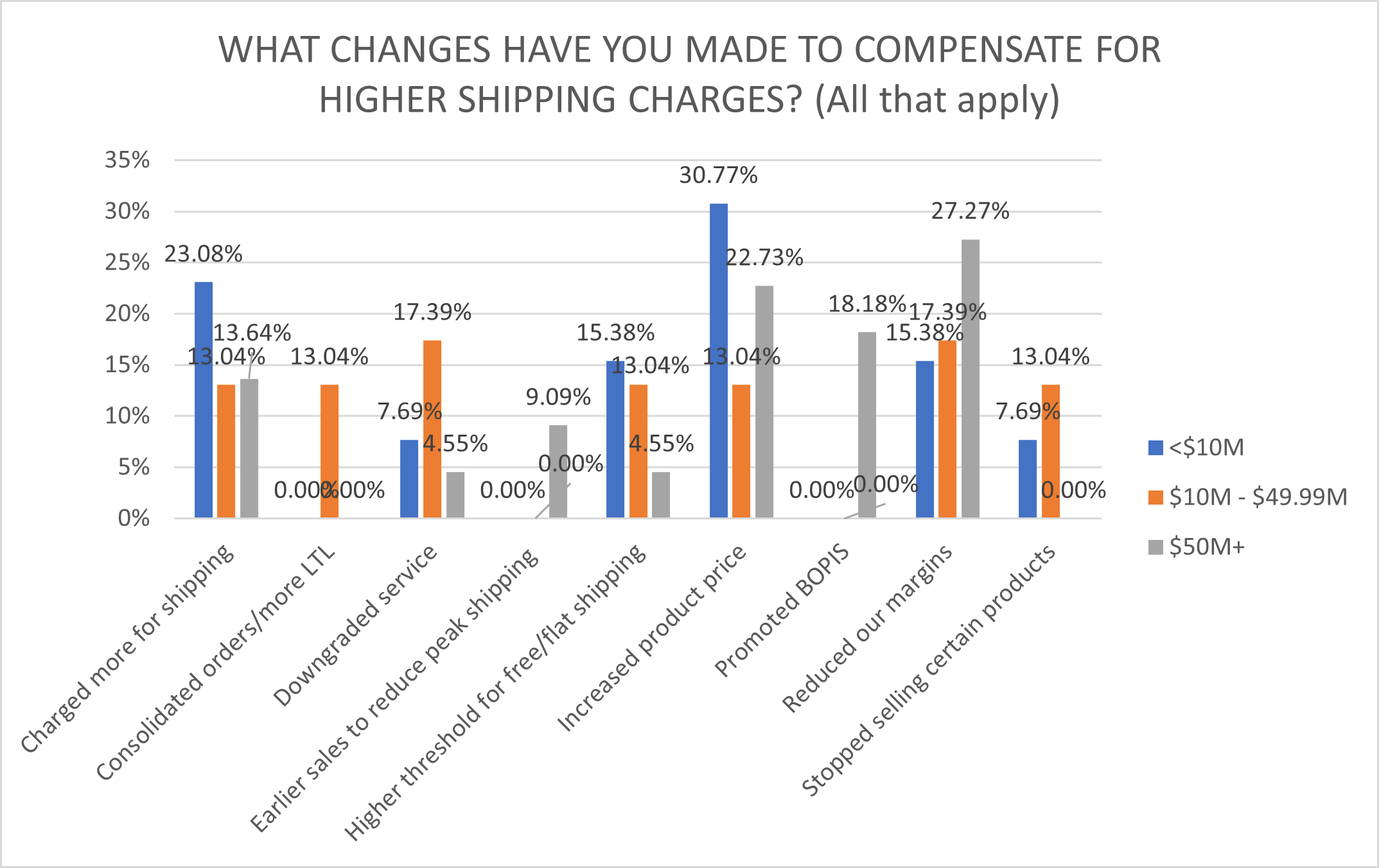

What changes have you made to compensate for higher shipping charges?