FedEx has announced an average General Rate Increase (GRI) of 5.9% that will go into effect January 1, 2024. The increases are generally softer than in 2023 (for reasons we’ll explain) but follow similar themes in terms of the services and fees most impacted.

The highlights of this year’s GRI include:

·How inflation correlates to the increases and why it matters

·Common surcharges… and what’s NOT being said

·Noteworthy Domestic Express Minimums

·Recommendations and takeaways for action

FedEx: The Business

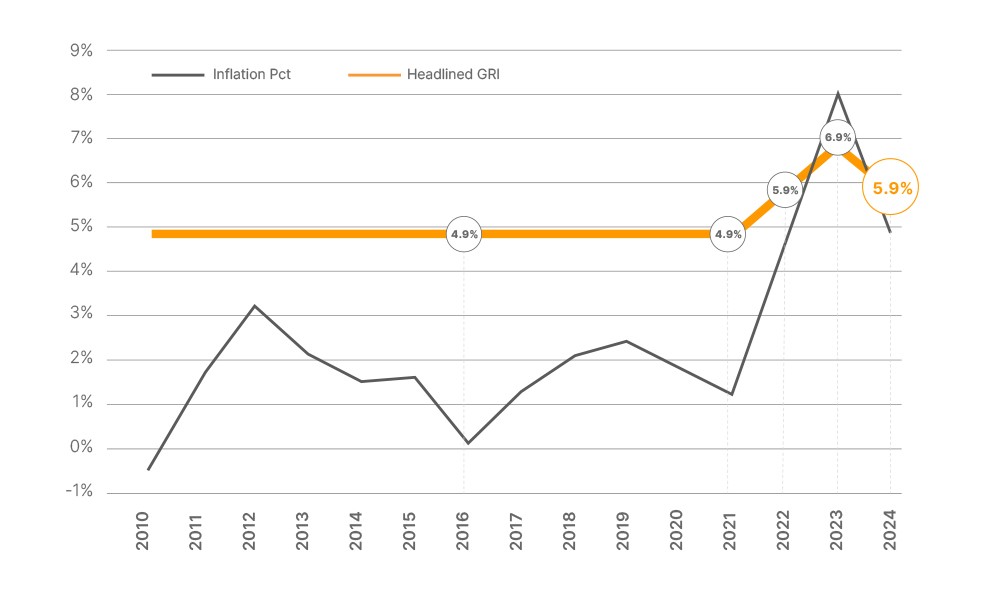

FedEx and the marketplace are in a very different position than one year ago in terms of inflation and demand. Today, the carrier faces increasingly difficult headwinds in the marketplace (as does UPS) with parcel volume, in general, declining. Yet while UPS is facing a bump in operating costs soon due to its new labor agreement, FedEx is hoping 2024 will be the year some cost-efficiency and benefits of its Network 2.0 initiative come to fruition. In addition to the impact of less inflation, the lower 2024 GRI of 5.9% compared to 2023’s historical 6.9% increase reflects these many factors.

As Inflation Goes, So Goes the GRI

The following Inflation vs. Average GRI illustration shows how closely the GRI has moved with inflation over the past few years. With present inflation returning to where it was two years ago, it makes sense why the average increase is again 5.9% as it was for 2022 and lower than the 2023 GRI. Notably, as the Increase by Service illustration below details, many of the increases by service in 2024 are lower than in 2022 even with the similar 5.9% ‘Headline’ GRI.

Illustration 1: Inflation vs. Average GRI

Going Soft on Some Services, with a Catch

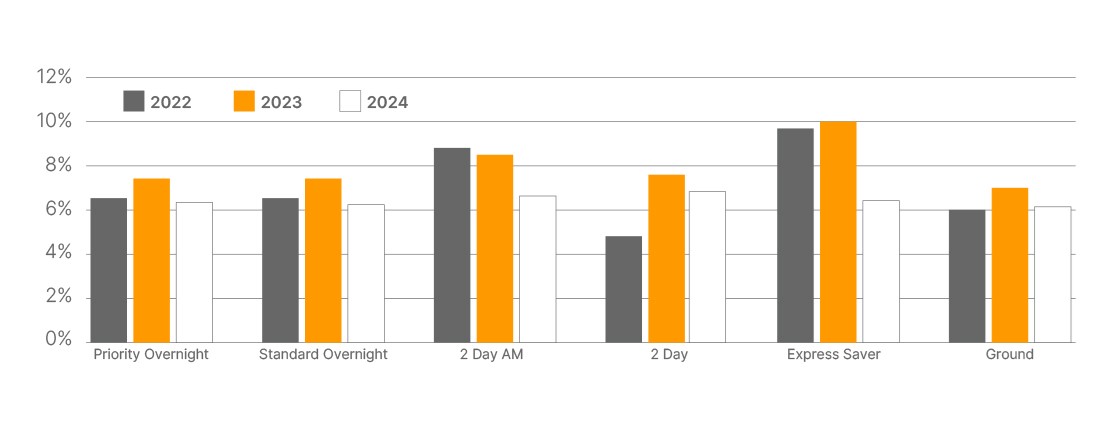

Some good news is that most domestic services will see a smaller increase in 2024 than in the past two years. The following Increase by Service illustration details the percentage increase by service for the past three years.

The lower GRI this year is not a surprise but it’s interesting that the rate increases for many services are smaller in 2024 compared to 2022’s GRI even though inflation and the announced GRIs are comparable. The two exceptions are Ground and Two Day, which are seeing greater increases this year than in 2022.

But, as you’ll soon read, even with generally smaller increases for services, FedEx has a plan to drive more revenue with larger increases in other ways.

Illustration 2: Increase by Service, Last Three Years

Common Surcharges and What’s Missing

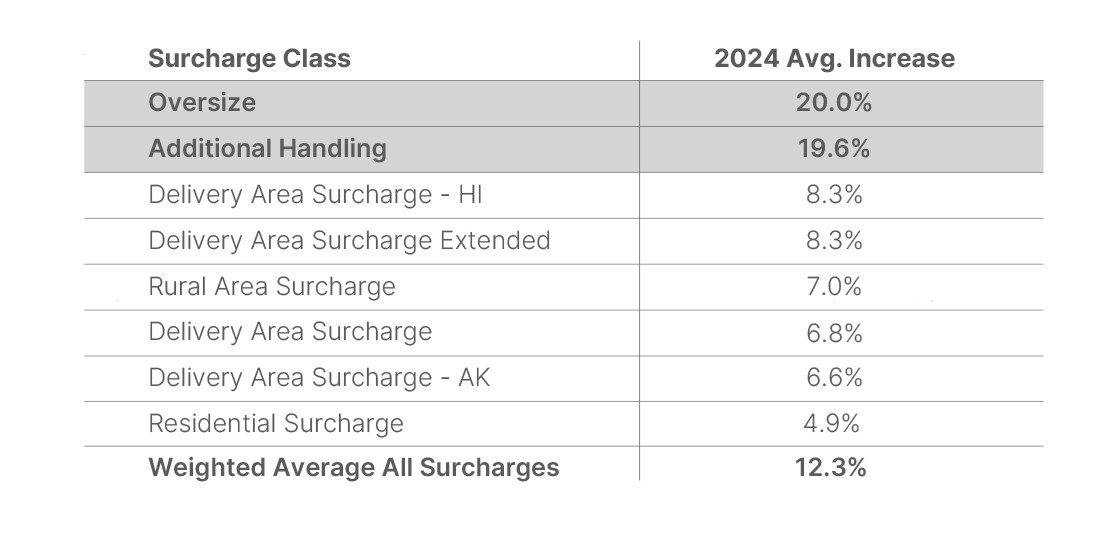

The story of surcharges in the 2024 FedEx GRI is not only about what’s been announced. The Common Surcharges illustration details the large increases in many of the most common surcharges — a weighted 12.3% average across all surcharges. Common categories such as Delivery Area Surcharges and Residential Surcharges are being spared with ‘only’ 5% to 8% increases. At the same time, others such as Additional Handling and Oversize charges are increasing by about 20%. Notable is that Additional Handling has increased by double-digits five out of the last seven years and Oversize six of the last seven.

These common surcharges are only part of FedEx’s plan to drive more revenue on top of its base services. What’s been left out of the GRI (and maybe the most significant) is the carrier’s likely plan for year-round Demand Surcharges. Set to expire at the end of peak season (January 14), FedEx has not tipped its hand on a plan to extend the costly surcharge. In 2023, Demand Surcharges were applied to Additional Handling and Oversize packages, two costs increasing greatly again with this GRI. Already facing a 12.3% increase in surcharges, the compounding effect of Demand Surcharges on top of those higher costs should make customers wary.

Illustration 3: Increase in Common Surcharges

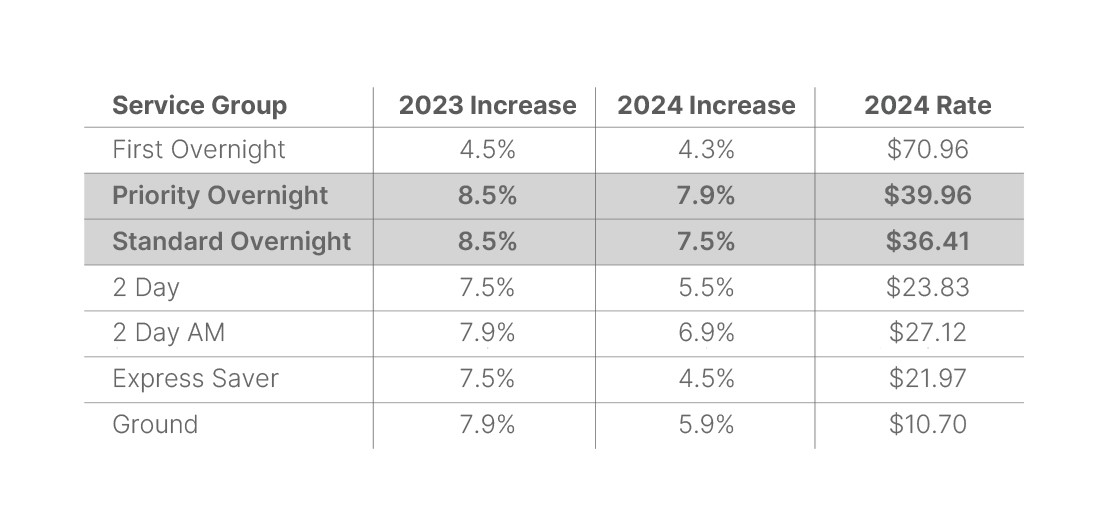

One Last Thing, Always Watch the Minimums

Like surcharges, Minimums can be a ‘sneaky’ way for customers to pay more than they realize. Like last year in the higher-inflation environment, Priority and Standard Overnight Minimums are higher than the others and remain an area of emphasis by FedEx. Minimums can also be costly for shippers without rate caps as many underappreciate the variance between actual minimum costs and when no Minimum is expected to apply. Noteworthy is that over five years, many minimums are up 30% to 40%.

Illustration 4: YOY Minimum Increase by Service

Recommendations and Takeaways

What’s a FedEx customer to do now? In summary, similar to the pre-COVID years, bulky packages are taking the brunt of the GRI in 2024. And, from a single rate perspective, Express Minimums and common Surcharges are seeing the largest percentage increases.

Moving forward, shippers should be aware that exposure to surcharges will continue to drive costs AND are not capped (even for shippers with rate cap clauses in their contracts). It shouldn’t be forgotten that the cost impact of surcharges is not included in the 5.9% headline GRI. Surcharges can expire or tariffs changed pretty much at the carrier’s discretion. Overall carriers have more flexibility to change the ‘rules’ compared to normal service rates.

There are two important pending announcements companies need to be watching for. First, as we’ve outlined, FedEx’s Demand Surcharges post-January 14 have not been published. When it happens, it will essentially be another GRI that no company can budget for right now and will exist on top of the announced GRI.

The second is that FedEx Ground Economy rates have not been announced including the Delivery and Returns Surcharge. Note that even a small $0.25 increase to this charge equates to a 25% increase and must be considered as part of a shipper’s “landed min.”

Our Recommended Call to Action: FedEx customers need to understand their shipping budget for 2024, draw lines in the areas they find unacceptable — and fight to get relief. Both carriers are facing severe market headwinds and are hungry for parcel volume whether to retain or win it. The time to renegotiate your carrier contracts has never been better.

The full FedEx 2024 GRI announcement can be read on the carrier’s website: https://www.fedex.com/en-us/shipping/rate-changes.html

Branden Burt is Director of Parcel Operations for TransImpact.