Why CFOs must challenge vendors to bring problem-solving ideas to the table.[1]

“As chief financial officers move beyond traditional roles, many are finding that vendor selection is becoming an important part of their expanded duties. When deciding which vendors are the right fit, CFOs should distinguish between those who simply supply a product or service and those who have the ability to challenge and collaborate in ways that make us and our companies stronger.

When the right time to change vendors and what is is the best way to go about it? Those are extremely important questions that take on strategic significance and can have serious consequences.

“Acceptable” is not good enough to meet the aggressive goals and objectives of most companies today.”

It’s easy to become comfortable with vendor relationships, especially those that have existed for a number of years and where the service and results delivered are fully acceptable. But acceptable is not good enough to meet the aggressive goals and objectives of most companies today. That’s why we need to challenge our vendors to continue to up their game.

If a company’s most important vendors are providing the same service that they’ve provided for years, using the same processes and approaches, it’s time to evaluate your options”.[2]

This makes a good case for the current NMFC (National Motor Freight Classification) LTL Pricing methods as they are used in today’s LTL pricing. The first NMFC was Effective April 1, 1936, 79 years ago!

Here are four reasons they don’t work today:

1) Rather than functioning in the free market of today, the LTL’s class- rate pricing system was designed for the heavily regulated markets of the past where motor carrier pricing was protected by antitrust immunity but subject to heavy regulation by the ICC/STB.

2) While competing modes make pricing adjustments in “real-time,” the outdated class- rate system cannot begin to effectively utilize the amazing capabilities of contemporary (21st century) technology.

3) The Class- rate system is based on classifications, rates and rules that the STB has recognized, as inaccurate, esoteric, confusing, and incompatible with currently predominant transportation pricing systems (foreign and domestic) that are based primarily on a shipment’s density or volume ( see Ex 656).

4) Class-rate promotes an adversarial (“zero-sum game” or “winner take all”) approach to pricing in contrast to newer competing systems where the parties share in the substantial economies and savings that are available through cooperation in pricing.

Getting outside your Comfort Zone

“Of course, replacing vendors can be challenging and pose a unique set of problems for CFOs, many of whom are uncomfortable with change. As a change agent, however, this is a challenge CFOs must to embrace. If we don’t force ourselves outside of our comfort zones, we’re doing a disservice to ourselves and to our companies.

Here’s the risk: relying on service providers who are comfortable with the status quo puts your company at a competitive disadvantage to those that are aggressively seeking the most innovative and progressive support. What’s more, it may also threaten your own position if you are viewed as accommodating their performance.

Once the evaluation process is underway, place vendors into two different camps: those that provide competent service and those considered critical partners. It’s an important distinction because the first group guarantees more of the same; the second group has the potential to drive increased value for small- and medium-sized firms.

Understanding which vendors can bring you new ideas and help solve problems, rather than only provide acceptable service, is critical to helping drive the business forward.”[3]

Who has a better method of LTL Pricing?

Can anyone tell me which Carriers, 3PL’s or Auditing companies have approached you with a new efficient, real time LTL Pricing method?

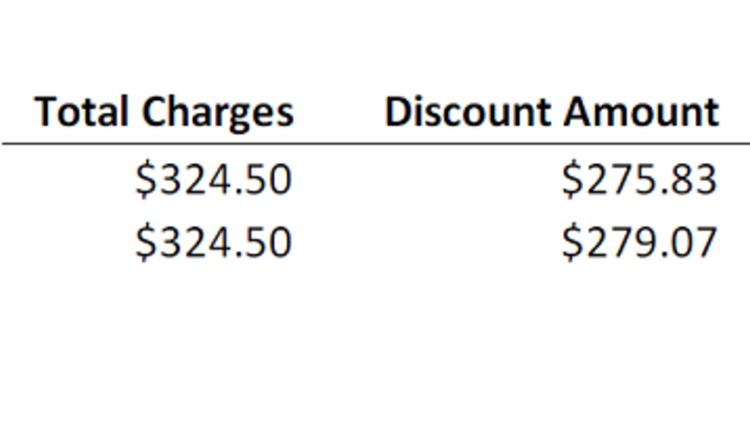

What Pricing method is critical to helping drive your business forward? Here is an example of “Make it Smaller Pay Less”:

Square, flat-topped milk jugs are the new way to package milk. A Sam’s Club press release states the new stacking configuration saves so much space that the retailer can ship the same amount of milk in half the number of trucks. That simple change is freeing up dock doors, warehouse space, and labor, and it’s saving enough on fuel and freight costs to yield a 10 to 20 percent price cut for consumer

A simple idea but how many Carriers know your book of business and commodities and shipping lanes enough to make this suggestion and follow through with savings for you, you customers and the Carrier? Lunches are nice; now show me some competitive advantage.

To find vendors that will rise to the challenge, pick a select group and work collaboratively with them. There will always be some vendors that are simply going to provide a basic service. In doing so, they identify themselves as non-essential parts of your business. But I’ve also found that if you choose skilled service providers who work creatively and collaboratively with you to solve problems, they will add value to the solution and to your business[4]

Now is the time to ask, what is Cube Base LTL pricing, or, ”Space Occupied LTL Pricing” and what does your company offer?

Bill Pugh (Formerly, Executive Director - National Motor Freight Traffic Association, Inc.) and Hank Mullen each have over 40 years of experience and are here to help. We’re fanatical about seeing you be successful.

If you have any questions or would like any more information, please give us a call at 770-380-1650 or 703-624-4240 or visit www.dynarates.com. Email Hank.Mullen@dynarates.com or Bill.pugh@dynarates.com. We are located in Atlanta Georgia and Falls Church Virginia.

[1] Reuse

We welcome the re-use, republication, and distribution of our content – just as long as you credit us. So we ask that you insert the following tagline when you use our content:

Reprinted with permission of Longitudes, the UPS blog devoted to the trends shaping the global economy.

[2] Kurt Kuehn is the former CFO of UPS. He retired in 2015

[3] Kurt Kuehn is the former CFO of UPS.

[4] Kurt Kuehn is the former CFO of UPS