Much has been written about how the small package world would change if Amazon were to enter the market. Though mostly speculative, just about any information you can find on the topic establishes Amazon someday shipping packages as a foregone conclusion.

Yet, when the news broke in February that the world’s most recognizable company would begin testing its “Shipping with Amazon” service in Los Angeles – news that by all accounts everyone expected – the ripple effect was felt from the West Coast to Wall Street.

On January 26, FedEx and UPS shares closed at near record highs of $268.85 and $132.72, respectively. Fourteen days later, a Wall Street Journal report about Amazon’s plans essentially stopped the bleeding on what had been a stinging slide for the world’s two top shipping companies. (To be fair, that span also saw the largest single-day point drop in history with the Dow Jones Industrial Average losing 1,175 points, a decline of 4.6%.)

Still, FedEx and UPS losses during the two-week span – a time during which high-level investors would surely have been aware of the pending announcement – amounted to 12.5 and 19.8%. Though shares have recovered slightly, stocks for the companies were down 6.6 and 10.1% five months into 2018. (The Dow Jones was down four percent YTD as of the writing of this article on May 2.)

So what does it all mean?

It depends on who you ask.

And if you could ask the famously secretive Amazon, I think it would tell you the last thing that you would expect to hear – that Amazon does not plan to directly compete with FedEx and UPS.

Two things seem relatively certain at this point:

- Amazon is developing ways to deliver some of its own packages.

- If it does so effectively, it will put pricing pressure on FedEx and UPS.

But it’s important to remember that Amazon was born in the digital age, whereas FedEx and UPS, as bonafide as they are, are still adjusting to life online. Think about it: Amazon is the largest internet company in the world. The company is half as old as FedEx and could be UPS’s great grandchild.

And in much the same way that today’s younger generations adapt to changing technology more quickly than their elders, so too has Amazon.

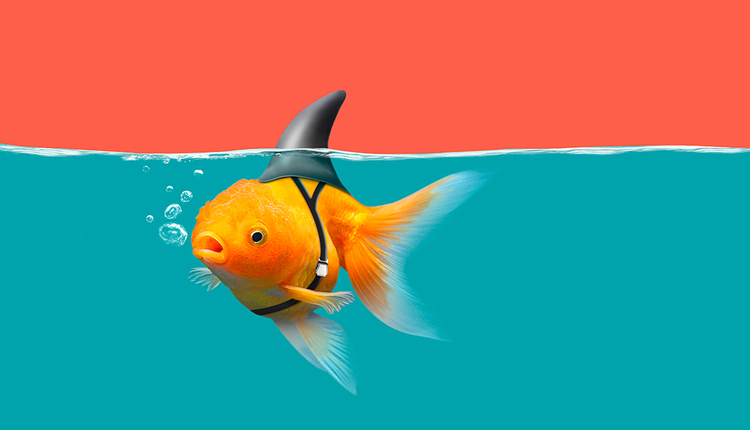

The point is that while Amazon’s entry into the small package space is a competitive threat to the major national carriers, it’s ambition is to solve the problem its own way, not to recreate what FedEx and UPS have spent so long developing.

And that’s where so much of the analysis you read today is missing the point.

Make no mistake, it would take a while for FedEx or UPS to be rendered obsolete. Each an innovator in its own right, it’s unlikely that either will fail to adapt at a pace necessary to remain relevant. There is something to be said for the companies that basically invented the industry, after all.

But what should scare both carriers more than Amazon’s presence is its approach to fixing the issues. That, combined with its financial and, more importantly, its data resources, poses a threat the likes of which neither carrier has ever seen. And because Amazon is a major customer of each carrier, it has unparalleled insight into how each is currently solving the problem of delivering packages to customers.

It’s yet to be seen what the future holds for SWA, but Amazon has proved keenly adept at problem solving. The problems posed by today’s delivery model have been well documented, and its inarguable that the industry is poised for disruption.

Amazon has proven that it’s pretty good at that, too.

Brandon Staton is an MBA candidate at The University of North Carolina Kenan-Flagler Business School and President and CEO of Shipmint, Inc., which helps corporate decision makers quickly connect with the industry’s top shipping consultants to save time and money.

![GettyImages-914834678-[Converted]](https://cms-static.wehaacdn.com/parcelindustry-com/images/GettyImages-914834678--Converted-.1133.widea.0.jpg)