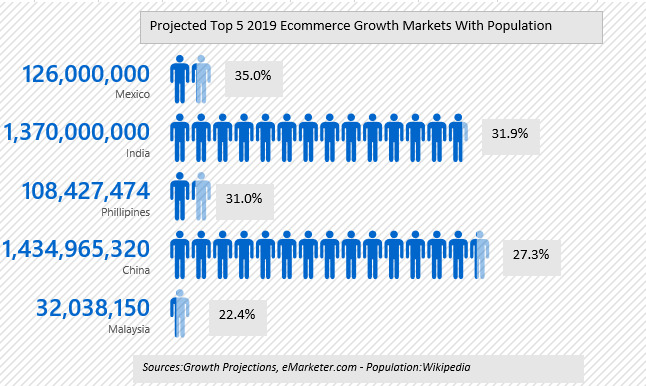

If international shipping is not on your radar already, it is likely it will be soon. After all, cross-border trade is the next big growth arena in e-commerce. Figure 1 shows the top five countries for projected e-commerce sales growth rates in 2019.

While these markets are only the top five growth rates, the worldwide non-US growth rate is expected to hit 21% in 2019 — 50% higher than the expected US growth rate of 14%. Two of the top five growth markets have populations and growth rates that dwarf the US market. For American companies not already shipping internationally but looking to grow revenue, these metrics are hard to ignore. But international shipping, while a lucrative possibility, is not something that should be jumped into without extensive research and preparation. One of the most important factors that could determine the success of your expansion is your choice of a carrier.

Choices Abound in the Global Sector

When comparing options for international shipping, there are more choices and competition between carriers. Domestically, only two national carriers (UPS and FedEx) and USPS ship directly to all 50 states. For international shipping, there are several more carriers that provide service to the same 200+ countries. Some will use various, country-internal postal systems for a portion of transit. These will typically have longer transit times and less definite delivery dates. Depending on your needs, these can be viable and, typically, less expensive options.

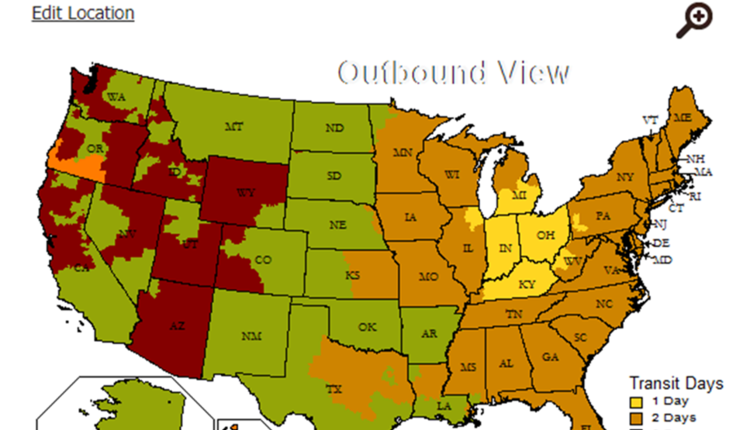

For those looking to mirror a typical domestic e-commerce experience, Figure 2 provides a look at three well-known carriers with time-and-day definite transit guarantees. Equivalent competing service levels are grouped together with carrier-published benefits and transit times.

| FDX International First

| DHL Express 9:00

|

UPS Worldwide Express

| FDX International Priority

| DHL Express 12:00

|

UPS Worldwide Saver

| ||

UPS Worldwide Expedited

| FDX International Economy

| DHL Express Worldwide

|

Figure 2

The best practices for negotiating international parcel contracts are generally the same as for domestic contracts. There are some additional accessorials to be diligent on, as well as export vs. import considerations, but key contract areas are similar. Be sure to familiarize yourself with the following:

- Base discounts + revenue tier discounts

- Incentives can be country-specific

- Minimums

- Dimensional Weight

- Accessorials

- Advancement fees and other ancillary clearance fees

- Out-of-Delivery-Area surcharges

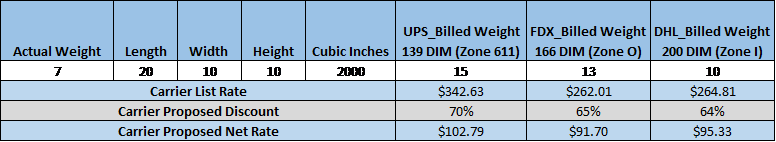

When comparing competing carrier offers, it is vital that you compare proposal net costs on a representative sample of shipment data rather than just contract discounts. For the following examples, assume your marketing department has decided that India is the initial market to wade into international shipping for export. They have determined there is demand for your widgets, and combined with the growth and population metrics, India is the logical choice. Since they also want to mirror the two- to six-day-definite transit promises offered domestic customers, you are tasked with deciding between carrier proposals for UPS Worldwide Expedited, FedEx International Economy, and DHL Express Worldwide.

Figure 3

In this hypothetical proposal example with package DIMs (see Figure 3), there several moving parts. When you compare zone rates, you’ll notice it is more complex than comparing the general carrier alignment in the domestic zones 2-8. If you simply compare offer discounts, you would not end up with the lowest cost carrier. Adding to the complexity is the fact that differing DIM divisor offers can have a substantial impact on the billable weight — and what you are subsequently charged. In the example in Figure 3, it is impossible to make a linear rate comparison at one billed weight.

Like a domestic carrier contract negotiation, what is most critical is the ability to analyze all moving parts on a large sample of actual shipping data. It is the only way to attain the true lowest cost proposal. Factor in minimums, various retail rates for the same accessorials, different dimensional fee parameters, and the frequency of each data point, and you’ll quickly see that the process can get very complex. This complexity is one of the reasons that some shippers choose to collaborate with a third-party expert to help them navigate this new territory.

But whether you partner with a third-party expert or do your analysis in-house, remember, the best practices for negotiating international parcel contracts aren’t much different from a domestic contract. The contracts are often combined for improved discounts and terms on both. If expanding into international markets is not on your radar already, the market size and potential growth rates of markets across the globe will put it there sooner or later. The carriers are fully aware this is the next big growth arena for them and are aggressively seeking market share. Don’t be surprised when your rep calls and wants to show you a “phenomenal” presentation on the international shipping opportunity.

Karl Wheeler is a Sr. Pricing Director at Shipware LLC, a parcel & LTL spend management firm dedicated to helping high-volume shippers reduce costs. Karl specializes in understanding how the carriers structure margin-based parcel contracts and utilizes that knowledge to help Shipware’s customers realize savings up to 30%. He welcomes questions or comments at karl@shipware.com.

This article originally appeared in the Fall, 2019 issue of PARCEL.