Note: Below is an excerpt of insights from a comprehensive report published by Trax Technologies. Read the full report here.

A STATE OF THE INDUSTRY REVIEW

How bad is it out there?

Just how bad are market constraints right now? In short, conditions across the industry are record-breakingly bad. If you’re a shipper right now, you’re waiting for goods that are delayed at point of origin, or even more frustratingly, still on the water. At the time of this article going to press, there were 153 ships off the coast of Southern California. The estimated financial value of the cargo on those ships is said to exceed $25 billion!Once goods do make it into port, those same shippers are then also faced with a multitude of hurdles getting inventory to warehouses or products to customers. If you’re a carrier, you are firmly in the driving seat in terms of setting rates, but your problem is delivering and doing it consistently amid escalating fuel costs, the need for more equipment to service business, and driver shortages that are only getting worse. You don’t need a crystal ball to see all of this is going to take a lot of collaborative work to resolve.

Predicting the unpredictable

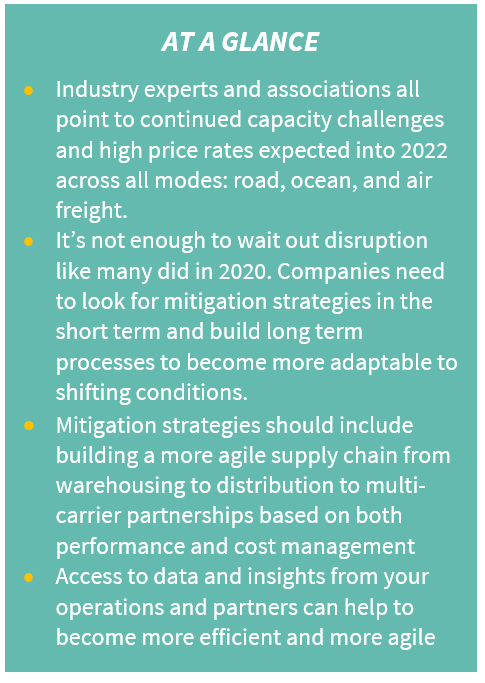

Problematic conditions require strategic action, but the wait-and-see strategies employed during the pandemic in 2020 won’t work in 2022. With intense pressures and massive constraints, the mandate remains the same – a return to profitability and growth. We can expect price volatility, escalating fees, and surcharges to plan around, adopting strategies that focus on risk aversion, resiliency in operations, and mitigation strategies to protect the present and the future.

MACRO FACTORS

What the economy and labor market tell us

The unemployment rate dropped to 5.2% this August, the lowest rate since April 2020, when a rate of 14.8% was the highest unemployment in the country since the Great Depression. While the labor market is strong, from dockworkers to truck drivers – the essential doers of logistics – our industry doesn’t have enough people in the right roles.

What consumer demand indicates

The Consumer Price Index (CPI) is a major indicator of market change. In the 12 months leading up to June 2021, we saw a rise of 2.5%, and 0.5% each month compared with a more stable rise of only 0.1% in June 2020. According to DigitalCommerce360, consumers poured $861.12 billion into online sales with US merchants in 2020, up an amazing 44% year-over-year. The impact to parcel shipments from that increase continued throughout 2021 and will continue throughout 2022 as well. Bloomberg Economics sees the CPI holding in the 4.5%-5% range through year-end, before steeper declines over the course of 2022, followed by normalization in 2023.

What to expect from inflation

The 12-month inflation rate currently sits at 5.4% and should maintain through the end of this year but it’s still the highest rate of inflation since 1990. In the near term, you can anticipate a three percent rate, which, of course, is still higher than the average 2.6% yearly rate from 2016 through 2019. Economic models predict 2.6% in 2022 and a drop to 1.9% in 2023, so in the short term, shippers can expect continued tough negotiations on pricing with carriers this year as well as likely rate pressure into the first part of next.

MITIGATION AND OTHER STRATEGIES

Creative problem solving

2020 and, in some ways even more so, 2021 have been a wakeup call across the supply chain, highlighting the need for agility, resiliency, and digitization. Big brands and leading retailers are leading the charge right now with creative, expensive problem solving. Walmart has leased its own vessels to guarantee ocean freight capacity for the upcoming holiday season. Home Depot too has brought in its own ships to improve distribution and is also renting space on its company-owned flatbed trucks. To be able to implement and manage these kinds of alternative strategies requires the critical visibility over your entire network as well as cost control and data management capabilities.

Data-driven decisions

Ask yourself if your operation is a true technology enabled process – do you make decisions based on data collection and analytical learnings from across your operation? The combination of event tracking software and the discipline of transportation spend management together can identify issues, illuminate opportunities, and create efficiency.

Execution strategies

When carriers maintain so much negotiating and price setting power and when tender rejection remains so high, diversification is important. It’s essential to move to a multi-carrier strategy utilizing robust order management, event tracking, and cost control/reduction technologies and capabilities. Overall, executional strategies need to balance service with cost. What is the true cost to serve a geography, a customer, a market?