Editor's Note: This article was updated on 10/28/22 to reflect a correction to 3 Day Select Rates and the Large Package International Fee

Matching rival FedEx’s September announcement, UPS has revealed its 2023 General Rate Increase (GRI) will also set an all-time high of 6.9%. While the FedEx increases are effective January 3, 2023, the new UPS rates will go into effect a week earlier on December 27, 2022.

As is always the case with carrier GRI, and noted with an asterisk at the bottom of the announcement, “the impact of these changes on your shipping costs will vary according to your shipping characteristics and the terms of your UPS agreement.” Translated, very few shippers will realize an increase equivalent to 6.9%; most will be higher. It’s important you understand how base rate and surcharge increases will impact your 2023 UPS spend.

While it’s impossible to analyze every change, below are some important takeaways for all shippers to note and assess:

1. UPS matches FedEx and sets an all-time high GRI

UPS waited four full weeks to announce its 2023 GRI, and to no one’s surprise it matched FedEx at 6.9%. For nearly a decade, the carriers set their annual increase at 4.9%, but broke that trend for 2022 and announced 5.9%. That one-point increase was a jolt to the industry, especially considering their customers’ pandemic-fueled struggles and UPS’s already record-setting profits.

While it was unfortunately predictable, increasing the 2023 GRI by another full point still comes as a shock as shippers grapple with a potential worldwide recession. With reports of excess capacity in all parcel networks, one would think carriers might use GRI announcements as a mechanism to acquire customers. Instead, they plan to use rate increases to offset volume declines and ensure revenue growth goals are met.

It should be noted that as of press time, UPS has not announced its 2023 Surepost rates. Shippers using that service should continue to check here for updated rates: https://www.ups.com/us/en/support/shipping-support/shipping-costs-rates/surepost-rates.page

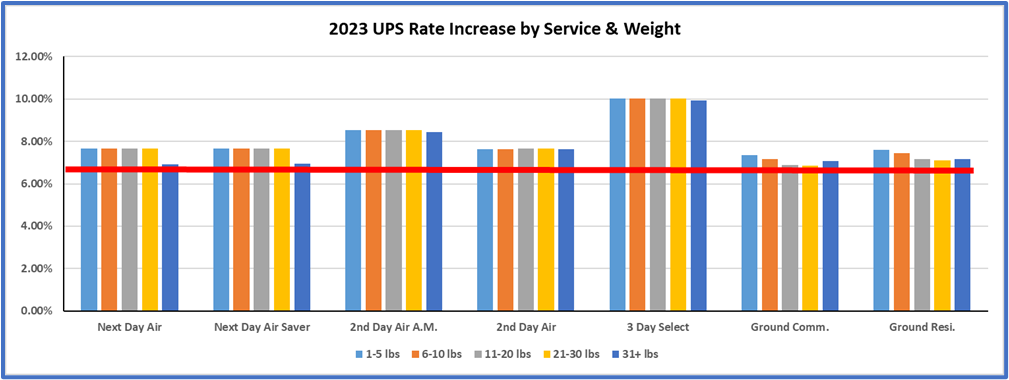

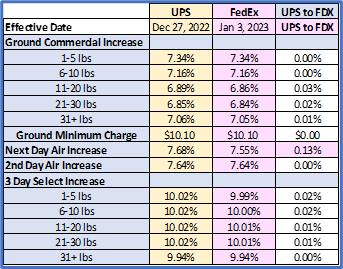

2. Rate increases are similar across most weight breaks, but longer zone shippers will see higher increasesAs illustrated by the following charts, all services will see rate increases across all weight breaks, and virtually all above the 6.9% target line.

Although not to the same degree as last year, UPS continues to hammer 3-Day Select with large increases. While not as popular with shippers as ground, two-day, and overnight services, the somewhat niche group of shippers who benefit from a 3-day guaranteed service, will once again be subject to the GRI's largest hikes.

Chart One:

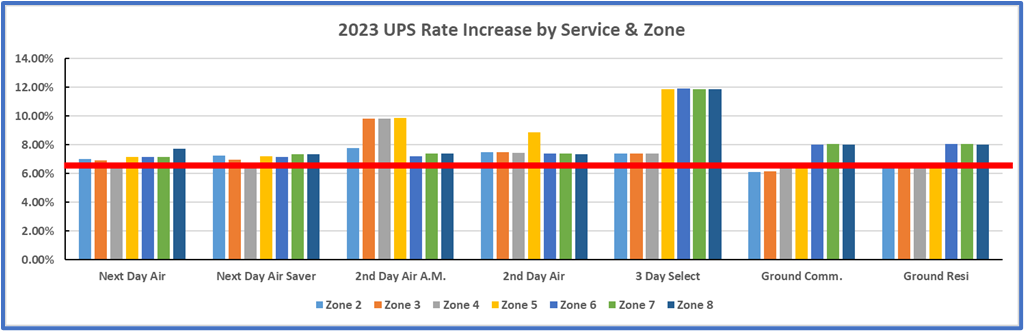

As you can see below, Zones 6-8 are taking higher increases than the lower zones. UPS is telling Ground shippers they want to get their packages in and out of the networks much faster, with fewer touches. UPS has also kept the shorter Zones (2-4) lower than the 6.9% increase, likely to compete the ever-increasing popularity of regional carriers.

Chart Two:

3. Ground Minimum Package Charge (1 pound, Zone 2) increased to $10.10, an increase of 7.9%

Also matching its counterpart, UPS has increased its Ground Minimum Charge to $10.10, a 7.9% increase. This is important because this charge is the absolute floor UPS will charge ground shippers no matter how good a discount they have negotiated. However, reductions to the minimum charge are negotiable, and we encourage all shippers to seek concessions, especially as increases to the minimum charge tend to exceed the GRI each year.

4. Peak/Demand Surcharges will be referred to as Demand Surcharges

UPS initially introduced the Peak Surcharge to pass along to shippers the additional costs it incurred to flex its network during the holiday season. Last year, the Peak Surcharge was renamed “Peak/Demand Surcharge” to justify the charge continuing well past peak season and to be charged year-round. At the time, we wrote, “While there is technically nothing incredibly noteworthy here, this change does foreshadow that ‘Peak’ is here to stay.” Now, UPS will refer to this as a “Demand Surcharge” for 2023 and beyond.

Based on recent earnings announcements, UPS achieving its revenue growth goals seems to depend on these “temporary” charges being made permanent, either as a line item or by folding the charges into base rates. There is precedent for this. Who can forget the “temporary” Fuel Surcharge introduced in the mid-2000s?

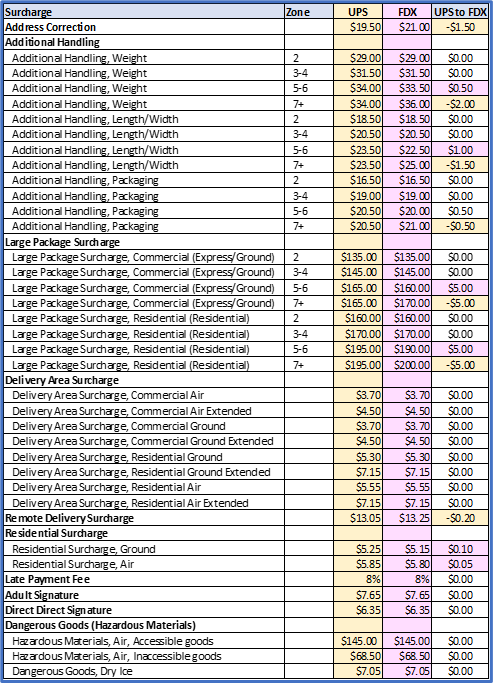

5. Almost all common surcharges will increase significantly more than the 6.9% GRI

Most read the headlines, or the email from their carrier rep, and think all their rates are increasing 6.9%. If you are not careful, you can blow your parcel budgets with this thinking because the annual GRI announcement does not limit surcharges to the 6.9% rate increase. Again, this year, most common surcharges will increase significantly higher than 6.9% and, depending on your specific profile, may be extremely detrimental to your parcel pricing. Surcharges make up between 20% and 40% of a parcel shipper’s annual spend. So, it’s critical you understand the impact of these increases.

Of particular note, shippers of large packages will once again be severely impacted by the 2023 increase. Additional Handling surcharges are increasing anywhere from 11.5% to 18.75%, and Large Package Surcharges are increasing significantly as well.

When speaking of surcharges to Wall Street analysts, UPS refers to them as “levers” that can be used to drive revenue to meet investors' expectations. Remember, though, as these charges increase dramatically year over year, UPS is opening the door for you to initiate negotiations to mitigate these increases.

6. The list of ZIP codes aligned to certain zones will change

Buried in UPS’s GRI announcement was a bullet point that some ZIP codes aligned to certain zones will change. Those changes have not been announced yet and may be unimportant to most shippers. However, the note here is that UPS can and will make changes to zone alignment, which will impact your pricing.

7. How does UPS’s GRI announcement compare to FedEx?

As has been the case over the past decade or so, the oligopolistic nature of both UPS and FedEx pricing will continue into 2023. As you can see in the charts below, there are very few differences between the two carriers’ most common services and surcharges.

This year, the only meaningful distinction between both carriers is in the 3 Day Service category, where FedEx is taking a much larger increase. This action should be seen as a “catch up,” as last year UPS applied much larger increases to this service level.

Table Two. Comparison of Base Pricing:

Table Three. Comparison of Surcharge Pricing:

As a reminder, our analysis of the FedEx GRI, as written by Keith Myers, can be found here: https://parcelindustry.com/article-5978-FedEx-2023-General-Rate-Increase-6-Key-Takeaways.html

What can shippers do?- Know your data and your specific shipping profile. That is the only way to fully analyze how these increases will impact you.

- Engage multiple carriers. Regional carriers are becoming increasingly viable for almost all shippers and often offer extremely competitive rates. For example, LaserShip and OnTrac, which merged earlier this year with sights set on becoming a full-service national provider, already fight for volume with about a dozen other existing regional carriers, and if most analysts are correct, will soon compete against Amazon, whenever they decide to become a common carrier. Shippers that haven’t investigated these options may be pleasantly surprised with what they find.

- Negotiate! With large increases and introductions of new charges, the carriers are opening the door for you to lobby them for relief.

In summary, UPS’s GRI announcement once again illustrates that UPS is focused first and foremost on driving profits, even at the potential cost of long-term harm to its loyal customers. Even as we enter a recession, as many believe, and even as there is excess capacity in the market, UPS set its GRI at an all-time high. Pouring gas on that fire, most surcharges are increasing significantly more than 6.9%.

There is never a wrong time to reach out to your carrier to discuss mitigation tactics. The key is to make sure you have a complete understanding of the impact of annual increases. Whether you have an in-house expert or partner with a consultancy, these increases can’t be ignored. Your budget is at stake, and you owe your organization the chance to have an informed negotiation with your carrier.

Paul Yaussy is a Senior Professional Services Consultant for Shipware, an industry leader in shipping intelligence and optimization (https://shipware.com/), where he consults and advises clients on transportation cost-reduction strategies. Paul joined Shipware in April 2021 after more than two decades in logistics management roles, most recently at JOANN Stores, where he distinguished himself as a transportation cost-reduction specialist and was responsible for leading the team that routed over $80M in parcel, truckload, intermodal, and LTL freight.