Matching rival FedEx, UPS has announced a 5.9% 2024 General Rate Increase (GRI). While the FedEx increases are effective January 1, 2024, the new UPS rates will go into effect a week earlier on December 26, 2023.

As is always the case with carrier General Rate Increases, and noted with an asterisk at the bottom of the announcement, “the impact of these changes on your shipping costs will vary according to your shipping characteristics and the terms of your UPS agreement.” Translated, very few shippers will realize an increase equivalent to 5.9%; most will be higher. It’s important you understand how base rate and surcharge increases will impact your 2024 UPS spend.

While it’s impossible to analyze every change, below are some important takeaways for all shippers to note and assess:

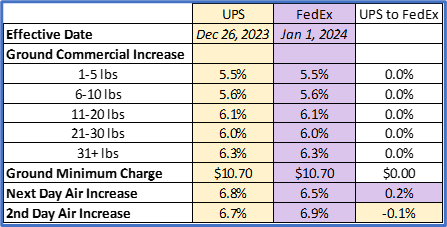

1. UPS caught off-guard, matches FedEx, raises rates 5.9%

Clearly, UPS was surprised when FedEx announced its annual increase rate. UPS quickly followed with its own 2024 GRI announcement on September 7, but did not release its rates until October 12, a whopping 25 business days later. To no one’s disbelief, UPS matched FedEx with a 5.9% GRI. For nearly a decade, the carriers set their annual increase at 3.9% or 4.9%, but broke that trend in 2022 with a 5.9% increase, and then again in 2023 with a record breaking 6.9% increase. The fall back in 2024 marks the first deceleration in annual increases for either carrier in at least a decade but is no reason for shippers to celebrate.

Coming off a very public labor negotiation earlier this year, UPS faces headwinds heading into 2024, especially in the first year of the newly negotiated Teamsters contract, when labor costs are expected to rise as high as nine percent year-over-year. Similarly, UPS admits losing business during the lengthy negotiation so raising rates higher than FedEx presented the risk of further alienating customers.

It should be noted that as of press time, UPS has not announced its 2024 SurePost rates. Shippers using that service should continue to check here for updated rates: https://www.ups.com/us/en/support/shipping-support/shipping-costs-rates/surepost-rates.page

2. Look for unannounced, hidden cost increases

In UPS’s announcement, it was noted that the list of ZIP Codes to which Area Surcharges apply will change and the list of ZIP Codes aligned to certain zones will change. Most shippers will not have the immediate ability to analyze these ZIP Code changes, which has the potential to be a sneaky way for UPS to increase yield. For example, if the number of ZIP Codes hitting Area Surcharge increases overall, shippers will see rates increasing. It will be interesting to see how much the net population is affected by these DAS ZIP Code changes. Likewise, if the number of ZIP Codes aligned to Zones 2 and 3 shrinks, turning those shipments into higher zone shipments, shippers will again unknowingly see rates increase. We are in the process of analyzing every ZIP Code to find any material changes that might have been made.

3. Rate increases are similar across most weight breaks, but longer zone shippers will see higher increases

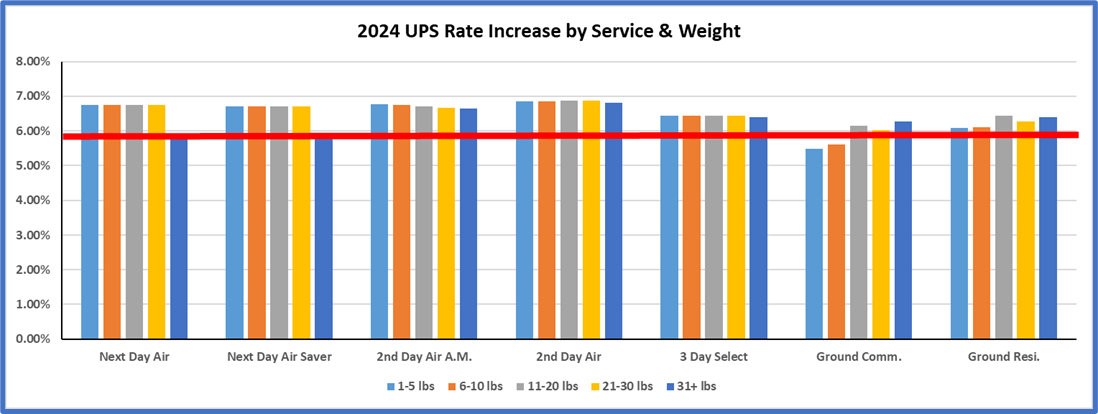

As illustrated by the following charts, all services will see rate increases across all weight breaks, and virtually all above the 5.9% target line.

As you can see in Chart One below, Next Day Air and 2nd Day Air shippers will see the largest increases across all weight breaks. Conversely, lightweight Ground shippers will see the slowest rise in rates next year.

Chart One:

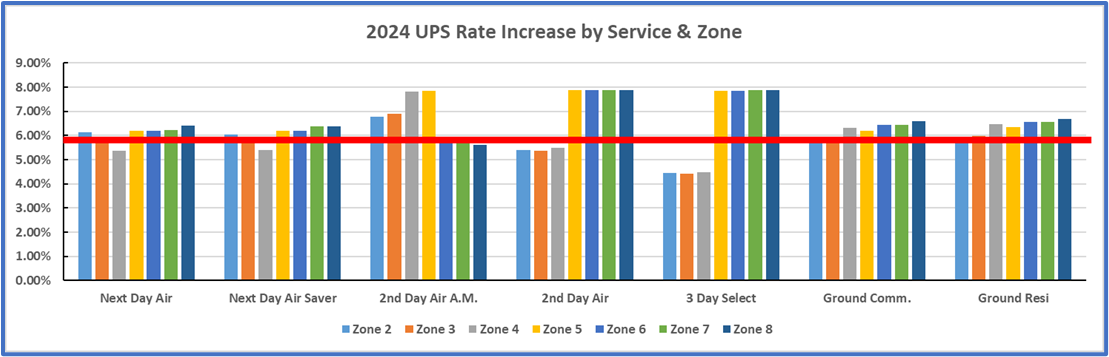

As you can see below, UPS has kept the shorter Zones (2-4) lower than the 5.9% increase, likely to compete the ever-increasing popularity of regional carriers. Also noteworthy is 2nd Day Air and 3 Day Select rates in Zones 5-8 taking on nearly eight percent rate increases.

Chart Two:

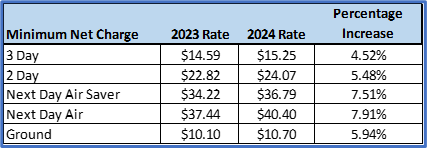

4. Can’t forget the effect of Minimum Charges

For shippers with existing discounts, the minimum charge, or floor price, go hand in hand with the rate increase. The floor price gives additional protection to UPS from any discounts they have already conceded. For example, even if you have a 100% discount, you will pay $10.10 for a ground shipment in 2023, or $10.70 in 2024, without negotiating minimum concessions. Yearly minimum charge increases can have a dramatic impact on your shipping costs.

In Table One, you can see UPS is more aggressive on Next Day Air and Next Day Air Saver services, with increases ranging one and a half to two points higher than the general rate increase. This tactic matches what FedEx announced back in August, as both national carriers realize these services distinguish them from the competition regionals provide. Meanwhile, Ground, 2nd Day, and 3 Day Select all have minimum increases that are the same, or lower, than the overall general rate increase in order to remain competitive with alternative carriers in the market.

Table One:

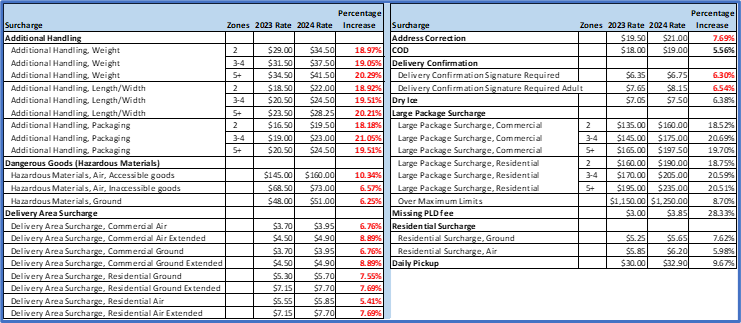

5. Almost all common surcharges will increase significantly more than the 5.9% GRI

Most read the headlines, or the email from their carrier rep, and think all their rates are increasing 5.9%. If you are not careful, you can blow your parcel budgets with this thinking because the annual GRI announcement does not limit surcharges to the 5.9% rate increase. Again, this year, most common surcharges will increase significantly higher than 5.9% and, depending on your specific profile, may be extremely detrimental to your parcel pricing. Surcharges make up between 20% and 40% of a parcel shipper’s annual spend. So, it’s critical you understand the impact of these increases.

Of note, shippers of large packages will once again be severely impacted by the 2024 increase. Additional Handling surcharges and Large Package surcharges are increasing 19.5% on average.

UPS often calls surcharges “levers” that can be used to drive revenue to meet investors' expectations. Remember, though, as these charges increase dramatically year over year, UPS is opening the door for you to initiate negotiations to mitigate these increases.

Table Two:

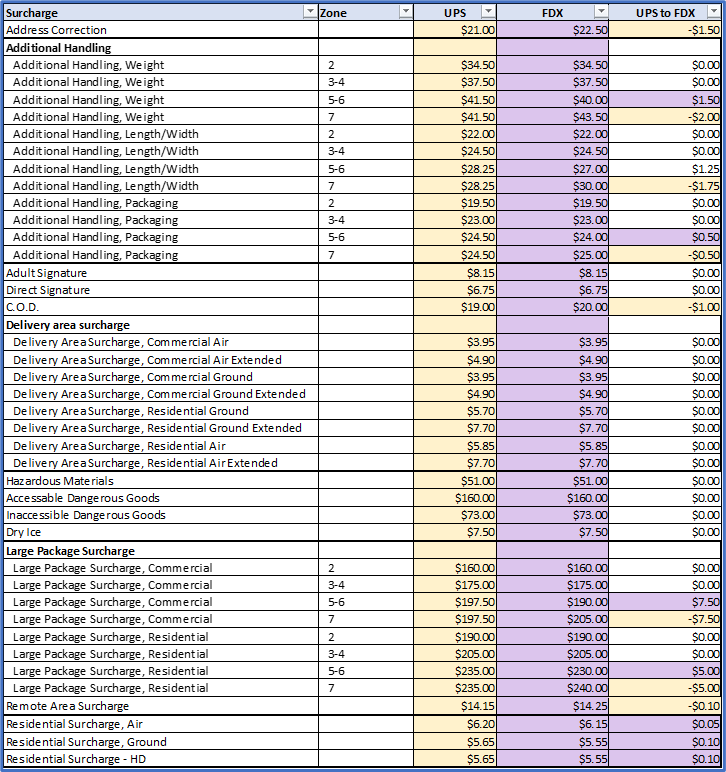

6. How does UPS’s GRI announcement compare to FedEx?

As has been the case over the past decade or so, the oligopolistic nature of both UPS and FedEx pricing will continue into 2024. As you can see in the charts below, there are very few differences between the two carriers’ most common services and surcharges.

Table Three: Comparison of Base Pricing:

Table Four: Comparison of Surcharge Pricing:

What can shippers do?

·Know your data and your specific shipping profile. That is the only way to fully analyze how these increases will impact you.

·Engage multiple carriers. Regional carriers are becoming increasingly viable for almost all shippers and often offer extremely competitive rates. It’s been a year since OnTrac and Lasership merged, offering coverage to 80% of the population. GLS, and others, continue their expansion. Amazon announced earlier this year that Amazon Shipping is now a service provider and has offered services on a case-by-case basis where there is a mutual fit, with plans on continuous expansion in 2024 and beyond.

·Negotiate! With large increases and introductions of new charges, the carriers are opening the door for you to lobby them for relief.

In summary, while UPS’s GRI decreased from 6.9% to 5.9% this year, shippers should still anticipate a double-digit price increase after factoring in all surcharge increases. The slowing of the annual increase can be viewed as a small win for shippers. However, there is never a wrong time to reach out to your carrier to discuss mitigation tactics. The key is to make sure you have a complete understanding of the impact of annual increases. Whether you have an in-house expert or partner with a consultancy, these increases can’t be ignored. Your budget is at stake, and you owe your organization the chance to have an informed negotiation with your carrier.

Paul Yaussy is a Senior Professional Services Consultant for Shipware, where he consults and advises clients on transportation cost-reduction strategies. Paul joined Shipware in April 2021 after more than two decades in logistics management roles, most recently at JOANN Stores, where he distinguished himself as a transportation cost-reduction specialist and was responsible for leading the team that routed over $80M in parcel, truckload, intermodal, and LTL freight.