The last three years have been a rollercoaster in our industry, with higher demand and costs than we have ever seen. So where are we now, and where are we going with parcel costs in the future?

There are several current factors that will impact our future:

1)The US macro environment will drive costs up, as fuel and labor remain elevated. However, inflation is predicted to stabilize to near four percent.

2)The outcome of the UPS/Teamsters negotiation: Thankfully, an agreement between the Teamsters and UPS has been reached. But UPS’s cost to serve will increase; more concessions and higher wages in the contract mean more cost to UPS. The company’s focus on margin means that these costs will be passed on to shippers, and, ultimately, consumers.

3)FedEx’s operational changes: FedEx is combining its divided business units. These changes are meant to increase efficiency and decrease costs. However, that will not necessarily be passed on to shippers and ultimately consumers. FedEx will look towards these decreased costs to improve margin.

4)The competitive environment: One downward force on parcel rates could be the competitive environment: The USPS is offering its Ground Advantage program, which will attract new volume. Amazon continues to move a larger percentage of its own volume, reducing its spend with UPS. There’s less overall volume to be had, so competition should increase.

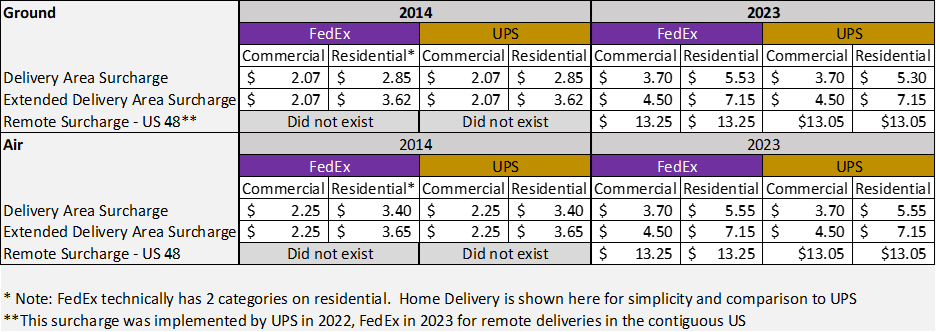

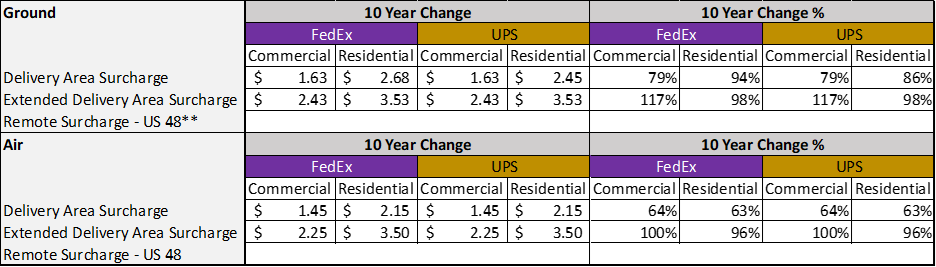

Historical Trends in Price Increases: Looking over the past 10 years of surcharge increases, the highest ones have to do with residential shipping and size.

One example surcharge tells the story of what has happened in the past 10 years. Delivery Area Surcharge (DAS) was imposed to help carriers recoup costs for addresses in low density or rural areas. Here’s how this charge has changed in 10 years:

Delivery Area Surcharge has had an average increase of over five percent each year, whereas Extended Delivery Area Surcharge (EDAS) has an average of over eight percent. UPS and FedEx have both added a category of DAS that did not exist two years ago. This Remote Surcharge is over $9 more expensive per package than the other DAS charges – plus, its implementation increases the overall scope of ZIP Codes that can be charged for delivery area. Additionally, the list of DAS/EDAS grows every year. This exemplifies carrier changes: they increase the fees for the current surcharges, add additional categories, and increase the underlying scope and application of the surcharges.

What are the expectations for transportation rates and surcharges for the 2024 GRI? My prediction is that UPS & FedEx will increase their transportation rates by 5.9%. Down from last year’s 6.9%, but still elevated from the previous decade-plus long trend of 4.9%. Where you will see a bigger increase will be in the surcharges.

As the example above indicated, EDAS increased by an average of eight percent over the last 10 years, much higher than the typical 4.9% increase of transportation rates. Other surcharges will follow this same trend. On some surcharges, we will see double digit increases. In particular, look for increases that typically apply to residential deliveries for e-commerce. DAS, EDAS, and residential surcharges will all have high increases. It would not be surprising to see a 15% increase on surcharges for 2024. So now what?

Read your agreements. Understanding your increase begins with a careful read of your agreements. Even if you have rate caps, you may still have exposure to the full GRI on any unprotected services. More often than not, the area of greatest exposure is in your surcharges, as they typically do not have caps.

Do the math. Summarize your spend for each service level and apply either 5.9% or your agreement’s rate cap(s) to determine a quick & dirty estimate of your GRI costs on transportation. On surcharges, a rough-cut number would be a 15% increase. Of course, this is in no way comprehensive, and calculating accurate impacts requires a much more detailed model.

Get help. Reach out to industry consultants for a more accurate picture of the GRI impacts of your specific agreements. Analysts can apply your shipping data against the expected GRI changes to give accurate impacts and targets for your negotiation or mitigation.

Negotiate or alternate. Once you determine the biggest areas of increase for your program, reach out to your carrier(s) to negotiate. If items cannot be negotiated, then evaluate alternative carriers like USPS and regional carriers that tend to have less surcharge costs.

Mark Taylor is the Senior Director of Transportation Solutions Consulting at Körber.

This article originally appeared in the September/October, 2023 issue of PARCEL.