You don’t have to dig very deeply into reports from the U.S. Energy Information Administration (EIA) to confirm what we already know, which is that even though current fuel prices may be lower than they’ve been in recent years, they are definitely back on the rise.

According to the EIA, crude oil is expected to rise to $87 per barrel by the end of 2011, which will be largely to blame for a corresponding rise in gasoline and diesel fuel prices.

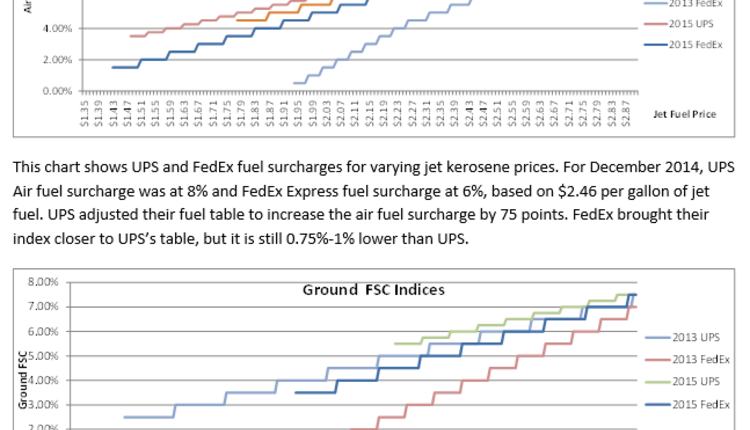

The predicted cost of oil is already negatively affecting shippers. Though UPS and FedEx announced reductions in fuel surcharges for 2011, they also announced higher base rates, which, we can assume with a reasonable amount of certainty, were calculated with their fuel surcharge losses in mind. Lower fuel surcharges are not likely to lower overall shipping costs in the coming years.

Higher fuel costs are also expected to have a negative effect on shippers due their impact on the trucking, air cargo, and ocean freight industries. While the expectation is that circumstances will improve for these industries over the course of the next several years in conjunction with the overall economy, rising fuel costs will not contribute to their supposed future success.

Crude oil production over the next five years and beyond is forecasted to remain constant. No anticipated increase in production coupled with rising costs should solidify shippers’ expectations of seeing higher rates and surcharges issued from the trucking, air cargo, and ocean freight sectors through at least 2015.

Solutions

The fuel increases of 2005 and their effects on the past five years have shown shippers that taking advantage of things like generous capacity, competitive freight rates, and other industry trends in the short term is fine, but relying on them to sustain a supply chain is not.

In 2009, record productivity lows and higher unemployment rates than we’d seen in decades in the manufacturing sector became sobering evidence of the ineffectuality of relying on trends to keep costs low. As long as fuel prices continue to rollercoaster and the economy is forced to buckle beneath them, manufacturers and shippers of all kinds will be better off implementing long-term cost-cutting solutions.

On the upside, shippers’ struggles over the past five years have resulted in an increased ability to predict the fuel cost-related challenges that are to come. Even better, many of the processes and solutions developed as result of the 2005 fuel price spikes have been improved upon and enhanced over the past five years, thanks, in part, due to better technology, which has made it possible for shippers to implement them smarter and more efficiently.

High-level market intelligence, in particular, has been given a great deal of attention over the past few years as large global shippers and the third party technology solutions providers who serve them found that by taking detailed market information and benchmarking it against a company’s unique shipping characteristics, powerful cost-saving tools could be generated and used to combat quickly shifting market trends, including overcapacity and less competitive freight rates, both of which became major issues for shippers during the latter half of the past five years, and continue to pose problems for them today.

Five modernized steps to developing long-term cost-saving solutions for your supply chain based on high-level market intelligence are below. While no one solution is going to be foolproof, marrying proven tactics with upgraded analytics will put you in a stronger position at rate negotiations tables—something that will no doubt be of greater value to you as rising fuel prices make lowering your supply chain costs even tougher.

Steps

1. Gaining market intelligence

By gathering, cleansing, and analyzing at least 12 months of your shipping data, then benchmarking it against those of a large number of competitors (1,000+), you can develop the market intelligence that will help you win better rates and incentives from your carriers and suppliers. To ensure that your market intelligence is derived accurately and presented impartially, partnering with a third party data analytics provider may prove to be an effective option. If high-level benchmarking and analytics are not part of your company’s core competencies, it will probably also be the most cost-effective option.

Obtaining objective market intelligence is key because it is the only way you can truly gain an accurate view of global trends, gain a solid understanding of your company’s standing in the marketplace, and prove to your carriers and suppliers that you have gained or are gaining total visibility and control of your supply chain.

2. Making the most of your volume

Your company’s market intelligence should make it possible for you to develop different scenarios that will predict how well you will be able to handle the costs associated with fluctuating volume, and volume increases, in particular. These scenarios can be used to develop strategies for tightening operations during leaner times, and also, for leveraging expected volume increases to achieve better rates and incentives from your carriers.

If your freight costs are limited to outbound volume, taking control of inbound volume provides an added opportunity during carrier negotiations to achieve more competitive pricing and incentives, using aggregate freight volume as leverage.

3. Negotiating lengthier agreements

Using your volume scenarios, negotiate lengthier trucking, air, and ocean agreements. If your scenarios are presented in a timeline based on your desired contract periods, you will have a better chance of achieving lengthier agreements and better incentives. Lengthier agreements make it possible to institute cap structures in your contract that will allow for greater visibility and more accurate forecasting of future freight costs.

4. Locking in fuel incentives

By requesting increased discount percentages relative to fuel or fuel surcharge caps, you may be able to protect yourself from the effects of fuel price hikes before they occur. In order to obtain fuel-related incentives from your contracted carriers, use your company’s freight volume-based scenarios and independent market intelligence as leverage. Market intelligence can help you to find ways to make concessions and perhaps ease your carriers’ burdens in other areas—not necessarily at any additional cost to you.

5. Ensuring carrier compliance

Use a transportation management system (TMS) to ensure carriers are compliant with all areas of your contracted agreements. Your TMS should contain key performance indicators (KPIs) that hold carriers accountable for all cost-related errors and service issues and require problems to be resolved within a specific period of time.

Conclusions

Less than favorable fuel prices do not have to keep you from enhancing your ability to manage your supply chain costs. High-level market intelligence can help you to keep your freight costs manageable, perform better forecasting, and take greater control of your supply chain and achieve better incentives by strategically leveraging your volume in order to alleviate your carriers’ fuel-related freight costs. Furthermore, increasing freight discount levels by doing things such as adding inbound suppliers’ shipping volume to your agreements can give your carriers even more incentive to cap costs associated with fuel and lengthen the terms of your agreements. Finally, compliance monitoring can hold the appropriate parties accountable and ensure that ongoing savings will be achieved.

According to the EIA, crude oil is expected to rise to $87 per barrel by the end of 2011, which will be largely to blame for a corresponding rise in gasoline and diesel fuel prices.

The predicted cost of oil is already negatively affecting shippers. Though UPS and FedEx announced reductions in fuel surcharges for 2011, they also announced higher base rates, which, we can assume with a reasonable amount of certainty, were calculated with their fuel surcharge losses in mind. Lower fuel surcharges are not likely to lower overall shipping costs in the coming years.

Higher fuel costs are also expected to have a negative effect on shippers due their impact on the trucking, air cargo, and ocean freight industries. While the expectation is that circumstances will improve for these industries over the course of the next several years in conjunction with the overall economy, rising fuel costs will not contribute to their supposed future success.

Crude oil production over the next five years and beyond is forecasted to remain constant. No anticipated increase in production coupled with rising costs should solidify shippers’ expectations of seeing higher rates and surcharges issued from the trucking, air cargo, and ocean freight sectors through at least 2015.

Solutions

The fuel increases of 2005 and their effects on the past five years have shown shippers that taking advantage of things like generous capacity, competitive freight rates, and other industry trends in the short term is fine, but relying on them to sustain a supply chain is not.

In 2009, record productivity lows and higher unemployment rates than we’d seen in decades in the manufacturing sector became sobering evidence of the ineffectuality of relying on trends to keep costs low. As long as fuel prices continue to rollercoaster and the economy is forced to buckle beneath them, manufacturers and shippers of all kinds will be better off implementing long-term cost-cutting solutions.

On the upside, shippers’ struggles over the past five years have resulted in an increased ability to predict the fuel cost-related challenges that are to come. Even better, many of the processes and solutions developed as result of the 2005 fuel price spikes have been improved upon and enhanced over the past five years, thanks, in part, due to better technology, which has made it possible for shippers to implement them smarter and more efficiently.

High-level market intelligence, in particular, has been given a great deal of attention over the past few years as large global shippers and the third party technology solutions providers who serve them found that by taking detailed market information and benchmarking it against a company’s unique shipping characteristics, powerful cost-saving tools could be generated and used to combat quickly shifting market trends, including overcapacity and less competitive freight rates, both of which became major issues for shippers during the latter half of the past five years, and continue to pose problems for them today.

Five modernized steps to developing long-term cost-saving solutions for your supply chain based on high-level market intelligence are below. While no one solution is going to be foolproof, marrying proven tactics with upgraded analytics will put you in a stronger position at rate negotiations tables—something that will no doubt be of greater value to you as rising fuel prices make lowering your supply chain costs even tougher.

Steps

1. Gaining market intelligence

By gathering, cleansing, and analyzing at least 12 months of your shipping data, then benchmarking it against those of a large number of competitors (1,000+), you can develop the market intelligence that will help you win better rates and incentives from your carriers and suppliers. To ensure that your market intelligence is derived accurately and presented impartially, partnering with a third party data analytics provider may prove to be an effective option. If high-level benchmarking and analytics are not part of your company’s core competencies, it will probably also be the most cost-effective option.

Obtaining objective market intelligence is key because it is the only way you can truly gain an accurate view of global trends, gain a solid understanding of your company’s standing in the marketplace, and prove to your carriers and suppliers that you have gained or are gaining total visibility and control of your supply chain.

2. Making the most of your volume

Your company’s market intelligence should make it possible for you to develop different scenarios that will predict how well you will be able to handle the costs associated with fluctuating volume, and volume increases, in particular. These scenarios can be used to develop strategies for tightening operations during leaner times, and also, for leveraging expected volume increases to achieve better rates and incentives from your carriers.

If your freight costs are limited to outbound volume, taking control of inbound volume provides an added opportunity during carrier negotiations to achieve more competitive pricing and incentives, using aggregate freight volume as leverage.

3. Negotiating lengthier agreements

Using your volume scenarios, negotiate lengthier trucking, air, and ocean agreements. If your scenarios are presented in a timeline based on your desired contract periods, you will have a better chance of achieving lengthier agreements and better incentives. Lengthier agreements make it possible to institute cap structures in your contract that will allow for greater visibility and more accurate forecasting of future freight costs.

4. Locking in fuel incentives

By requesting increased discount percentages relative to fuel or fuel surcharge caps, you may be able to protect yourself from the effects of fuel price hikes before they occur. In order to obtain fuel-related incentives from your contracted carriers, use your company’s freight volume-based scenarios and independent market intelligence as leverage. Market intelligence can help you to find ways to make concessions and perhaps ease your carriers’ burdens in other areas—not necessarily at any additional cost to you.

5. Ensuring carrier compliance

Use a transportation management system (TMS) to ensure carriers are compliant with all areas of your contracted agreements. Your TMS should contain key performance indicators (KPIs) that hold carriers accountable for all cost-related errors and service issues and require problems to be resolved within a specific period of time.

Conclusions

Less than favorable fuel prices do not have to keep you from enhancing your ability to manage your supply chain costs. High-level market intelligence can help you to keep your freight costs manageable, perform better forecasting, and take greater control of your supply chain and achieve better incentives by strategically leveraging your volume in order to alleviate your carriers’ fuel-related freight costs. Furthermore, increasing freight discount levels by doing things such as adding inbound suppliers’ shipping volume to your agreements can give your carriers even more incentive to cap costs associated with fuel and lengthen the terms of your agreements. Finally, compliance monitoring can hold the appropriate parties accountable and ensure that ongoing savings will be achieved.