It is early July, and the future is unclear.

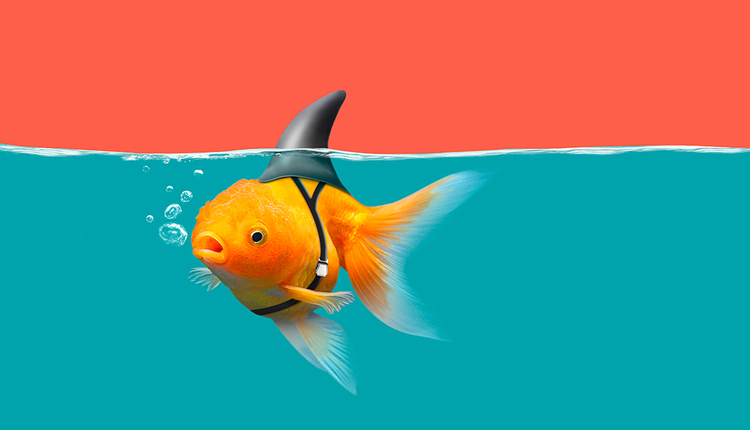

The opposition is firmly entrenched on either side and possesses resources so far outnumbering their own that winning is improbable and even survival is uncertain.

The opposition is firmly entrenched on either side and possesses resources so far outnumbering their own that winning is improbable and even survival is uncertain.

Then, with its back against the wall, the underdog, desperate to seize an opportunity, sees its chance.

It had to start somewhere.

No, this is not the American Revolution. It is the United States Postal Service. And on July 1, it fired a shot that, while not heard around the world, certainly piqued the interest around shipping circles everywhere.

Under increasing pressure to perform in the face of imposing competition from the world’s two largest parcel shipping companies, the future for the USPS has at times seemed bleak. But the timing of the announced dimensional weight pricing changes by FedEx and UPS could not have provided a better platform for the proposed USPS cost cuts absorb the spotlight.

Now, for the first time in years, shifting volume to the Post Office could again be a viable option.

That is because its brass decided to buck the trend of rising prices and make a play for market share when it slashed prices in key areas of its Commercial Plus Price Sheet. While the rate structure still must receive approval from the Postal Regulatory Commission, the proposed prices demand that shippers take the USPS seriously, lest spend nearly 50 percent more on certain packages.

USPS Commercial Plus pricing charges commercial and residential packages equally, while FedEx and UPS each tack on a $2.90 surcharge for the latter. Commercial Plus requires a minimum volume threshold of 50,000 packages per year, and any shippers that wish to divert volume could reap heavy benefits if the pricing model is approved and thus goes into effect on September 7.

The most significant and consistent price changes occur with shallow-zone (2 through 4) USPS shipments that weigh up to 15 pounds; specifically residential shipments. USPS Commercial Plus rates for packages in this range would be cheaper than FedEx and UPS published rates by an average of 27 percent for commercial shipments and about 45 percent for residential ones.

The announcement is part of a move not only to become a stronger player in the lightweight parcel market, but also to shift its current customers toward a more efficient supply chain. Proposed retail rates would actually increase an average of 1.7 percent over where they stand now. However, the USPS is leaving customers a perfectly sensible option to help mitigate these increases via its Commercial Base pricing model, which contains proposed cuts that can be attained simply by using Click-N-Ship, PC Postage products, permit imprints, or digital mailing systems (meters) that generate an IBI (Information Based Indicia) and submit data electronically, according to a release on the USPS website.

Still the buzz is almost solely about the Postal Service’s push to attract short-zone shipments on the premise of lower rates. As such, when comparing to FedEx and UPS rates, it is important to factor commercial and residential ground discounts to determine what the true impact of diverting volume to the USPS would be.

A current FedEx or UPS customer that qualifies for USPS Commercial Plus pricing and receives an average discount on its FedEx and/or UPS ground volume likely would achieve more substantial savings on residential shipments as opposed to commercial ones, since USPS residential shipments are not subjected to residential surcharges.

A current FedEx or UPS customer that qualifies for USPS Commercial Plus pricing and receives an average discount on its FedEx and/or UPS ground volume likely would achieve more substantial savings on residential shipments as opposed to commercial ones, since USPS residential shipments are not subjected to residential surcharges.

Another factor that could skew the numbers in a positive way for the customer is fuel surcharge. FedEx and UPS charge a percentage-based fee for fuel, depending on the market, whereas the USPS has no such add-on for commercial and/or residential ground shipments.

All things considered, the proposed Postal Service rates do indeed have strong potential to significantly help cost-conscious companies save money. While it is important to weigh the pros and cons relative to your own company’s business rules and best practices and to analyze your own unique data to determine the true net savings potential, there is little doubt that the latest move by the USPS is bold.

Whether it proves to be revolutionary? Well, that remains to be seen.

Brandon Staton is the Marketing and Communications Manager for Transportation Impact, LLC, and First Flight Solutions, industry-leading parcel spend management firms and No. 547 on the 2013 Inc. 5000 and No. 183 on the 2013 Inc. 500, respectively. Brandon and the Transportation Impact team have helped negotiate small package contracts for some of the most well-known companies in the world, reducing their respective parcel shipping costs by an average of 22%. Brandon can be reached directly at 252.764.2885 or via email at bstaton@transportationimpact.com.

Brandon Staton is the Marketing and Communications Manager for Transportation Impact, LLC, and First Flight Solutions, industry-leading parcel spend management firms and No. 547 on the 2013 Inc. 5000 and No. 183 on the 2013 Inc. 500, respectively. Brandon and the Transportation Impact team have helped negotiate small package contracts for some of the most well-known companies in the world, reducing their respective parcel shipping costs by an average of 22%. Brandon can be reached directly at 252.764.2885 or via email at bstaton@transportationimpact.com.

![GettyImages-914834678-[Converted]](https://cms-static.wehaacdn.com/parcelindustry-com/images/GettyImages-914834678--Converted-.1133.widea.0.jpg)