As we approach what is hopefully the end of the COVID pandemic, UPS and FedEx continue to apply new peak surcharges in response to what they describe as ongoing capacity issues. Service Guarantees have been suspended for almost a full year, and there is still no word from the carriers on when they might be reinstated. This article will address recently announced, new increases from both carriers.

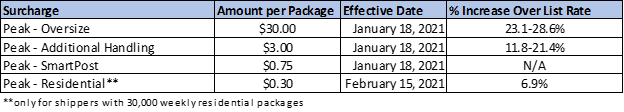

FedEx Domestic:

FedEx continues to penalize shippers that send larger packages and high volume e-commerce shippers (>30k packages per week). Large packages strain carrier networks, requiring additional labor to handle and consuming premium space on trucks and planes. Generally, larger e-commerce shippers have deeper discounts than lower volume shippers, so FedEx is tagging this less profitable segment of its client base with these upcharges as well.

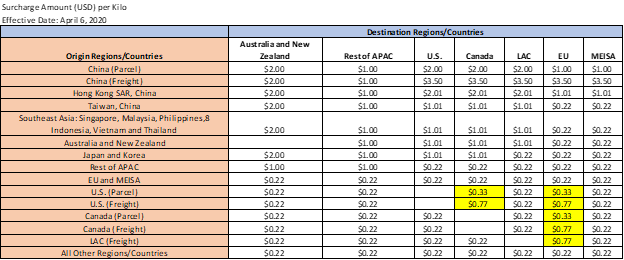

FedEx International:

The carriers’ Revenue Management teams have been especially active by implementing new, intra-year international surcharges. As charges are, in part, applied by origin-destination pairs, forecasting the impact of these increases can be challenging. While the dollar amounts in the following chart may seem small in the expensive world of international shipping, these charges are per kilo, which can add up quickly.

Note that the cells highlighted in yellow were increased on February 15th, 2021. These cells increased from $0.22, so the % increases are 50% for the $0.33 cells and 250% for the $0.77 cells.

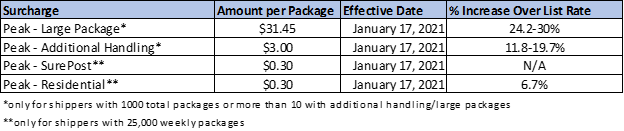

UPS Domestic:

Moving to UPS, we see a similar story to FedEx. There are two primary differences: 1) SurePost requires a minimum number of packages before fees are assessed, and 2) it’s a smaller fee. The weekly gate for UPS is 25,000 packages vs. 30,000 for FedEx. Moreover, UPS is assessing additional import fees based on origin region.

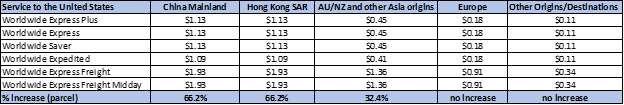

UPS International:

Besides higher costs, what do all these increases mean for shippers? The primary takeaway is this: expect far more than one increase per year.

It wasn’t all that long ago we were used to one annual rate increase, known as the General Rate Increase, or GRI. Over the past few years, we’ve seen multiple mid-year increases to existing rates, as well as the introduction of completely new accessorials. However, nothing compares to what we’re seeing now.

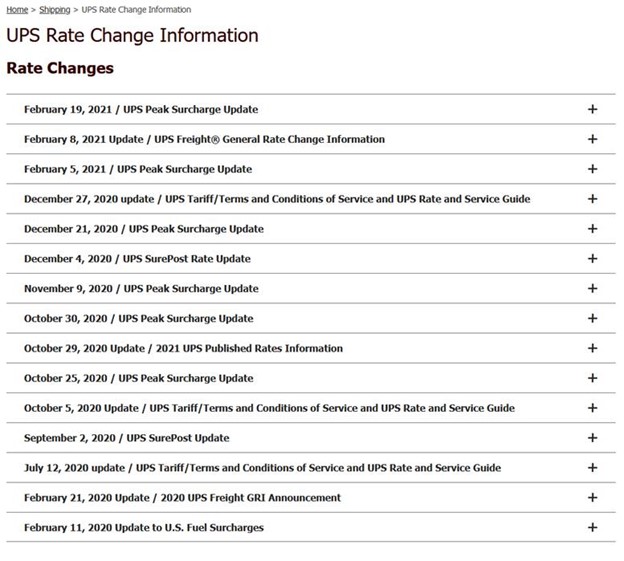

If a picture is worth a thousand words…

The graphic above displays all the UPS changes in roughly one calendar year.

Another takeaway for shippers: it’s now more important than ever to understand how all these intra-year changes are affecting your shipping costs. Complex pricing and rules make it difficult to determine how these and other carrier changes impact your organization, but understanding these changes is more important than ever.

Matt Bohn is Senior Consultant for Shipware, a parcel consulting firm that specializes in cost reduction and recovery services. Prior to his work at Shipware, Matt spent nine years as a Senior Pricing Advisor at FedEx, where he analyzed pricing programs and wrote pricing contracts for some of FedEx’s largest e-commerce and retail shippers. If you would like to contact Matt and the Shipware team, you can contact Shipware here. To model the financial impact of these changes, or to have an expert determine potential savings to your existing shipping agreement, please reach out to us (inquiries@shipware.com) for a complimentary analysis.