Typically, with a smaller organization, the responsibility of managing the carriers falls on the shipping manager or operations manager. This responsibility is in addition to the many other jobs required of this person from warehousing, including running TMS, shipping, operations, and managing incoming returns and invoice resolution.

As part of managing the carriers, most of the responsibility of renegotiating carrier agreements also becomes part of the job. And, when it comes to taking on a carrier contract negotiation, it can become complicated if you lack the dedicated resources or guidance to put together a strong RFP. Most importantly, it’s critical to be proactive and the one who initiates the agreement renewals and amendments… not the carrier.

Along with so many other responsibilities, the shipping manager deals directly with their carrier rep. This rep is normally the sole source of the information the manager receives from the carrier. For low- and mid-volume shippers, you can often feel like there is a lack of attention from your rep. Whether you have a good, proactive rep, or one that doesn’t provide much help, is a key factor in whether or not the manager is at a disadvantage. It is crucial to create and maintain a good working relationship and have your rep work as an advocate for your company. And, most importantly, it is critical for managers to also develop these close relationships with the non-incumbent carrier.

Plan to have regular meetings and discuss a quarterly business review with your rep. Work closely with them to review your usage, time in transit, and major areas of spend, including the impact of new surcharges. This will identify areas for improvement and potential savings. During these reviews, update your rep with plans for your organization such as growth, peak season planning, new product box sizes, and other changes to make sure your carrier agreements are adjusted to reflect your unique profile.

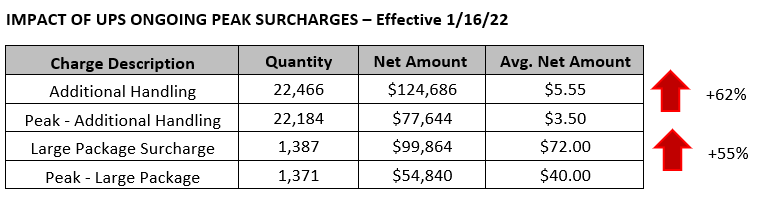

One shipper recently spoke with their carrier representative about a large increase in surcharges and was told, “Unfortunately, the AHS and Oversize peak surcharges were not implemented when your agreement was executed. Those were new peak surcharges.” Obviously, that is not something a shipper wants to hear.

|

In addition to the reviews with your carrier, become familiar with your invoicing shipping data. Analyze your data and learn where all your money is going. By knowing what your major spend areas are and true shipment cost, you will have specific and targeted talking points to take to the carriers for contract adjustments. Many carriers will push back on providing lower rates. Using your data to show increases in cost and YOY change will give you an advantage.

Change Is Good (Except When It Isn’t)

Another challenge managers face is dealing with unexpected changes from the carriers. We used to be able to rely on changes once a year with the annual general rate increase (GRI). However, the last couple years have shown that changes are being implemented all year long and often at times with little warning. Prioritize staying connected with the reps so they will keep you updated with upcoming announcements and carrier tariff changes such as new peak surcharges, new services, surcharge rule changes, and fuel rate index adjustments. Getting an alert will help you have a head start in planning for these changes, especially since midyear changes can drastically affect your organization’s budget for the year.

Not only do you need to have a strong relationship with your carrier, but oftentimes, the manager typically does not have a good relationship with the non-incumbent carriers. It is important to have on-going conversations with all the major carriers, as well as regional carriers. Unless you have consistently engaged the non-incumbent carrier, you will not receive a robust proposal from them.

Additionally, don’t overlook regional carriers, as they can often provide not only faster service but do so at a lower cost. Diversifying your carrier footprint will allow you more flexibility and shipping options. Using more than one carrier can also help leverage the multiple source strategy. Having a relationship with only one carrier leaves potential risk if your incumbent carrier decides to implement capacity restraints like we have seen a great deal of in the most recent years. If your capacity is maxed out you will have additional routes to ship your packages already setup to easily shift your volume.

However, if you decide to bring in additional carriers, be aware of how much volume/revenue you are pulling from your main incumbent carrier, as there are a lot of ways the carriers take advantage of this situation. Many carrier agreements are structured around your shipment spend and your rate incentives are tied to it as well. If significant volume is pulled, this will negatively affect your current incentives. Review where your organization falls in the incentive tiers and shift volume accordingly. If volume and spend drop too low, many organizations convert their LTL spend to their incumbent carrier. This additional revenue can help with meet the requirements to keep current incentives.

There are many challenges to managing and controlling your carrier agreements, and it continues to become more complicated. Remember, you should be able to bring in your CFO or CEO to support your efforts, and now you can provide them with the information needed to achieve bottom line savings.

Stephanie, Managing Director at Navigo Consulting Group, has been in the logistics and distribution industry since 2009. She is presenting How to Predict & Analyze 2023 Accessorials at the upcoming PARCEL Forum in October. Navigo specializes in contract benchmarking, distribution analysis, and transportation spend management. Since 1995, Navigo has reduced its clients’ shipping costs by more than 20%. Stephanie can be reached at Stephanie@navigoinc.com or 562.621.0830.

This article originally appeared in the September/October, 2022 issue of PARCEL.