The e-commerce landscape has changed dramatically over the last two years. Retailers have had to balance the acceleration towards e-commerce and meeting consumers’ expectations of fast and free home delivery with rising rates, surcharges, and crippling volume constraints from national carriers that erode profitability and compromise customer satisfaction.

As retailers seek strategies to overcome these obstacles, what was already trending has now become crystal clear: Putting all your eggs in the single-carrier basket doesn’t work anymore.

Carrier diversity is a proven solution that can help retailers lower their costs, increase their flexibility and capacity, and meet consumer demands. Here’s why retailers should act now to diversify their carrier mixes to create a supply chain that sets them up for success.

Shipping Is Getting Even More Expensive

National carriers have generated billions of dollars during the e-commerce shift by prioritizing profits over partnerships. By their own admission, national carriers are focusing on revenue quality and selectively choosing volume that can maximize yield through GRIs, surcharges, and repricing customer accounts.

The Cowen/AFS Parcel Freight Index, which tracks parcel transportation pricing versus a January 2018 baseline, reached a record-breaking high of 27% in the second quarter of 2022, as fuel surcharges more than doubled from last year. Meanwhile, UPS saw a 5.7% revenue increase in Q2, despite a four percent decrease in average daily volume. The remainder of the year will continue to be expensive for FedEx shippers, based on the company’s recently-announced peak residential delivery surcharges for the holiday season, which can range from $1.25 to $6 for FedEx Ground and $2.25 to $7 for FedEx Express. UPS is expected to follow suit with a similar pricing structure.

Consumers Are Expecting Faster Home Delivery

As more consumers shift to e-commerce, fast and free home delivery has become a competitive differentiator for retailers. Seventy-four percent of consumers are choosing one retailer over another based on the availability of next-day delivery. Avid shoppers, or those who make six or more online purchases a month, are increasingly likely to shop with a new retailer that provides faster delivery options. In fact, 85% of avid shoppers indicated they would try a new retailer that offers next-day delivery.

Source: LaserShip survey with Hanover Research

Slow delivery also causes retailers to lose customers. Seventy-one percent of consumers consider slow delivery to be three or more days, and they will shop elsewhere to get their items delivered faster.

Source: LaserShip survey with Hanover Research

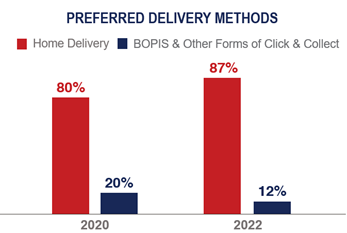

In addition to delivery speed, free shipping and home delivery continue to have a major impact on consumer shopping decisions. Seventy-five percent of consumers say that free shipping has a major influence on where they choose to shop in 2022, up nearly 20% from 2021. While many retailers invested in buy online, pick up in-store (BOPIS) and other forms of click-and-collect during the pandemic, an overwhelming 87% of consumers still prefer to receive their items at home. Sixty-four percent of consumers that use BOPIS are driven to do so to avoid paying for shipping.

Source: LaserShip survey with Hanover Research

Single-carrier shipping strategies have proven unable to provide the service that retailers need to satisfy consumer expectations. Retailers need to pursue an alternative that can provide fast and free home delivery while helping them protecting their margins. The days of relying solely on one carrier are long gone. If retailers want their businesses to thrive, the shift to diversification needs to begin right now.

Josh Dinneen is Chief Commercial Officer at LaserShip/OnTrac.

This article originally appeared in the September/October, 2022 issue of PARCEL.