If you missed Part One of our survey, click here.

Dozens of shippers (commanding approximately $3.5 billion in aggregate annual shipping spend) participated in Shipware’s live parcel pricing and benchmarking survey at the 2022 PARCEL Forum in Chicago. Participating shippers responded anonymously to survey questions based on ranges. Technology-enabled and totally blinded to avoid confidentiality concerns, the survey was designed to help shippers better understand how their pricing compares to other shippers. Moreover, all survey responses were cross-tabulated by industry, company revenues, primary carrier, and annual parcel volume/spend for more meaningful correlations.

Part One covered demographics, negotiating histories, and best practices. Part Two delves into actual discounts and incentives, as well as the shipper’s relationship with their carrier rep.

While no shipper would ever knowingly leave money on the table, some shippers have clearly done a better job than others when it comes to negotiating the most favorable rates and terms. Find out if you’re one of them by reading the results below!

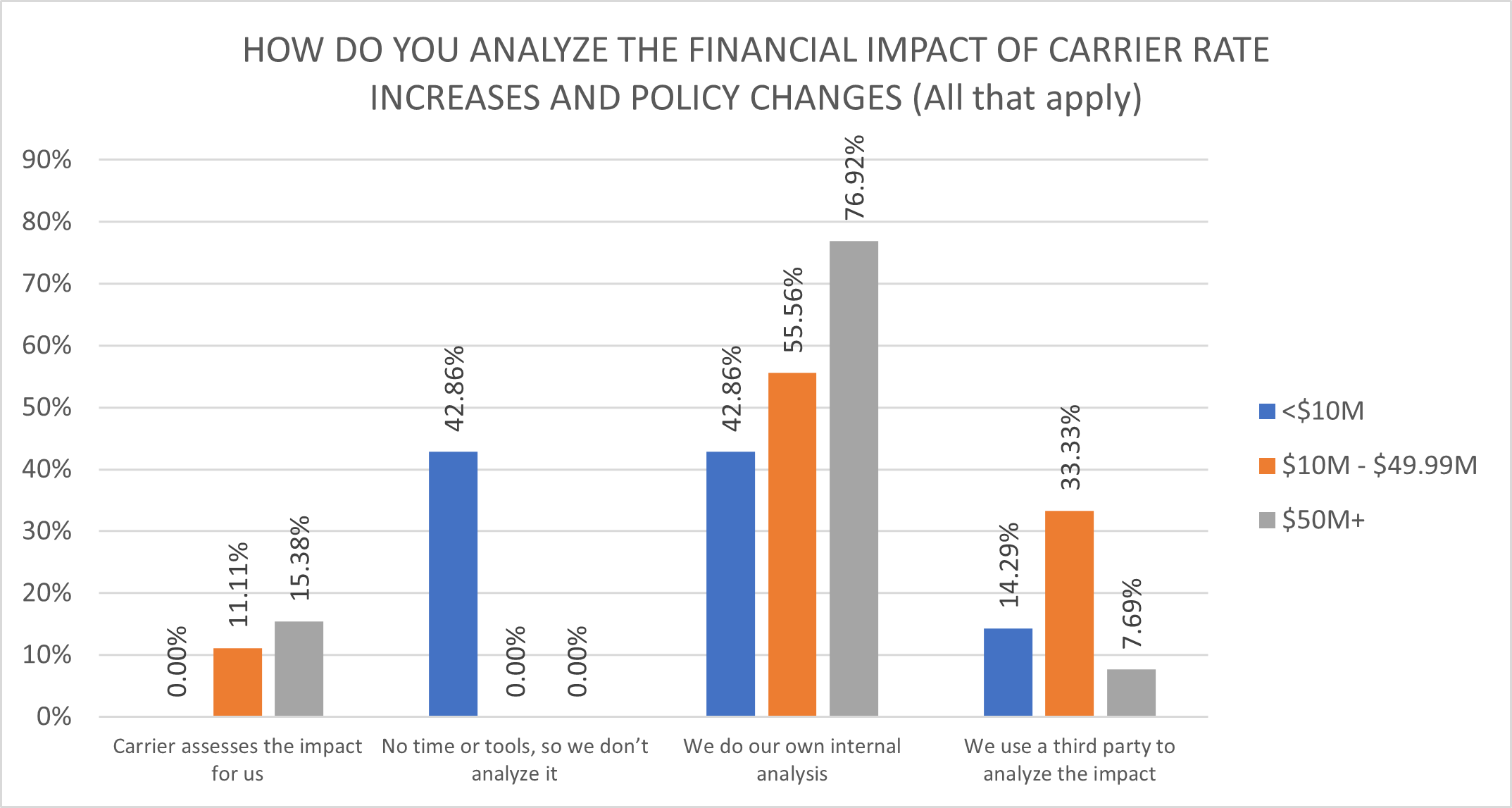

ANALYZING FINANCIAL IMPACTS

Analyzing the financial impact of carrier rate increases, policy changes, and contractual modifications is vital to negotiating the best possible discounts, but some shippers lack the necessary expertise and ability, or report just not having the time to do it. In fact, 11.11% of medium shippers ($10M-$49.99M in annual parcel spend) and 15.38% of large shippers ($50M+) rely on their carrier rep to tell them the value, and 42.86% of smaller shippers (less than $10M) don’t analyze it at all. Carrier pricing processes are intentionally opaque, even for your carrier rep, which can cause an imbalance of power in the negotiation. Take back some of that power by quantifying any changes using your own independent analysis.

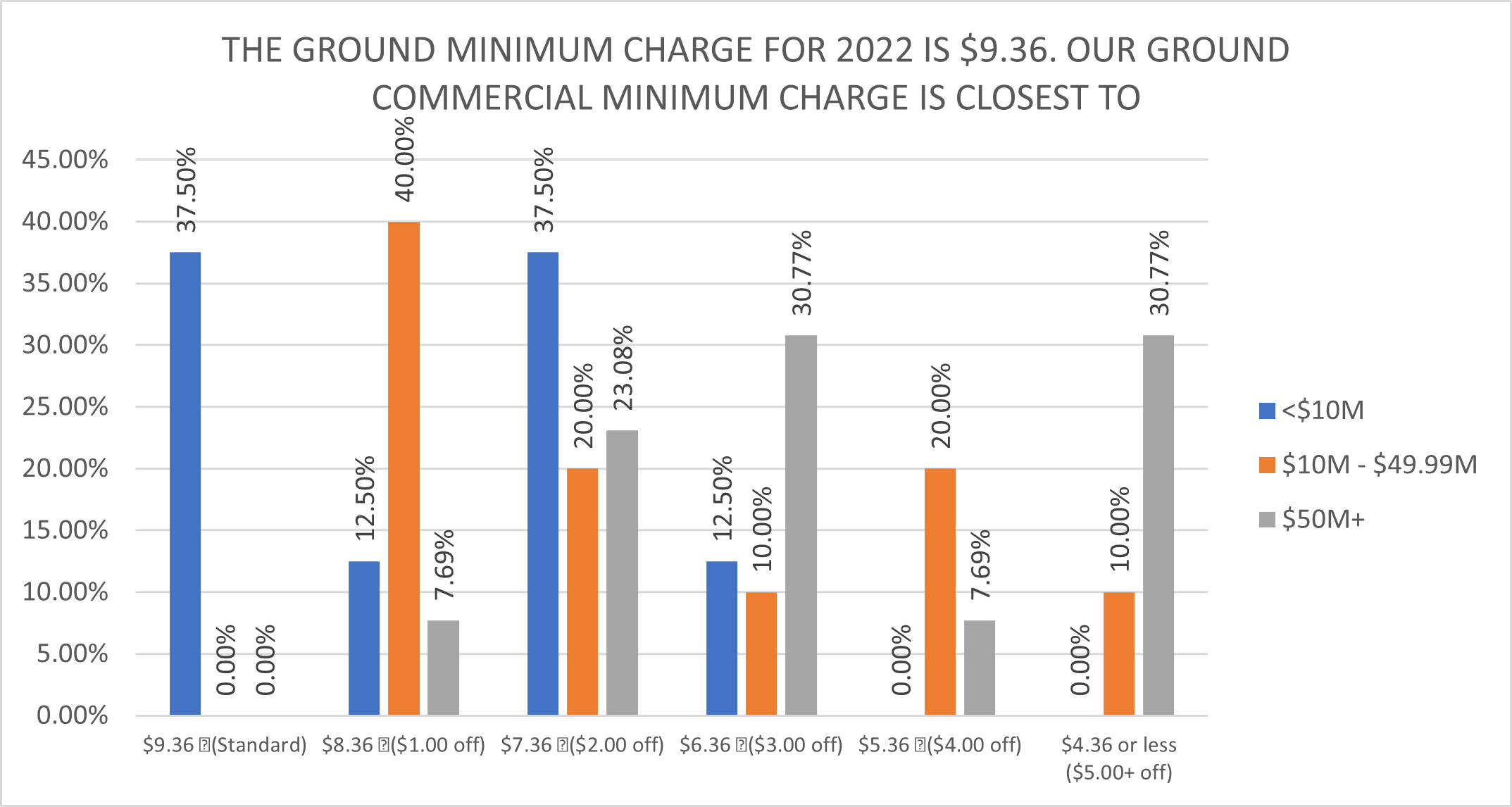

MINIMUM CHARGE ADJUSTMENTS

Most carrier contracts include minimum charges, the lowest amount a carrier will accept for a given type of package. For both FedEx Ground and UPS Ground, the most common minimum is the current published rate for a Zone 2, 1 pound package. When this survey was administered in 2022, the minimum charge was $9.36. In 2023, shippers pay at least $10.10 for every Ground package (not including surcharges), unless they negotiate a minimum charge reduction. For packages weighing 10 pounds or less, the net rate a shipper pays is often dictated more by the minimum charge adjustment than the discount.

Commercial Ground Services

For commercial Ground services, the smaller shippers in the survey (<$10M) ranged from no minimum charge adjustment to $3.00 off, while larger shippers reported adjustments of up to $5.00 off or more.

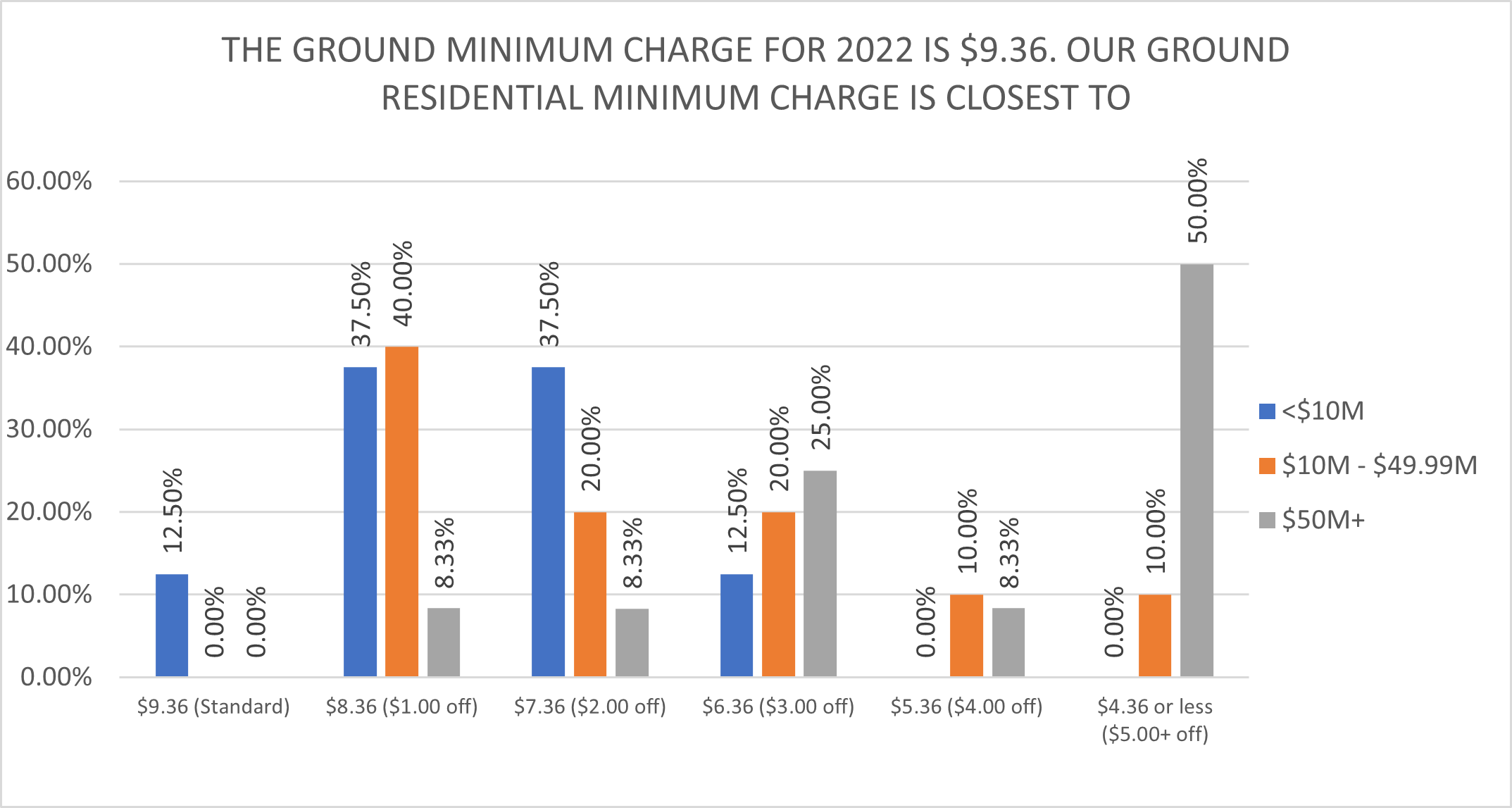

Residential Ground Services

The mix changes somewhat for residential Ground shipments, especially for the largest and smallest shippers in the survey, with residential Ground minimum reductions trending larger than for similar commercial Ground shipments.

BASE RATE INCENTIVES (aka, service-level incentives)

The base rate is the service-level charge before any accessorial charges or surcharges are applied. Due to low utilization and to save space, three-day products, FedEx Ground Economy (SmartPost), and UPS SurePost are excluded from this article despite being included in the survey.

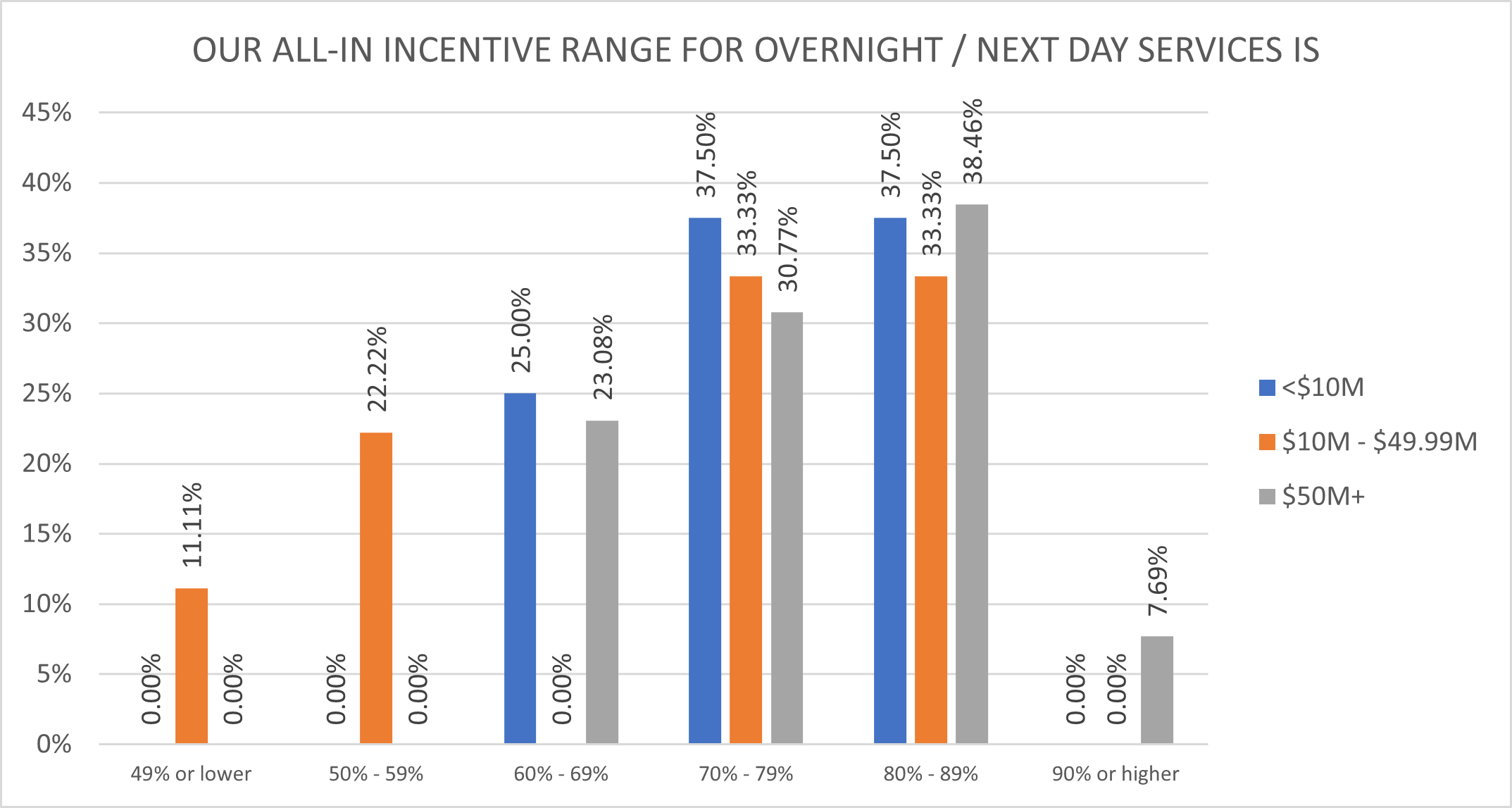

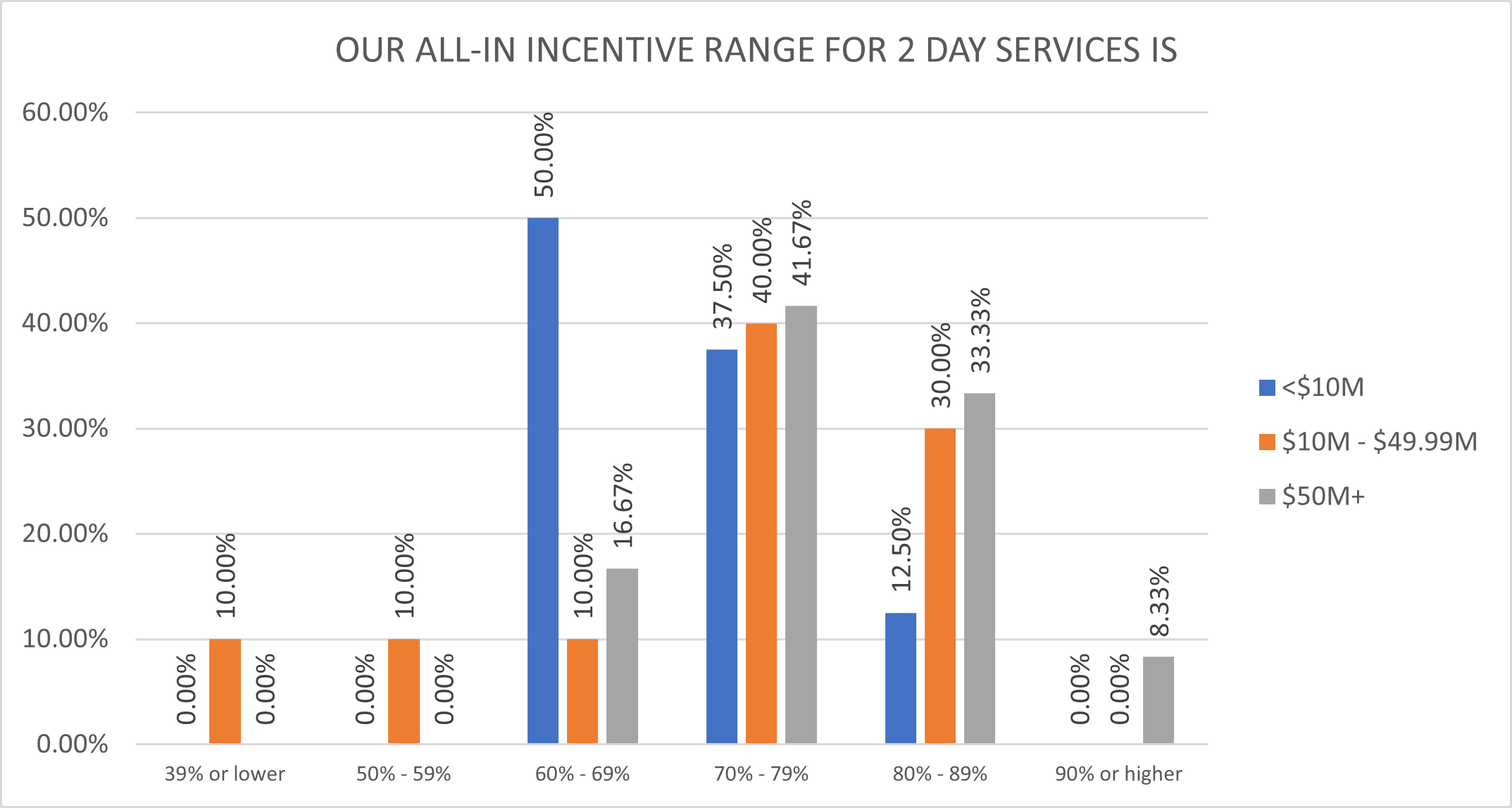

1-Day and 2-Day Services

(FedEx Overnight, UPS Next Day Air, FedEx 2Day, UPS 2nd Day Air)

While the largest shippers had the highest discounts and the smallest shippers had the lowest, there is a noticeable trend toward the middle, regardless of shipper size. Questions about applicable minimums are planned for the 2023 survey.

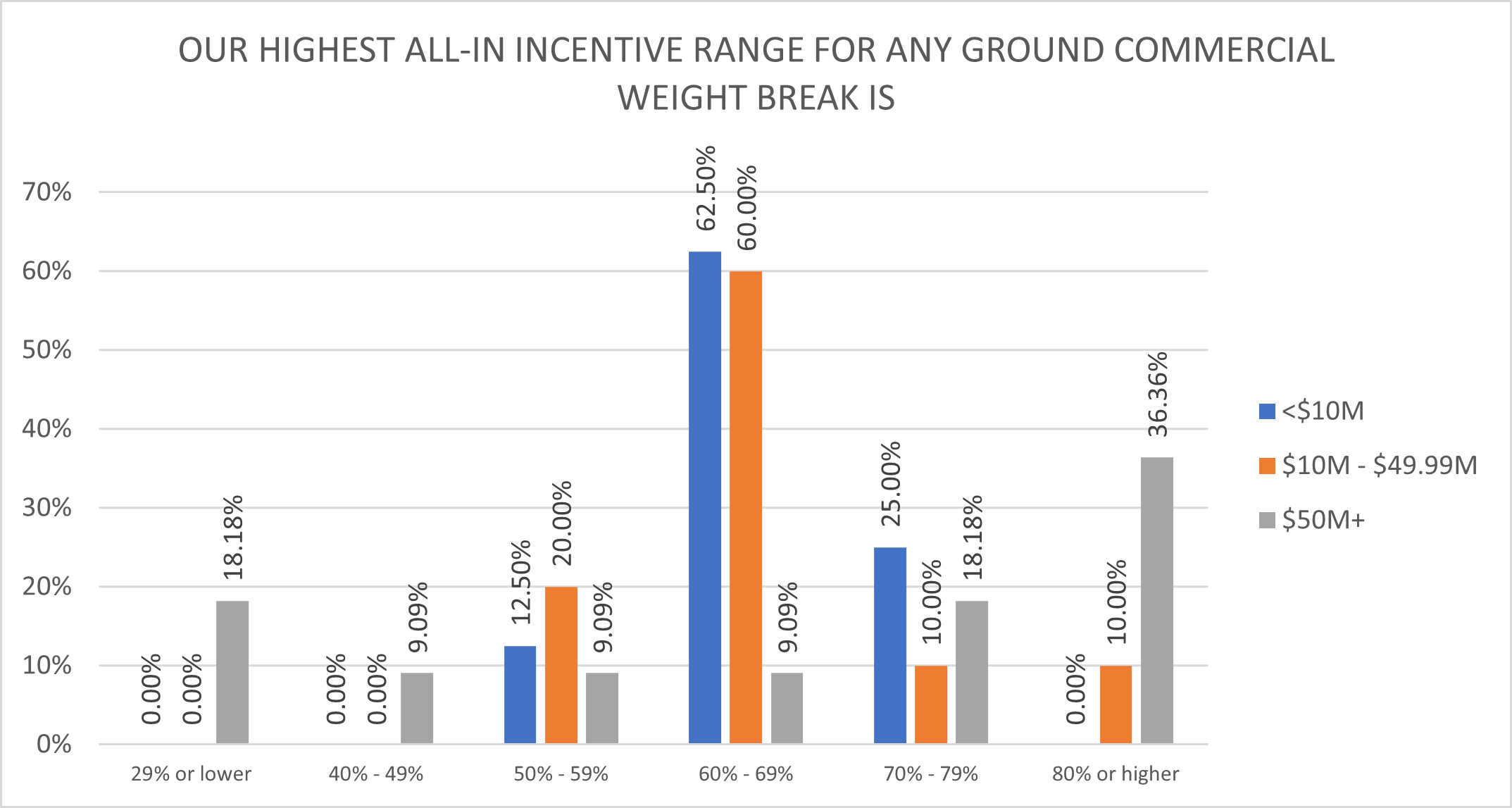

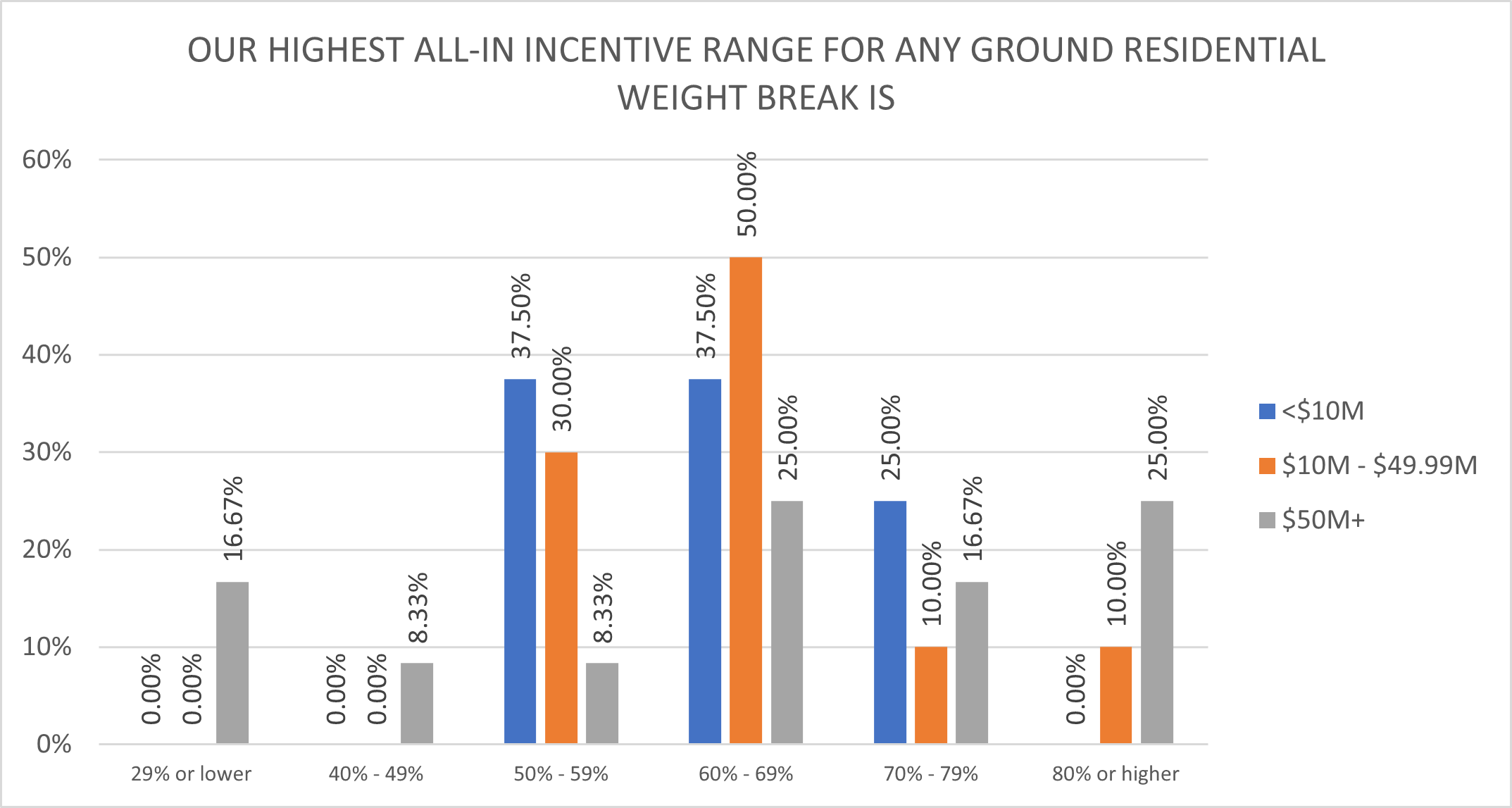

Ground Services

With effective incentives on the lower weights mitigated heavily by minimums, we collected the highest all-in incentives for both commercial and residential Ground services. Discounts typically drop about 10 points between the highest and lowest weight breaks. For example, a response of 70% to either of the following two questions suggests that packages 31 pounds and heavier receive a total incentive of 70%, while packages weighing five pounds or less have a total contractual incentive of around 60%.

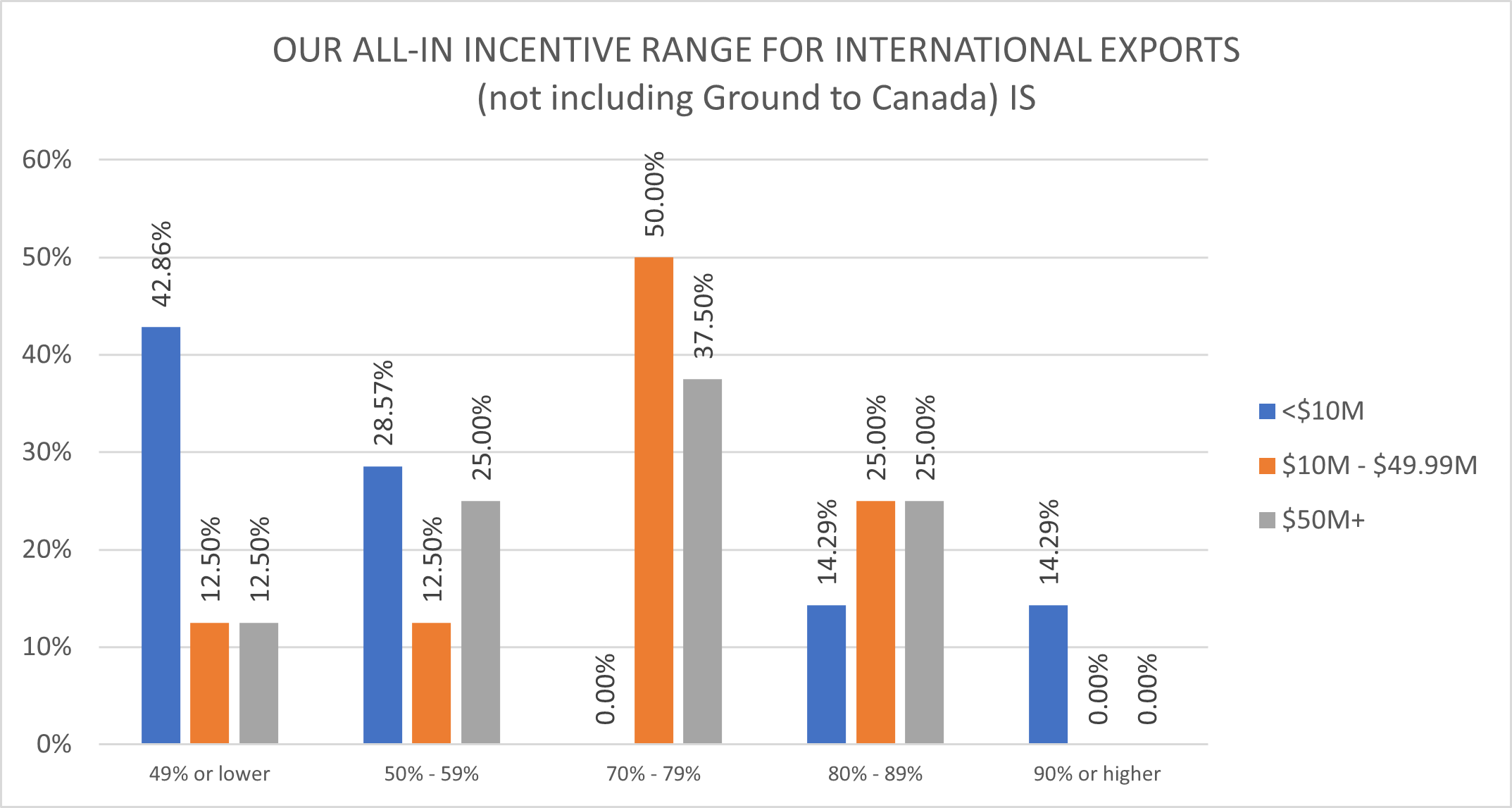

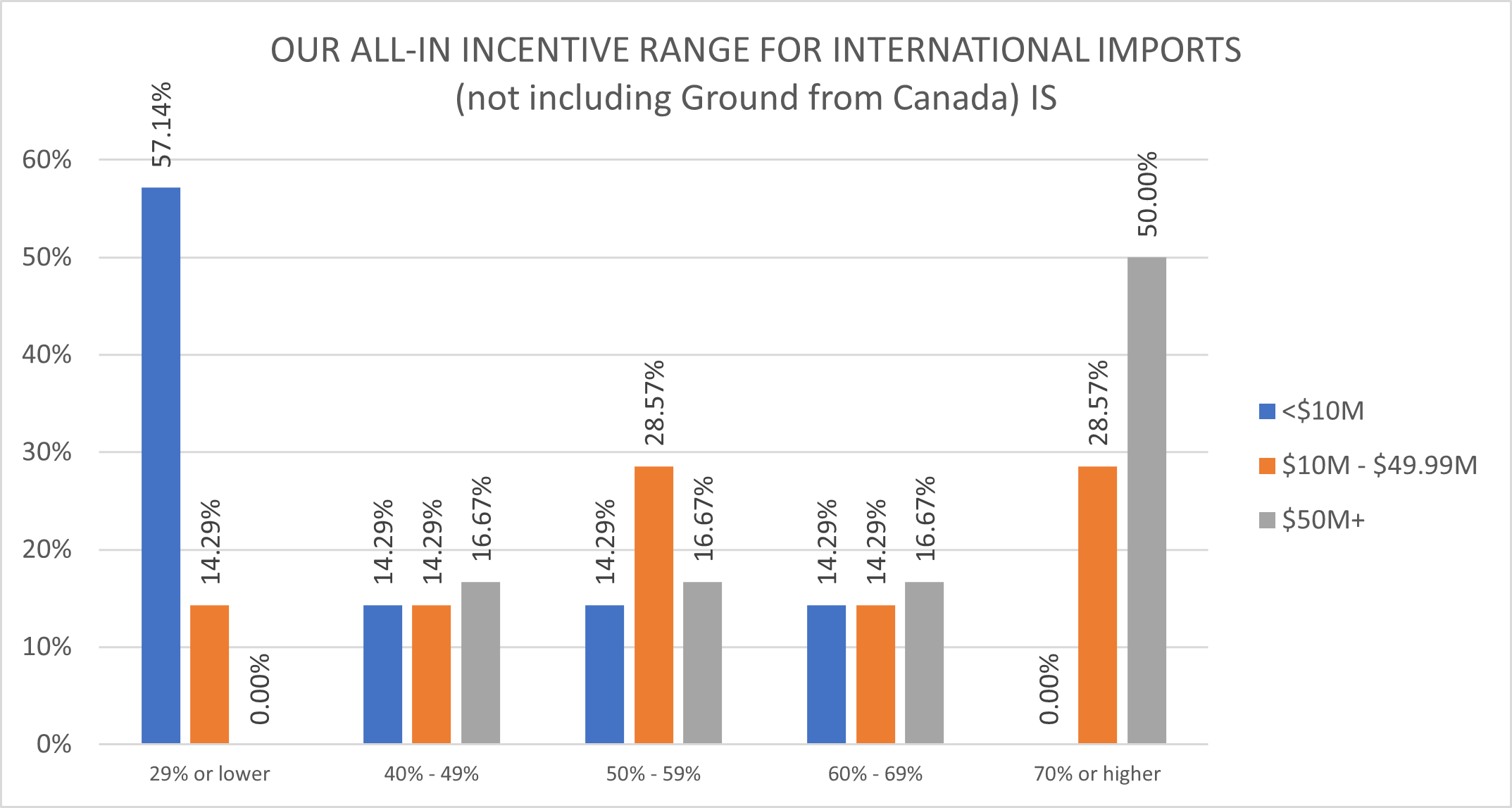

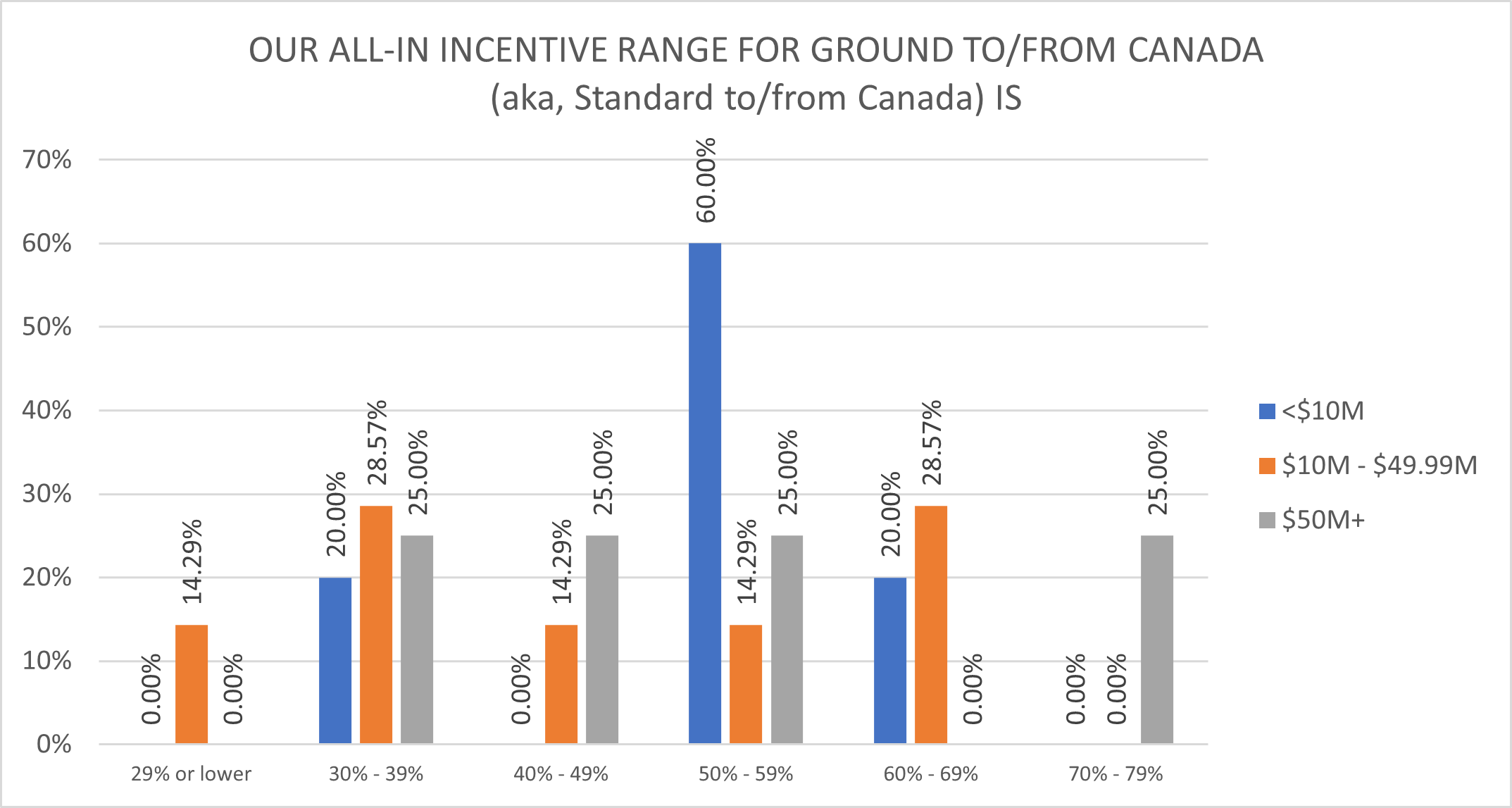

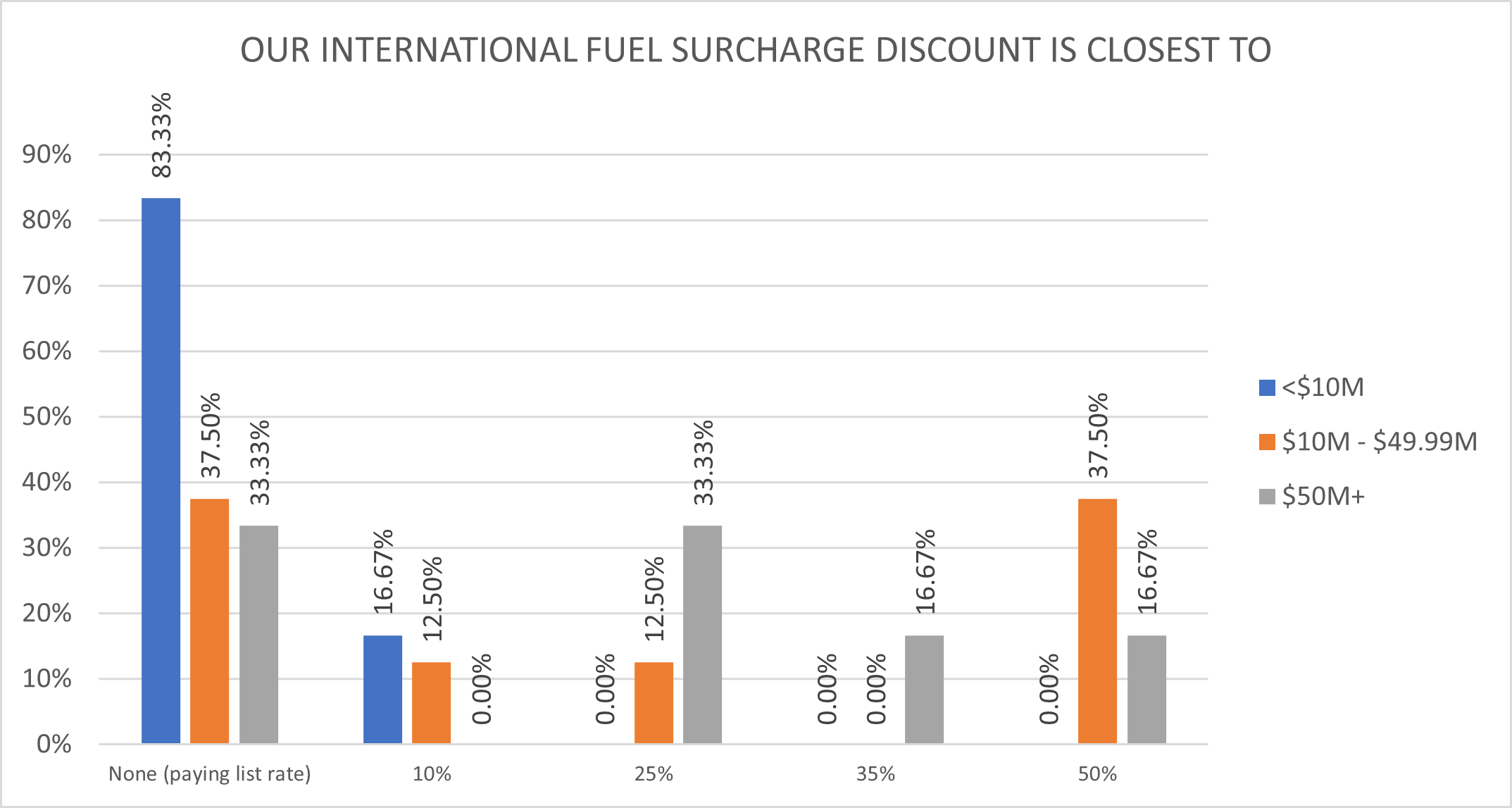

(Express/Air Import and Export Services, Canada Ground Services)

FedEx and UPS have more direct competition for shipments into and out of the US, which can lead to wide differences in incentive levels. For example, a $5M shipper that sends mostly export packages could easily have a higher incentive than a shipper ten times their size that ships mostly within the United States. Unlike the faster services, standard brokerage charges are not included in the price for ground shipments to and from Canada, which is priced differently as a result. Minimums still apply to international shipments, but usually differ by zone for each service level.

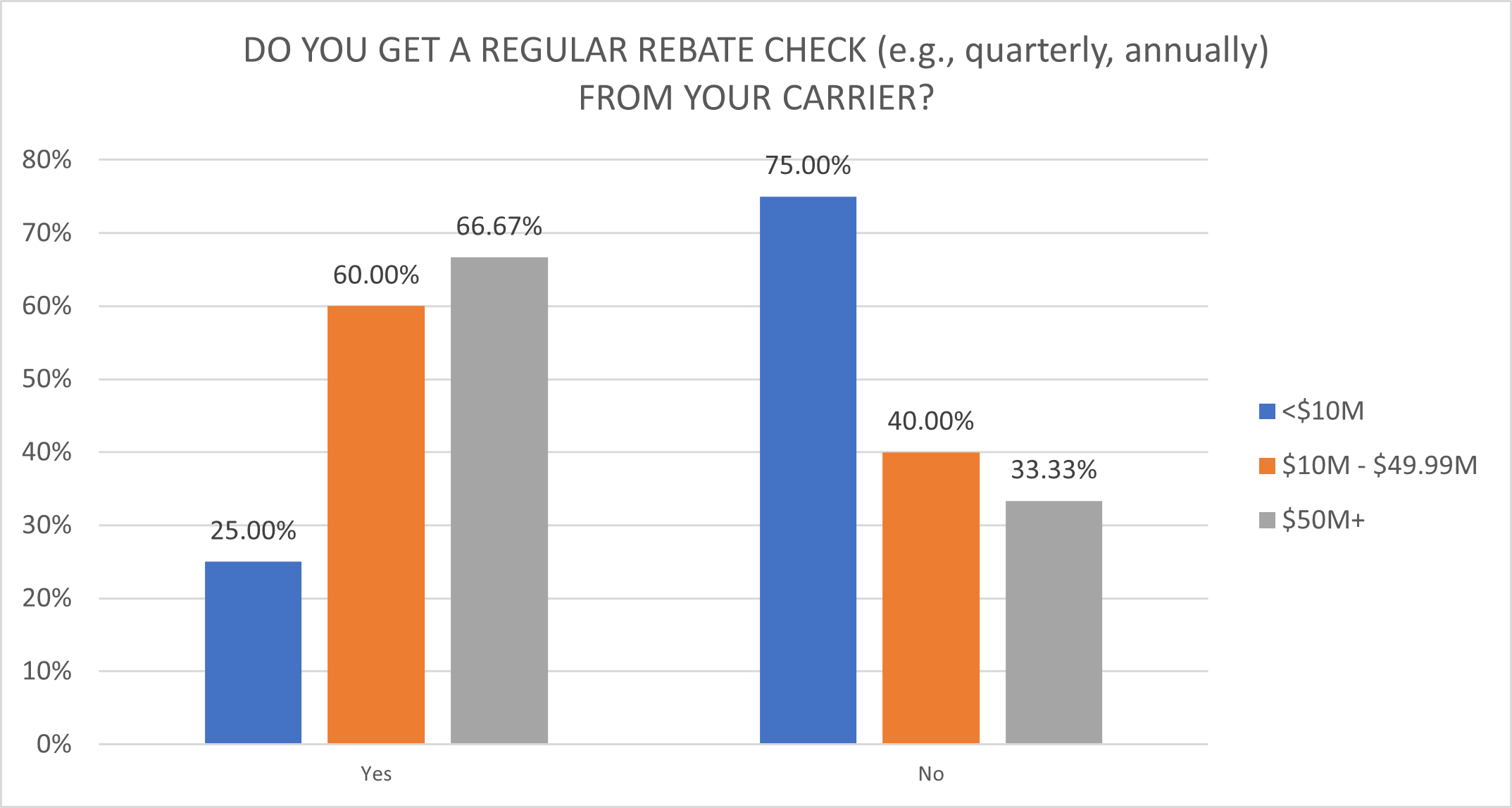

Deferred Incentives (aka, Rebate Checks)

In addition to discounts applied at the time of shipping, some shippers receive a deferred incentive, usually based on quarterly performance. The value of a deferred incentive varies by two factors, even if the percentage is the same:

- Whether it applies to gross or net package spend

- Whether or not it is limited by service-level minimums

Most deferred incentives require the shipper to reach certain spending tiers (aka, earned discount tiers or revenue bands). Tracking performance to these tier commitments is easy for a gross deferred, since it uses the same rolling average provided on the weekly carrier invoice, but almost impossible for a net deferred. Plus, a gross deferred is an additional incentive off the published packages charge, while the net deferred is applied to the smaller net amount remaining after the weekly incentives are applied.

Deferred incentives subject to minimum charges will not pay out below the applicable minimum charge, often diminishing the value of the deferred incentive significantly.

Carriers may offer a deferred incentive to shippers of any size, but they become more likely as parcel spend increases.

DISCOUNTS ON SURCHARGES AND ACCESSORIAL FEES

Accessorial fees apply when a shipper requests additional services or features like capturing a signature, offsetting carbon emissions, delivering certain services on Saturday, or having a regularly scheduled carrier pickup. Under the right circumstances, it is possible to negotiate a discount on any of these fees.

Surcharges are applied based on a package characteristic. Any trait straying from the carrier’s ideal is potentially subject to these charges. Triggers include size, weight, longest side, second-longest side, packaging material, shape, ZIP code, residential delivery designation, and many more. In fact, costs for some packages have almost tripled since 2015, with surcharges accounting for almost 90% of that increase. If FedEx and UPS can isolate a package characteristic, they can also charge for it. But if FedEx and UPS charge for it, you can ask for a discount on it.

A few additional things worth noting:

·Accessorials and surcharges are not included in the annual General Rate Increase estimates released by the carriers.

·Accessorials and surcharges are not typically included in negotiated rate caps.

·Some surcharges (e.g., fuel surcharge, third-party billing fees) are calculated as a percentage of many or all other charges applied to the package.

·New surcharges are especially profitable for the carriers since almost every shipper will pay the full rate for months before negotiating a discount.

·Discounts on accessorials and surcharges are often more polarized than incentives on base charges. Larger shippers tend to get more and better discounts than smaller shippers.

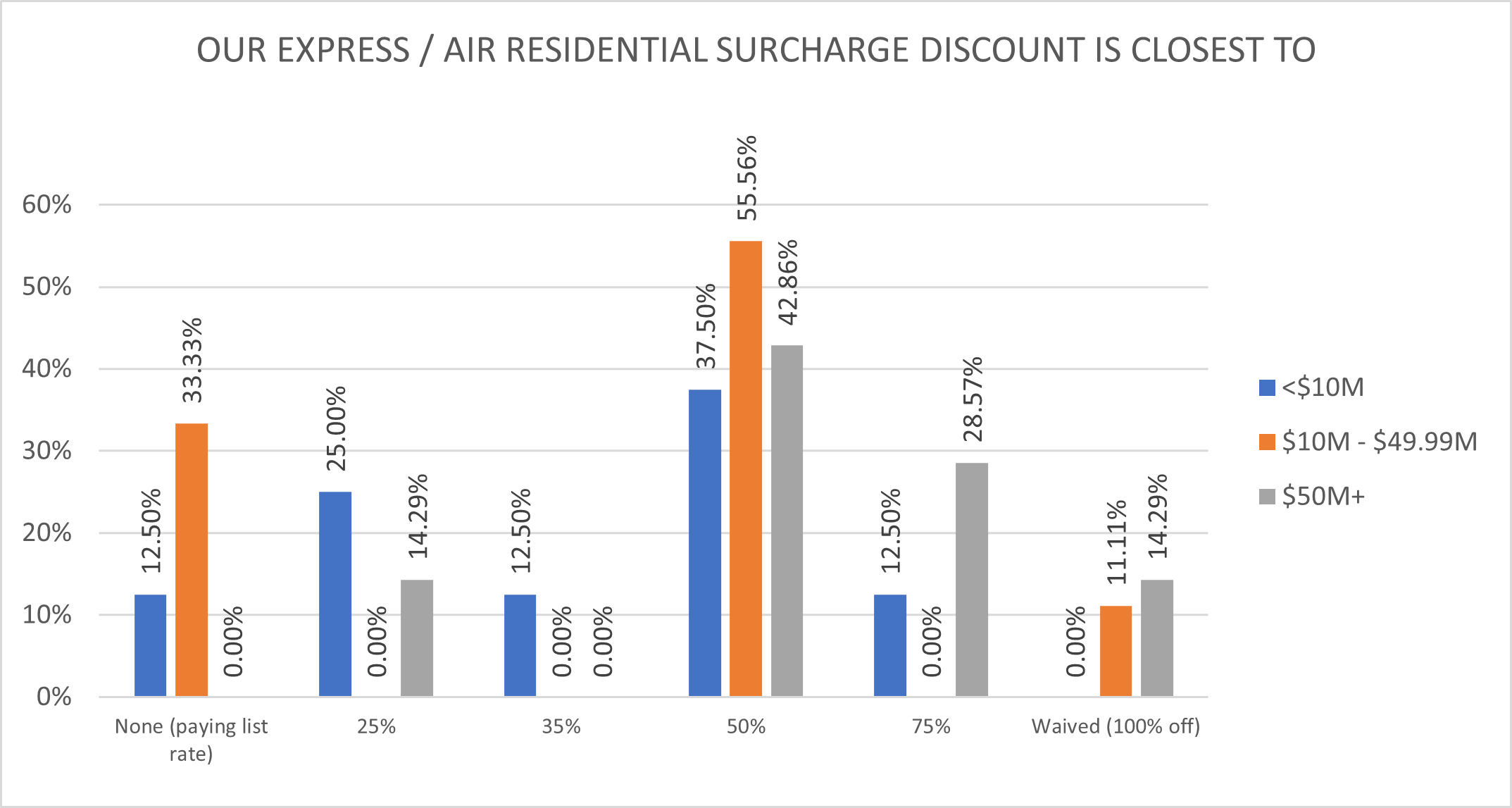

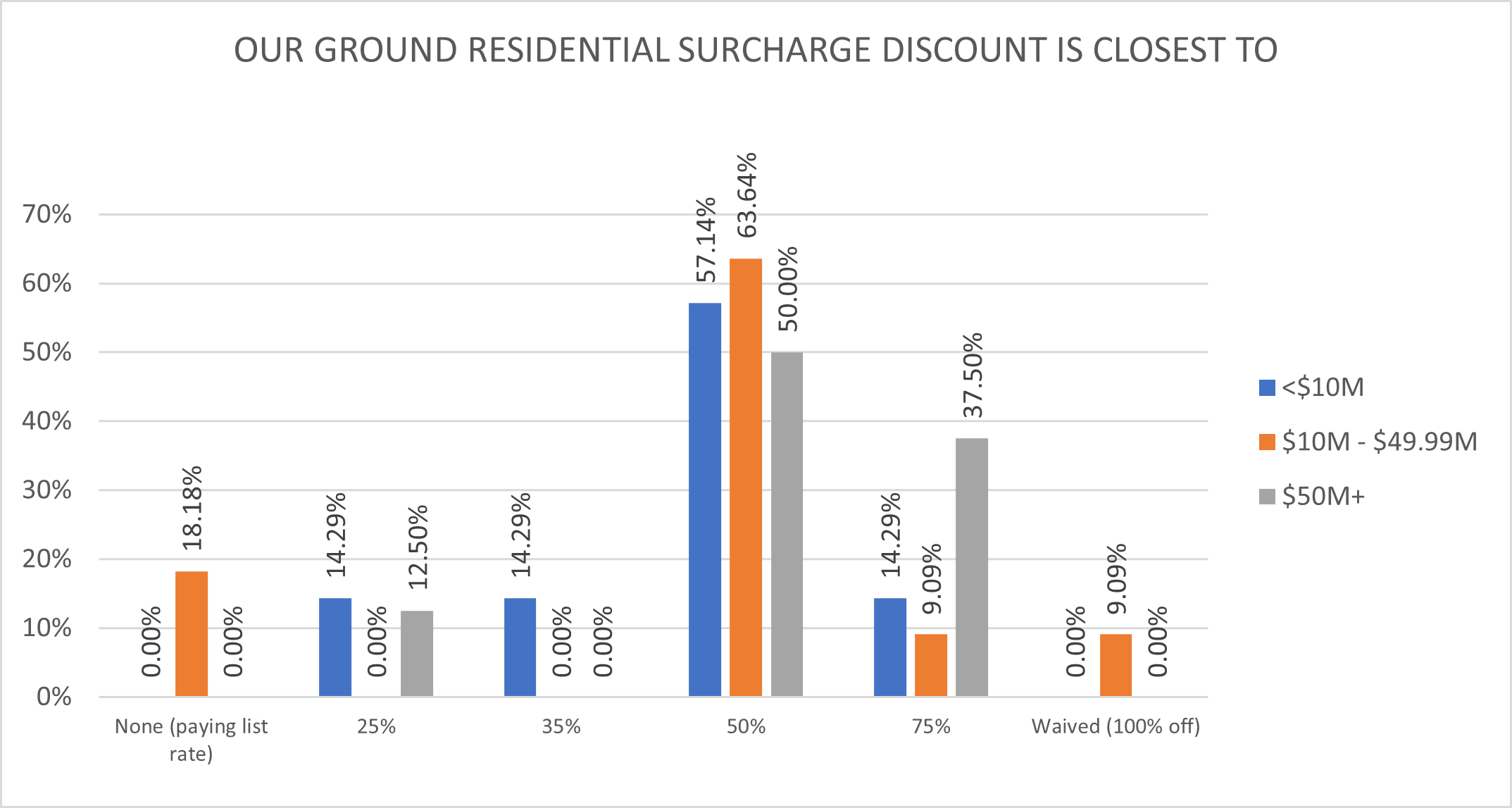

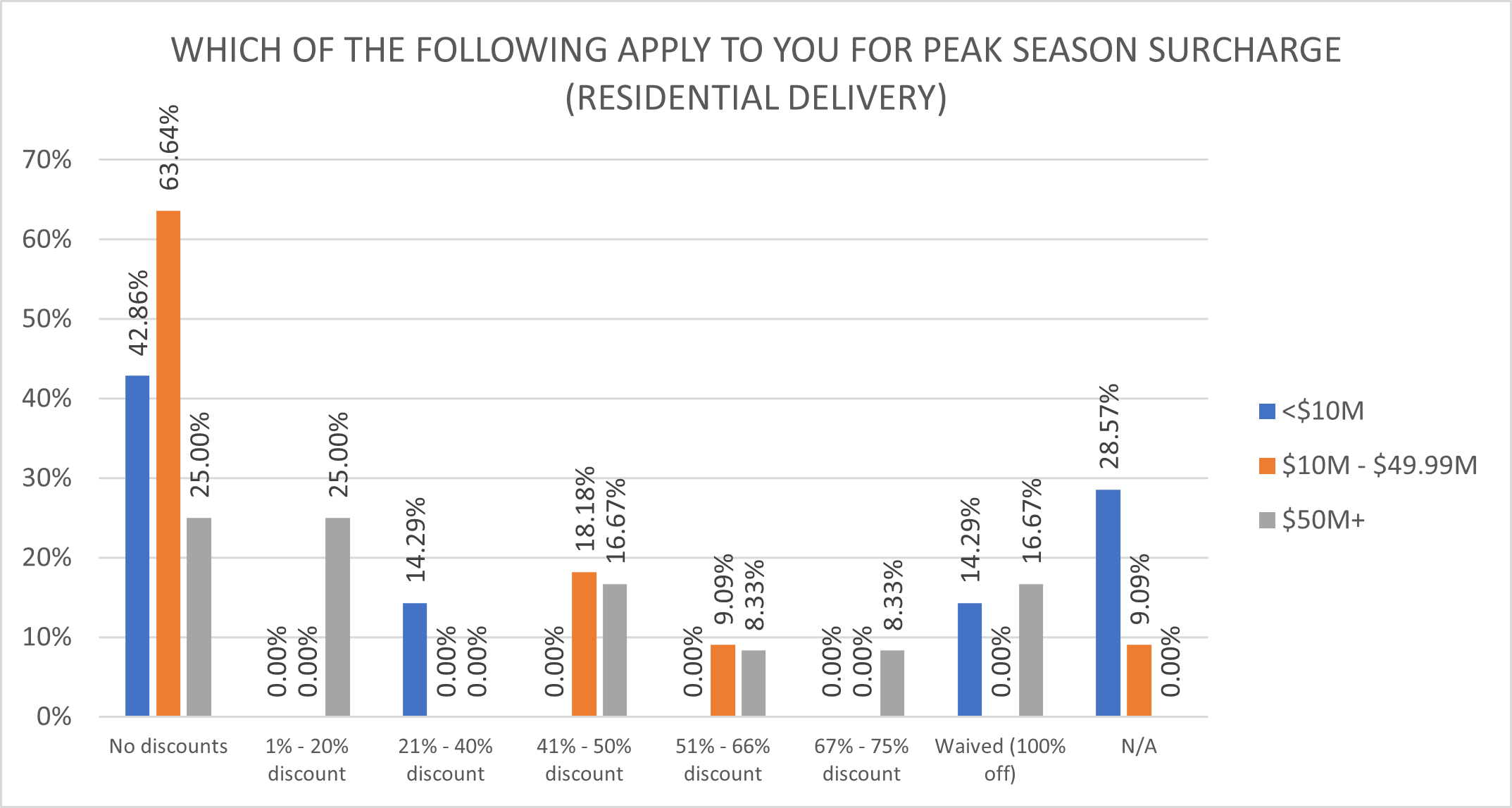

Residential Surcharges

For Express/Air shipments, FedEx charges slightly less for residential deliveries in 2023 than UPS, $5.80 versus $5.85. The comparison for Ground packages is not as easy. UPS charges $5.25, while FedEx charges either $5.15 or $5.50, depending on how the shipper processes the package (for the cheaper surcharge rate, choose the FedEx Home Delivery service).

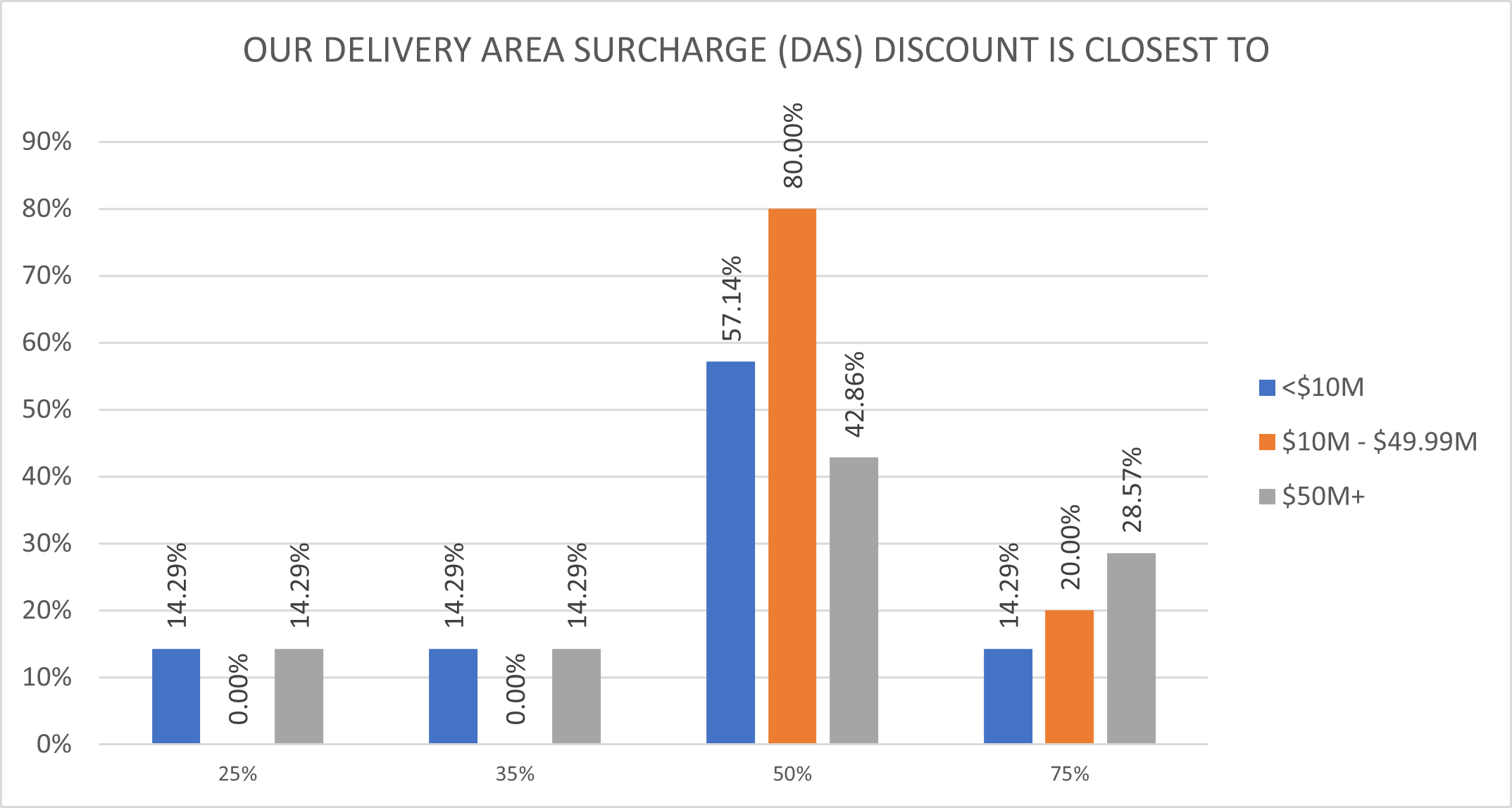

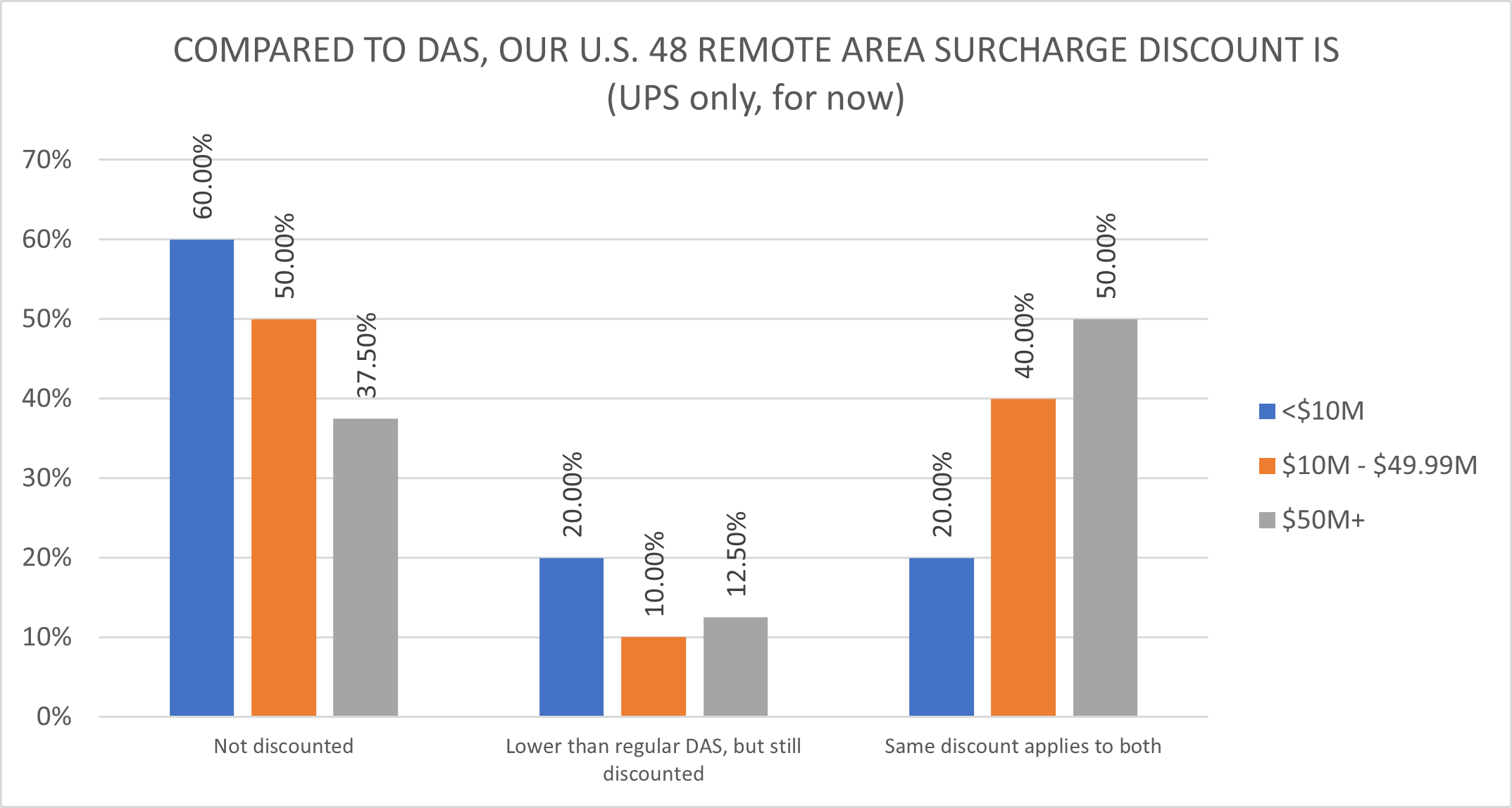

Destination/Delivery Area Surcharges

These charges apply to packages sent to ZIP codes identified by the carriers as rural or super-rural. The amount of these charges varies by service and residential/commercial designation, but the same discount percentage often applies. In 2022, UPS added an expensive new surcharge, U.S. 48 Remote Area Surcharge, for ZIP codes it considers extra-super-rural. FedEx followed with their new Remote Surcharge for the 48 contiguous states effective January 30, 2023.

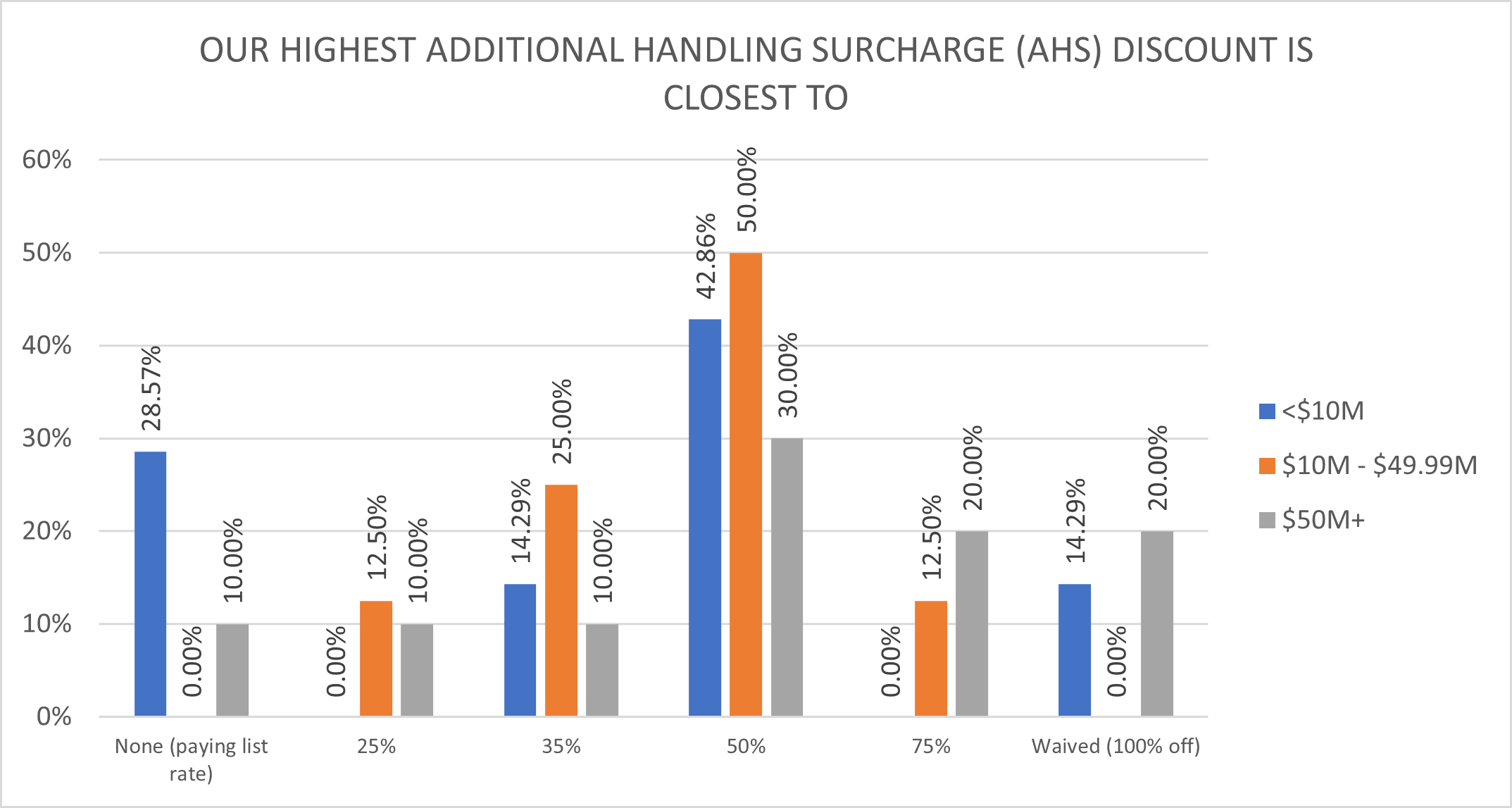

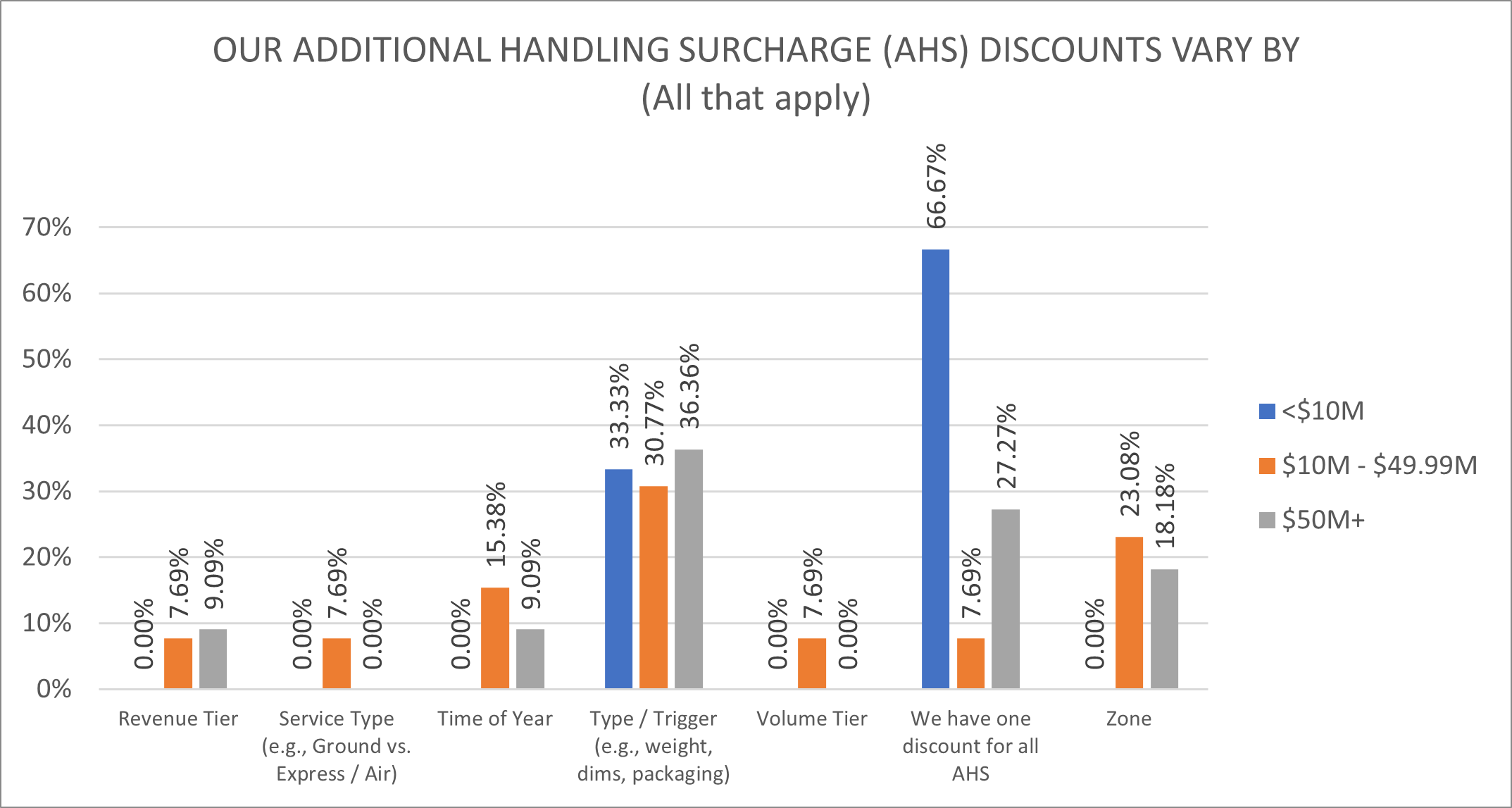

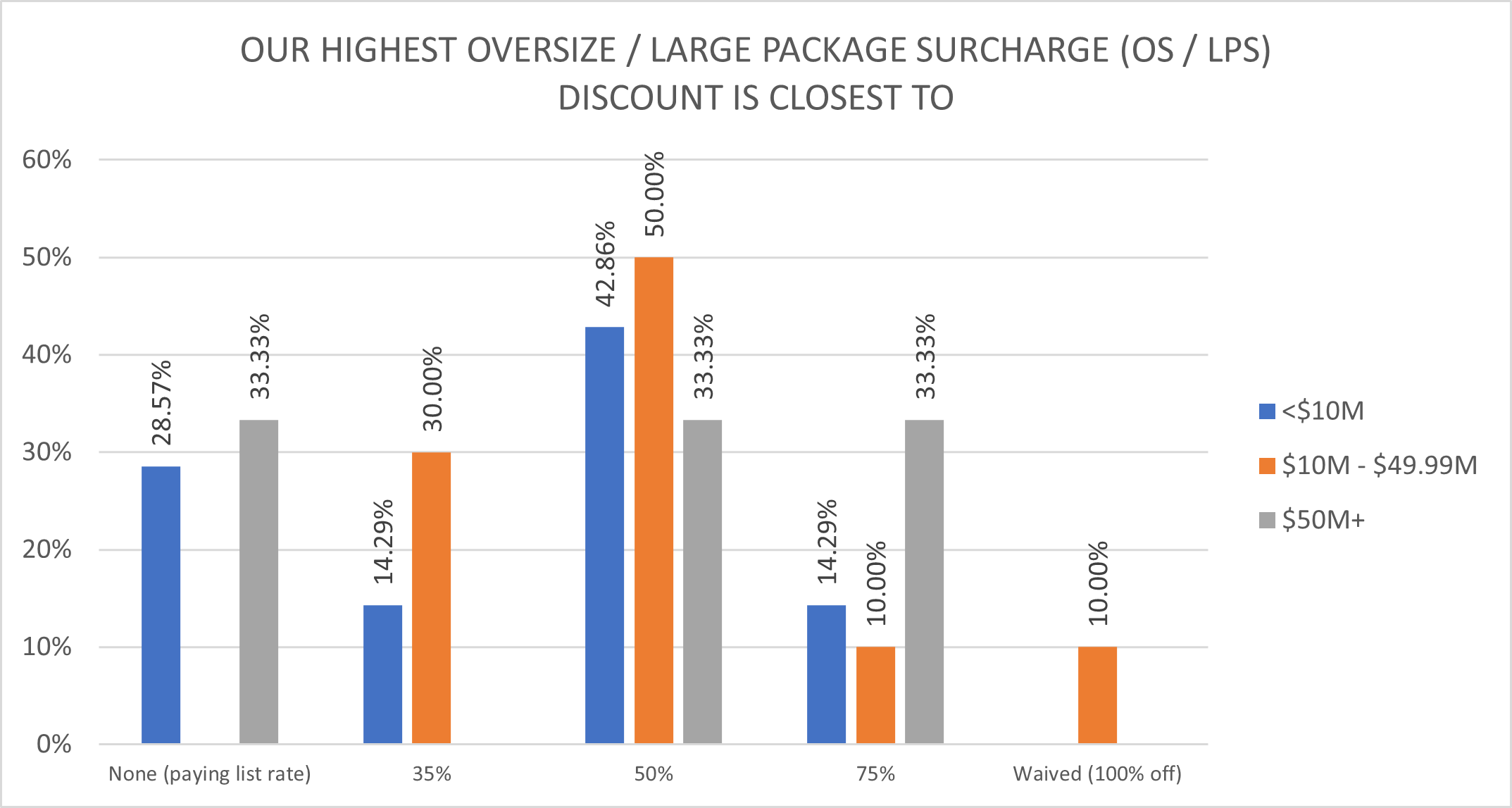

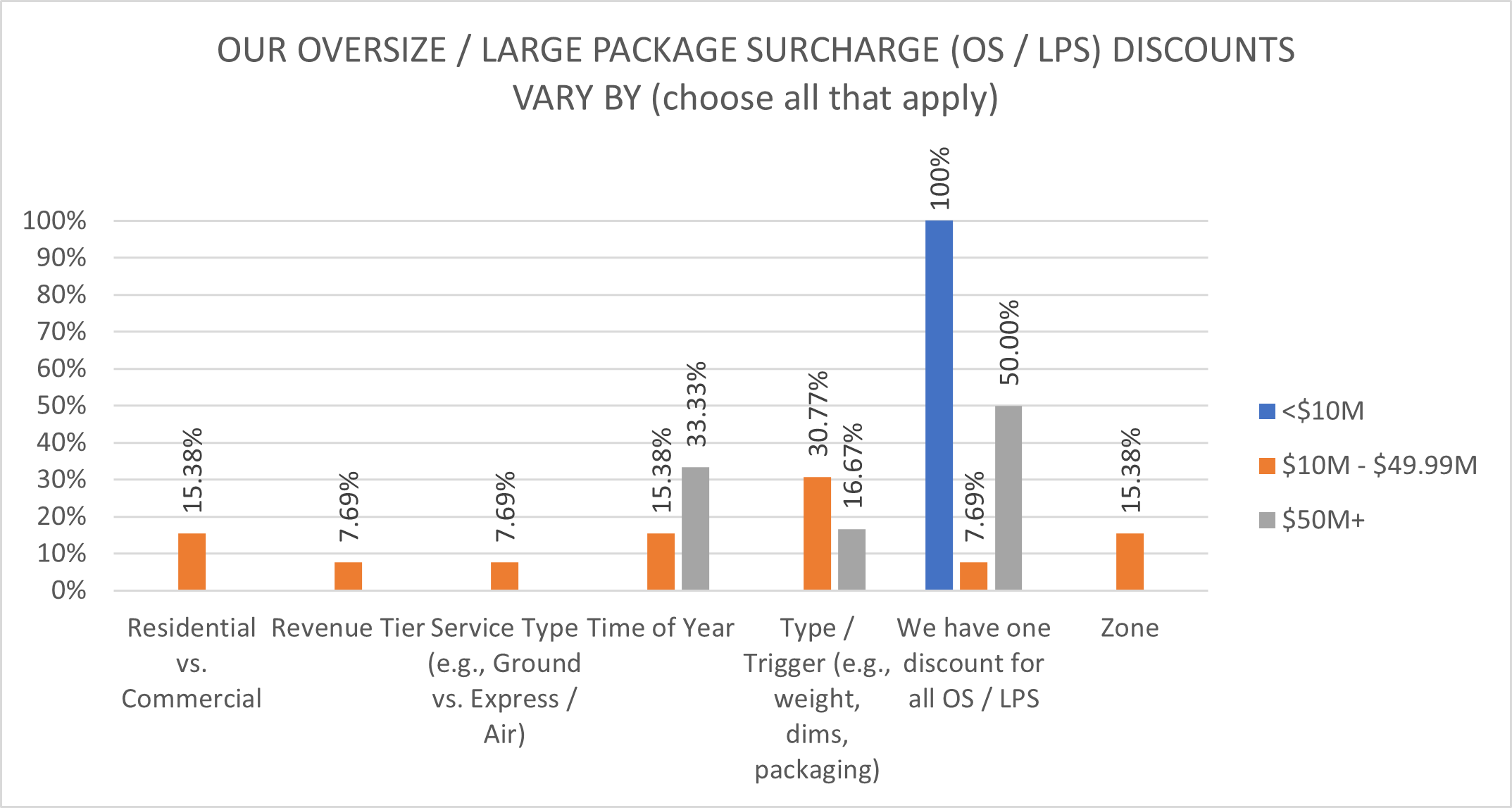

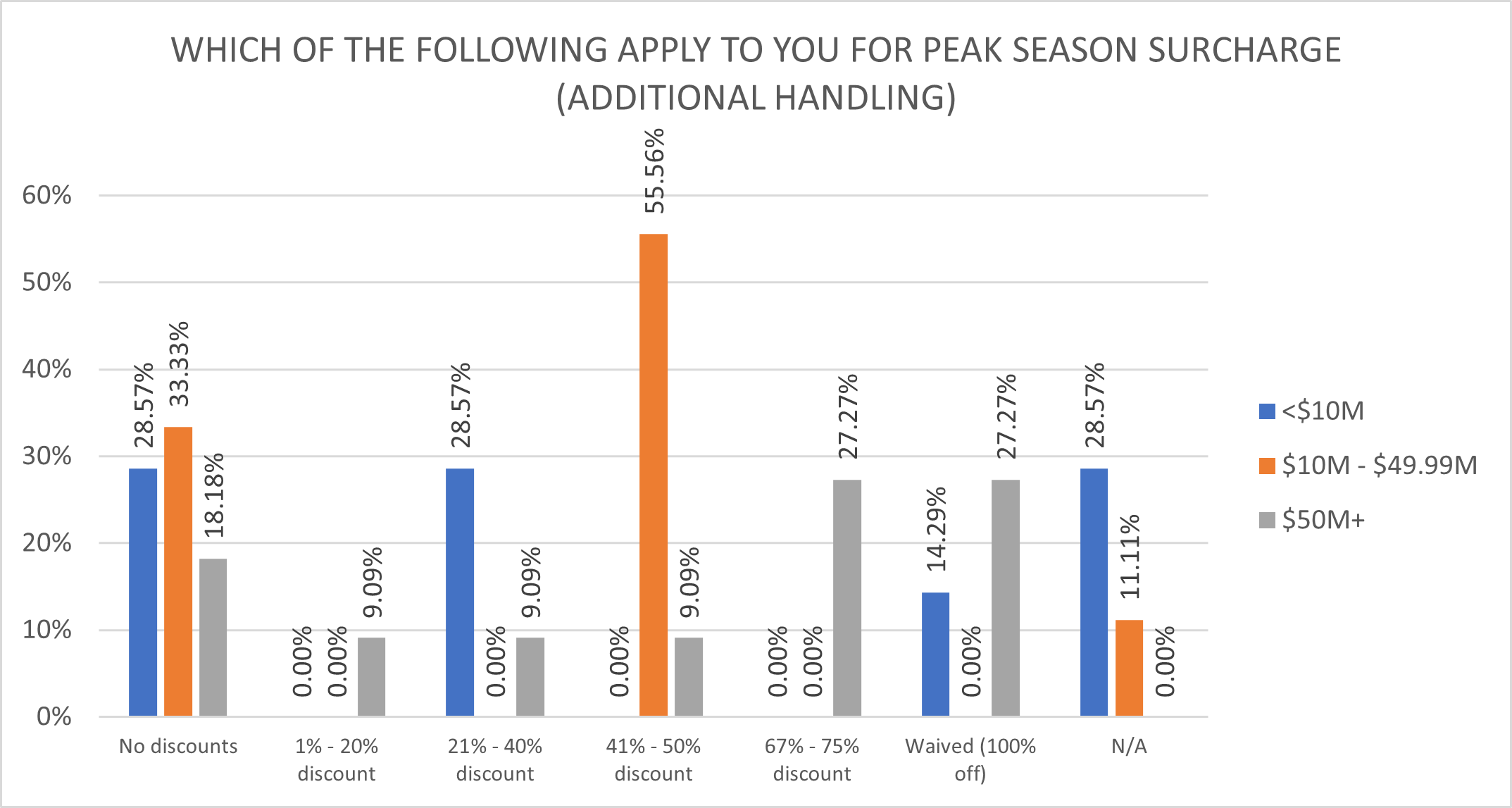

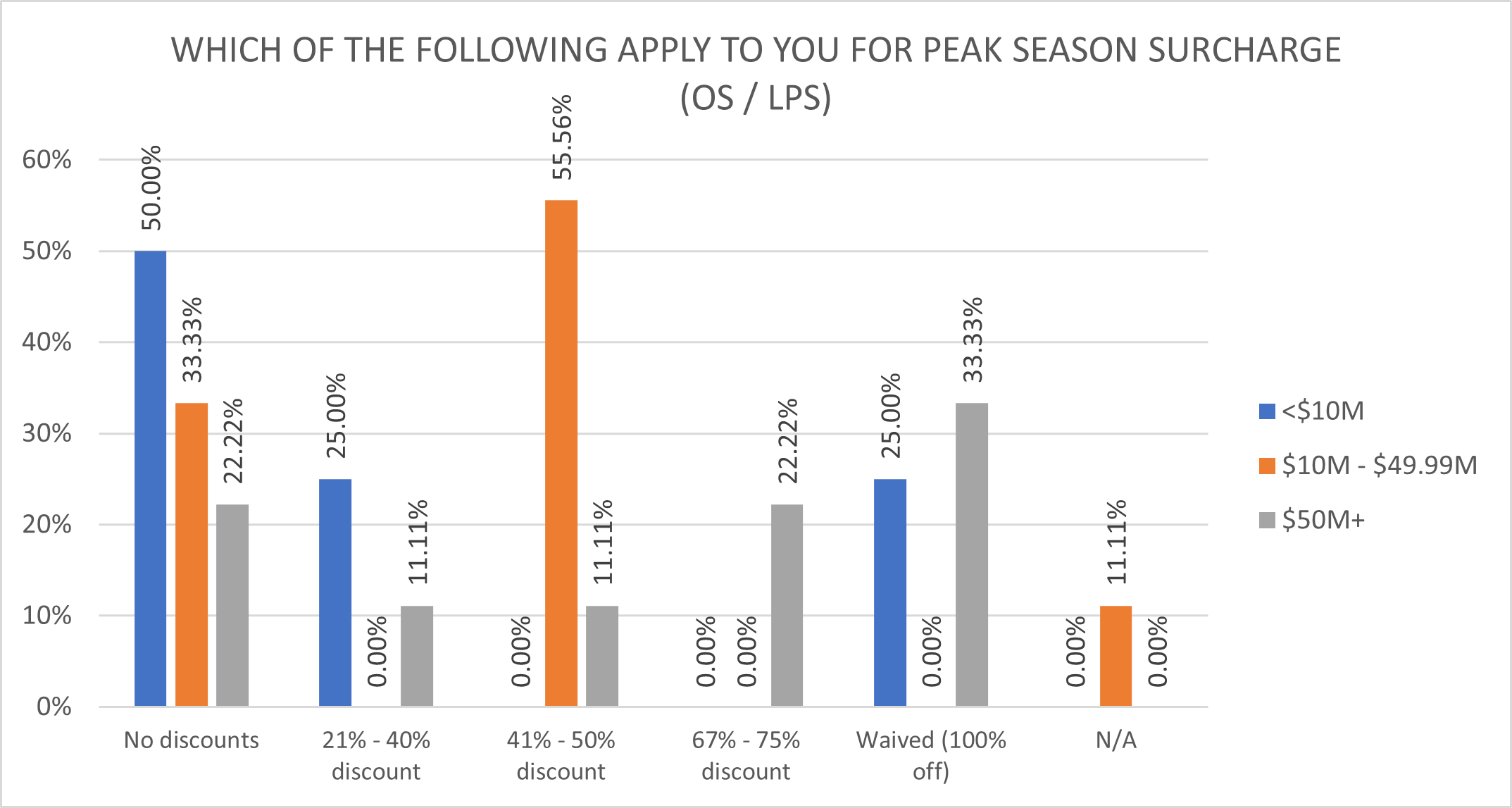

Size- and Weight-Based Surcharges

Additional Handling charges and Oversize/Large Package Surcharges have evolved dramatically over the past ten years, with new triggers being introduced and old triggers becoming more restrictive. A zonal element was also added, increasing costs even more for shipments sent longer distances.

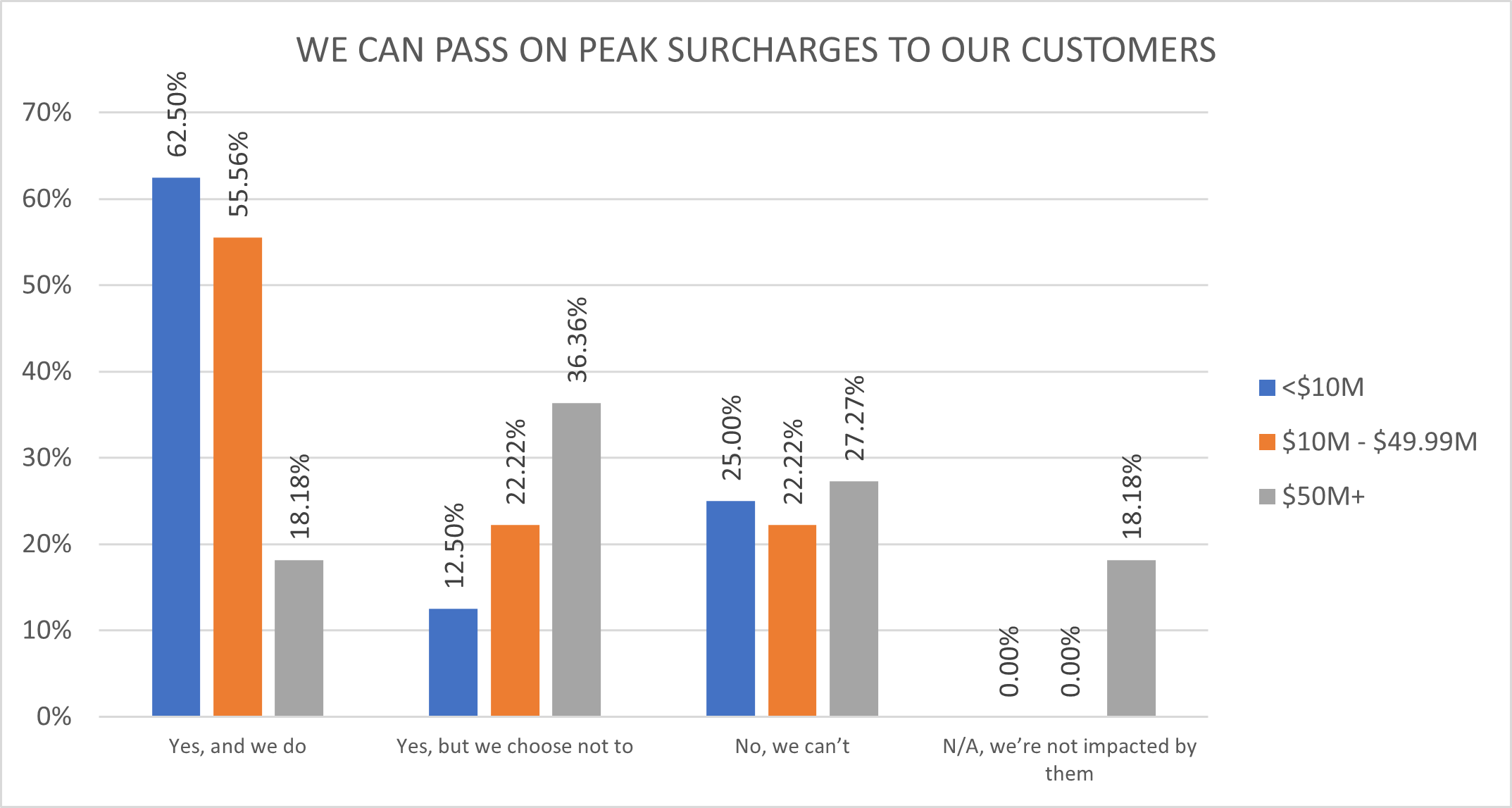

Peak/Demand Surcharges

Originally implemented to offset the additional costs carriers incurred to stretch their networks during the Q4 holiday season, they were also sold as necessary to keep packages moving during the Covid-19 pandemic. Unfortunately for shippers, the carriers’ stock prices have become addicted to the profit they generate. In 2022, despite shrinking demand for their services, UPS kept Peak Season Surcharges in place all year for packages eligible for an Additional Handling or Large Package surcharge. FedEx followed suit in 2023, extending timelines indefinitely for Additional Handling and Oversize charges. Despite demand being even lower in 2023 than it was in 2022, UPS changed the name of the peak residential surcharge to “Demand Surcharge” and extended it indefinitely for qualifying packages.

We asked participants if they could pass on these additional costs to their customers. About 25% of shippers of all sizes said they could not.

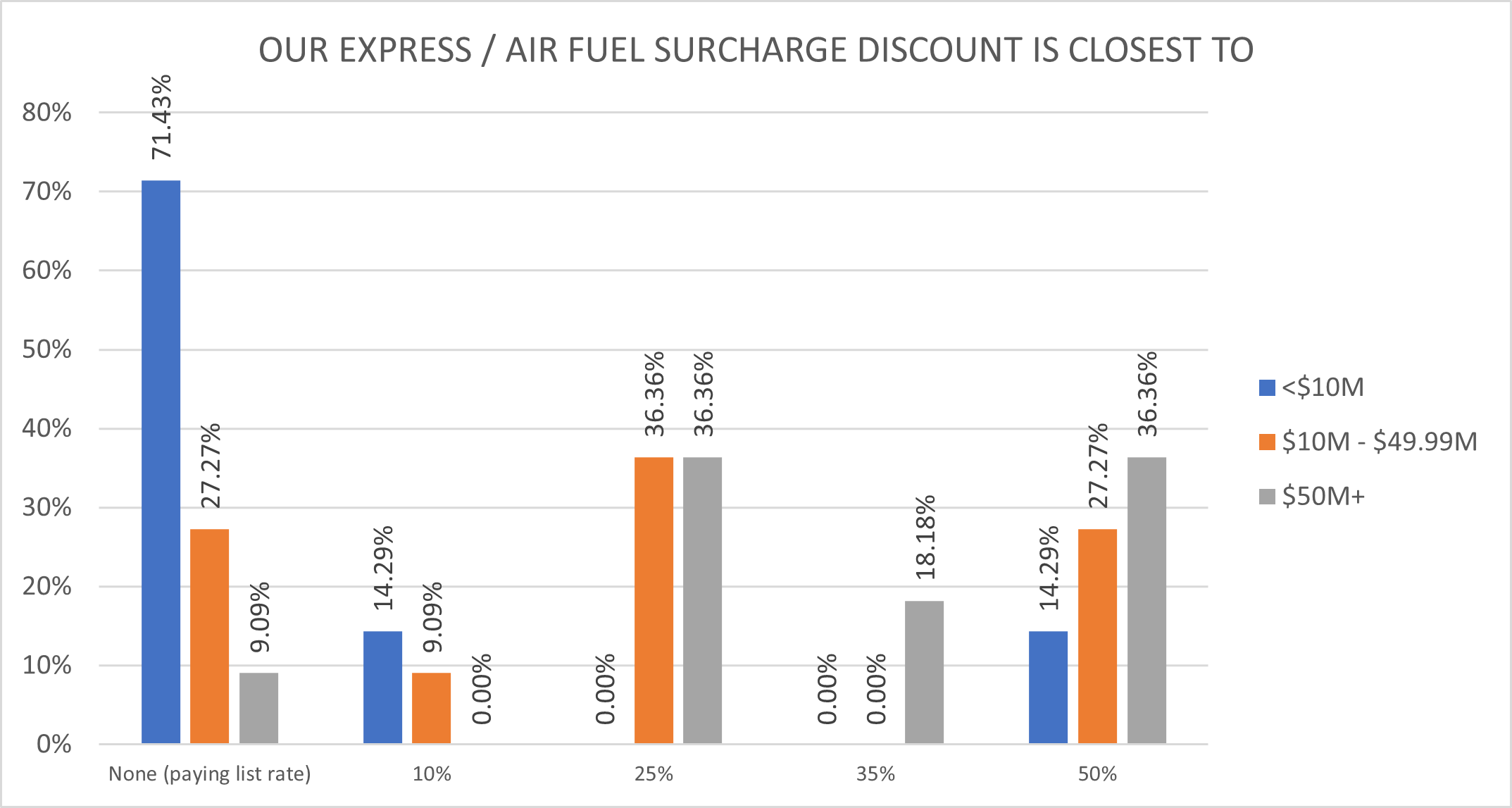

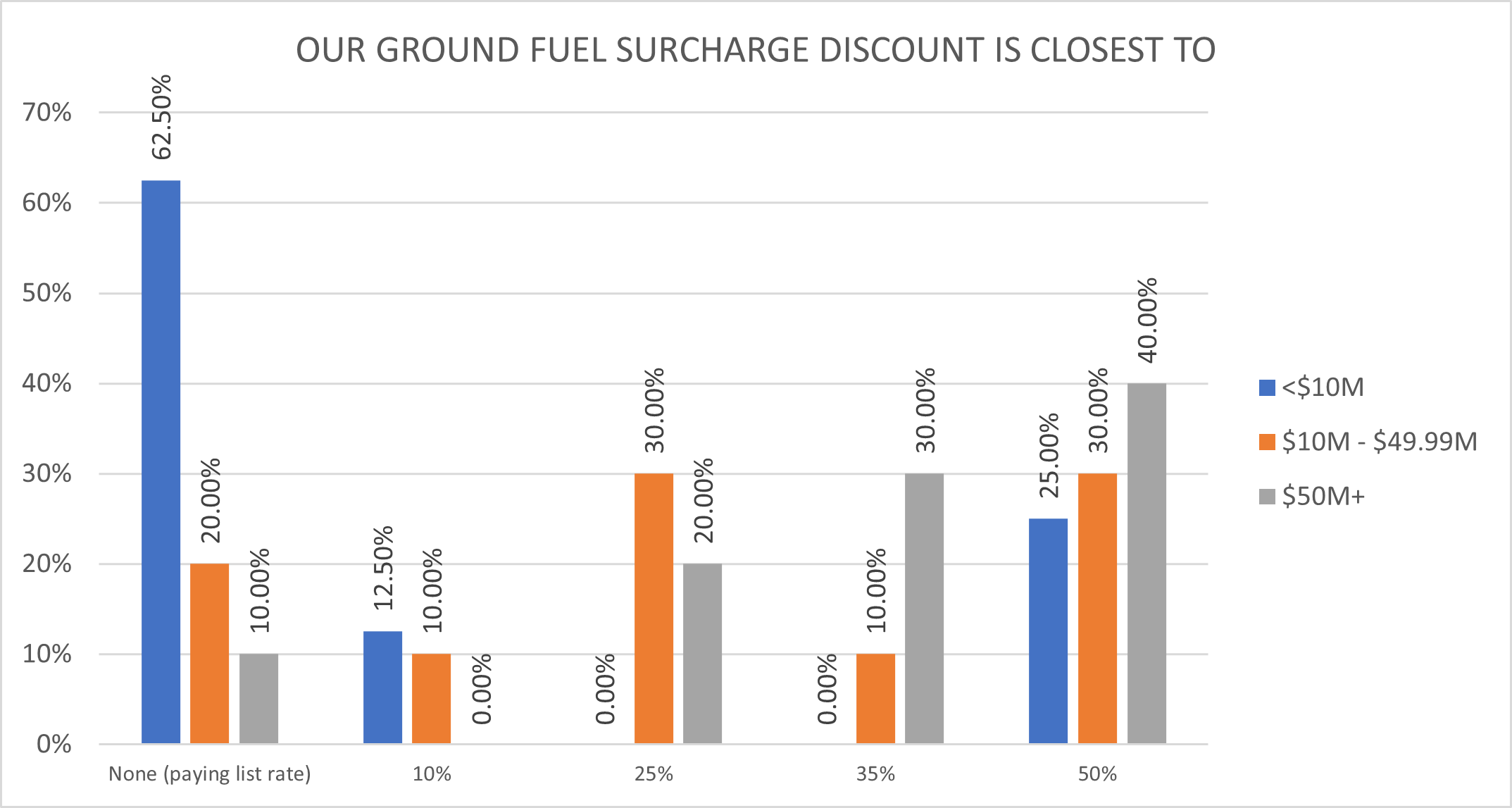

Fuel Surcharge

Fuel Surcharge rises and falls with the average market price of diesel or jet fuel, but carriers modified their fuel tables to charge shippers for almost twice as much fuel per package in 2022 as they did in 2020. The tables rise faster, fall slower, and charge more for each price range. The charge is also calculated as a percentage of a larger number, thanks to carrier rate increases and the introduction of new surcharges. The result is that the fuel surcharge amount levied on a package in 2020 might have purchased a quarter gallon of diesel (at 2020 rates), while the same package in 2022 was charged for almost half a gallon, even as the average market price of fuel skyrocketed. Predictably, these higher fuel surcharges provide a material boost to the carriers’ profit margins.

Discounts on Fuel Surcharge are typically reserved for larger shippers ($10M+), which is reflected in the survey responses, but plenty of exceptions exist.

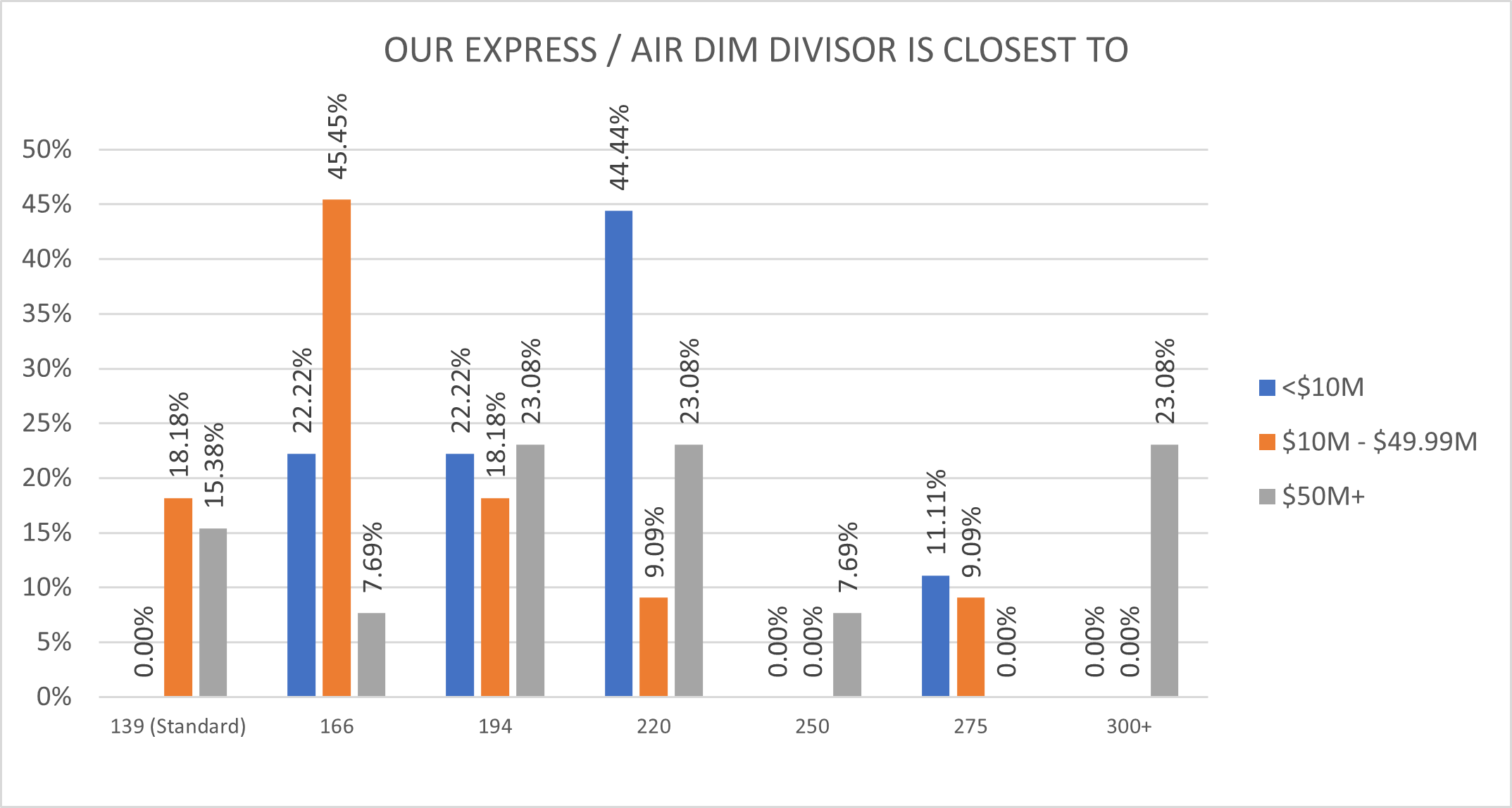

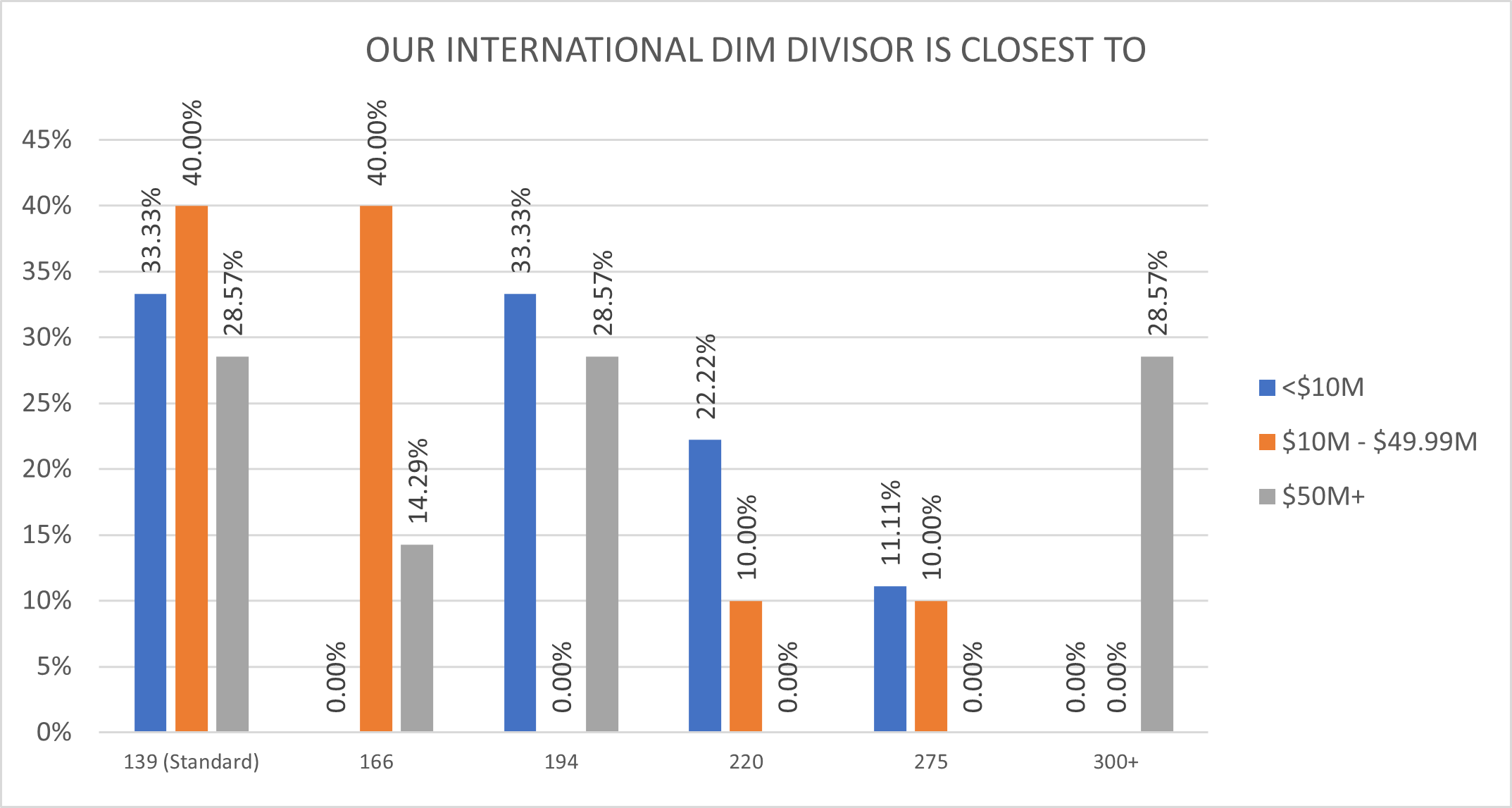

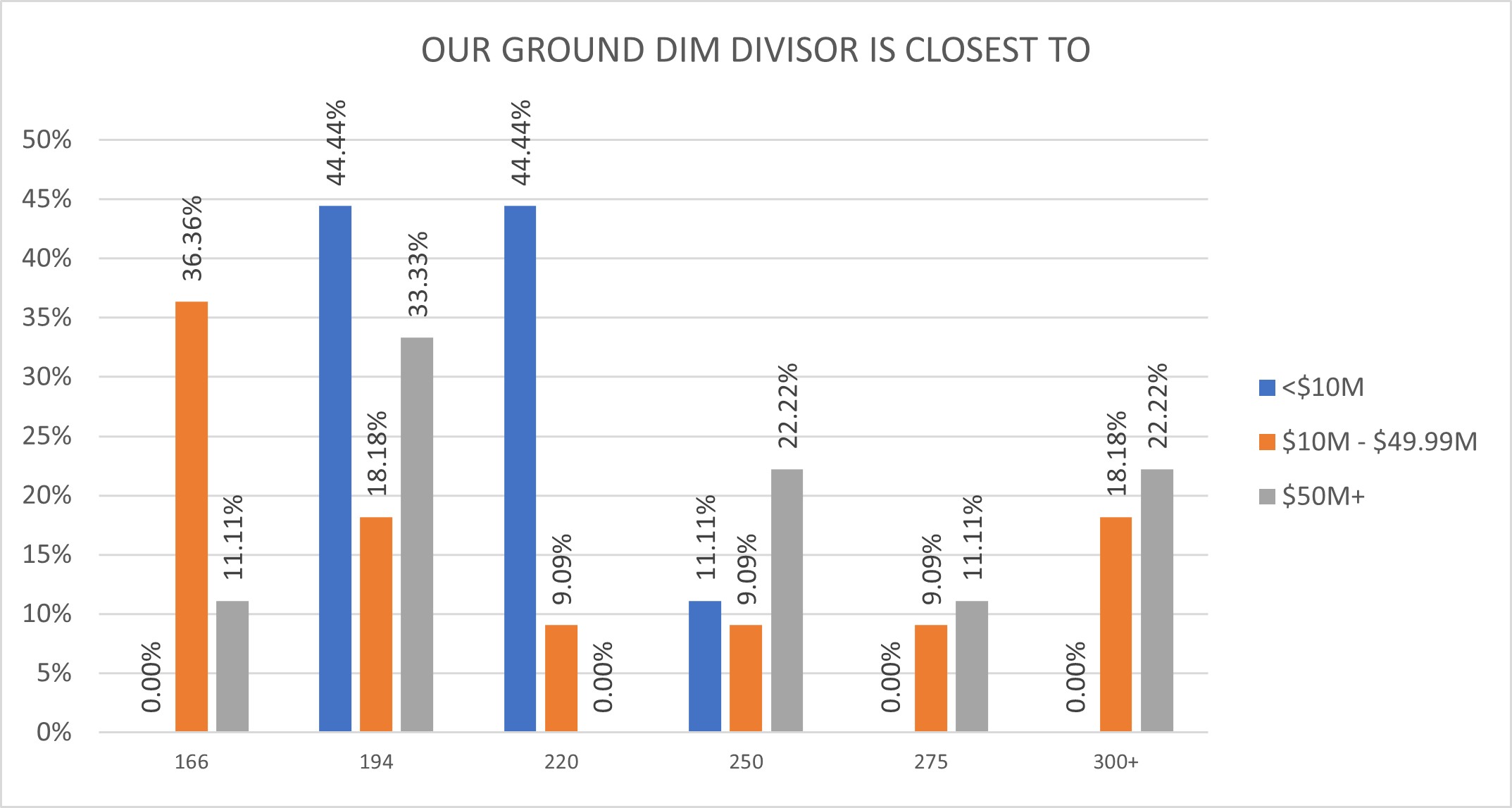

Dimensional Weight

Light products in big boxes take up as much space in trailers as heavier boxes of the same size. Dimensional weight was introduced so carriers could collect roughly the same revenue for both boxes, regardless of actual weight. Dimensional weight is calculated by multiplying the box’s length (in inches in the U.S.) by its width and height, then dividing that result by a number called the Dimensional Weight Divisor. The billable weight is the larger of the actual weight and the dimensional weight. The published divisor is 139, but the larger the divisor, the lower the dimensional weight, and the closer the shipper will get to paying for just the actual weight of the shipment.

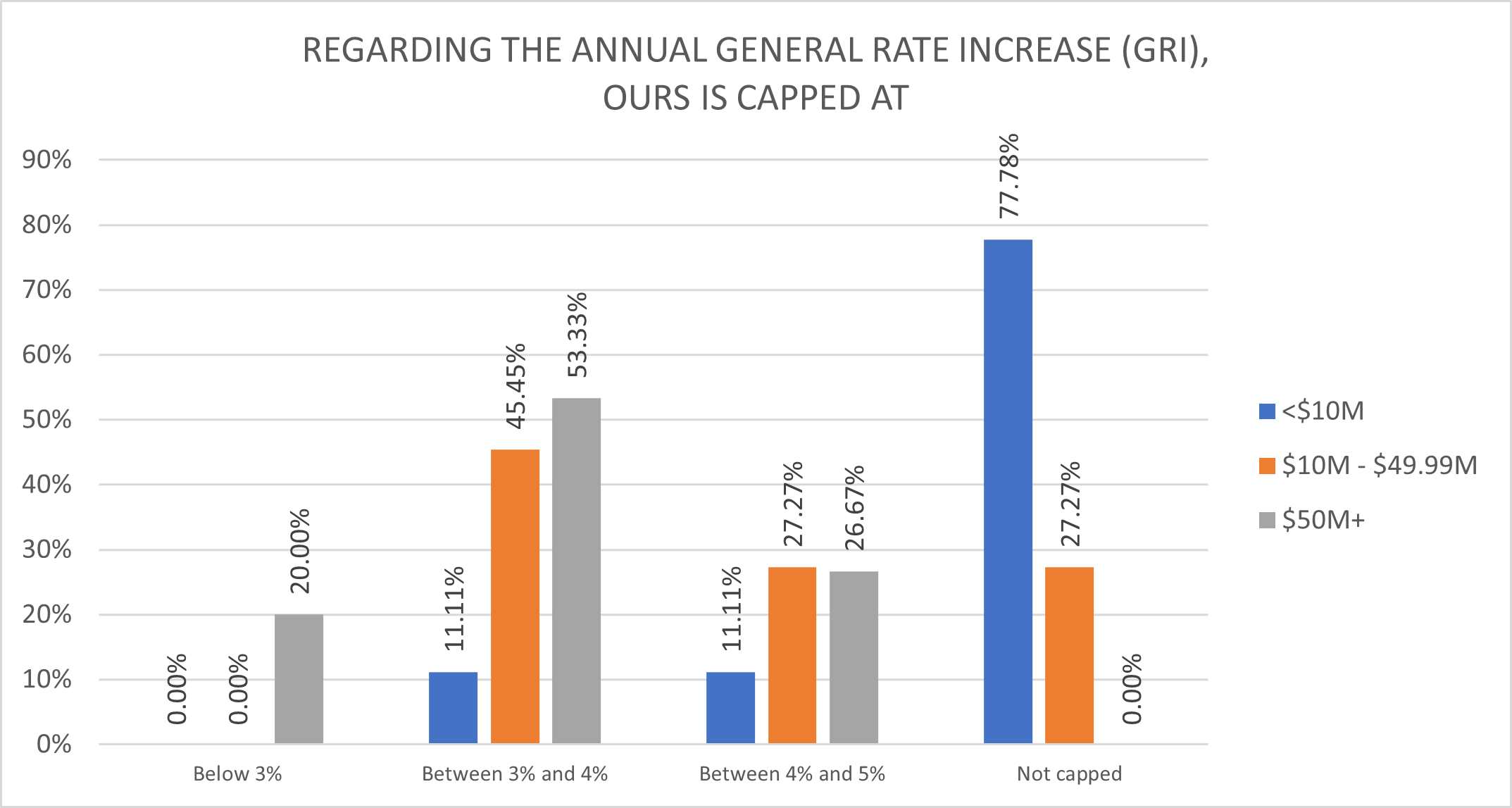

General Rate Increase (GRI) Caps

FedEx and UPS raise their rates each year and call it their General Rate Increase, or GRI. Both carriers reported an average 2023 GRI of 6.9%, a record high for both. The real impact on shippers, however, is an increase closer to 10% because the average only applies to base rates (not accessorials and surcharges, which frequently increase at significantly higher rates), and increases often target popular service/weight/zone combinations. Negotiating a rate cap can help minimize some of the GRI by capping increases to minimums and slightly raising some service-level incentives, but rate caps do not impact accessorials and surcharges. GRI caps are usually reserved for larger shippers, which is borne out below, but plenty of exceptions exist. Finally, watch out for clauses, especially in FedEx contracts, that could eliminate the negotiated rate cap if inflation is too high or you fall short of spending targets.

HARMFUL CONTRACTUAL FEATURES

In addition to laying out discounts and incentives, carrier contracts often include clauses that remove service guarantees, reduce or eliminate incentives, limit competition, and restrict the shipper’s ability to negotiate. Failure to adhere to these clauses can lead to steep penalties. These clauses are unacceptable in most cases and should be rejected.

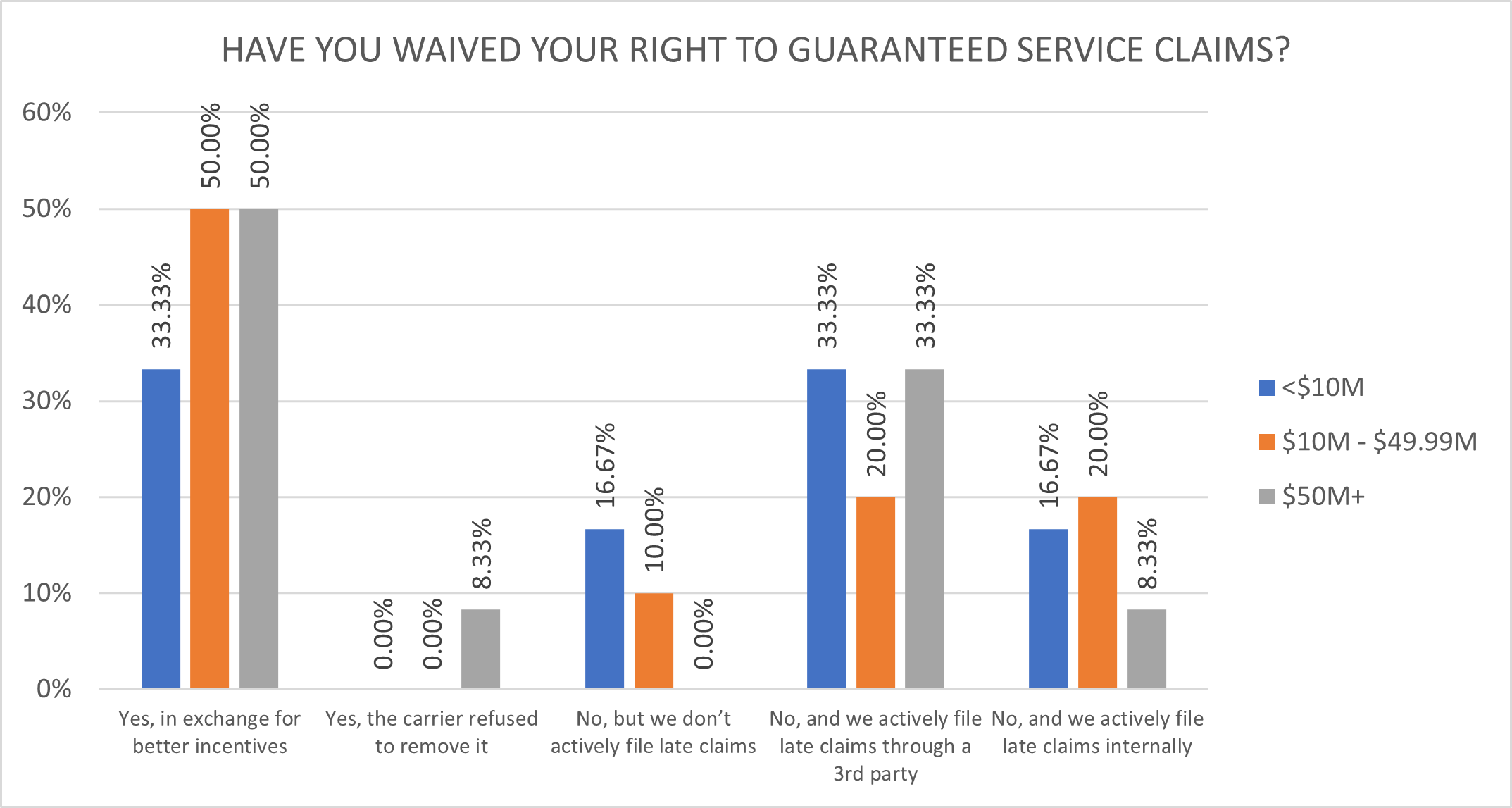

Waiving the Right to File a Guaranteed Service Claim

Before the Covid-19 pandemic, Ground and Express/Air services were all guaranteed to be delivered by a certain time and/or date. Filing claims for late shipments commonly retrieved 4% to 6% of a shipper’s total package spend. These guarantees were understandably suspended during the height of the pandemic, but only guarantees on one-day services have since been reinstated. There is a reason carrier are often willing to trade additional incentives for a waiver of service guarantees: If a shipper’s carrier agreement waives the right to file guaranteed service claims, there is nothing holding the carrier responsible for poor performance.

Every shipper should complain loudly and frequently about the suspension of these guarantees!

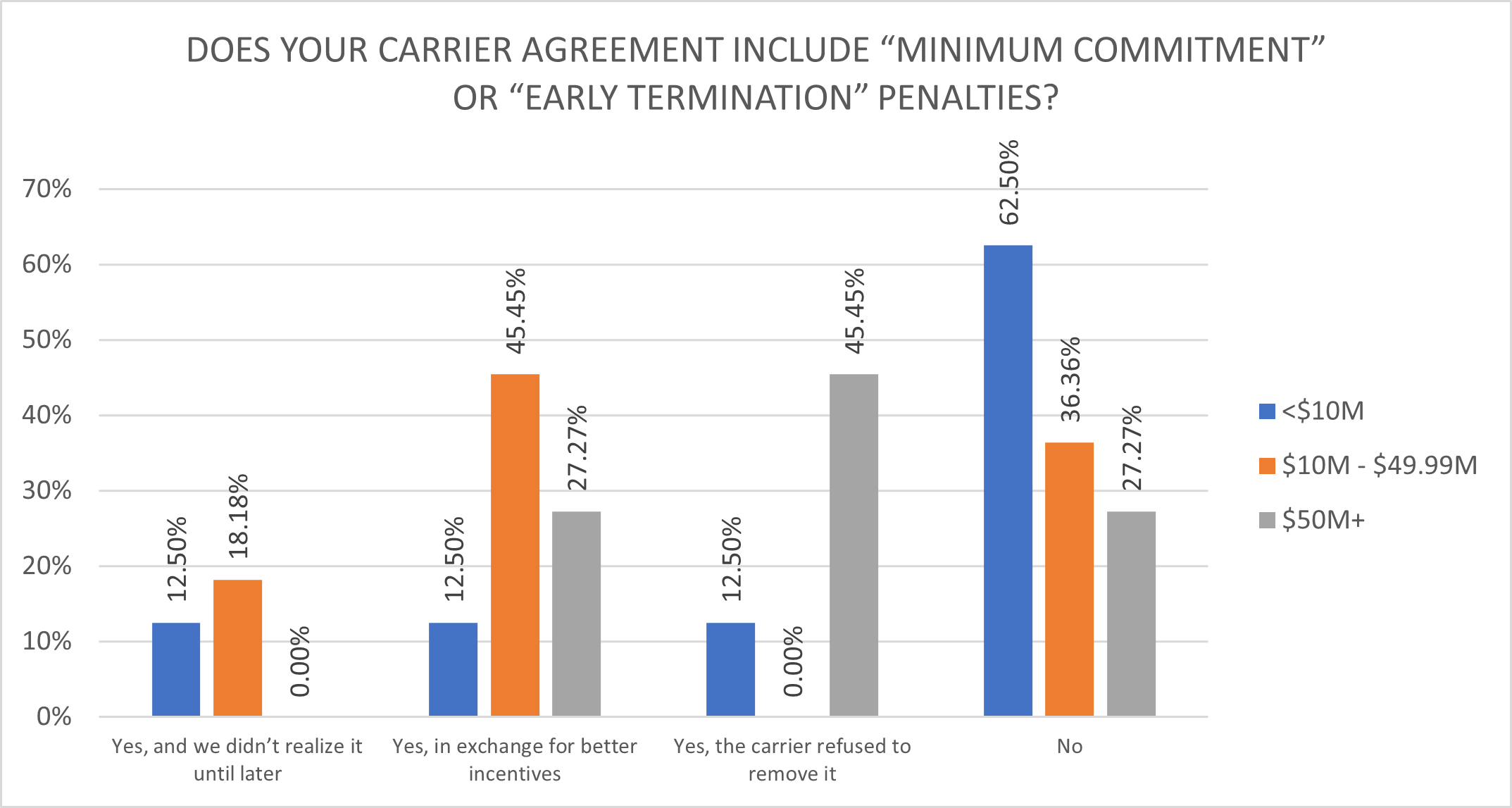

Minimum commitment clauses and early termination clauses limit competition and restrict a shipper’s ability to react to a rapidly changing market. While they differ in how they achieve these ends, the limitations are similar and often overlap. The most common elements include:

- Shipper agrees not to renegotiate existing incentives or negotiate new discounts until 90 days before the term of the agreement expires. The carrier, however, remains free to apply unprecedented and unlimited increases.

- Shipper agrees to give the carrier a certain percentage of their controllable parcel volume, sometimes as high as 98%.

- Shipper agrees to meet specific net spend commitments (but the carrier rarely provides the ability to properly measure performance).

- Shipper agrees not to terminate the agreement during the term of the agreement.

- Shipper agrees not to divert any packages away from the parcel volume the carrier analyzed when creating the agreement.

Penalties for both clauses are also similar, usually based on the shipper’s last year or quarter in which they met the commitments. The most common fee is 2% (or the flat-rate equivalent) but can range from less than 1% to more than 10%.

UPS is currently more likely to pursue these payments than FedEx, even threatening to impose fees on some shippers when the only reason they fell short of their commitments was that UPS unilaterally decided not to accept all the shipper’s volume. First, UPS forced these shippers to scramble to find alternate carriers on short notice during the busiest time of the year, then UPS threatened to charge exorbitant fees if the shipper didn’t return the volume to UPS once UPS decided they wanted it again.

These clauses become more common as the shipper size increases, but the carriers go through periods of including it with every offer, not expecting that everyone will accept it.

MISCELLANEOUS EXTRAS

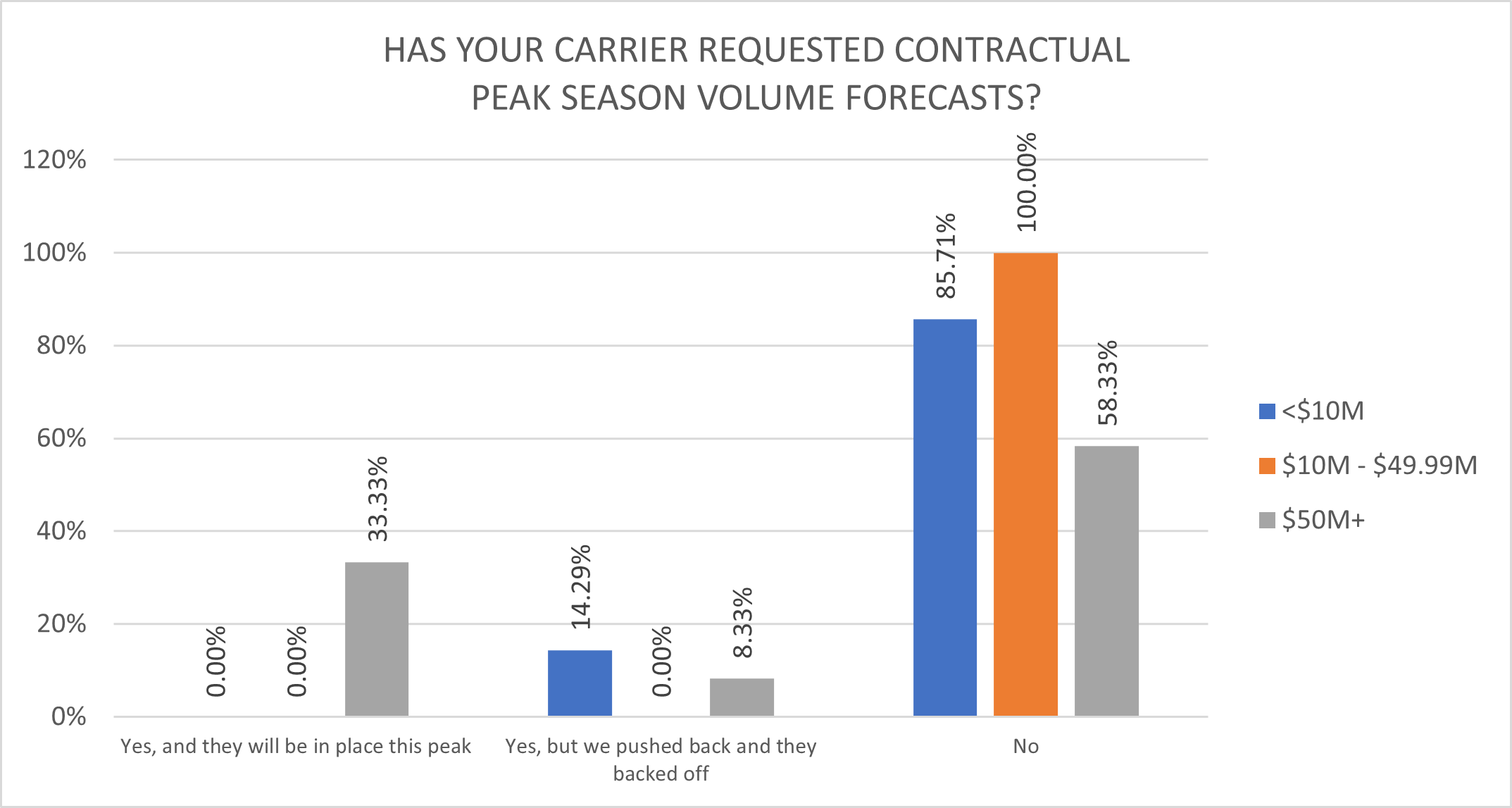

Peak Season Volume Forecasts

When shippers provide carriers with volume forecasts during the busiest months of the year, the carrier can improve asset utilization and keep their network flowing as smoothly as possible. But when carriers charge a per-package fee for straying too far from the forecast, even for reasons outside the shipper’s control, this practice becomes problematic. Worse, there is usually no reciprocal commitment, as many shippers learned the hard way during Q4 2020, when both UPS and FedEx decided unilaterally they would accept far fewer packages from some shippers than they had previously agreed to carry. This sent shippers on last-minute scrambles to find alternate shipping options, eventually causing a backup at the USPS that didn’t clear until January. Shippers paid more, many Christmas presents were delivered weeks late, and UPS made record profits, all during the height of the Covid-19 pandemic.

This year’s results show a substantial decrease in the percentage of shippers providing peak season volume forecasts. More than half of all respondents provided forecasts in previous years, while this year only 33% of the largest shippers complied (no small or medium shippers provided forecasts).

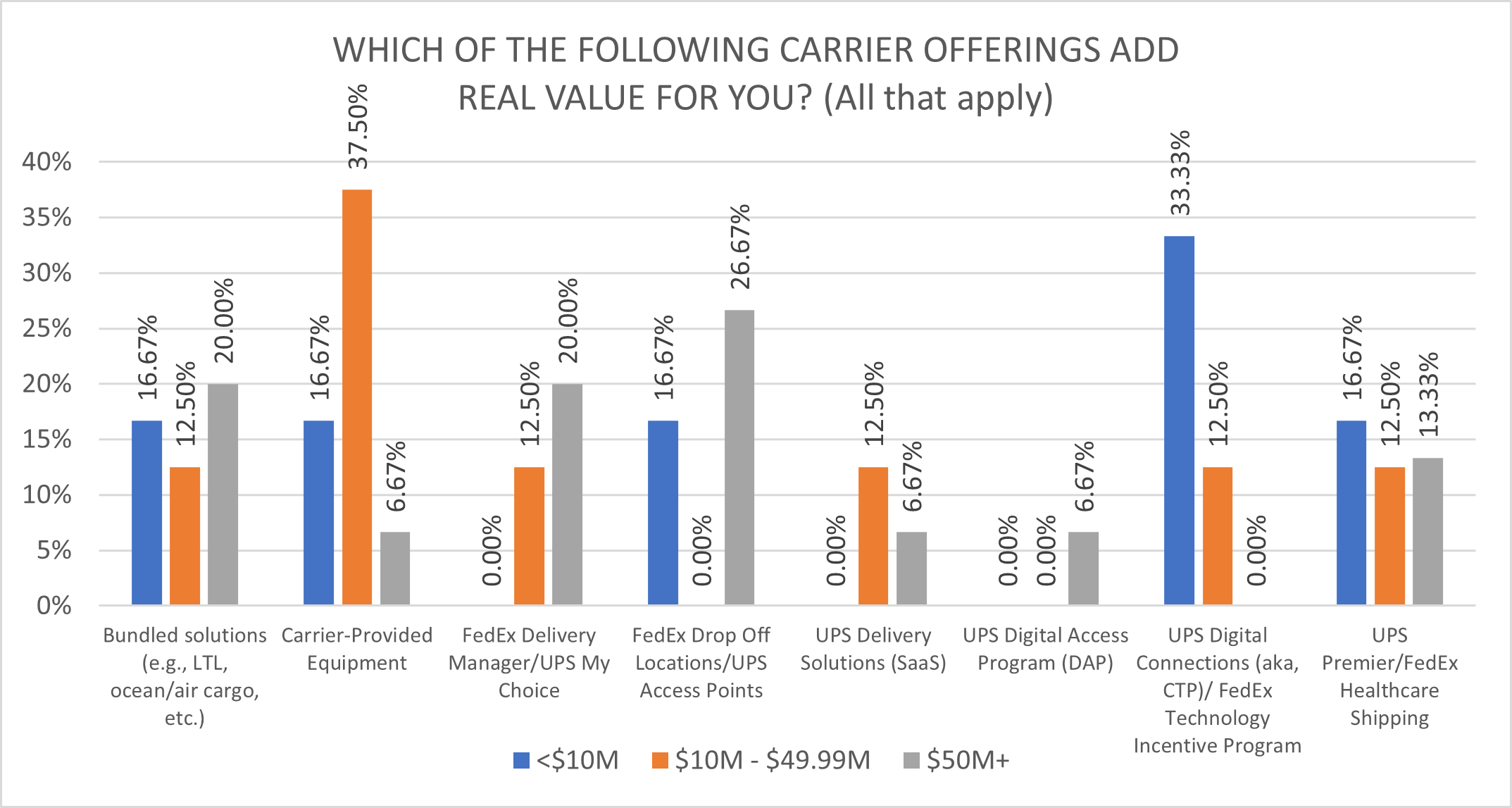

Carrier “Value-Adds”

Many pricing offers from FedEx and UPS start with PowerPoint slides claiming savings from services outside the pricing agreement. A shipper should not allow this to cloud their judgement – these “soft dollars” are not equivalent to the bottom-line savings achieved through the pricing negotiation, and most services can be found with both carriers – but they can tip the scale when considering two very similar pricing proposals.

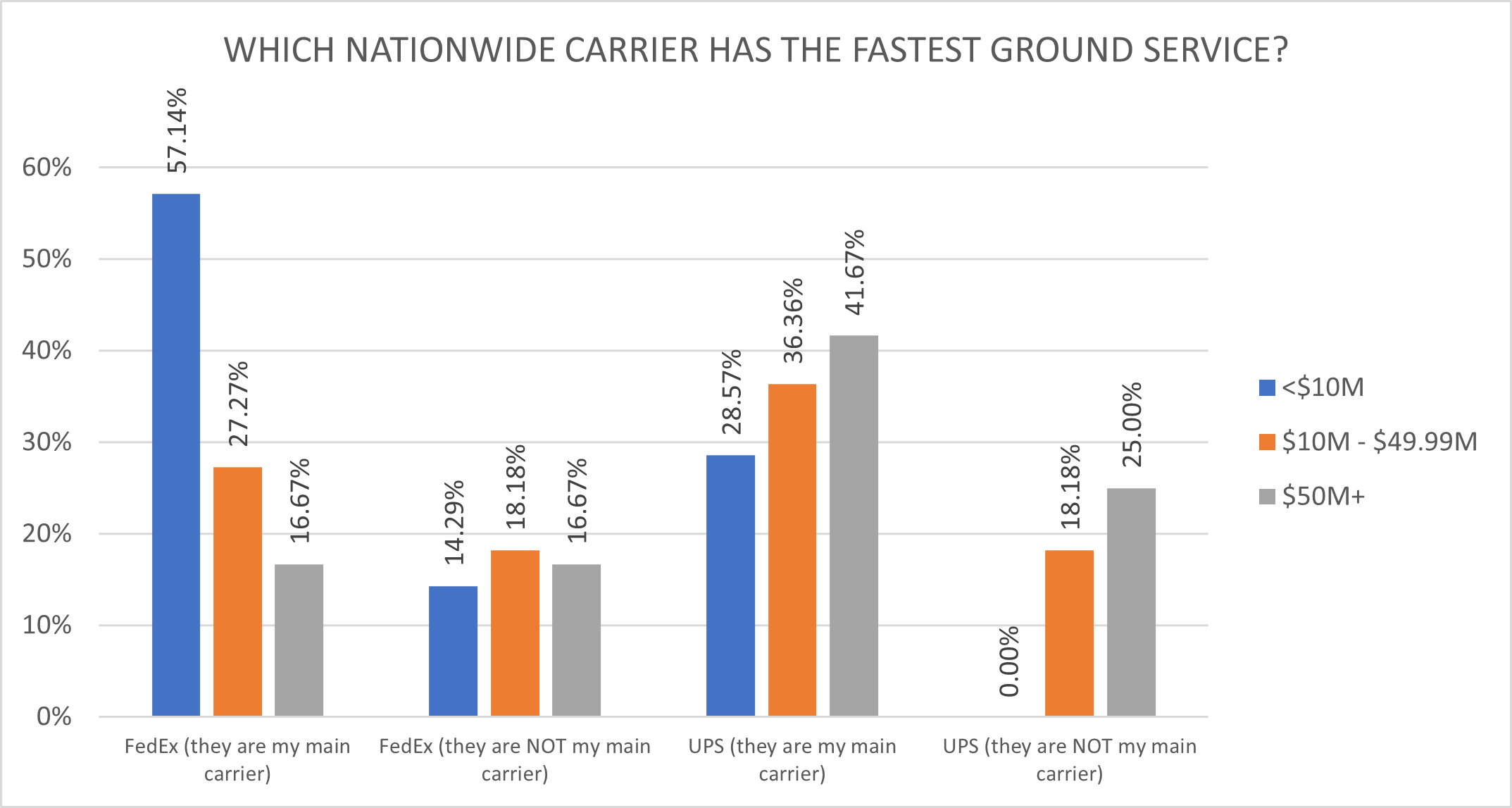

Perceptions of Speed and Reliability

PARCEL published an intriguing article by Karl Wheeler earlier this year that digs into the limitations of the on-time delivery performance metric (On-Time Delivery Performance: Fact or Spin?). The short synopsis: After analyzing millions of UPS and FedEx packages sent during Peak 2022, UPS is doing a great job marketing slower services, and they want shippers to pay more for these slower services. The truth is that both carriers go through cycles of better and worse service, and while most people prefer one carrier over the other, that preference may be based on emotion and/or old data. Both carriers do an exceptional job almost all the time.

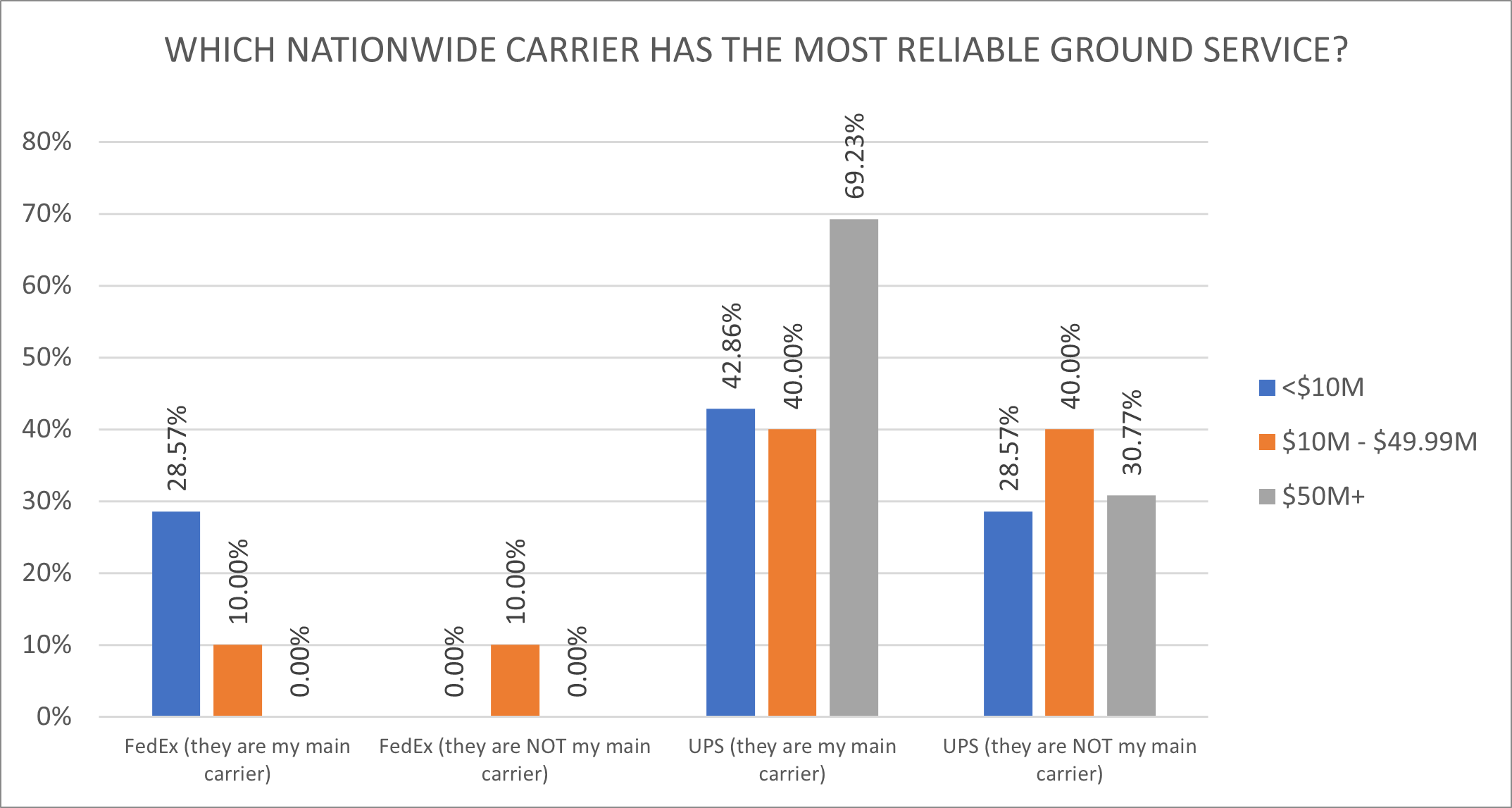

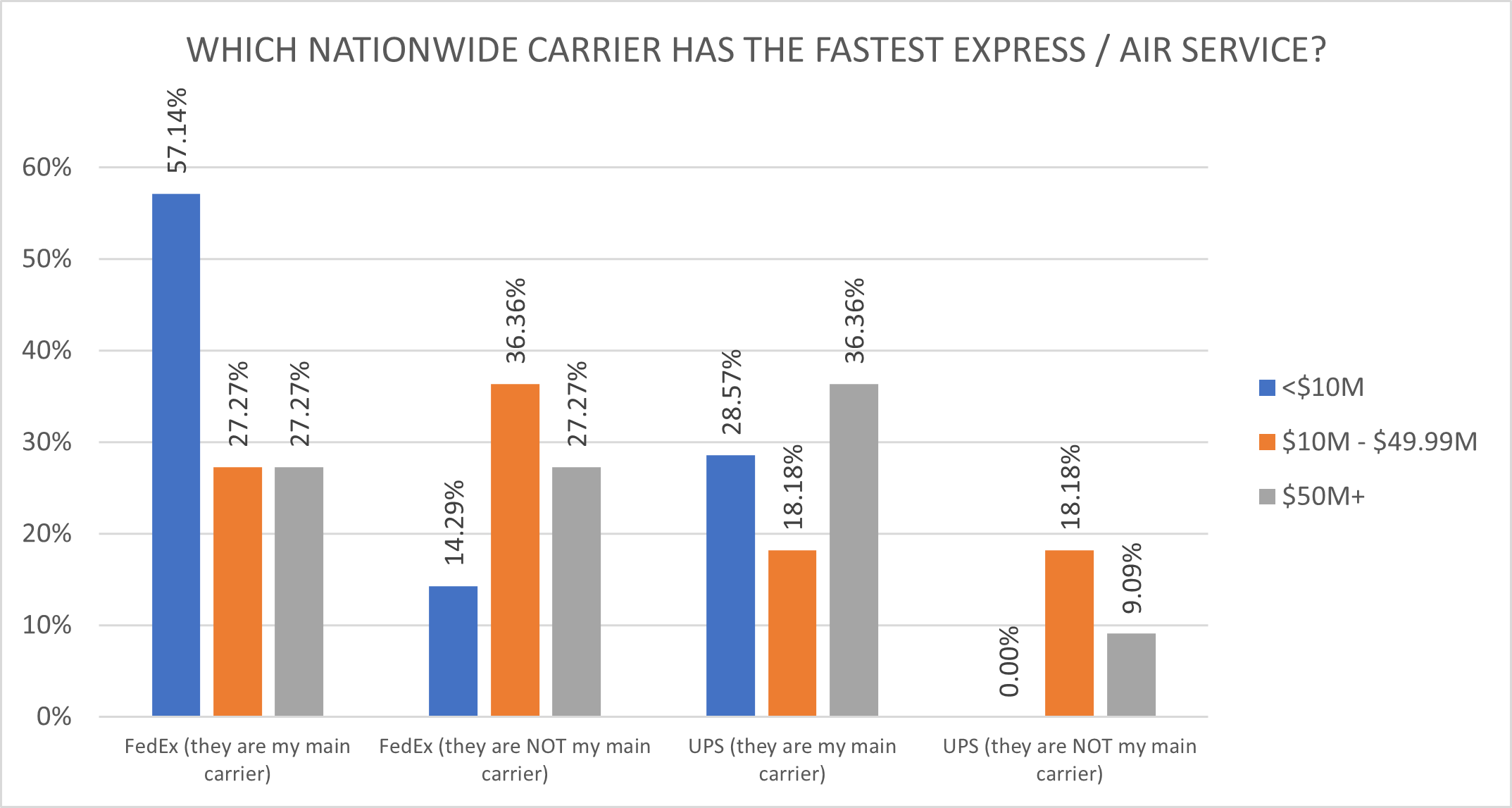

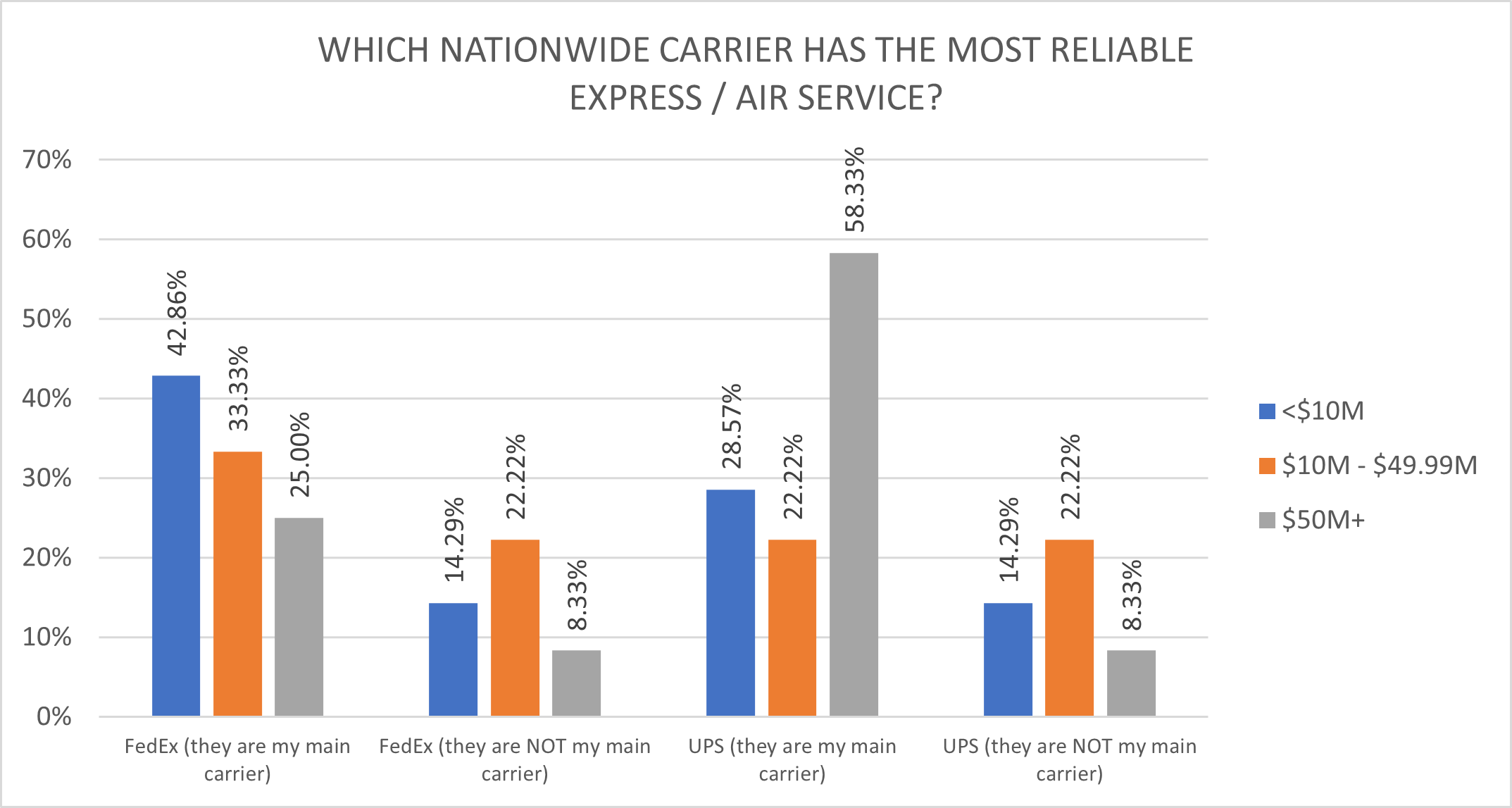

In this survey, small shippers were more likely than medium or large shippers to view FedEx as the faster, more reliable carrier for both Express and Ground shipments, although FedEx scored particularly low on perceptions of Ground reliability among all shipper sizes.

Carrier Representatives

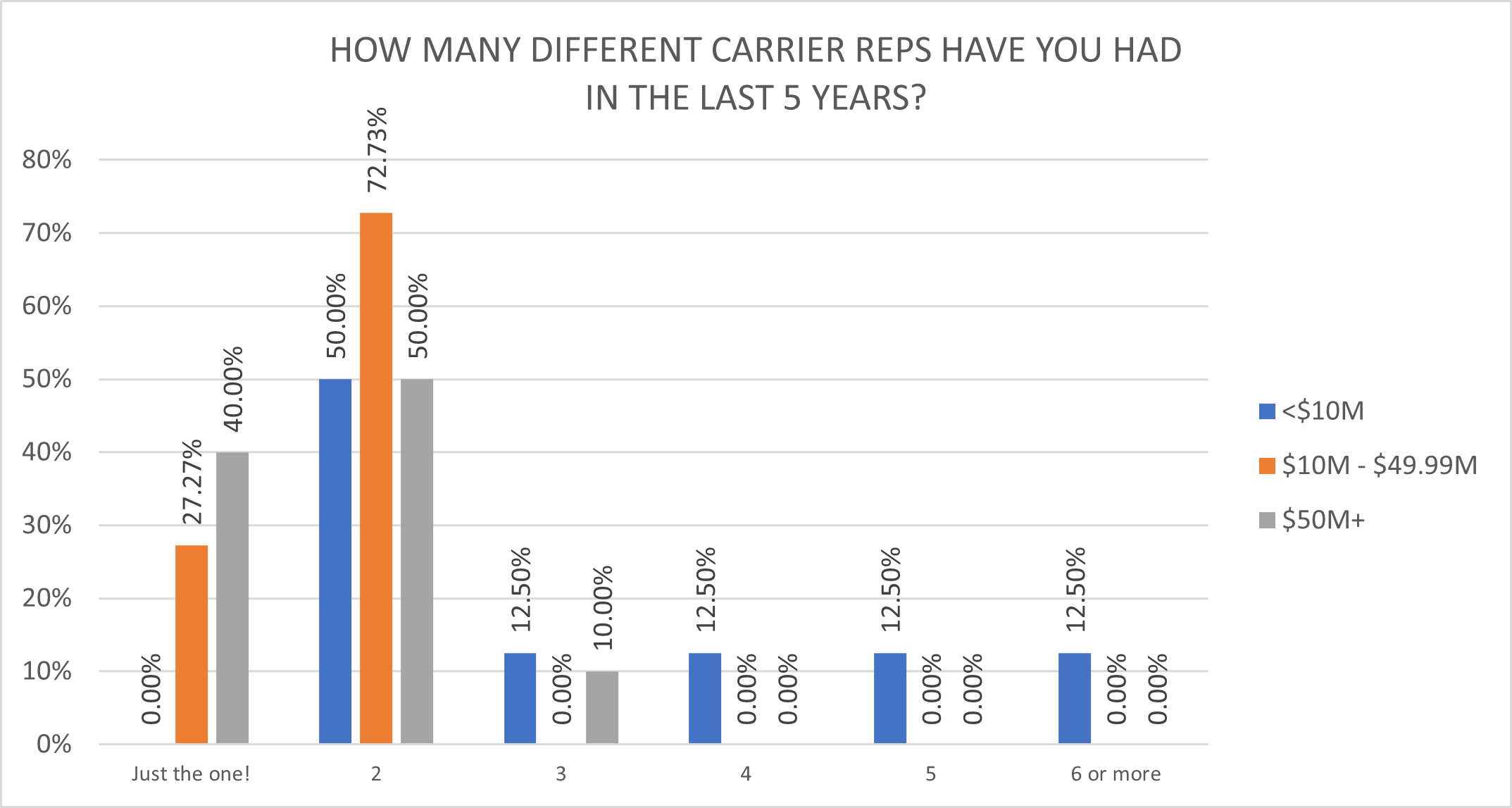

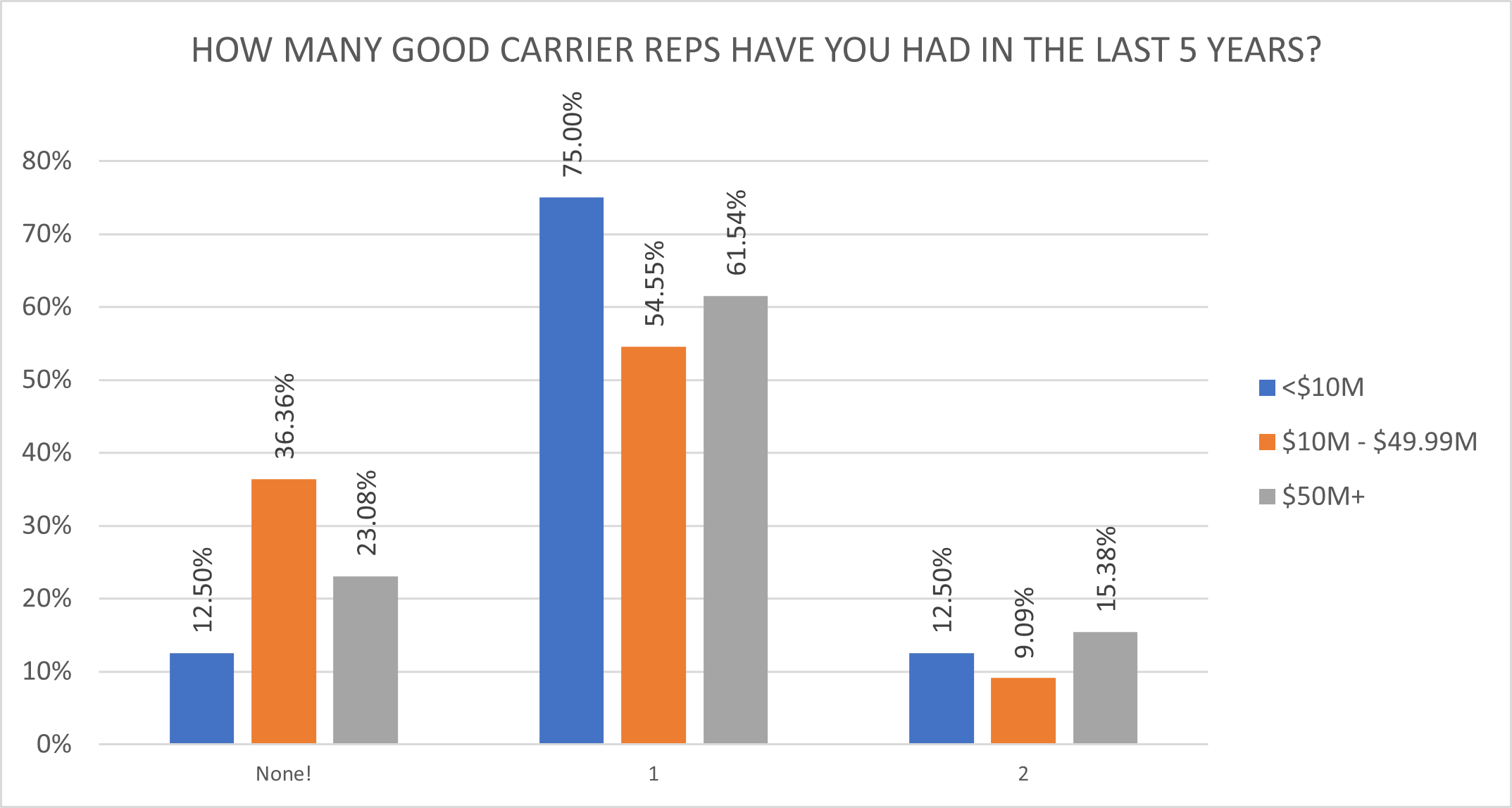

Since the start of the Covid-19 pandemic, both carriers have reduced their Sales staff by roughly 30%. While most respondents had two or more reps in the past five years, an overwhelming majority reported having one good rep during that time.

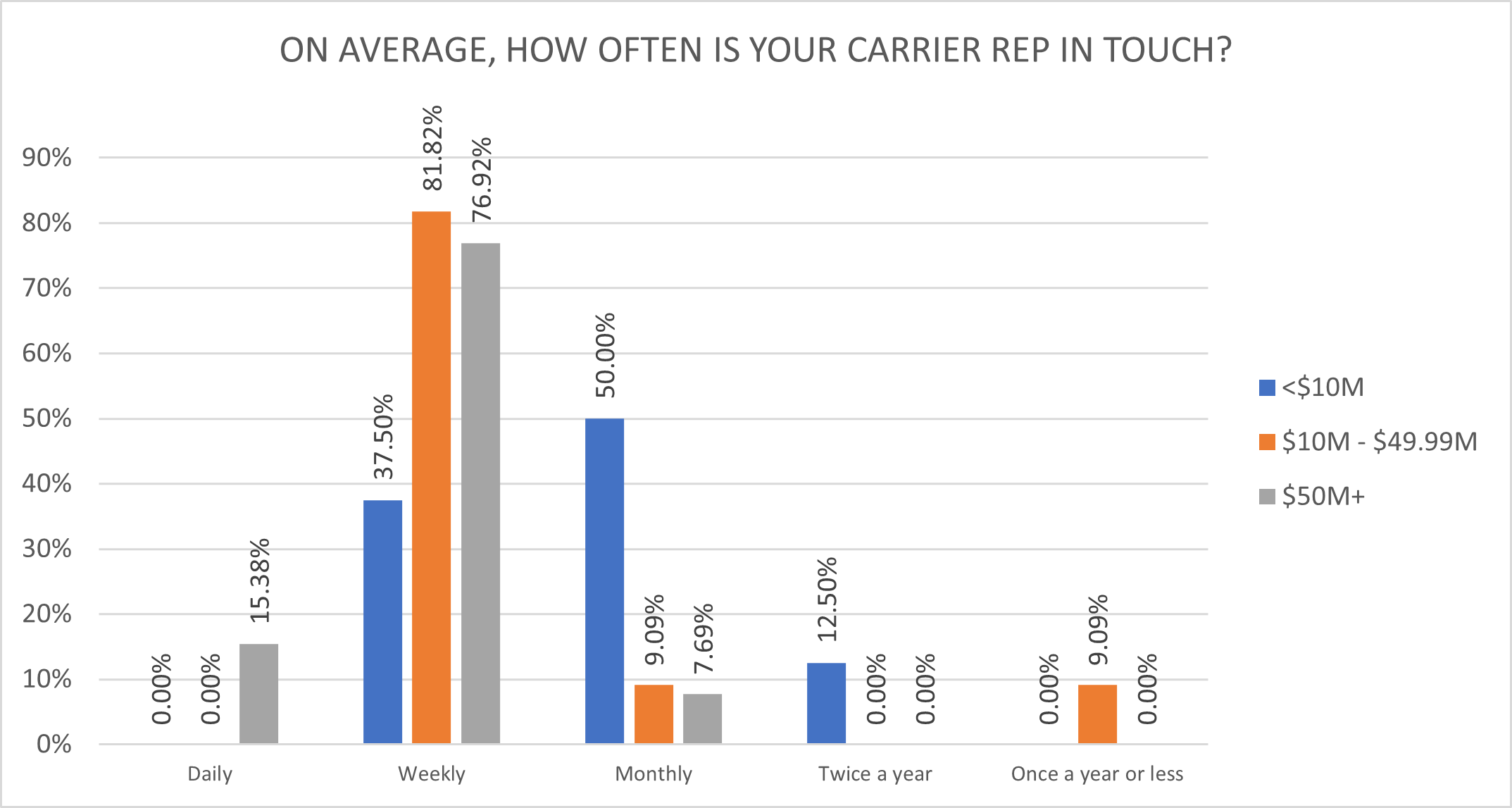

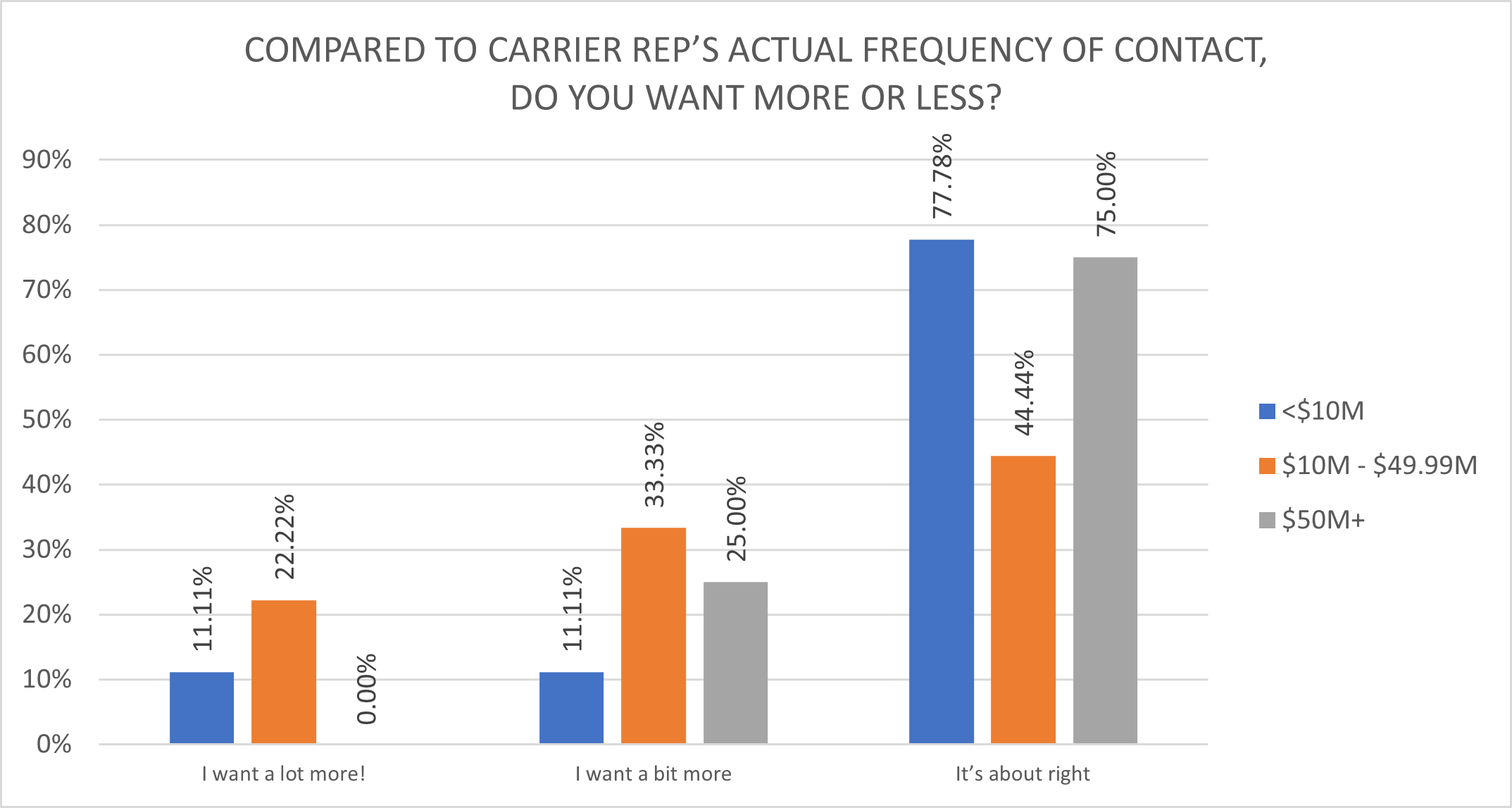

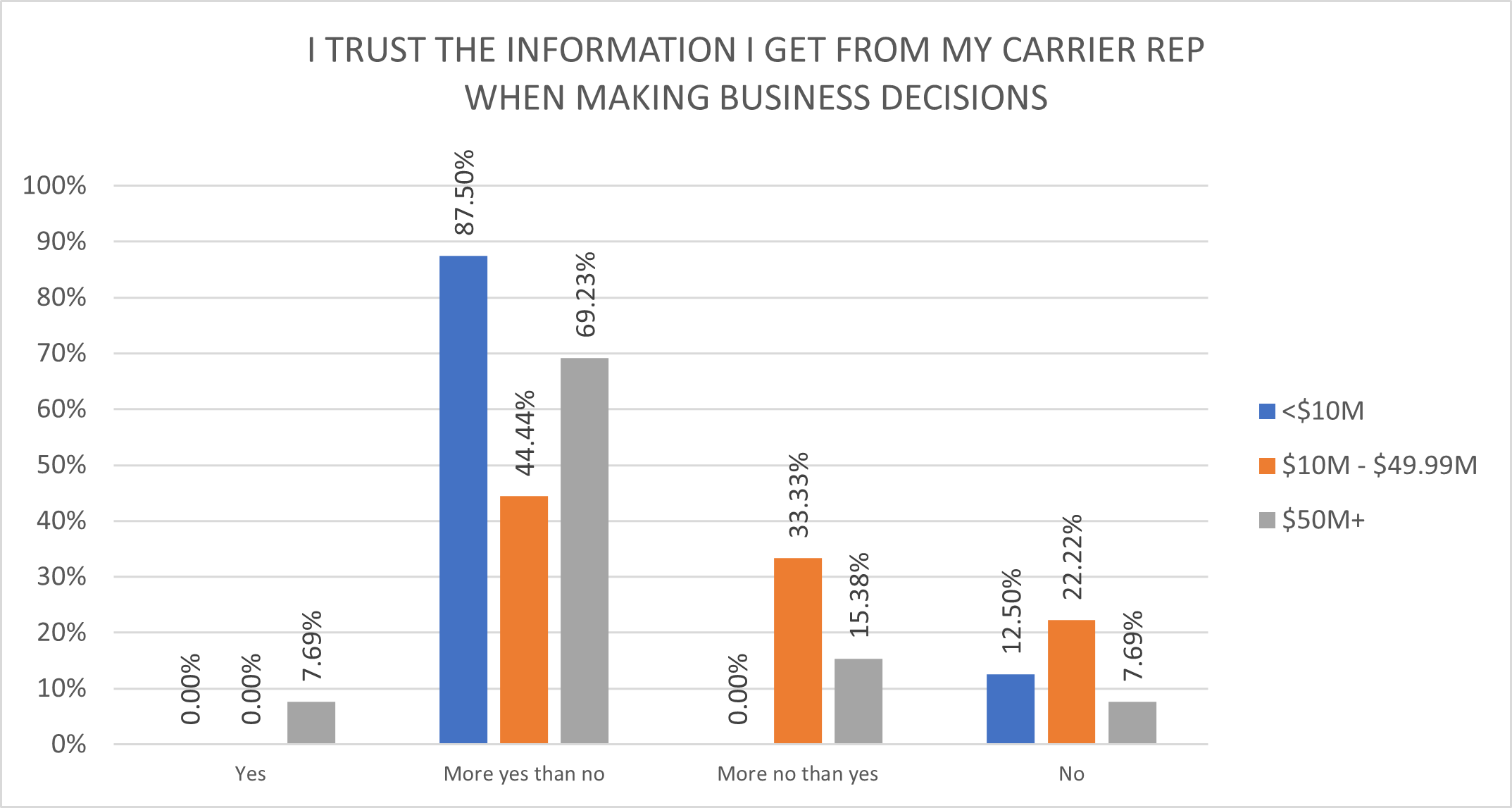

Most respondents were contacted weekly by their rep, which lined up with the preferences of most small and large shippers, but 55.55% of medium-sized shippers desired more frequent interaction. The majority of small and large shippers also trusted information they received from their rep, at least most of the time, while more than half of the medium-sized shippers answered either “more no than yes” or “no” to the question of trust.

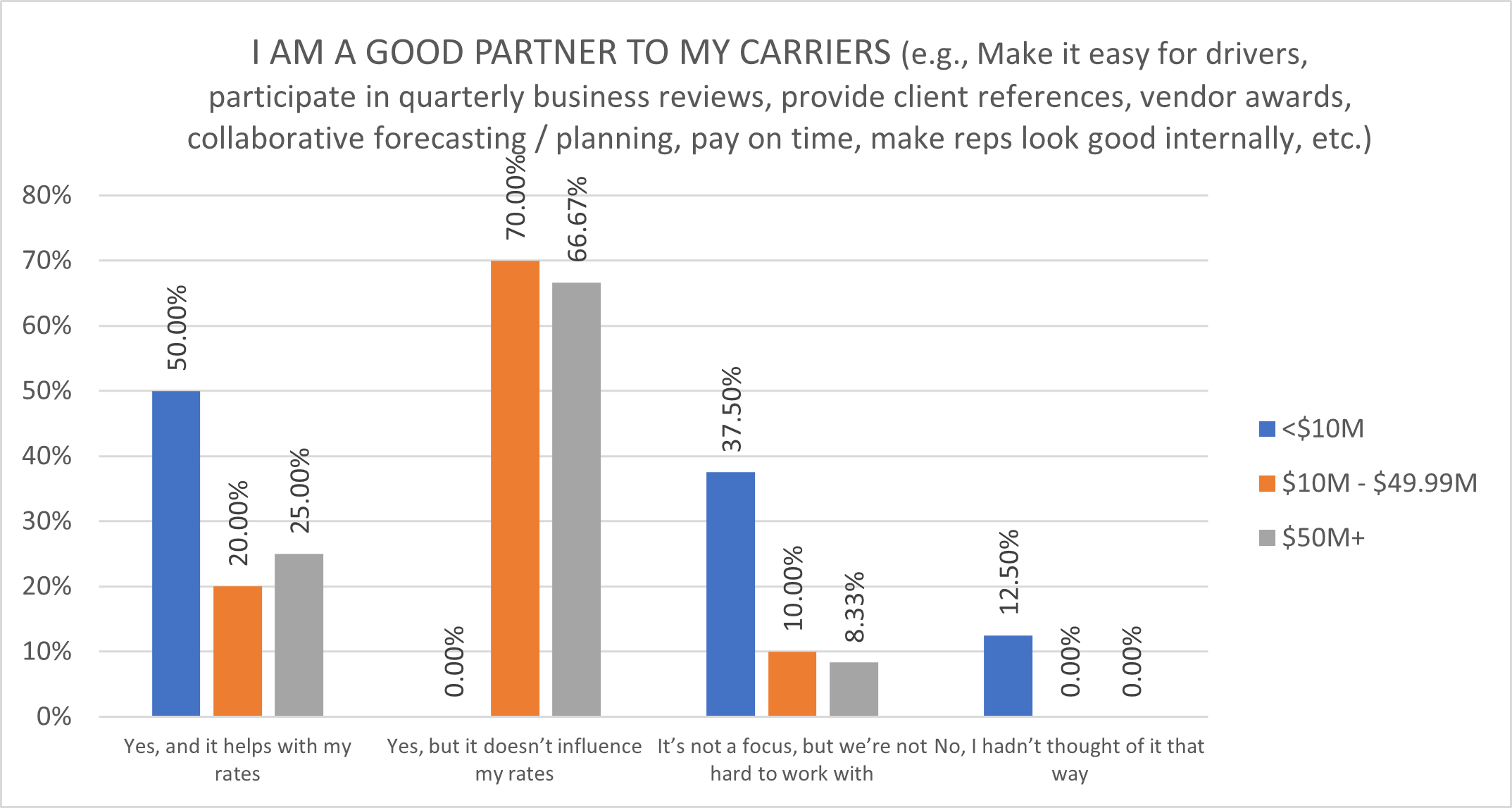

On a related note, most shippers of all sizes report doing their part to make it easy for the carriers to work with them. This is in line with the 2021 PARCEL article, “The Key to Success for the Shipper/Carrier Relationship,” where Paul Yaussy wrote that “having a great relationship with your carriers is critical to the success of your organization.” Unfortunately, 70% of medium-sized shippers and 66.67% of large shippers did not believe it influenced the rates they negotiated. It is noteworthy that half of the largest shippers, the group with the fewest average carrier sales reps over the past five years, saw the most benefit from a good working relationship.

Carrier Earnings Calls

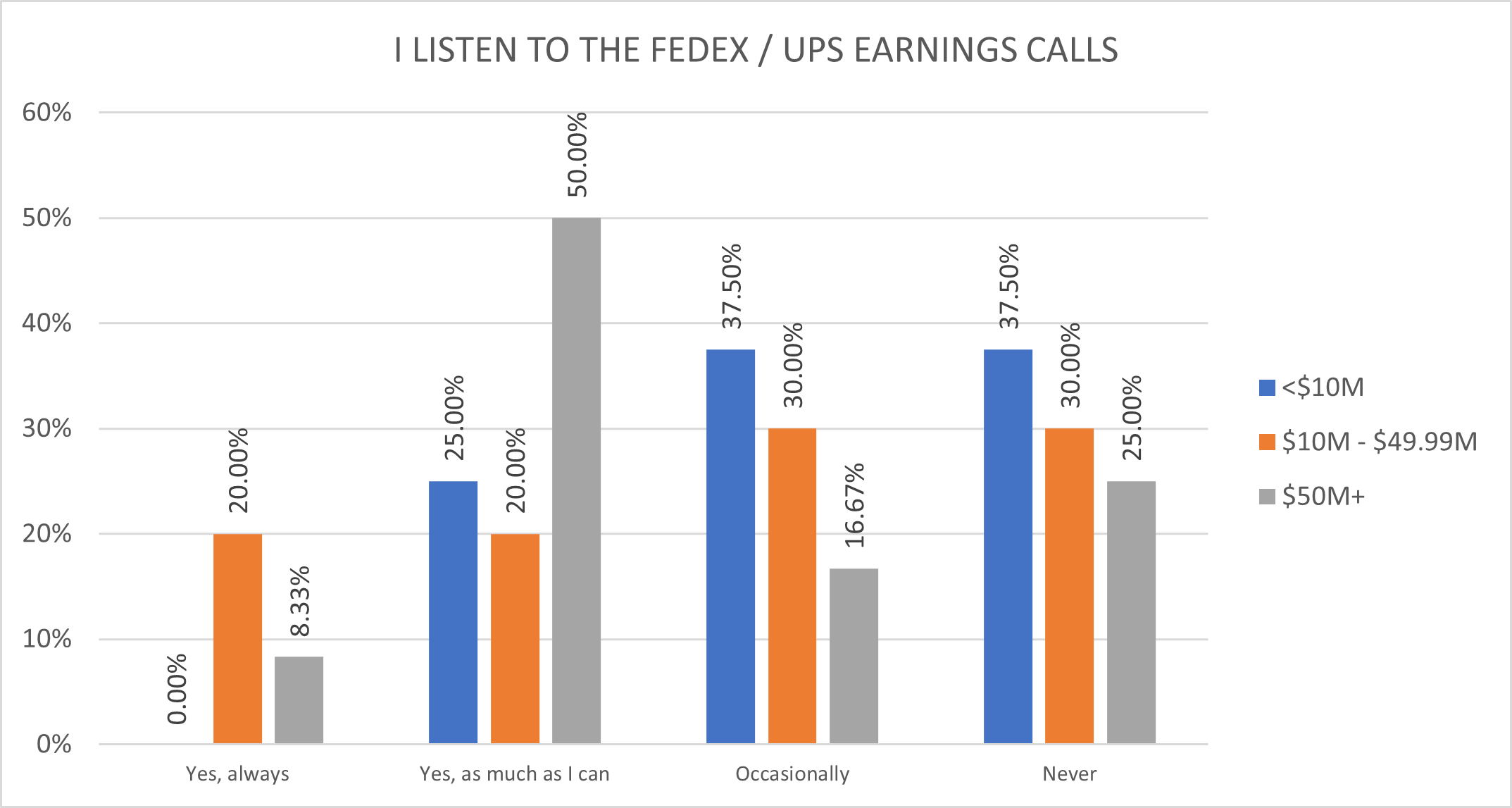

Every quarter, UPS and FedEx forecast and report their performance. They also give insights into overarching strategies and their associated tactics. Because these reports are designed to inform and influence their shareholders, the explanations can differ dramatically from what a shipper may hear from their sales rep. (To be clear and fair, most sales reps are faithfully reporting what they read and hear, but most of what they read and hear gets filtered through management and marketing functions before it reaches front-line salespeople.) Anyone hoping to achieve the best possible savings should listen to the carriers’ earnings; they provide insight that is hard to find elsewhere. Among survey participants, large shippers were most likely to listen to earnings calls at least some of the time.

UPS and the Potential for a Teamsters Strike

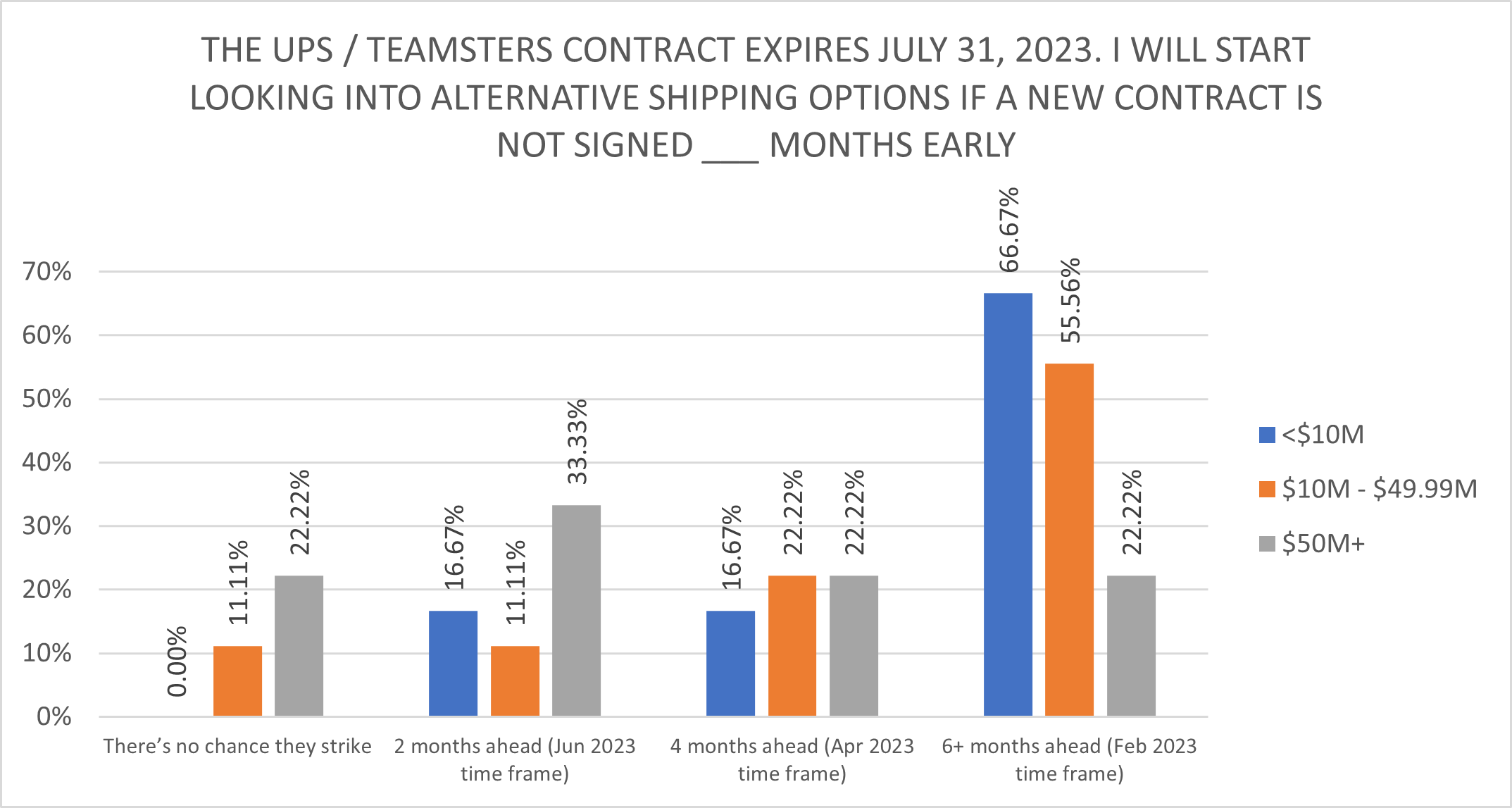

Almost two thirds of UPS employees belong to the Teamsters Union. That’s about 340,000 drivers and warehouse employees that may walk off the job on August 1st if UPS hasn’t agreed to a new contract with the Teamsters. This happened only once before, for just over two weeks in 1997. A few months later, FedEx, which had no Ground service at the time, bought the parent company of RPS, a smaller ground shipper, which was rebranded as FedEx Ground in 2000.

During the 2000s and 2010s, to ease the minds of shippers and investors, UPS often finalized the contract the beginning of the year it was due, about seven months in advance. A few locals always held out for unique contractual concessions, called supplementals, which were negotiated semi-independently, but the master contract was basically complete in Q1. Sean O’Brien, the newly elected General President of the International Brotherhood of Teamsters, led one of those locals from 2006 to early 2022.

This year is different in practically every way: Both UPS and the Teamsters have new leaders with something to prove, UPS collected record profits during the COVID-19 pandemic, the market is cooling and may be headed into a recession, the competitive landscape has changed dramatically, and much more. This discussion will continue to fill many articles even after the new contract is resolved, but in the meantime, shippers are left wondering what, if anything, they should do to mitigate the risk of a Teamsters strike.

When asked in October 2022 how early they would begin looking for alternative carriers if a new UPS/Teamsters contract wasn’t signed, the most popular answer was six months or more. The largest shippers, however, were almost evenly split. At the time of writing (April 2023), many shippers that followed this guidance found a willing partner in FedEx and others. Shippers that waited until April or later may find fewer discounts available as non-UPS carriers shift their focus from winning new clients to providing the best possible service to retain their new clients. Regardless of potential difficulties, a Teamsters strike would impact practically every department within a UPS-only shipper. Smart transportation leaders will consult with c-level leaders and all department heads before deciding how to deal with this risk.

SUMMARY:BENCHMARKING VALUE & LIMITATIONS

Benchmarks can only take a shipper so far in their carrier negotiations. While overall package volume and shipper spend are important to carrier pricing algorithms, FedEx/UPS discounts also rely heavily on the carrier’s analysis of distribution footprints and physical package characteristics, which are directly tied to the carrier’s cost drivers. Other pricing factors include the carrier’s desired operating ratios, sales commissions, strategic account value, and competitive considerations.

Simply reviewing benchmarking data may not be enough to conclude that you should receive similar discounts. Benchmarks, like those published above, provide shippers with an idea of what’s possible – high watermarks for which to strive. No shipper has the best possible discount on every service, and this is okay! The carriers need to make money and mitigate network risks too. Understand your shipping data – which services and charges contribute most to your shipping spend – and focus instead on using that knowledge to negotiate the lowest possible average cost per piece.

Finally, a sincere thank you to everyone who participated in this survey, and to everyone at PARCEL, who facilitated the gathering of this data by bringing together shippers, industry experts, and carriers at PARCEL FORUM ‘22! Don’t miss PARCEL FORUM ’23, September 12th and 13th in Nashville, Tennessee, for your opportunity to participate in this ongoing research (and much, much more)!

Josh Taylor is the Senior Director of Professional Services at Shipware, LLC, a parcel consultancy that helps high-volume shippers reduce shipping costs by as much as 30%. He previously spent 17 years at UPS in Revenue Management Strategy, Pricing, and Sales. He uses his broad industry knowledge and specific expertise in parcel pricing and services to help clients optimize their supply chain. He is a frequent speaker at industry conferences and webinars, and his opinions and articles are regularly published in industry-specific and mainstream outlets.