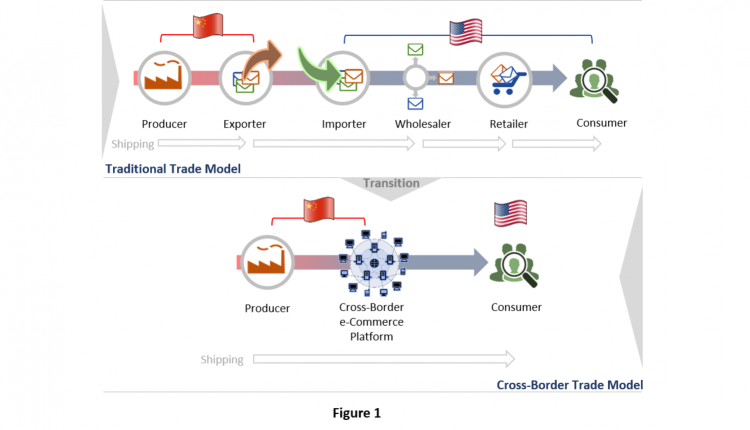

Globally, the shift in trade models has happened rapidly in westernized economies. In China, these changes have occurred a bit more slowly. However, Chinese policies regarding cross-border e-commerce have picked up momentum in the last two years with a heavy concentration on direct B2C sales. Figure 1 visualizes this trade paradigm shift and its impact on the relationship between the product supplier (producer) and consumer.

The traditional trade model was heavily dependent on small and medium foreign trade companies, or middlemen. The new cross-border paradigm, however, eliminates these trade companies and provides the merchant or producer of the goods with a more direct relationship to their international e-commerce consumers.

In China, American consumers’ appetite for international products is being driven by cheaper prices and unique product offerings that are not available domestically. And the steady shift in trade models increases the opportunities for Chinese merchants and product manufacturers to sell their products directly to the American consumer. However, these opportunities come with a number of challenges that the merchant or product supplier should be aware of prior to initiating a cross-border e-commerce program.

Challenges and Solutions

With the globalization of online retail sites like Alibaba, DHGate, and LightintheBox, China is leading the charge with cross-border e-commerce offerings that are attracting large numbers of US consumers. Global cross-border e-commerce is estimated to grow to almost $1 trillion (USD) by 2020, a compound annual growth rate of 27%. Yet for American’s making cross-border purchases, significant issues continue to be focused on the logistics of product delivery:

· Shipping costs are too expensive.

· Transit times for delivery are too long.

· Bottlenecks in customs delay receipt or add unexpected costs.

· Tracking products from origination to destination may not be available.

· Return processes are cumbersome or too costly.

Balancing Transit Times and Costs

Traditional delivery models struggle to meet the needs of consumers’ in today’s global e-commerce environment. Express delivery tends to be high-priced and can often drive the overall cost of the product to unacceptable levels. Less expensive, no-frills mail options tend to be slow and inconsistent with limited or no tracking. Localized fulfillment can bridge some of the gaps between cost and transit times. However, maintaining inventory is expensive and updating the product mix to the most current models is slow.

Consumers continue to put pressure on suppliers to reduce or eliminate shipping charges on their product purchases. Although consumers’ expectations for cross-border delivery are a bit more flexible, there remains a direct connection between unexpected shipping costs and shopping cart abandonment. And similar to domestic shoppers, cross-border purchasers are likely to spend more on products when their shipping cost expectations are met.

Accounting for these consumers’ attitudes, it becomes even more important for e-tailers exploring international markets to find a balance between the traditional delivery models. To meet this balance, a number of hybrid delivery companies have surfaced in the United States in the past decade. These companies have developed unique delivery models that often provide middle-mile air, customs clearance, and final-mile delivery by USPS. By shifting the traditional paradigms, these models deliver products directly to consumers in far fewer days than most mail options, while reducing express delivery charges by significant amounts.

Navigating the B2C Customs Processes

When exploring a direct-to-consumer model, making sure products will pass through customs quickly is key to ensuring transit time commitments with your customers. Traditional trade models placed the customs responsibilities on middlemen that provided a necessary service, but added little value to the process.

With today’s evolving models, navigating these customs hurdles becomes the responsibility of the e-tailer and/or their delivery partner. A strong delivery partner works collaboratively with the supplier to address specific issues that are common to the process and issues that may be isolated to the country of origin. For example, China has traditionally generated more concern with the importation of products that are counterfeit, knock-offs, or forgeries. If these types of products are discovered, not only does it hold up that specific product delivery, but it can hold up delivery of all products within the shipment.

These are real concerns for the delivery partner as their models are built around consistent shipping volumes and final delivery to the consumer. Early collaboration amongst partners is crucial to developing effective processes that reduce the risk of products getting held up in customs. Ultimately, eliminating customsissues and establishing a consistent delivery expectation helps develop brand trust — a good thing for both the delivery partner and product supplier.

Parcel Tracking and Returns Processing

Nearly 20% of American consumers making cross-border purchases list the inability to track parcels as an issue that prevents them from making more cross-border purchases. In today’s highly connected world, consumer confidence is directly linked to the visibility of their product from purchase to delivery. By using delivery partners that provide end-to-end product tracking for both the consumer and supplier, you can increase consumer confidence and extend your brand with repeat customers.

American cross-border consumers also list difficulties in returning purchased products as a barrier for making more purchases. Suppliers’ return merchandising systems often require damaged or incorrect products to be physically returned prior to processing a refund. Yet because of the high cost of getting these goods back to the supplier, returned merchandise is usually shipped via slower, more economical methods. Consumers, on the other hand, who receive wrong or damaged products are unwilling to wait under the current models that require “return receipt” prior to issuing a refund or replacement product.

To bridge this gap, developing a localized return process that decreases both cost and time for return receipt is vital in alleviating consumer concerns. And, communicating this policy to potential consumers in clear, concise language can make the difference between a sale and no sale.

Conclusions

The American appetite for international products, from China and other countries, continues to grow and drive significant volumes of cross-border purchases. This appetite provides significant opportunities for international suppliers and e-tailers who can effectively sell and deliver products that these American consumers desire.

As traditional international trade paradigms continue to squeeze out middlemen, more and more responsibilities for navigating these international B2C delivery obstacles fall on the product supplier. By investing the time in understanding these obstacles and identifying the right delivery partner, international suppliers can increase their opportunities by making a strong first impression and driving repeat consumer purchases.

Doug Caldwell is Vice President of International Development, International Bridge, Inc. He can be reached at doug.caldwell@myib.com.